Integrated and First Principles Modeling for Hybrid Life and Health Products

Life insurance policies with embedded or attached long-term care (LTC) benefits, or hybrid products, have been sold on the market for decades. Hybrid products are typically offered as a base life insurance contract with an LTC (or a chronic illness) rider. For this article we will refer to LTC riders, though the principles discussed are applicable to most health riders.

Pricing and valuation for hybrid products have evolved with the growth of this market. Actuaries have modeled these products and riders in many ways, but the most common methods are, a) modeling the rider separately from the base life insurance policy (“independent” modeling), and b) integrating the modeling of the base life contract and the LTC benefit (“integrated” modeling).

Modeling Approaches

Integrated models perform calculations based on the fundamental policy values, often using assumptions from first principles. A first-principles approach to modeling means that hybrid policy assumptions such as morbidity, mortality, and other policyholder behavior are expressed in their most basic form.

The morbidity assumptions for the LTC rider component of a hybrid policy, for example, can be expressed as annual or monthly claim costs. These claim costs are comprised of many assumptions such as the incidence of claim, the mortality of claimants, the rates of recovery, and the expected cost of care compared to the maximum benefit available (also called utilization). There are hybrid models accept these granular assumptions directly and create projections of active lives, lives on claim, recovered lives, and more. We refer to this approach as an integrated first-principles (IFP) model.

In contrast to the integrated approach, the independent modeling approach separates the rider and base policy modeling.

When modeling the rider independently from the base life insurance, actuaries have traditionally taken a pricing approach similar to other LTC and A&H products: Developing morbidity estimates through claim costs and making top-side or high-level adjustments to account for the fact that the rider interacts with another contract. This separation of modeling can be useful in simplifying the actuary’s modeling tasks, but there are shortfalls that we discuss in this article.

Integrated First-principles (IFP) Modeling

IFP models allow for separate entry of assumptions for claim incidence rates, disabled (on-claim) mortality, active life mortality, claim recoveries, and utilization. IFP models are structured to segment policyholders into various states (active, on-claim, once on claim but now recovered, etc.) with associated probabilities.

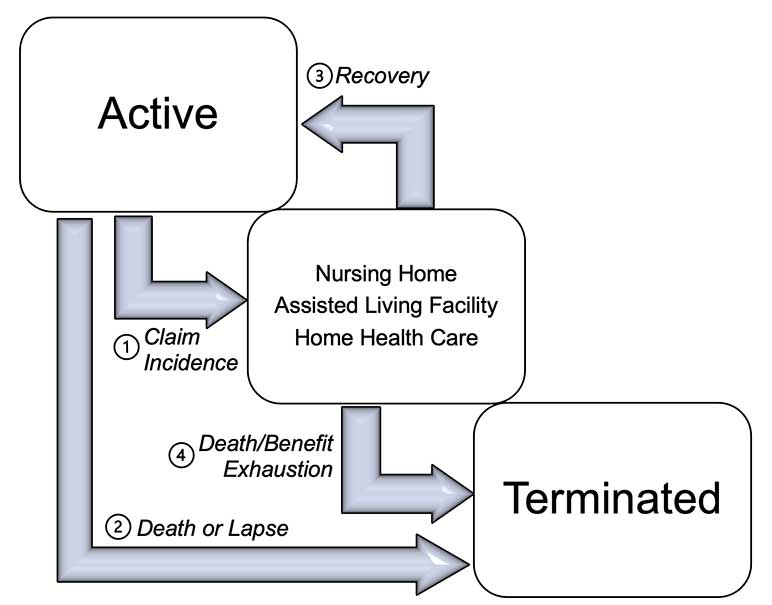

There are multiple states to consider when modeling hybrid products. Figure 1 below demonstrates these states and their associated transitions. For example, at issue, a policyholder begins in the active state. This policyholder may then either, (1) move to the disabled state (on-claim), or (2) terminate their policy due to death or lapse. If the policyholder moves to the disabled state, the claimant may either, (3) recover back to the active state, or (4) terminate due to death or benefit exhaustion.

Figure 1

Transition States

IFP modeling requires more data, assumptions, and modeling resources, but in our opinion the benefits can outweigh the costs such as those discussed in this article. Actuaries may also wish to track lives even after benefit exhaustions to maintain conservation of mortality.[1] IFP models have the benefit of added precision, which can allow the actuary to calculate these lives.

Advantages of IFP Modeling

There are many advantages to an IFP model over an independent modeling approach. Three of the most important advantages are:

- Capturing hedging effects between the base policy and LTC rider

- Modeling the interplay of assumptions and margins

- Calculating cash flows and reserving for active and disabled policies separately for future valuation points

With IFP models the actuary can also appreciate more detailed analyses of cash flow testing, more accurate and robust valuation models, and the ability to fine-tune more granular assumptions within the model.

We discuss the importance of each of the three primary advantages in the next sections.

Hedging Effects of Hybrid Products

One of the main attractions of hybrid products from an insurer’s viewpoint are the internal hedging effects the LTC component has in correlation with the base policy. Higher LTC incidence than expected typically reduces payable death benefits, and vice versa, since death benefits and LTC benefits initially draw from the same benefit pool.

Independent hybrid models typically quantify the hedging impact by having two separate components: The cost of the rider, and the death benefit savings. The death benefit savings under this approach reflects the fact that, once a policyholder moves to the disabled state with higher disabled life mortality, the remaining policyholders in the active state should have improved (lower) mortality to ensure the total mortality replicates the desired industry study or company experience analysis. In short, the death benefit savings are a short-hand approximation of the conservation of mortality assumption.

The simplifications within the independent modeling approach may cause future headaches for some actuaries. First, under the independent modeling approach the actuary has less detail for analysis and decision making. Hybrid actuaries will find it beneficial to differentiate between active benefits and disabled benefits within the model. This distinction serves to increase understanding of the policy risks and cashflows. To create this style of bifurcated analysis, the model needs to track active and disabled life buckets using incidence rates and a separate disabled life mortality.

Secondly, in an independent model, morbidity claim costs and “death benefit savings” need to be recalculated to capture effects beyond second-order changes as experience develops or assumptions are modified. This upkeep is a strain on modeling logistics and may result in the actuary missing interactions that are not captured by the independent model.

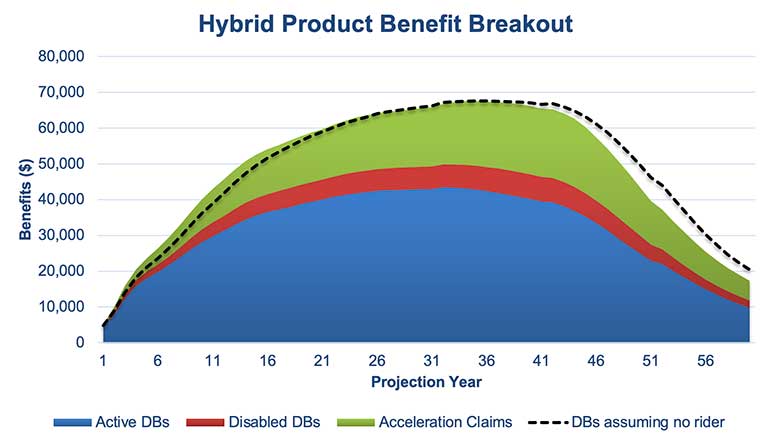

Figure 2 below shows death benefits (DBs) and LTC acceleration benefits from our illustrative IFP hybrid model consisting of a distribution of approximately 350 policies with issue ages varying from 25 to 75, and approximately US$1.2M of annualized premium.

Figure 2

Hybrid Benefit Breakout

The IFP approach captures the risk hedging impacts implicitly, thanks to the tracking active and disabled buckets. Under this framework, it is simpler to calculate and attribute cash flows as shown in the graphic above. The cost of the rider is estimated by determining the present value of future benefits in total less the present value of future benefits of the base life policy.

Under the independent modeling approach, the process can be more cumbersome. Modeling under the independent framework, where the base contract and LTC rider are modeled separately, typically entails the following steps:

- Develop claim costs based on the combination of incidence, claim continuance (mortality and recovery), and claim utilization.

- Apply any needed adjustment to set claim costs on an active lives basis, instead of a total lives basis. This step will depend on how LTC morbidity assumptions were developed in experience studies.

- Determine the conservation of mortality adjustment, or the "death benefit savings" to model in the rider (i.e. the reduction of base policy death benefits due to the payout of rider claims).

To capture the hedging effects, an independent model still requires significant work, and this is vulnerable to a number of drawbacks including: Limited flexibility, limited granularity of cash flow detail, and additional model risks such as misestimation of assumptions or not capturing the interplay of assumptions.

One additional drawback of using an independent model is the conservation of mortality (death benefit savings) adjustment doesn’t pick up first order impacts under assumptions updates or sensitivities (without iterating) like the IFP model does, thus distorting the benefit streams for analysis.

Modeling the Interplay of Assumptions and Sensitivities

An independent hybrid rider model will require careful consideration; the actuary will potentially oversimplify some of the complex interactions between key assumptions.

As an example, a company may conduct a new mortality experience study and expect that total mortality is unchanged from prior expectations, but that disabled life mortality has reduced. The implication of this study is that active life mortality has increased if total mortality remains the same. How might the impact of a higher active life mortality impact the base policy? We expect the higher active life mortality to negatively impact the emergence of death benefits of the base policy in isolation. On the other hand, fewer policies in force in future years means fewer expected lives and future LTC claims.

If we also now layer on a reduction to the disabled life mortality, our claim continuance will increase leading to higher expected claims.

We can model the base policy independent of the LTC rider in order to quantify the impacts of these assumptions, either independently or combined. The results of the model may not be intuitive, and the actuary may need to re-derive the claim costs and create other simplifications. In contrast, an IFP model quantifies these assumption changes directly.

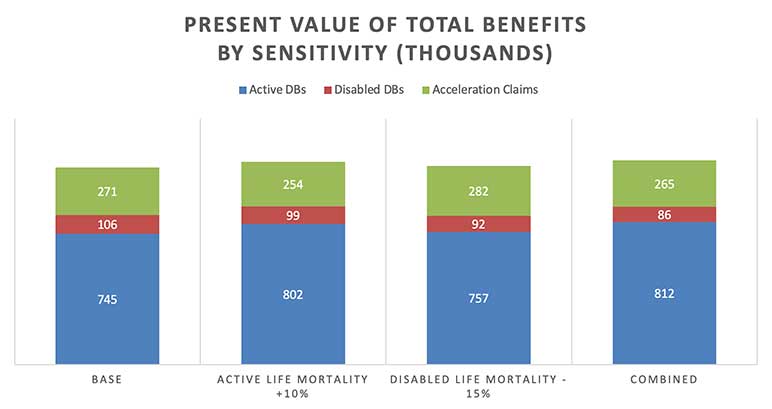

Figure 3 below shows results from our illustrative IFP model under four different scenarios: A base run, a 10 percent increase in mortality for active lives only, a 15 percent decrease in mortality for disabled life mortality, and both sensitivities combined.

Figure 3

Sensitivities

For the base policy, we are not certain if the total death benefits will be higher or lower given a change to the mortality assumptions without a comparative model analysis. The impact of the total changes will largely depend on the magnitude of change for each assumption, the mix of business, and policy specifications. These items are more difficult to quantify immediately using an independent modeling approach because it only captures second-order impacts with model iterations.

Similarly, focusing on the LTC rider only, the higher active life mortality leads to fewer policies in force in future years. The reduction in disabled life mortality will have two counteracting effects: Fewer terminations due to deaths, more recoveries, and more benefit exhaustions. Again, the higher order impacts of these assumption changes are difficult to accurately quantify using the independent modeling approach.

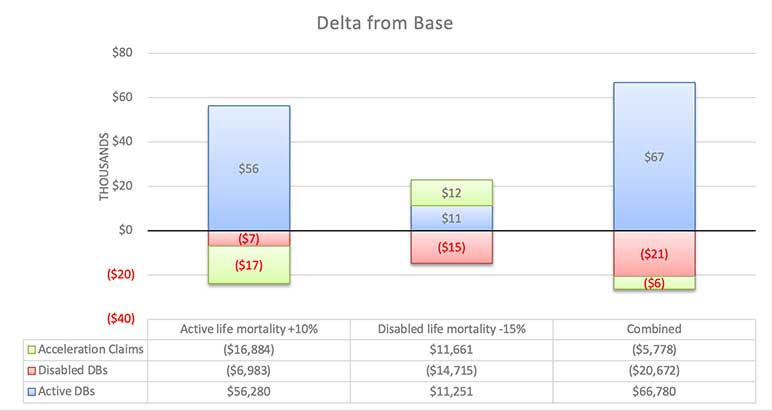

We developed the calculations in Figure 4 by adding simple scalars to the active and disabled life mortalities and reviewing results for reasonableness. Producing the similar analysis within the independent modeling framework is more involved:

- Recalculate claim costs.

- Recalculate death benefit savings adjustment and associated J-Prime factors (proportion of projected active versus disabled lives in force).

- Re-run the base model with adjusted claim costs.

- Review results for reasonableness (more difficult with a Claim Cost model), and rerun the process for each subsequent adjustment.

Once developed, the IFP model produces results in a more straightforward manner, allowing for easier analysis of complex issues such as the interplay of assumption changes to projection results.

Cash Flows and Reserving at Future Time Steps

We also recognize the benefits of IFP modeling in cash flow testing and reserving for Hybrid products. As a block of hybrid policies ages, experience is certain to deviate from that assumed in pricing. Contrary to the independent modeling approach, an IFP model segments active and disabled lives into different states. This allows for several key advantages outlined below:

- An integrated first-principles model can handle on-claim policies at the valuation date without any major changes to the morbidity assumption. The model places the policies that are on claim in the disabled state at the projection start.

- For some companies that develop first-principles actuarial assumptions from experience studies, model output will align more closely with the results of those studies. Tracking deaths, lapses, and claimant information can be readily compared against assumed active and disabled life mortalities, claim incidences, and lapses.

- Companies can accurately project active life reserves and disabled life reserves using the active and disabled life states

- The actuary does not need to accommodate any simplifying modeling steps, which produces more accurate cash flow testing results.

- The approach integrates well to comply with certain regulations (VM-20, AG-51).

Companies who use IFP models for their hybrid products will have access to more granular detail, enabling management to make necessary in force improvements, capital planning decisions, and pricing determinations.

IFP models are also better equipped to address emerging regulatory standards, including VM20, GAAP LDTI, and IFRS 17. These emerging standards have placed emphasis on regular updates to assumptions, which as described above, is a strength of IFP models.

Conclusion

As hybrid products are more increasingly modeled under an IFP approach, modeling base life insurance policies on an integrated and first-principles basis with LTC riders produces more informative, precise, and robust models. Modern actuarial software continues to make advancements in the hybrid product space, offering out-of-the-box integrated first-principles functionality for hybrid products with the added flexibility needed for product customizations.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.