Accumulated Annuity Design

By Lloyd Foster

Product Matters!, May 2024

Background

Retirement benefits constitute an important aspect of the financial security programs that actuaries address in their regular professional work.

In fact, retirement seems to be a buzzword, not only for those workers within 10 years of retiring, but also among the middle-aged, or even younger individuals just entering the workforce. As in the past, insurance companies have correctly seen this as an opportunity, developing annuity plans that can accumulate adequate assets by the time workers reach the appropriate retirement ages.

It should be noted in this regard, that the customers of these insurers still harbor the same mentality as they did 30 to 40 years ago, viz. a combination of:

- The investment of policyholder assets in high-yielding, equity-related securities and

- Preservation of at least the original net investment made by the policyholder.

When the market first expressed a desire for a product capable of simultaneously satisfying these needs, the insurance industry responded by providing a proliferation of various “guaranteed minimum” product riders attached to variable life and variable annuity plans. In strictly investment terms, these were simply put options attached to equity funds (or equivalently, call options attached to risk-free bonds). Even though this arrangement suited the demands of the public, the mechanics of the (at the time) novel design (i.e., derivatives embedded in accumulative insurance products) proved problematic (both financially and operationally). So problematic in fact, that the major insurers exited the guaranteed minimum business by the end of the second decade of the 21st century.

Today the guaranteed minimum concept still carries theoretical appeal to any prospective customer who is told about it, but hardly anyone in the insurance industry is doing the telling anymore. The poor experience that virtually all insurer participants endured, proved sufficiently instructive to dictate that the insurance industry keep a respectable distance from any financial plan faintly resembling the variable-accumulative-guarantee products of the past.

The consuming public today must therefore revert to the variable products that prevailed prior to the giddy days of Guaranteed Minimum Death/Withdrawal/Account/Income Benefits, and be satisfied with the security structure these current products represent.

Is the buying-public justified in demanding something better from the insurance industry? Most likely, even though undoubtedly we cannot return to the days of the popular GMWB riders with their underpriced features and under-hedged positions. But does that render the situation hopeless for ambitious product and marketing actuaries? Most definitely not.

Otherwise there would be no point in writing this article.

A New-Old Insurance Product

Defining the Product Benefits

Rationale

The typical investor (including owners of cash-valued insurance products) persistently harbors the notion of market timing: the ability to obtain superior investment returns by judicious timing of investment and divestment.

Conventional wisdom counters this proposal with the tried and true approach of simply going with the market, using an adequately diversified portfolio. The sentiment driving this latter viewpoint is that such a portfolio, over time, will invariably yield the desired results that satisfy the financial needs of the investor.

Given the current state of product development with respect to variable annuity and variable life offerings from the insurance industry, the owners of such policies must compliantly acquiesce to the dictates of the conventional approach. Nevertheless, the idea of market timing remains in the minds of many policyholders, manifesting itself obliquely in the frequent exercise of fund transfers between different equity types within a policyholder’s portfolio.

Taken to an extreme, this continual transfer of money between risk types becomes counterproductive to both policyholder and insurer (e.g., the policyholder incurs increasing levels of transaction costs, and the insurer gets bogged down with administrative minutiae, keeping track of the many transactions back and forth).

The idea that drives the design of the product being suggested below, encompasses an investment approach that goes one step beyond diversification of fund amounts across fund types: it diversifies the timing aspects of investment/divestment. This obviates the need for obsession with any and all forms of market timing, including proxies to market timing as exhibited in excessive fund transfers within a portfolio.

Design

- The product provides a retirement lump sum that is the total of accumulated amounts from a portfolio of many different equity, debt and money-market fund types.

- In addition to the above, there is a special fund type that credits fixed interest at a minimal rate (for practical purposes, 0%), and is invested in the least risky securities conceivable.

- Where risk is being viewed in both credit and market terms.

- Each fund type is assigned a fixed end-date (a maturity).

- The total accumulated retirement benefit is determined (meaning chosen by the policyholder) at inception.

- This pre-determined amount becomes the target for the insurance investment department to achieve.

- This target retirement fund is not guaranteed by the insurer, thus avoiding the pitfalls of the “guaranteed minimum” debacle faced by the insurance industry in the former era of variable life/annuities.

- The arrangement of end-dates and fund amount allocations is selected to accumulate, in total, the desired target amount.

- The “accumulation” aspect of the product has two distinct considerations:

- The accumulation rate for a fund type as determined by its risk/reward profile.

- After hitting its maturity date, the accumulated amount in a particular fund type is automatically transferred to the special low-interest, low-risk fund type described above.

- With the exception of the end-date transfers above, no transfers between fund types are allowed.

- The entire portfolio matures on the end-date of the fund type with the longest maturity.

- The product is unique, and accomplishes its goal of diversifying the market-timing desire of the policyholder, in the following way:

- There are many different combinations of maturity dates that will produce the same target value.

- The product allocates the policyholder deposit, not only across fund types within the portfolio, but also across selected combinations (with the selection being entirely up to the policyholder) of maturity dates.

- The selection is made at policy inception, and cannot be changed subsequently.

- Each combination of maturity dates represents a potential “market timing” endeavor that would have been made by an investor engaging in such a practice.

- Since the necessary investment choices are already made at inception, there is no need for the usual continual switch of funds between fund types.

Illustrating the Product Mechanics

Assume that Illustrative Life Insurance Company (ILIC) offers an annuity version of this product, with the following characteristics:

Seven Different Fund Types

The annuity types range from a safe, low-yield (5%) account, to a risky, high-yield (20%) fund. The expected accumulation factors for the fund types are shown below:

A = {1.05, 1.075, 1.1, 1.125, 1.15, 1.175, 1.2};

Units

For ease of presentation, we will treat the product as using “units” as its currency, where one unit = $1,000.

A Specific Policy

Imagine now that a new policyholder deposits a net amount of 700 units with ILIC, for investment in its variable annuity line. Having heard of the above product, the policyholder decides to use it as the preferred vehicle of retirement funding. The policyholder expects to accumulate, at the end of the investment horizon, an amount of 3,000 units.

ILIC provides the policyholder with a specific policy, where the 700 units are divided equally across 100 different emerging fund scenarios. In each of the fund scenarios, the available seven units are divided equally across each of the seven fund types described previously.

Note: The division of funds into equal parts is merely a means of simplifying the presentation. In reality, the policyholder could allocate the 700 units as desired.

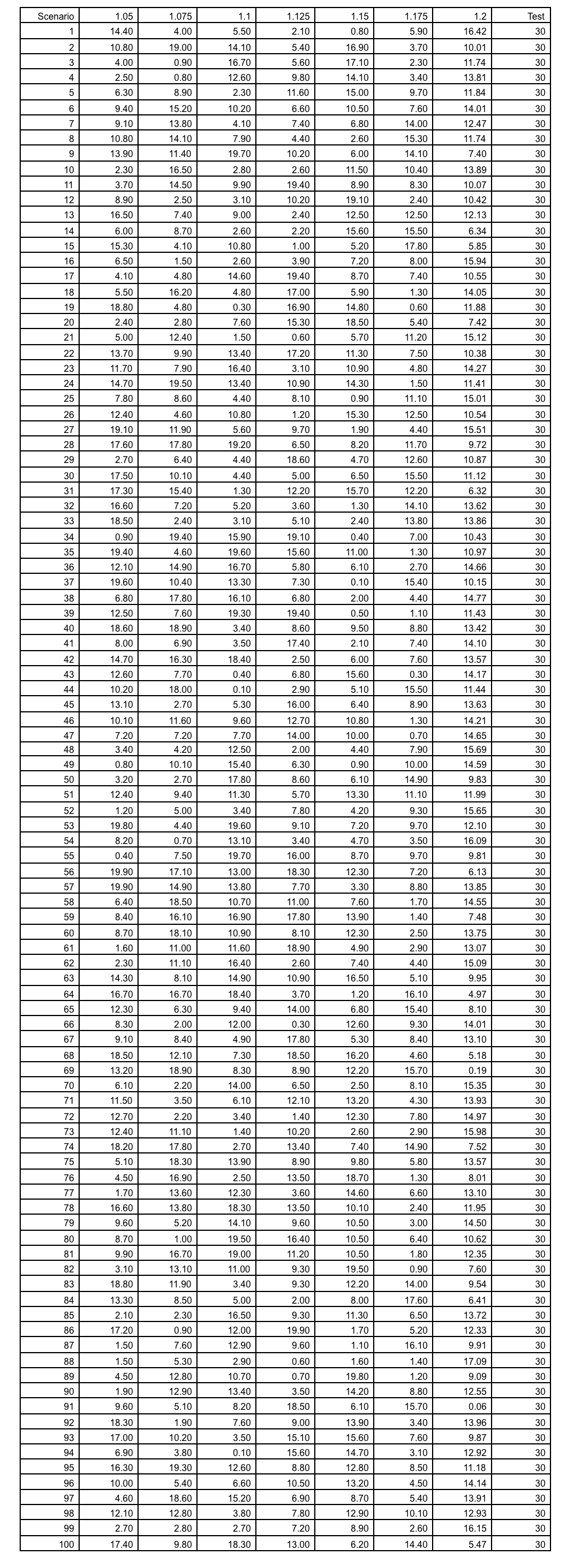

The policy characteristics are shown below:

The explanation is as follows:

- For each of the 100 scenarios, numbered as shown, the above table shows the maturity date for each of the seven fund types.

- On the maturity date, the amount in the fund type is transferred in total to the low-interest, risk-free account.

- For simplicity of presentation, the risk-free account is assumed to bear 0% interest.

- The allocation across not only fund types, but also maturity dates, covers a sufficiently wide spectrum, to diversify away the element of market timing that the policyholder might potentially contemplate.

- The final column shows the total accumulated fund value for each scenario.

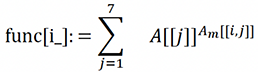

If we denote the above matrix as Am, the function to compute the accumulated fund value is given by the following formula:

To illustrate, the fund accumulation for the 4th scenario would be:

func[4], which yields an answer of 30.

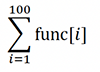

The total accumulated fund across all scenario types, would then be:

which in this case amounts to 3,000.

The Risk of the Product

Determining Probabilities

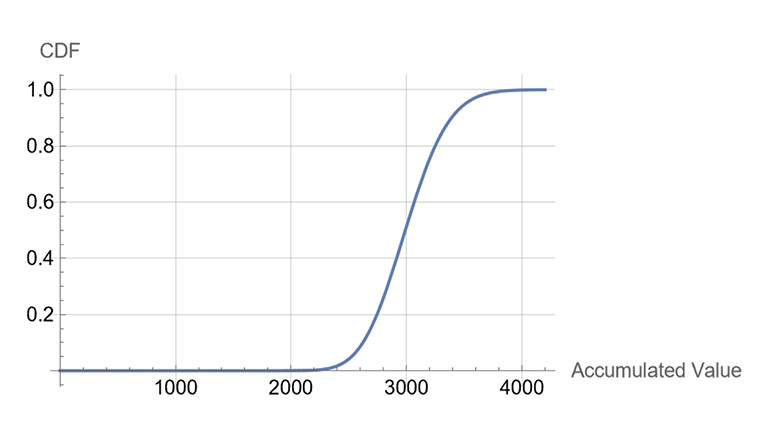

We will next assume that it is possible, by application of statistical techniques, to reliably determine a probability distribution function for the actual ending accumulated amount for this policy.

For the purposes of the demonstration, we will imagine that the distribution function that best fits this policy is a Gamma distribution with shape parameter 100 and scale parameter 30.

Note: This would result in a mean accumulated fund value of 3000 units, and a standard deviation of 300.

Its CDF would be as shown below:

We would then be able to determine important statistical characteristics of the fund value. For example, we could demonstrate that there is a probability of less than 1.8%, that the accumulated fund value would fall more than two standard deviations below the mean.

Using the notation of Wolfram’s Mathematica:

gd = GammaDistribution[100.0, 30.0];

mn = Mean[gd]

3000.0

vr = Variance[gd]

90000.0

std = StandardDeviation[gd]

300.

CDF[gd, mn - 2std]

0.0171083

Venturing Into Dangerous Territory

One last flight of imagination to round this off:

Imagine that you chair the Risk Committee of ILIC. You were therefore instrumental in approving the launch of the above product.

A year after launch, the product is proving to be a winner—the public cannot get enough of it.

But now, a team of the best marketers and product actuaries at ILIC have come up with a variation to the initial plan design: provide a guarantee of the targeted accumulation value. The idea would work provided ILIC proceeded according to the steps below:

- ILIC guarantees the targeted accumulated account (e.g., the 3000 units in the example above).

- This guarantee is secured by holding required capital at a stipulated degree of confidence

- E.g., based on the 1.71% probability derived previously, ILIC would hold capital of two standard deviations (i.e., 68 units).

- The design and pricing of the product ensure that ILIC receives a return on capital commensurate with the perceived risk.

So here is the question for you: given your knowledge of the past history of the insurance industry with respect to guaranteeing equity-derived securities, but also given the difference between this current product and the “guaranteed minimum” riders of the past, would you be in favor of the proposed product variation?

Conclusion

Over the 200+ years of its history, life insurance has not been famous for being an exciting industry. In fact, when viewed in the light of the profession that underpins its stability and security, life insurance was often seen as the very opposite of exciting (some of the most vicious jokes about boredom and social awkwardness have been made at the expense of actuaries).

During the last decade of the 20th century, as well as the first two decades of the 21st, life insurance seemed to take on an aura of excitement and attractiveness as insurers competed in the design and marketing of ever more exotic, derivative-based products.

Today, that excitement has all but died down as insurance companies, presumably having learned their lesson, revert to the traditional methods of product development and marketing. Few companies would boldly rush to market with the latest version of a GMWB/GLWB annuity rider.

But as in most aspects of life, the issue is not an either/or decision. Excitement lies on a spectrum that can be compared to the combination of hot and cold water from the faucet. It is up to the user to decide what combination produces the requisite temperature, avoiding the extreme risks of being burned or frozen.

At issue is the determination of where on such a spectrum this product proposal would lie, assuming it merits being considered relevant.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Lloyd Foster, FSA, MAAA, is CEO at Foster Colley Inc. He can be reached at lloyd.foster@fostercolley.com.