By Karen Monks

By Karen Monks

This article was originally published in the December 2011 issue of Agent’s Sales Journal. Mobile technology is changing rapidly and since original publication, more and more insurers have mobility in the plans for producer tools.

Those who ignore the mobile technology revolution may place their businesses at a disadvantage. Consumer behavior and expectations, along with pressures to conduct business more efficiently, are making the shift toward mobile platforms more than just a fad. The challenge is how to use mobile technology tools and solutions not only to enhance productivity but also to nurture personal customer interactions and promote customer service.

With the advent of mobile digital technology, the question is whether life insurance companies can benefit from this new high-tech, high-touch approach to sales. The further challenge for insurers is how to choose from among the bevy of technologies, and which approach will be most secure and effective for their business, agents, and brokers.

North American life insurance companies are not at the forefront of offering their sales force mobile apps. But, even with the challenges mobile technology may introduce, it won’t be long before a mobile device with an insurance company-supported application is part of every life agent’s cadre of sales tools.

Over the years, the industry has relied on a fairly low-tech, high-touch process of selling insurance products. Laptop PCs and the Internet initially met with slow acceptance due to a combination of internal resistance and a lack of external pressure. Today the Web has changed from frightening challenge to a necessity, and it has changed the relationship between agents and clients. A recent insurance study found that eight out of every 10 new life insurance clients obtained insurance quotes or information from a company’s website, and then contacted an agent to purchase a policy.

Even though today’s consumer relies on PCs and the Internet, the same is not true for the agents. Many agents still predominantly rely on paper for presentations, illustrations and completing applications. Mobile technology has the potential for increasing the use of technology by agents and making a lasting impression on the consumer as well. In contrast to the years it took for the Web to catch on in insurance, mobile is relatively quickly becoming an expected platform in distribution.

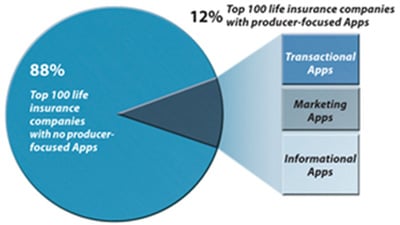

In a recent study, Celent found that 12 percent of the top 100 life/annuity/health insurers in North America have implemented applications on mobile devices for their sales force. Celent categorized mobile apps as transactional, marketing-related, or informational. An example of a transactional app that uses company networks to access and submit data is John Hancock’s "iIllustrate" mobile app. The app allows agents to generate illustrations for clients on iPads. The agent securely accesses a native mobile app that replicates much of the functionality of the company’s network illustration. Non-transactional apps provide marketing materials or information to the agent. Two insurers who offer marketing-related apps include Aflac and The Hartford. Aflac developed LaunchPad, which integrates video, animation, calculators and regulatory information into understandable and practical sales presentations. The Hartford loaded iPads with online presentations, marketing materials and product information to free annuity wholesalers from having to bring along binders of marketing paperwork to client meetings.

A small percentage have implemented an app. But according to discussions with life insurance CIOs, while mobile applications are not yet implemented in their businesses, nearly 50 percent are investigating their use.

Today’s diversity among mobile platforms and hardware devices brings about challenges in deciding which platform or device to offer to agents. In general, each operating system offers a variety of smartphones and at least one corresponding tablet from which to choose. As the variety and number of mobile platforms proliferate, insurers must decide on the capabilities they want to deliver and then figure out the best way to utilize a platform’s unique features and functionality to achieve those goals.

Insurers say that their largest concern is security. For many insurers, the BlackBerry is the only choice because of its security features, but other mobile platforms are stepping up to meet enterprise security concerns. As insurers explore each platform, they must consider the effectiveness of a device in preserving or expanding the personal, intimate connection between agent and customer while mitigating the security implications of their choice. Insurers should develop a list of capabilities they want and then figure out which devices deliver those capabilities as they investigate app development. The tablet provides an agent the ability to have an interactive selling experience, but mobile phones can be successful as well, depending on what functionality is desired.

Even after choosing a platform or device, insurers might decide that cross-platform portability is the better approach to mobile app development. Although native apps are built for one mobile platform and take advantage of the specific features and functions on a specific device, mobile apps that use Mobile Web technologies are often more cost effective and can be reused across mobile platforms and websites. Depending on what kind of app is desired, there are challenges and benefits to both approaches. The cross-platform approach, however, may be very important if an insurer chooses to adopt a "bring your own technology" approach to asset management.

No matter the development approach, the benefits of a mobile strategy can quickly be erased by unmanaged operational and regulatory risks such as not managing lost or stolen devices, PC-like attacks or accessing data outside of the corporate firewall. Companies need to be sure before buying a fleet of mobile devices or implementing a BYOT policy that those devices meet a set of security specifications. Security specifications should be developed after determining what kind of data the devices will handle and what regulations the insurer is bound by under data protection law. Implementing a mobile strategy requires an insurer to balance its desire to offer and meet the broadest range of internal and external customer expectations with security, risk, and privacy concerns.

Although there are risks, agents can benefit from having certain functions on their mobile tools. Additionally, mobile apps offer tremendous opportunity to increase market share and customer value. Some benefits include recruiting and retaining younger salespeople, enhanced customer service, error reduction due to electronic data submission, direct access to marketing materials and more interactive comfortable selling.

The value of a producer-focused mobile strategy at the outset is probably not from revenue generation. The value instead comes from better service to customers and agents at a lower cost. The revenue will follow, but patience is necessary. Among those that have implemented mobile apps, benefits have been achieved. Life insurers should investigate successful mobile stories inside and outside of insurance. Even though life insurance companies have been followers on several technology trends, insurers should not sit back and wait when it comes to mobile technology, at least not for long.

Karen Monks is an analyst in Celent's North American Insurance Practice, Richmond VA., concentrating on life insurance technology and trends. She can be contacted at kmonks@celent.com.