By PW Calfas

By PW Calfas

Speed to market. Consistency of product features across regions. Improving both are common goals of insurance distributors. One method many companies are using to achieve such improvements allows them to receive form approval from their choice of more than 40 states by submitting the form to just one set of official reviews. The method: submit the form for review through the Interstate Insurance Product Regulation Commission (IIPRC; insurancecompact.org). The IIPRC is the product standard-setting arm of the Interstate Insurance Compact. As the two are so closely related, for purposes of this article the Compact will be used to refer to both the Interstate Insurance Compact and the IIPRC.

Structure

The Compact is an agreement between member states to develop and use a single set of uniform standards as the guidelines to be followed for forms to be approved, including any actuarial-type requirements. A member state may, upon joining the Compact and as a new uniform standard is introduced, choose to opt out of any uniform standard. This allows for a member state to support uniformity of product standards while simultaneously supporting any unique needs of its population. Aside from LTC-related uniform standards, there has been little opt-out activity among member states.

Member states do not require that form filing and approval go through the Compact filing process. However, any form not filed through the Compact is subject to the unique form filing requirements of the state in which it is filed.

Member States

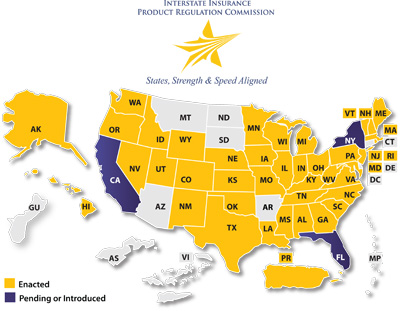

At this time, there are 41 member states. The three largest non-member states, California, Florida and New York all have introduced legislation to join the Compact or are in a pending status. It is not certain that those states will join, but there is at least some interest in Compact membership within the law-making bodies of those states.

Reprinted with permission from the Interstate Insurance Product Regulation Commission (IIPRC).

Uniform Standards

The Compact has developed a large number of uniform standards that describe the requirements to be met for each type of form it may review. Additional uniform standards are in development. The uniform standards that have already been adopted are available on the Compact’s website and are a valuable tool for those who develop forms to be filed.

At this time, adopted uniform standards cover only forms for the individual market. Some uniform standards for group markets are in development.

Product types covered by adopted uniform standards include life, annuity, disability and long-term care. The form types covered by uniform standards include policy forms, applications and rider forms, as well as forms unique to certain product features.

Utilizing The Compact

Forms are filed with the Compact via the System for Electronic Rate and Form Filing (SERFF). When a filing is created, the filing company selects the member states for which the filing will be effective. The filing company may later add to the filing any additional member states, including any states that may have joined after the form was filed.

Beyond a short learning curve the time and effort required to submit a form for approval through the Compact is comparable to that of a typical state filing submission. Also, recent experience has shown that review/response/approval time for form filings through the Compact have tended to be on par with a typical state filing of the same form type.

A recent development of the Compact that is likely to improve turnaround time is the best practices checklist. This new resource is intended to be used as a tool to avoid common errors seen in Compact filings. It was published mid-2012 and is available on the insurance company resources section of the Compact’s webpage.

Costs

The fees for insurance companies to utilize the Compact can be split into two categories: annual registration fees and filing fees. A summary of the current fee structure is in the table below.

| Fee Type | Fee ($) |

| Annual Registration | 5,0001 |

| Filing Fees | |

| Life/Annuity Form | 5002 |

| LTC/DI Form | 1,000 |

| LTC Rate Revision | 500 |

| Amendment to Filing | 250 |

1 – Fifty percent reductions available for both regional filers (12 or fewer states) and registration July 1 and later.

2 – Fifty percent reduction available for regional filers.

Many, but not all, member states collect form filing fees when selected on a form filing through the Compact. A comprehensive chart detailing those fees can be found on the Insurance Company Resources section of the Compact’s webpage.

Benefits

Improved speed to market—as a result of a single filing taking the place of 40+ state filings—is one significant benefit to a company submitting a filing through the Compact. Additionally, enough state approvals to consider a product launch can all be received at one time, reducing the uncertainty of a targeted launch date.

Better consistency across markets is another significant benefit to a company submitting a filing through the Compact. Since the Compact allows for one form to be used in each of the 40+ member states, potentially dozens of state-alternate versions of one form can be eliminated. Marketing and administering one version of a product across the 40+ member states can greatly reduce many of the challenges faced by insurers, both in the home office and in the field.

Discussion

The following are a few excerpts from a discussion about the Compact. Participants in the discussion are insurance professionals experienced in form filing and compliance functions and include:

- Zyvonne Adams, AIRC, ACS

director, Legal and Compliance, The Baltimore Life Insurance Company

zyvonne.adams@baltlife.com; - Susanne M. Lewis, AIRC, AAPA

senior contract forms specialist, TIAA-CREF

slewis@tiaa-cref.org; - Mark Nafziger

director, Life and Annuity Product Implementation and Compliance, Horace Mann Life Insurance Company

nafzigm1@horacemann.com; - Peretz Perl, FSA, MAAA

director and actuary, Product Actuarial, TIAA-CREF

pperl@tiaa-cref.org; - Chris Rzany

senior product and project manager, Fidelity Life Association

chris.rzany@fidelitylife.com; and - Susan K. Vinson, FLMI, CCP, AIRC, ACS

director, Contract Compliance & Filing, Colonial Life & Accident Insurance Company

skvinson@coloniallife.com.

What do you see as the expected/potential benefits of participation in the Compact?

Susan K. Vinson -

We’ve been a member since the Compact began. We have filed two life products (whole life and UL) as well as submitted an application mix-and-match filing.

In all of our filings we received approval within 60 days of the initial submission. (With the application filing we received an overnight approval.) Because we typically file in all states it has been much easier for us to file once with the Compact and receive the approval to then market the approved forms in 40+ states. This results in less filing prep for the contract development team and also fewer state versions to address in our enrollment and mainframe systems; not to mention less variations in our advertising and training materials prepared not only for the field but also for the home office staff.

The speed to market has been well worth the price we pay to be a member. We have called our reviewer and found all staff members receptive to phone calls; in addition they truly seem interested in helping us to get our filings correct. They were even open to discussing the mix-and-match filing before we ever filed. We were a little hesitant to file and called to discuss with our usual reviewer. He told us exactly what he needed to see and as a result we received approval the next day.

Mark Nafziger -

We haven’t used the Compact yet, but started paying for the service this year. Our justification for the purchase was:

- Compact is committed to quickly addressing filings (60 days) versus more than a year in some states;

- We hope to deal with fewer examiners (more efficient use of time);

- Less state alternate contract language and applications; and

- Hopefully filing requirements are better documented by the Compact than by the individual states.

What types of forms have you filed through the Compact? How would you rate your overall experience with the filings process? What turnaround times for objections or approvals have you experienced? Are there any parts of the process that have worked particularly well? How about parts that didn’t work so well?

Susan K. Vinson -

We have filed UL, whole life and an applications mix-and-match. Our experiences have been outstanding. Turnaround times were approximately 30 days on initial response and less for resubmission responses. The staff is open to phone calls prior to the actual filing to help ensure that we file correctly and include everything needed. I can’t think of anything that didn’t work well.

What are some of the challenges you’ve encountered when filing with the Compact?

Zyvonne Adams -

I think I have mentioned that the mix-and-match process can be somewhat cumbersome.

Have you encountered any specific processes that had a steep learning curve?

Zyvonne Adams -

Not really.

What have been your experiences with the Compact Standards?

Susan K. Vinson -

We have had very good experiences with the Compact thus far.

Zyvonne Adams -

Our experience has been good.

Are they easy to use?

Susan K. Vinson -

We found them easy to follow and understand.

Zyvonne Adams -

Yes

At what stage in the product development process do you review them?

Susan K. Vinson -

We review them at the beginning of the product development process to determine if we might benefit from filing through the Compact.

Zyvonne Adams -

Usually, during the early stages of the process in order to determine if a compact filing will be a benefit to the project.

Are the Standards helpful reference documents when responding to objections from a filing reviewer?

Susan K. Vinson -

Yes, we find that they are.

Zyvonne Adams -

Yes, they can be.

While state approval of forms through the Compact review process can generally be considered approvals for use in the member states, there still may be additional state-specific regulations that must be complied with or that may cause a given product to not pass all of a state’s requirements. [Two that may come to mind are New Jersey’s Rule N.J.A.C. 11:4-59 (Annuity Disclosure) and Washington’s WAC 284-23-550 (relationship of death benefits to premiums)] Do you have a process to determine which state regulations are superceded by Compact approval and which are not? Are there any such regulations you would suggest others consider to ensure proper compliance when using Compact-approved forms?

Susan K. Vinson -

Our understanding is that Compact approved forms do not always have to comply with state specific requirements. A state’s agreement to participate in the Compact waives SOME of the state requirements, especially if they are addressed in the Compact forms/rates.

Peretz Perl -

While we are not yet active users of the Compact, I may be able to shed some light on what is being asked relative to the responses that have been provided thus far.

The two examples you provided (dealing with annuity disclosure and pricing) are not policy form requirements per se. They are requirements dealing with the manner in which a particular product needs to be sold (e.g., disclosure), administered (e.g., lapse notices), or priced (e.g., WAC 284-23-550).

As the two respondents below have stated, approval by the Compact clearly supersedes any form-specific requirements—e.g., certain required provisions that a state may otherwise expect to see in a form and that might otherwise have been required as a condition of policy form approval—the Compact does not necessarily supersede other requirements related to the way a company does business related to those forms.

So for example, pricing requirements can still apply, administrative requirements, advertising requirements, required notices, and the like could still be applicable.

Again, as a not-yet-user of the Compact, we have not had an opportunity to catalog these distinctions. However, there certainly would seem to be the possibility for such continued applicability of state-specific requirements.

Chris Rzany -

Agreed. The distinction between policy form requirements and other requirements related to doing business is a useful one here. The latter category of requirements generally apply, regardless of the fact that a form may have been approved through the Compact.

Conclusion

The Compact can be a valuable tool—one which stands to become more valuable as additional uniform standards are developed and as more states join the Compact—for insurance companies that operate in multiple states. Every such company should become familiar with the Compact to see if it can be of value for its unique situation.

PW Calfas, ASA, MAAA, is an associate actuary with Federal Life Insurance Company. He can be contacted at pwcalfas@federallife.com.