By Gil Lowerre and Bonnie Brazzell

Those not experienced in the voluntary business often think that product dictates success in the market. While product—along with price, innovative design and compensation—often drive sales for other insurance businesses, that simply isn’t the case with voluntary sales. Newcomers or those

that have only a minimal presence in the market often mistakenly think that if they just build the “best” voluntary product, with the best features and benefits at a good price, brokers will be excited about selling it and, in turn, sales will be great. In voluntary benefits, however, this approach has

proven to rarely work. Sooner than later, these carriers often find they’ve captured little of the sales they expected.

Those not experienced in the voluntary business often think that product dictates success in the market. While product—along with price, innovative design and compensation—often drive sales for other insurance businesses, that simply isn’t the case with voluntary sales. Newcomers or those

that have only a minimal presence in the market often mistakenly think that if they just build the “best” voluntary product, with the best features and benefits at a good price, brokers will be excited about selling it and, in turn, sales will be great. In voluntary benefits, however, this approach has

proven to rarely work. Sooner than later, these carriers often find they’ve captured little of the sales they expected.

Our research shows that about 71 percent of all employers (with 10 or more employees) offer at least one voluntary product and approximately 38 percent of employed Americans own at least one voluntary product. With roughly 114 million employees in the United States, that means only 43 million (38 percent) currently own even one voluntary product. Using the percent of employers currently offering voluntary, that leaves roughly 45 million that have access to voluntary through their employers but have not yet bought. In addition, there are another 26 million employees working in businesses that have yet to offer voluntary benefits. That means the market for voluntary benefits at both the employer and employee levels is wide open.

So with all this untapped opportunity, why isn’t just building a solid product the key to achieving sales? The reason is distribution. This is the “scarce” commodity in the voluntary market. As a result, most competition among carriers is for the attention of the distributors. Yet many carriers overlook the fact that not all distributors are alike.

Eastbridge segmentation research has identified several major categories of distributors/producers, each with unique needs, challenges, and approaches to the market:

Career Agents—These producers work primarily for a single company and sell that company’s voluntary/worksite products. Aflac and Colonial reps are examples of Career Agents.

Classic Worksite Brokers—These distributors are brokers that focus on voluntary sales. Their operations may be small or medium sized, and they typically sell directly to employers and often offer support services to their clients.

Worksite Specialists/Enrollment Companies—This segment consists of large marketing organizations whose primary focus is supporting other brokers who need their expertise in voluntary. Benefits communications and enrollment are key services offered by this group.

Benefit Brokers—These distributors typically focus on employee benefits, particularly traditional group benefits. Some are actually benefits agencies inside of a commercial lines agency. For all, voluntary products are generally offered as an additional line.

Occasional Worksite Producers—These producers are insurance generalists. They have a small agency that sells insurance products other than voluntary/worksite—group, individual, or property/casualty. Voluntary/worksite products are usually a small part of their operation.

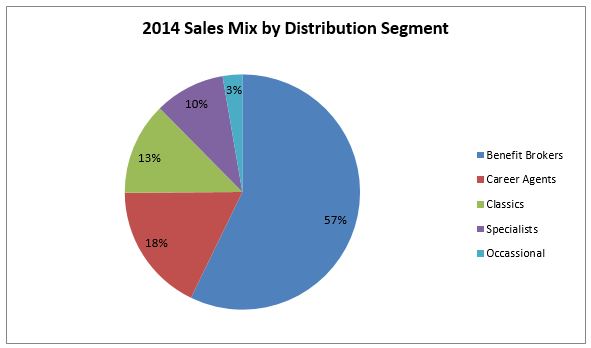

While all segments are selling in the market, based on the sales numbers, the dominant group is the Benefit Broker. This segment generated 57 percent of all voluntary sales in 2014 and, over the last few years, have had the fastest growth of all segments.

Many carriers try to target the Benefit Broker segment because of its size and growth. However, to truly reach and penetrate this segment, it must be divided into several different sub-segments based on their size and experience with voluntary sales. Those sub-segments as well as the others listed above have different needs and interests. They value different products for different reasons, and often value products less than other features of a carrier value proposition, including sales support, tools, enrollment assistance, administrative capabilities, etc.

While this article does not go into detail on each segment and sub-segment, we will highlight a few noteworthy differences that illustrate why building a great product is rarely the basis of sales success. In fact, product is often relatively unimportant in the overall battle for brokers. Sure, you have to have a ‘good’ product, but it is not usually the product that wins the competitive war. Instead, it is how well you match up with the broker’s overall needs that determines success.

A simple chart with just two segments helps illustrate these points.

| Worksite Specialist | Small Benefit Broker | |

| Sales and Marketing Support | Nothing, leave me alone | Help me make the sale at the employer level |

| Enrollment Support | Nothing, leave me alone | Enroll the case for me |

| Service | I like to use my own choice of vendors | Don’t mess up my case |

| Commissions | High heaped commission | Doesn’t matter |

| Product Characteristics | Best of breed products | Don’t embarrass me and keep it simple |

| Most Often Sold Products | Universal Life, DI, CI, Accident | GVLT, DI, Dental |

| Importance of Innovation in Product | Reasonably important; often are early adopters of “new” voluntary products | Not that important; these brokers aren’t likely to be early adopters of “new” product ideas |

| Pricing | Doesn’t matter that much, just be in the ballpark | Be lower than the others |

| Preferred Carriers | Carriers with high commissioned products who understand the voluntary market in great detail | Same carrier I use for my “core” products |

It would be very difficult (and expensive) for a carrier to meet both sets of needs. Using a blended approach, by meeting “halfway,” also doesn’t work since the carrier won’t be competitive in either. Rather, the most successful carriers in the voluntary space first identify the types of distributors with whom they are most likely to be successful and then develop their entire program around the unique needs of the selected distributors. Even the type of products you should include in your company’s portfolio depends on the types of brokers you target.

For example, carriers wanting to appeal to the Small Benefit broker will need simple products that are as close as possible to the employer-funded products these brokers are accustomed to selling. The carrier will also need to either supply enrollers or at least provide the tools for enrollment. Commissions are not that important to this broker; safety and ease are much more important. These brokers say they want to offer the lowest price, but in reality, that is often not the case (all those services impact the ability to have the lowest cost to the employee). The most successful carriers targeting this segment provide a complete turn-key system that enables Small Benefit brokers to offer and effectively enroll voluntary products without having to handle all of the details themselves.

If, on the other hand, the carrier is trying to attract Worksite Specialist brokers, they will need high-commissioned products that are reasonably competitive and are perceived as “best of breed.” As noted in the chart, however, these products are not necessarily the typical “core” products. Specialists often ask for and expect underwriting concessions, so the product needs to allow this. The specialists don’t want any of your services, especially not sales/marketing or enrollment support. Instead, they want all the “costs” that are built in for these services (such as what would be needed for the turn-key system mentioned above) to be put into commissions.

The objective is to have the highest profitable level of sales, not to have the best product. Successful voluntary carriers understand they first need to decide which type of producer(s) they want to target and then to fully understand what those producers care about in a carrier’s value proposition. They also need to invest in product, administration, service, compensation, tools, and support, etc., that match the needs of those targeted producers. Only then can they achieve maximum success.

Eastbridge Consulting Group, Inc. is a consulting firm based in Avon, CT, serving the voluntary/worksite industry. Gil Lowerre is president of Eastbridge Consulting Group, Inc. He can contacted at info@eastbridge.com . Bonnie Brazzell is vice president of Eastbridge Consulting Group, Inc. She can be contacted at info@eastbridge.com.