Comparison of Risk Adjustment Programs—California Medicaid Managed Care Versus CMS Medicare Advantage, PART II

This article is Part II on this topic, continuing the Part I article published previously. We begin with a discussion of disease categories.

Disease Categories

CMS-HCC Risk Adjustment Model

The 2020 CMS-HCC Model (current model, Version 24) includes 86 payment HCCs. Below are some examples (not a complete list) for your reference:

|

Kidney |

HCC134 - Dialysis Status |

|

Kidney |

HCC136 - Chronic Kidney Disease, Stage 5 |

|

Kidney |

HCC137 - Chronic Kidney Disease, Severe (Stage 4) |

|

Kidney |

HCC135 - Acute Renal Failure |

|

Kidney |

HCC138 - Chronic Kidney Disease, Moderate (Stage 3) |

|

Blood |

HCC046 - Severe Hematological Disorders |

|

Blood |

HCC047 - Disorders of Immunity |

|

Blood |

HCC048 - Coagulation Defects and Other Specified Hematological Disorders |

|

Diabetes |

HCC017 - Diabetes with Acute Complications |

|

Diabetes |

HCC019 - Diabetes without Complication |

|

Diabetes |

HCC018 - Diabetes with Chronic Complications |

|

Heart |

HCC087 - Unstable Angina and Other Acute Ischemic Heart Disease |

|

Heart |

HCC086 - Acute Myocardial Infarction |

|

Heart |

HCC088 - Angina Pectoris |

|

Heart |

HCC085 - Congestive Heart Failure |

|

Heart |

HCC096 - Specified Heart Arrhythmias |

|

Vascular |

HCC106 - Atherosclerosis of the Extremities with Ulceration or Gangrene |

|

Vascular |

HCC107 - Vascular Disease with Complications |

|

Vascular |

HCC108 - Vascular Disease |

Earlier this year (in 2023), CMS released a new model, the finalized 2024 CMS-HCC Model (Version 28), which includes 115 payment HCCs. CMS plans to phase in the new model over three years:

- For 2024 Payment Year, CMS will blend CY 2024 risk scores using 33% of the risk scores under the finalized 2024 risk adjustment model and 67% of the risk scores under the current 2020 CMS-HCC Model.

- For 2025 Payment Year, CMS expects risk scores will be calculated as the sum of 67% of the risk score calculated under the finalized 2024 CMS-HCC risk adjustment model and 33% of the risk score calculated under the 2020 CMS-HCC risk adjustment model.

- For 2026 Payment Year, CMS expects that 100% of the risk scores will be calculated using the finalized 2024 CMS-HCC risk adjustment model.

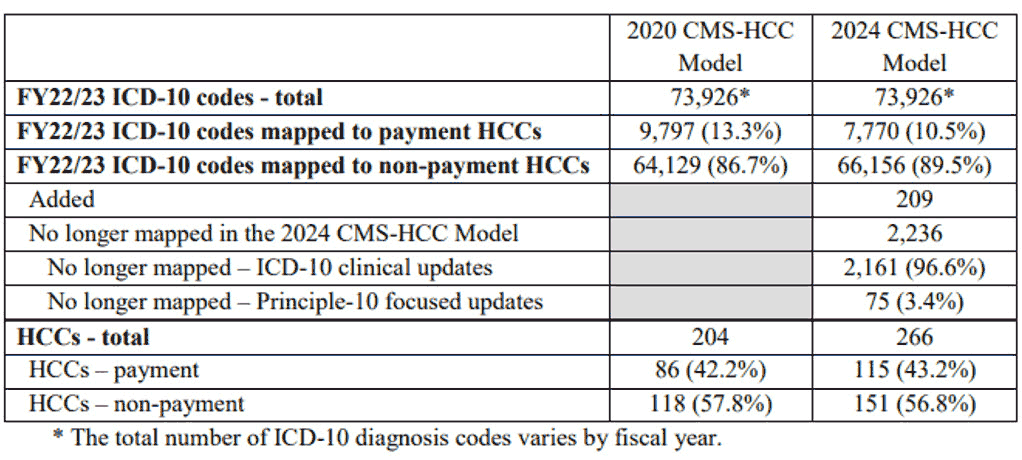

The CMS 2024 model reflects important technical updates and the table below released by CMS summarizes the main changes.

Table 1

Summary Statistics for the 2020 CMS-HCC and 2024 CMS-HCC Classifications

CDPS+Rx Risk Adjustment Model

The CDPS+Rx model Version 6.5 includes 67 CDPS disease categories and 15 MRX categories. The restricted MRX model relies on National Drug Codes (NDCs) and is used to supplement the diagnosis-code-based CDPS model. For the 67 CDPS categories, it uses 23,453 ICD-10 codes in total, and 55% (12K+ out of 23K+) of the codes are for Skeletal. There are three Skeletal disease severity levels, Very Low, Low, and Medium.

Besides Skeletal, some examples (not a full list) of other disease categories under the CDPS+Rx risk model are as below:

- Cardiovascular (extra low, low, medium, very high);

- Cancer (low, medium, high, very high);

- Diabetes;

- Gastrointestinal;

- Hematological;

- Infectious;

- Psychiatric;

- Pulmonary;

- Renal;

- Skin, and many more.

Some examples (not a full list) of the restricted MRX Disease Categories (Version 6.5) are also listed below for your reference:

- Cardiac;

- Diabetes;

- ESRD/Renal;

- Hepatitis;

- HIV;

- Infections, High;

- Inflammatory /Autoimmune;

- Malignancies;

- Multiple Sclerosis/Paralysis;

- Parkinson’s/Tremor;

- Psychosis/Bipolar/Depression, and more.

Similar to other risk models, there are hierarchy logics within the CDPS+Rx model to set flags and assign cost weights when there are multiple conditions present for the same patient during the study period.

DHCS does not use all CDPS+Rx disease categories from UCSD due to carved-out benefits like maternity and other factors.

ICD-10 Diagnosis Codes Used

The Medicare Advantage Risk Model uses diagnosis codes from medical encounters only without using any pharmacy NDCs like the CDPS+Rx model.

For Medicare Advantage Non-ESRD beneficiaries, the 2024 CMS-HCC risk model includes 7,770 ICD-10 codes mapped to payment HCCs, while the 2020 CMS-HCC Model includes 9,797 ICD-10 codes mapped to payment HCCs. There were 209 new codes added while 2,236 codes are no longer mapped to payment HCCs in the 2024 Model (see table above for details). Codes are no longer mapped due to ICD-10 clinical updates and updates related to discretionary coding.

Regarding Medicare Advantage Coding Pattern Difference Adjustment and for CY 2024, CMS will continue to apply the statutory minimum MA coding pattern difference adjustment factor of 5.90 percent.

The Medi-Cal Managed Care Risk Adjustment Model uses both ICD-10 diagnosis codes from medical claims and prescription drug NDCs as described above. It also includes much more ICD-10 codes than the CMS Medicare Advantage risk model.

Cost Weight

Cost weight for the CMS Medicare Advantage risk model is determined and updated by CMS.

For Medi-Cal Managed Care risk adjustment, DHCS does not use the national cost weights included in the standard CDPS+Rx risk model from University of California San Diego but has developed their own cost weights based on historical claims data for Medi-Cal members.

Sub-Models for Different Populations/Other Factors

Risk scores calculated under both the CMS-HCC model and the DHCS CDPS+Rx model include demographic risk score and disease risk score.

At an elevated level, the CMS Medicare Advantage program uses two models:

- CMS-HCC NON-ESRD model produces different risk scores for beneficiaries who reside in either the community (full dual, partial dual, non-dual) or an institutional setting, or who are new enrollees (new to Medicare/not enough diagnosis data, Chronic Special Needs Plans new enrollees).

- CMS-HCC ESRD (End Stage Renal Disease) model predicts medical (Parts A and B) costs for the population in ESRD status. The ESRD model is a suite of models that produce risk scores for beneficiaries in Dialysis, Transplant, and Functioning Graft statuses. For 2023, the CMS-HCC ESRD model includes new enrollee, continuing enrollee, functioning graft, and long term institutional (LTI) segments.

- Additionally, CMS uses the RxHCC model to predict Medicare Part D plan liability costs for prescription drugs under the Part D program and uses the PACE risk model for PACE plan beneficiaries.

The CMS-HCC Non-ESRD risk model uses several demographic factors in calculating the risk score, including:

- Age;

- sex;

- medicaid eligibility: An additional factor in the risk score if eligible for Medicaid;

- disability status: Additional factors in the risk scores of community residents who are disabled beneficiaries under 65 years old; and

- original reason for Medicare entitlement: Inclusion of a factor (vary by age/sex) in the risk score for beneficiaries aged 65 or older who were originally entitled to Medicare due to disability.

On the other hand, the Medi-Cal Managed Care CDPS+Rx risk model includes three sub-models due to different cost weights:

- Child;

- adult: Including the Adult and Optional Expansion COA (Category of Aid); and

- SPD (Seniors & Persons with Disabilities):

Including SPD Child and SPD Adult; Child Interaction Factors are applied to the SPD Child population only, due to benefits covered under the CCS (California Children’s Services) program.

This concludes our Part II article on this topic. Hope you have enjoyed it.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.