Developing an Actuarial Science Program: It Takes a Village

By Marco V. Martinez

Expanding Horizons, August 2022

In this article I want to share my experiences coordinating an actuarial program at the UCAP (Universities and Colleges with Actuarial Programs)-introductory level. Let’s start with some context of my institution. North Central College (NCC) is a private, four-year, comprehensive liberal arts college with a semester academic calendar. It has about 3,000 students, primarily undergraduate, and the campus is 28 miles (a 30-minute train ride) from downtown Chicago.

When I arrived at NCC in 2013, I found an actuarial program comprising around 20 students. Anecdotally, one or two students passed an actuarial exam and found an internship or a job within the actuarial profession annually. Unfortunately, at that time, none of the faculty members in our department specialized in actuarial science. In fact, I was the only applied mathematician. At that time, I had zero knowledge of actuarial science. However, I saw a place where I could be valuable and have since made actuarial science one of my niches. The experiences I describe here are from my time leading the program—unofficially from 2014 to 2016 and officially as the appointed coordinator from 2016 to 2021. I stepped down from this position in May 2021 and was replaced by the current coordinator, Dr. David Schmitz.

Accomplishments

How do you measure the success of an actuarial program? Exam pass rates? Job placements? Size? I’ll let you decide what is most important for your institution, but the following are some highlights of how our program evolved in recent years.

- Students passing actuarial exams: Based on data collected up to 2020, our passing rates for the first two exams are above 80 percent. Most of our students graduate with two exams. In 2018, 30 of our students passed at least one actuarial exam. In that same year, two students graduated with four exams,[1] and in 2019, two students graduated with five exams.

- Students obtaining internships and jobs: Since 2017, at least 10 students per year secured paid summer internships, and in 2019, there were 15. Since 2019, at least 10 of our students have had jobs waiting for them after graduation. This is almost a 100 percent job placement rate.

- Receiving national recognition:

- Individual students have earned awards and scholarships, including one of only 16 Milliman Opportunity Scholarships in 2018[2]; a 2019 Lincoln Laureate[3]; two 2019 Actuarial Diversity Scholarships[4] and another in 2020[5]; and a 2021 NAMIC Mutual Insurance Foundation Scholarship.[6]

- NCC’s actuarial program is now recognized by the Society of Actuaries (SOA) as a UCAP-introductory curriculum.[7]

- Gamma Epsilon, our campus’s Gamma Iota Sigma (GIS) chapter, has been recognized every year since its establishment at the annual GIS Conference with a Special Achievement Award[8] (2019) and an Excellent Chapter Award (2020 and 2021).

Please note that the success of the program is largely due to our students and alumni. While we have worked hard to provide the right resources, guidance and opportunities, none of that would have mattered if the students had not proved successful beyond the classroom.

Although many of the measures listed are regular events at universities with larger and traditional actuarial programs, they were incredible successes for a liberal arts school of our size without faculty formally trained in actuarial science. In addition, the program has grown at a rapid pace since 2014[9]: in 2018 we were named NCC’s fastest growing major (from 2017 to 2019 the program had around 60 students).

The Process

How were we able to achieve all of this in a relatively short period? During my first year at NCC, I spent a considerable amount of time talking with students and alumni about their expectations and experiences with the actuarial science major and identifying places where we could improve. From these conversations and other activities, it was clear that more action was needed with respect to the preparation and timing for the actuarial exams and the internship process.

Exams

Our first step was to provide the proper tools for our students to pass the actuarial exams.

At the time we had classes for the Probability (P) and Financial Mathematics (FM) exams, but they were open to students beyond the actuarial major and did not offer any support on exam-taking strategies. In 2014, I created and taught a seminar specifically for actuarial students that served as intensive preparation for Exam P. We also created a similar seminar for exam FM (I am grateful to Dr. Richard Wilders, who developed and taught the class for several years). Creating a new class is a long process at most institutions. We started with the class as independent study, then had students register for a section of an existing problem-solving seminar in the mathematics department. Finally, we were able to have our own specific classes created for both preliminary exams. Those classes are now required for our actuarial majors, and they run concurrently with each of the Probability and Financial Mathematics classes. Now our students take two classes that focus on the preparation for actuarial exams in addition to the classes where they learn the theory.

The first time I taught the class as an independent study, I was also in the process of taking Exam P. I failed the first exam but passed the second time, before I taught the class the second time. Failing an actuarial exam was one of the most valuable experiences in my journey. It allowed me to understand better what my students were going through and also helped me learn how to study better and be more strategic in my teaching and advice to students. I later took Exam FM and passed, and currently I am working to get my credentials as an Associate of the SOA.

We also offer classes for actuarial exams beyond P and FM, but we have found that students do not need an accompanying seminar. By that time, they are more comfortable with actuarial exams and can study more independently. My institution supported me for several summers with internal grants that allowed me to study for exams. NCC also provides important institutional support by allowing our department to reimburse students for exam fees for any exams they pass as NCC students. This has been very useful for supporting and recruiting students.

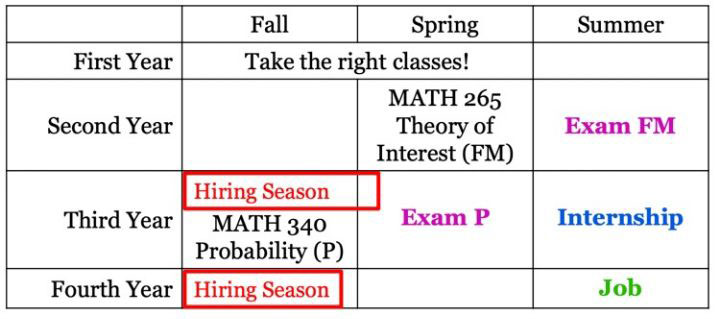

In addition to providing appropriate classes, we are very intentional about timing. We deliberately make all actuarial students aware that we expect them to take and pass one actuarial exam by the end of their sophomore year (or before), do an internship no later than the summer of their junior year, and take another exam in their junior and/or senior year. Our general four-year plan is summarized in Table 1.

Table 1

NCC Four-Year Plan for Actuarial Majors

We have many entry points for our actuarial majors. The majority of our students start in Calculus I or II, but we also have some students arriving after completing all calculus classes or starting in Precalculus. Our program is flexible enough to accommodate any of these entry points. If your institution has academic advisors in addition to faculty (like NCC), it is very important to work closely with them to deliver a unified message to students. I spend a good deal of time meeting regularly with advisors to update them on changes to our curriculum and highlighting the importance of taking the right classes the first two years.

An additional step we have taken with respect to classes is working closely with the departments of economics, accounting and finance to provide the right classes for Validation by Educational Experience in these subjects. Having those classes was necessary to be able to get into the UCAP program from the SOA.

Internships/Jobs

The next step was to better prepare our students for hiring season, especially for internships. For this step our alumni were critical, and our location was very helpful. Chicago is a major hub for the industry. We started bringing in guest speakers from different industries. In addition, we connected with major professional actuarial organizations. I did the research and submitted the application that allowed NCC to be included in the SOA UCAP listing, as well as the SOA University Support Actuary Program. Attending SOA teaching conferences was extremely helpful for learning new ideas from successful programs—specifically how to interact with companies. During my first few years at NCC, I was hesitant to invite companies to our school, then I learned that I just have to ask. The majority, if not all, of industry representatives are more than willing to support undergraduate programs.

Another organization that helped us by providing professional development, connections to industry and access to career fairs was Gamma Iota Sigma. Finally, the Organization for Latino Actuaries (OLA) and the International Association of Black Actuaries (IABA) really helped to support our minority students through several scholarships and professional development. NCC became affiliated with two Casualty Actuarial Society (CAS) programs: the CAS University Liaison Program and the CAS Academic Central program. These examples show that if you are starting an actuarial program or developing one, you do not have to do all the work yourself. There are many organizations with amazing programs and people ready to support you.

In addition to hosting speakers from different companies, we made sure to prepare our students for hiring season. Interviews for actuarial internships and full-time positions often require day-long sessions with companies, where applicants answer both technical/analytical questions and behavioral questions. It was critical for our students to be prepared; we focused particularly on building a résumé and preparing for a successful interview. We hosted meetings on campus and had a group of students create handbooks on both topics. We also required that students complete several mock interviews with our career development center on campus as part of their exam seminar courses. In 2020, in the middle of a global pandemic, we held our first actuarial career fair, and several companies presented recruiting talks at NCC or requested our résumé book.

Community

We are very proud of the work we have done to create a sense of community among our students. In 2014, we founded our Actuarial Science Club under the leadership of several students, which provides both social cohesion and the necessary tools to learn about the industry, including preparing for hiring season by providing résumé reviews and mock interviews. A recent outgrowth of the club is our GIS chapter Gamma Epsilon.[10]

We have been very intentional about supporting our students since day one. We have a strong mentorship program in which we pair each first-year student with a senior or junior (based on similar backgrounds or interests). Mentors meet frequently with the younger students during the semester to provide support in their classes but also in their professional journey. Mentors are critical to helping students understand the right classes to take and the importance of getting involved, and they also serve as inspiration since the majority of them have already passed several exams and completed internships. They help our younger students to trust our process and guidance.

It took years to arrive at this final wording, but the sentiment of all my interactions with students is always “Learn as much as you can from others, but also share what you know to help others.” It is important to realize that for all of this to happen you need to spend quality time with your students. Spending a lot of one-on-one time with most of my students was the best way to get to know them and be able to provide the best advice possible. This was my favorite part of the job, but it is very time-consuming.

We have also emphasized diversity, equity and inclusion as a hallmark of our program. We work to be a very welcoming community. We have deliberately provided leadership opportunities for women and underrepresented groups in our program. A particular example of this was our 2019 panel for women in actuarial science. In fact, our program’s student population is far more diverse than is the profession as a whole, as illustrated by NCC, CAS and SOA data from 2019/20 shown in Table 2.

Table 2

Diversity of North Central Actuarial Students vs. the Actuarial Profession

In addition to our efforts at NCC, we have been engaged regionally since 2019 in the SOA/CAS High School Day, where we join an amazing group of volunteers from the industry and academia to show students from underrepresented groups in the Chicago area what being an actuary is and how to become an actuary.

Lessons Learned

All of these efforts and accomplishments sound great, but there were definitely hard times. If I were to start from scratch again, I would do some things differently, particularly connecting with organizations like the SOA, CAS and GIS earlier, as well as asking for support from industry earlier. An industry speaker can get students to do and understand many things I cannot communicate in the classroom. The industry is incredibly willing to support you.

The one thing I would definitely change is that I would not do all of this as a junior faculty member (untenured). It was really hard to do everything required for building the actuarial program on top of keeping up with my research agenda and making sure I fulfilled all the requirements for tenure. My advice for faculty is either to wait until you are tenured or to make sure you get release time and all your efforts will count toward your tenure package (get this in writing). To be fair, my institution and department never requested that I lead and revamp the actuarial program; it was my initiative and idea.

Acknowledgments

I have purposely avoided naming any students/alumni in this paper, as it would be impossible to name all those who played a significant role in the development of our program. But my gratitude goes out to all of them. I am convinced I learned much more from all of them than they learned from me. I want to reiterate that every single achievement of our program is a reflection of the hard work of all our students.

Similarly, it would be impossible to name all the actuarial professionals who at some point supported our program by giving talks, helping me better understand the profession, giving one of our students a chance for an internship or a job, giving feedback on résumés or mock interviews, or helping us create a better curriculum. I am incredibly thankful.

Additionally, I am very grateful for the support my institution, in particular Dr. David Schmitz, provided to me and the program. David was my chair during my first years at NCC, and he allowed and encouraged me to dream big. In addition, he has also been taking actuarial exams and is getting close to his associate credentials.

Finally, a huge thank-you to all the professional organizations—SOA, CAS, GIS, OLA, IABA, just to name a few—that provided critical support and guidance for our students and program.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Marco V. Martinez, Ph.D., is an associate professor of mathematics and actuarial science at North Central College. Marco can be reached at mvmartinez@noctrl.edu.