By Anthony Cappelletti

The number of households with pets worldwide is significant. Cats and dogs are everywhere—and people are spending more on them than ever before. The list of pet expenditures includes food, toys, clothing, grooming, and veterinary care. Many consider their pet as a family member. Full disclosure, I consider my 2-year-old Cavapoo [1] to be a part of my family.

It should be no surprise that pet insurance is one the fastest growing lines of business for general insurance as pet owners seek insurance coverage for pet health care expenses. However, pet ownership and consideration of general insurance goes beyond pet insurance. There are considerations of liability that can involve homeowners (or renters) insurance and automobile insurance. In this article, I’ll step through the influence of cats and dogs on general insurance.

Pets by numbers

Statistics on pet ownership are a little fuzzy. They are based on numerous surveys carried out by various agencies using different statistical techniques. Some focus on one country or continent while others attempt to be international. Some focus on cats and dogs while others consider all pets. The numbers don’t always match up, but they are interesting. Below, I highlight the results from four often quoted surveys.

- A 2016 internet survey by market research firm GfK SE [2] across 22 countries estimated that 57 percent of households owned a pet [33 percent of households owned dogs, 23 percent owned cats, 12 percent owned fish, and 6 percent owned birds]. The following are statistics by type of pet from a sample of the countries in the survey:

|

Country |

Dogs |

Cats |

Fish |

Birds |

|

U.S. |

50% |

39% |

11% |

6% |

|

Canada |

33% |

35% |

9% |

4% |

|

China |

25% |

10% |

17% |

5% |

|

Brazil |

58% |

28% |

7% |

11% |

|

Russia |

29% |

57% |

11% |

9% |

|

UK |

27% |

27% |

9% |

4% |

- The U.S. Census Bureau’s American Housing Survey from 2017 reported that 49 percent of households own a pet.

- A 2016 survey by the American Veterinary Medical Association estimated that 57 percent of households in the U.S. own a pet [38 percent own dogs, 25 percent own cats, 13 percent specialty pets, and 3 percent birds]. [3]

- A 2016 survey by the American Pet Products Association estimated that 68 percent of households in the U.S. own a pet.

Wading through all the numbers, it does look like there are a lot of pets in many parts of the world. Worldwide, the number of dogs and cats owned as pets is likely in the hundreds of millions. The market for pet food, toys, clothing, grooming, and veterinary care is large. The American Pet Products Association estimated that pet industry expenditures in the U.S. were nearly $70 billion in 2017. [4]

Pet Insurance Facts

When we speak of pet insurance, we are talking about pet health insurance. Pet health insurance is much like health insurance for humans—with similar methods for ratemaking and reserving. So why I am including this in a discussion of general insurance? Pet insurance is considered general insurance by insurance regulators because pets are considered property under the law.

In the U.S., pet insurance business is classified and reported under the inland marine line of business [5] in the NAIC property/casualty (P/C) annual statement. For the general insurance actuary signing the NAIC P/C Statement of Actuarial Opinion of an insurer that includes this business, it means understanding a type of business that is not typical of general insurance. The actuary may choose to rely on the work of another for setting the reserves on this block of business (e.g., a qualified health actuary with experience in pet insurance). The actuary should pay attention to ASOP 38 if making use of the work of another. [6] Most states require a full P/C insurance license to sell pet insurance.

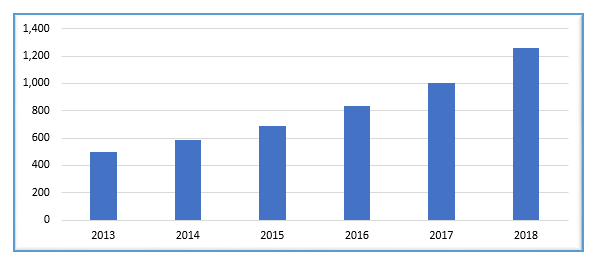

Modern pet insurance for cats and dogs has its origins in Sweden in the 1920s. It was generally limited to high-value pets. Coverage was not commonplace. Pet insurance was first offered in the U.K. in the 1940s and the U.S. and Canada in the 1980s. Since the 2000s, pet insurance premium volume has grown significantly as greater numbers of pet owners are purchasing coverage. Figure 1 shows written premium for pet insurance in the U.S. from 2013 to 2018 as reported by the North American Pet Health Insurance Association (NAPHIA). [7]

Figure 1

Direct Written Premium for Pet Insurance in the U.S. in USD millions

Pet insurance in the U.S. has grown from just under half a billion dollars in premiums to nearly 1.3 billion dollars in only five years—an average annual growth rate of over 20 percent. Of the total premium volume, nearly 90 percent is from insuring dogs. And there is more room to grow as it is estimated that only 1 percent of the pet cats and dogs in the U.S. are covered by pet insurance.

It should be noted that pet insurance statistics in the U.S. cannot be gathered directly from financial statement reporting since it is not a line of business category on its own. It is generally classified as inland marine which also includes coverage for certain property items that are transportable and not covered in a standard property insurance policy (e.g., high-value musical instruments, catering equipment, mobile medical equipment, contractor equipment).

Pet insurance is not a standardized product. Each company offering it has their own variations for a policy. However, there are two basic policy types: accident & illness plans, and accident only plans. Some accident & illness plans include a wellness plan that would include routine health maintenance costs. There are also differing levels of coverage. For example, there can be basic and comprehensive coverage options where comprehensive coverage includes basic coverage plus reimbursements for additional items (e.g., prescriptions, x-rays, and lab fees). Plan features can also vary significantly between insurers, plans and coverage levels. These features can include deductibles (per claim and/or policy term), coinsurance provisions and limits (per treatment, claim, policy term). Many policies include an exclusion for preexisting conditions, but some policies include additional exclusions (e.g., congenital/hereditary conditions, cancer treatment, dental care, behavioral therapy). Sometimes policies have plan options to add-on coverage for policy exclusions for an additional premium. Add-on coverages may have their own limits/deductibles/coinsurance amounts.

Some insurers just write dog policies, some write both cats and dogs, while others also include birds and exotic pets. Pricing is based upon the policy type, level of coverage selected, plan features, and species/breed/age of the pet. Consumers must be mindful of policy differences when shopping for pet insurance.

Some veterinary discount plans are marketed as pet insurance—but they are not really insurance. They are just a contract between the veterinarian and the pet owner whereby the pet owner pays the veterinarian an annual membership fee to obtain discounted services. These products are not legally insurance and are not regulated as insurance.

Pet Insurance, Actuaries and Insurers

As stated earlier, pets are property (legally speaking) so pet insurance is a general insurance line of business. In the U.S., it is reported within the inland marine line of business in the NAIC P/C Annual Statement. To perform the specific role of appointed actuary signing the Statement of Actuarial Opinion (SAO) for a company reporting in the NAIC P/C Annual Statement, one must meet the specific qualification standards for taking on this role. Currently, this means a fellow of the Casualty Actuarial Society (FCAS), a fellow of the Society of Actuaries (FSA) from the general insurance track, an Associate of the Casualty Actuarial Society (ACAS) who has also passed CAS Exam 7 or a Member of the American Academy of Actuaries that has been approved by the Academy’s Casualty Practice Council (CPC) to sign a P/C SAO. [8]

But pet insurance is much like human health insurance, so the actuaries involved in product development, pricing and reserving are those trained in health insurance (members of the SOA in the health track). These health insurance actuaries would not be permitted to sign a P/C SAO for a company with pet insurance unless they are an Academy member and approved by the CPC to sign that company’s SAO. Note that this would be the only regulatory restriction placed upon a health actuary working on pet insurance. They are not restricted from product development, pricing and reserving pet insurance.

Pet insurance companies can have unusual structures to satisfy regulatory requirements. Consider the IHC Group in the U.S.—an insurance group writing health, disability and life insurance through its various insurance company subsidiaries. But the IHC Group also writes pet insurance through its pet insurance provider subsidiary, PetPartners Inc. PetPartners Inc. is not a P/C insurer, it is an insurance provider. The pet insurance from PetPartners is actually underwritten by American Pet Insurance Company (APIC), a P/C licensed insurer. APIC is not affiliated with PetPartners. APIC also underwrites pet insurance from two other pet insurance providers independent of IHC Group: Pet’s Best and Trupanion. APIC is owned by Trupanion.

|

American Pet Insurance Company is the only national Property and Casualty Insurance Company solely focused on marketing and underwriting pet health insurance in the United States. We are a New York domiciled property and causality insurance company owned by Trupanion, Inc. a provider of pet health insurance in Canada and the United States. American Pet Insurance Company website [9] |

Even though APIC only writes pet insurance, the appointed actuary providing the SAO for APIC’s NAIC P/C Annual Statement must meet the qualification standards for a P/C SAO.

Pets and Cars

Although I have seen some amusing videos on the internet of cats and dogs behind the wheel of a vehicle, pets can’t drive. They are not insureds under the automobile insurance policy. So why include automobile insurance in a discussion of pets and general insurance? Because pets do influence automobile insurance.

Distracted driving is a problem. People do not always focus on the task of driving when operating a motor vehicle. These days, it seems that many people are paying more attention to their phones than driving when behind the wheel. But that’s a discussion for another day. Distracted driving does increase the likelihood of an accident. Driving with a pet in the vehicle can cause a driver to be seriously distracted.

Having your pet on your lap while driving may make you (and your pet) feel good but it is not a good idea. If you are in an accident with an unrestrained pet it will either be severely injured by becoming a high-speed projectile within the vehicle (potentially hitting the driver or a passenger with great force) or by being impacted by an airbag. For the safety of the pet, the pet should be restrained properly—tethered to the seat belt mechanism or in a crate. This will result in less severe injuries to the pet. An unrestrained pet is also a source of distracted driving. A pet may demand your attention at a moment that you need to stay focused on driving. This can lead to accidents. Despite this, many people do not restrain their pets while driving. A 2011 survey by the American Automobile Association and Kurgo found that less than 20 percent of dog owners restrain their dogs while driving. [10] This survey also included an interesting list of activities that people admitted to being engaged in while driving: petting the dog, using their arms to secure the dog while braking, feeding the dog, and playing/interacting with the dog.

|

An unrestrained 10-pound dog in a crash at 50 mph will exert roughly 500 pounds of force, while an unrestrained 80-pound dog in a crash at only 30 mph will exert approximately 2400 pounds of force. American Automobile Association/ Kurgo, 2011 Pet Passenger Safety Survey |

Some jurisdictions have laws that require a pet to be secured in a vehicle while it is in operation. The state of New Jersey requires pets to be tethered or in a carrier in the car. Fines for violations can be as high as $1,000. Even without a specific law, general distracted driving laws can be applied to drivers with unrestrained pets and there is the possibility for law enforcement officials to lay charges under animal cruelty laws for not safely securing a pet in a vehicle. In addition to this, having an unrestrained pet cause an accident may be a reason for an insurer to deny a claim for collision damage from the accident.

One may get into an accident with a restrained pet in which the pet gets injured. Automobile insurance may cover the expenses of treating the pet’s injury. If the driver with the pet is not-at-fault in the accident, these expenses would be covered by the at-fault driver’s property-damage liability insurance. If at-fault, the expenses may be covered through collision coverage (if this optional coverage was purchased). Pet insurance would cover these expenses if they were not covered by automobile insurance.

Currently, no insurers that I am aware of use pet ownership as a rating factor for automobile insurance. But accident history is a rating factor. Unrestrained pets increase the likelihood of accidents that can affect your automobile insurance premium.

Pets Behaving Badly

Sometimes pets behave badly, and pet owners are responsible under the law for the behavior of their pets. If a pet causes bodily injury or property damage to a third party, the pet owner must pay for the injury/damage. Insurance to protect a pet owner from liability for a pet’s actions is usually included within a standard homeowners or tenants insurance policy.

Dog bites are the most common type of bad behavior by pets creating liability for the pet owner. The World Health Organization estimates that injuries to people from dog bites are in the tens of millions annually. For the U.S., the annual estimate for people bitten by dogs is 4.5 million and approximately 900,000 seek medical attention. [11] While dogs lead the pack (pardon the pun), other types of pets are also responsible for causing bodily injury (e.g., cats from biting/scratching, birds and snakes from biting). Pet owners need to be mindful of their pet’s behavior.

Tort claims generally require negligence. That is, the injured party must show that the pet owner was careless. However, certain jurisdictions have a dog-bite statute in which pet owners are automatically liable for injuries caused from a dog bite if the dog was not provoked.

While homeowners and tenants policies include coverage for liability from pets biting third parties, some insurance companies will exclude this coverage for certain breeds of dogs they deem to be dangerous (e.g., Doberman Pinscher, German Shepherd, Pit Bull, and Rottweiler) or individual dogs that have been classified as vicious for prior bad behavior (regardless of breed.)

For pet owners without coverage from a homeowners or tenants insurance policy, there are other options. It may be possible to purchase an umbrella policy that covers dog-bite liability. Separate dog liability insurance policies are also available from some insurers. Pricing of these policies is based on breed of dog and any prior bad behavior.

While I have focused on injuries from pet bites, liability can be from other causes. Consider a dog owner that allows their dog to be off leash and the dog directly causes a motor vehicle accident. There is the possibility that the dog owner could be liable for bodily injury and property damage arising from the accident. Whether or not there is liability will depend upon the unique circumstances of the case.

Pets and Insurance—A Final Point

Many people own pets. It is important for pet owners to understand how pets can affect insurance. It is also important for those in the general insurance industry to understand the influence that pets can have on the business of insurance. Insurance coverage for pets is not standard. One must always look at policy wording whether for purchase as a consumer, or for analysis/design as an actuary.

One final point I would like to make is not really about pets and general insurance but is about pet safety during a natural disaster. Those that live in hurricane and flood prone areas know the importance of having insurance protection for damage caused by natural disasters. But insurance protection from natural disasters will not keep pets safe. Many pets are lost in natural disasters. Pet owners that live in these areas should consider their pets in their plan for natural disaster preparation. They should consider having an emergency kit that includes with items for their pet and a carry crate readily available so that they can take their pet with them if an evacuation is necessary.

Anthony Cappelletti, FSA, FCIA, FCAS, is a staff fellow for the SOA. He can be contacted at acappelletti@soa.org.

[1] Cavapoo is one of the accepted names for a crossbreed dog that is part Cavalier King Charles Spaniel and part Miniature Poodle. They are also referred to as a Cavadoodle.

[2] GfK, is an international market research company based in Germany. The numbers by pet type cannot be added up to get the total percentage of households with a pet because some households own more than one type of pet.

[3] The Washington Post Note: The numbers add up to more than the total of 57% because some households own more than one type of pet.

[4] Insurance Information Institute, Facts + Statistics: Pet Statistics, Expenditures include food, supplies, medicine, veterinary care, grooming, boarding, and animal purchases.

[5] One may wonder what is meant by the term inland marine. This terminology originates from ocean marine insurance. Ocean marine insurance is used to insure property, workers, vessels, passengers, and crew during marine transport. It is one of the earliest forms of developed general insurance and was a significant coverage offered with the development of the Llloyd’s insurance market. A different category of insurance was desired for property after marine transit was completed and the property was moved on land. Since, at the time, the property insured was the same, it was called inland marine as it could be viewed as an extension to ocean marine. This categorization seems a little quirky now since inland marine now covers property that is deemed movable but not necessarily related to ocean marine (e.g., construction equipment, cameras/recording equipment, musical instruments, and pets).

[6] Actuarial Standards Board, Actuarial Standard of Practice (ASOP) No. 38, Using Models Outside the Actuary’s Area of Expertise (Property and Casualty)

[7] The North American Pet Health Insurance Association

[8] There are further restrictions not identified in the text above. For example, a Casualty Actuarial Society member must include the U.S. version of CAS Exam 6 and a fellow of the SOA’s GI track must include the U.S. version of the SOA GI FRE Exam and include the SOA GI ADV Exam. Also, those Academy members approved by the CPC are generally only given approval limited in time (e.g., three years subject to reapplication/renewal and scope (e.g., certain lines of business or companies). In addition to meeting the basic education requirements noted here, there are also experience and continuing education requirements that must be met.

[9] American Pet Insurance Company