By Anthony Cappelletti

When one thinks of the costliest catastrophes to affect the general insurance industry, one usually thinks of floods, windstorms, earthquakes, and terrorism. However, over the past few years, there has been a significant increase in losses from wildfires. General insurers, insurance regulators and the insured public are now paying more attention to wildfires. One might say that the increasing risk of wildfire catastrophes is the “hot” topic in the general insurance industry today.

There appears to be an increasing trend in the frequency and severity of large wildfires in both the U.S. and Canada.

In Canada, the Fort MacMurray wildfire of May 2016 in Northern Alberta resulted in $3.7 billion in insured losses. This accounted for nearly three-quarters of the $5 billion in total insured losses from catastrophes in Canada for the year. This event required the evacuation of over 85,000 people and destroyed more than 2,500 homes. Prior to 2016, the year with the greatest insured losses from catastrophes was 2013. The total insured losses from catastrophes in Canada for 2013 was $3.2 billion—most of this amount was from two separate floods. The second largest amount of total insured losses from a single catastrophic event in Canada was the 1998 ice storm in southern Quebec and eastern Ontario. The 1998 ice storm caused just over $2.2 billion in total insured losses (inflation adjusted to 2017 dollars). The 2016 Fort MacMurray wildfire was a record setting catastrophic event in Canada.

In the U.S., losses from wildfires in 2017 and 2018 were significant. Catastrophic losses in 2017 were dominated by three destructive Category 4 hurricanes (Harvey, Irma and Maria)— accounting for approximately $68 billion in total insured losses. However, 2017 also had unprecedented catastrophic losses from wildfires with over $13 billion in total insured losses. Of that amount, approximately $12 billion was from three major wildfires in California (Tubbs Fire, Atlas Fire and Thomas Fire) in a three-month period from October to December—over 15,000 homes were damaged or destroyed and over 100,000 people were evacuated. As a point of comparison, total insured losses from all wildfires for the ten-year period from 2007 to 2016 was $9 billion (inflation adjusted to 2017 dollars). 2017 was a record for total insured losses from wildfires. But that record didn’t last long. While not all of the statistics have been finalized for 2018, it is clear that insured losses from wildfires in 2018 will surpass that from 2017. A single wildfire in northern California (Camp Fire) will likely account for $12.5 billion in insured losses, the most ever for a wildfire. Total insured losses from wildfires in California for 2018 will likely be around $18 billion—most of this is from three wildfires: Camp Fire, Woolsey Fire and Carr Fire.

The amounts are significant and can’t be ignored. But what is driving the increase in losses from wildfires?

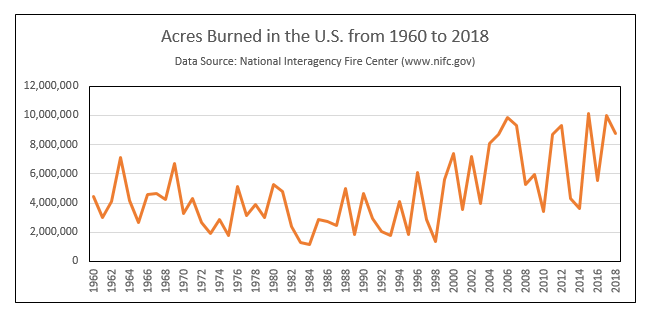

Wildfires need a cause of ignition and a supply of combustible material. Ignition may be caused by humans or nature. Common human causes of ignition include carelessness with campfires (or burning of debris), improperly discarded cigarettes, fireworks, arson and problems with power transmission (e.g., faulty or downed power lines). Natural causes of ignition include lightning strikes and lava. The U.S. Department of Interior estimates that most wildfires in the U.S. are started by human ignition. As for combustible material, wildlands are an abundant source. Given a cause of ignition and a supply of combustible material, a wildfire will spread quickly under certain weather conditions. Drought and strong winds provide optimal conditions for the spread of a wildfire. It would appear that these conditions are more prevalent now in the west and northwest of the U.S. and Canada. When examining statistics from the National Interagency Fire Center1 for the period from from 1960 to 2018, we note that the number of acres burned in the U.S. has an increasing trend of 1.2 percent annually using a simple exponential trend line. If we only use the period from 1990 to 2018, the annual trend is 4 percent.

There have always been wildfires. Most wildfires burn with little attention because the threat to property and human life is insignificant. There are more acres burned from wildfires now compared to levels over the past 50 years but that doesn’t fully explain the drastic increase in insured losses. In fact, annual acres burned from wildfires from the 1920s to the 1950s was much higher than the levels we have now. In those years, there was little effort expended to extinguish wildfires as most did not threaten lives or property. An interesting point of fact—while the acres burned has been increasing since the 1980s, the number of fires is actually showing a decreasing trend over this same time period.

The recent increase in destruction to property and insured losses from wildfires arises from the wildland-urban interface (WUI). The WUI is the area of home development adjacent to or in wildland areas. These areas are significantly exposed to the risk of wildfires. The WUI is growing. A recent article published in the Proceedings of the National Academy of Sciences of the U.S.A. noted that “the WUI in the United States grew rapidly from 1990 to 2010 in terms of both number of new houses (from 30.8 to 43.4 million; 41% growth) and land area (from 581,000 to 770,000 km; 33% growth), making it the fastest-growing land use type in the conterminous United States.”2 New home development now tends to focus on the WUI.

In addition to the growth of the WUI, little attention has been paid to mitigating the risk of wildfires to properties in the WUI. Homes were being built in the WUI with combustible roof and siding materials. Vents in homes were not fitted with screens that could block burning embers from entering homes. Homes were built relatively close to each other in the WUI with combustible landscaping (i.e., trees planted adjacent to the homes). Fences and decks in the WUI tended to be built from wood instead of non-combustible materials.

Given ample ignition sources, abundant combustible material, weather conditions favorable to wildfires, growth of the WUI, and minimal attention to risk mitigation, it’s no surprise that we are seeing a significant rise in destruction of property and insured losses from wildfires.

Insurers use catastrophe models for risks such as hurricanes and earthquakes. These models are used for ratemaking, risk transfer arrangements, measuring cumulative exposures and capital adequacy. For wildfire losses, insurers traditionally only looked at historical loss data. This was acceptable when insured losses were not a major issue. However, the recent trends in wildfire losses have stimulated the development and use of wildfire catastrophe models from commercial catastrophe model vendors. Insurers are now making use of these probabilistic models in much the same way that they use catastrophe models for hurricane and earthquake risks. The probabilistic wildfire catastrophe models generally take into account many factors such as proximity of structures to other structures and wildlands, structure type/materials, weather patterns, topography, fire suppression resources and any risk mitigation measures. The models take into account damage from both fire and smoke. This is important since a home not damaged by fire may be rendered uninhabitable due to extreme smoke damage.

Homeowners insurance does cover fire and smoke damage. However, the cost of replacing or repairing a damaged home after a wildfire can be much higher than the normal cost of replacing or repairing a home. This is due to demand surge. When a home is damaged by a kitchen fire, usually only one house is severely damaged. The costs of repair or replacement are easily estimable based upon the pre-fire value of the home. However, when a vast number of homes are simultaneously damaged by a wildfire, the cost of repair or replacement is much higher because of the surge in demand for limited quantities of building materials and trades people. This is known as demand surge which is experienced after most catastrophic events—whether it be from wildfire, hurricane or earthquake. Catastrophe modelers include a demand surge component in their models as it is a significant factor in determining the cost of an event.

The effects of demand surge are significant and can be an issue from homeowners. Coverage limits under a homeowners policy are based upon the insured value at time of policy inception. These limits may be significantly inadequate in the aftermath of a wildfire. Homeowners in the WUI should pay careful attention to insured value and whether or not it will be sufficient after a wildfire loss. California now has a law that permits homeowners policyholders to receive an updated reconstruction cost every other year or at renewal.3 This should lessen the effect of underinsurance.

Homeowners insurance also covers additional living expenses due to any mandatory evacuations and during periods when the home is deemed uninhabitable. These costs can be significant as it may take a long time before homes in an area are deemed habitable. These amounts are generally included within wildfire catastrophe models.

With wildfire catastrophe models, insurers are better equipped to measure their exposure to wildfires and they have the tools to better underwrite and price business based upon this risk. But this does create a potential problem in that higher risk homes may be faced with unaffordable or unavailable coverage—not unlike the situation seen with homes in flood zones.

In California, there has been an increase of policy nonrenewal in the WUI and an accompanying increase in policies written by the California FAIR Plan.4 The California FAIR Plan is a residual market that can insure properties unable to obtain coverage in the private insurance market. This includes properties in the WUI that are exposed to wildfire risk. FAIR policies provide minimal coverage for homeowners. The issues faced by homeowners has not gone unnoticed by legislators and insurance regulators in California. A number of laws have been proposed in the state that contemplate insurance for wildfires. These include:5

- Prohibiting cancelling or nonrenewing homeowners policies for a year in any county that has had a declared state of emergency.

- Permitting the combination of the dwelling limit with limits on other structures for those affected by a catastrophe when the dwelling policy limit is insufficient.

- Requiring up to three years of additional living expenses.

- Prohibiting the use of wildfire catastrophe models to set overall prices (requiring the use of historical averages).

Laws, such as those noted above will have some effect but will not likely not completely address the issues of availability and affordability of homeowners in the WUI. One may look at other catastrophe risks to see potential problems and solutions. Hurricane risk is being handled in Florida with the assistance of a government run “reinsurer,” the Florida Hurricane Catastrophe Fund (FHCF) which reimburses insurers for a portion of catastrophic hurricane losses. Flood risk is almost entirely handled by the federal National Flood Insurance Program (NFIP).

It is possible that the government may need to bear wildfire risk, either by supporting private industry (as is done with hurricane risk and the FHCF) or replacing private industry (as is done with flood risk and the NFIP). Any plans for dealing with wildfires and insurance should also deal with risk mitigation efforts. Building codes need to be strengthened especially in the WUI. Property density in the WUI needs to be considered. Homeowners should be strongly encouraged to institute loss mitigation/prevention measures on their property. This could be made a condition for insurance coverage.

This article has focused on homeowners insurance as it is the insurance line of business most affected by wildfires. However, it is not the only line of business affected by wildfires. There are some commercial properties in the WUI and they are exposed to property losses and business interruption from a wildfire. Liability insurance may also be involved in a wildfire when the cause is unintentional ignition from a human source. There have been actions against energy companies where wildfires were caused by faulty power lines. Automobile insurance comprehensive coverage will have claims from vehicles destroyed by the fire. And finally, health insurance can see an increase in claims due to health problems (e.g., from exposure to smoke or water contamination) after a wildfire.

Anthony Cappelletti, FSA, FCIA, FCAS, is a staff fellow for the SOA. He can be contacted at acappelletti@soa.org.

1 https://www.nifc.gov/fireInfo/fireInfo_stats_totalFires.html

2Radeloff, Volker C., David P. Helmers, H. Anu Kramer, Miranda H. Mockrin, Patricia M. Alexandre, Avi Bar-Massada, Van Butsic et al. "Rapid growth of the US wildland-urban interface raises wildfire risk." Proceedings of the National Academy of Sciences 115, no. 13 (2018): 3314-3319.

3Jergler, Don. “Will California See More Laws and Regulations in Wake of Wildfires?” Insurance Journal, November 13, 2018.

4 California Fair Access to Insurance Requirements

5Webb, Cody and Eric J. Xu. “The California Wildfire Conundrum.” Milliman Insight, November 27, 2018.