By Patrick T. Leary

By Patrick T. Leary

The Changing Times

While more long-standing issues including the recruitment of new sales talent and the aging of the existing field force create a background against which today’s industry operates, recent research conducted by LIMRA and McKinsey and Company examines additional issues that have emerged and merit attention. Ultimately, these new developments present opportunities for organizations that, if leveraged appropriately, can set them apart from the competition.

The research discussed in this article is based on survey data collected via an online survey and phone interviews conducted in 2012, with nearly 2,000 insurance and investment advisors. The study participants represented multiple distribution organizations, including insurance companies, broker/dealers, banks, and RIAs with a focus on the largest firms.

Let’s begin with an overview of the current state of face-to-face distribution and the framework within which today’s financial services organizations now operate. This framework is dictated by the following three basic realities:

- The dominance of independent distribution,

- The emergence of the contemporary advisor, and

- The development of the integrated sales and service model.

Independent Distribution

Independent distribution is the leading sales channel for many core industry products. Today it accounts for more than half of the life insurance written and two-thirds of annuity business written. In the independent realm, advisors are actively screening carrier partners, while independent distribution networks (IMOs and BGAs, for example) have become central to distribution strategy.

The independent distribution networks now play a critical role in the competition for sales talent and market share and today more independent advisors prefer to place their business through an intermediary as opposed to placing it directly with a carrier. With much of the business now written through independent channels, and with industry consolidation creating large mega-distributors and distribution networks, these organizations now have significant leverage among manufacturers. In an effort to differentiate themselves, these independent organizations have gone beyond the traditional mix of services—to providing other value-added support such as advanced marketing attorneys and marketing services.

Further, these independent distribution networks will seek new sources of revenue, which likely will lead them to expand into new markets, offer new services, or tap into new sales channels. Carriers must decide what value proposition, beyond product, they will provide to these organizations in order to have a seat at the table. These trends raise the question of how far carriers need to go in providing services to these increasingly vertically integrated marketing organizations. As supported in LIMRA’s 2012 Turning Point research, for both the independent organizations and the carriers, key to their future success will be having a clear strategy for differentiation and executing it well.

For those carriers not working through independent distribution networks, but instead distributing directly to advisors, there is increased competition as advisors constantly revisit and reevaluate their carrier relationships and look to “shorten their shelves.” Today, independent advisors place business with just half of the companies they are contracted with.

In addition, almost half of the independent advisors stopped writing business with at least one carrier in the past two years, typically due to noncompetitive product offerings. Other factors contributing to the dissolution of distribution relationships include the carrier’s financial instability, a desire to reduce the number of companies they are contracted with, and service and support issues. However, the fact that advisors constantly evaluate their partner carriers provides an opportunity for manufacturers to differentiate themselves through product, service, and delivery models that will attract the business of today’s independent advisors.

Today’s Contemporary Advisor

Over time, competitive pressures, market demands, and new regulations have created a new profile for today’s insurance advisors. Many have broadened their practices and incorporated investment and advisory solutions. Likewise, investment-oriented advisors now include insurance and advisory services as part of their business. Financial services organizations have responded in kind, as many now offer-to varying degrees-a wide range of insurance, investment, and advisory solutions through affiliated and third-party channels.

As such, the competition for clients, especially pre-retirees, will be especially fierce as more advisors across various insurance and investment channels now provide an entire suite of products and services to meet client needs. They and their carriers no longer just compete with other insurance-oriented advisors and carriers, but also with investment-oriented advisors and their firms. These include independent advisory representatives (IARs), bank advisors, and advisors affiliated with full-service and independent broker/dealers.

This emergence of the contemporary advisor-who has expanded his or her practice to include new offerings beyond the traditional product set-has contributed significantly to today’s distribution environment and is becoming more engrained. For today’s career and independent insurance advisors, 30 percent of their gross revenue comes from investment and advisory business, up from 23 percent in 2004. What is very telling is that almost half of insurance-oriented representatives consider their primary area of expertise to be something other than insurance.

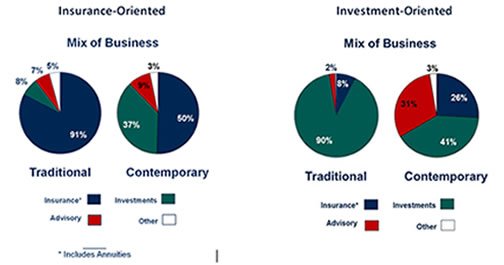

Yet, while the contemporary advisor is becoming increasingly prevalent, this does not mean that the traditional advisor is going away. A significant number of advisors in both the insurance and investment space remain successful focusing on their traditional core business. As a result, organizations now must support multiple types of advisors, each with unique needs (Figure 1). No longer is one support model sufficient; companies must identify where they will build competitive advantage that will align the most desired advisors with their strategic priorities.

Figure 1: Traditional Versus Contemporary Advisors

*Click To View LargerSource: LIMRA (2013)The Integrated Sales and Service Model

The increased need to deliver products and services in an efficient and cost-effective way—coupled with the evolving expectations of today’s consumers—has created today’s integrated sales and service model.

Similar to what has happened in the consumer products space, financial services organizations are adopting the concept of multichannel marketing (also referred to as “omni-channel retailing”), where consumers are presented with a consistent experience across web, mobile, and retail stores. In this approach, technology takes center stage as the organization gains a single view of the customer across its channels, as opposed to several siloed views. It recognizes that today’s customers will leverage multiple outlets as they research and buy products and services.

Well entrenched in the consumer products space, today’s customers have come to expect multichannel marketing and distribution regardless of the product or service they are buying, including financial services. As such, firms and their advisors must be able to deliver this consistent experience across affiliated and third-party channels, as well as across contact center, web and mobile platforms.

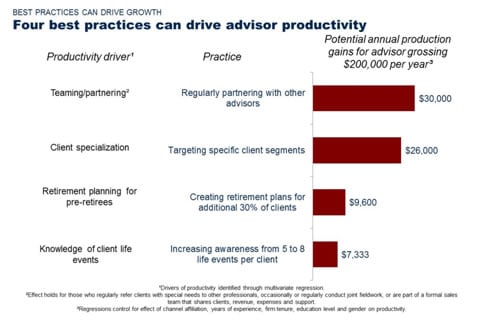

Today’s advisors recognize this need. Demands in the technology arena are more specialized; yesterday’s differentiators are today’s table stakes. To meet the needs of today’s clients, advisors are demanding more advanced technology for client acquisition and maintenance. Their interest in smart phones, tablets, and social media is high; a significant number would like to incorporate such technology to access information, obtain quotes, gather data, present information, and use for training/continuing education (Figure 2). Advisors also say they plan to increase use of social networking and video conferencing to contact their clients. In fact, our research shows that the number of advisors who expect to initiate daily or weekly contact with their clients via these methods is expected to rise significantly over the next three years.

Figure 2

Source: LIMRA and McKinsey & Company (2013)

Continued Demand for Service and Support

Today’s distribution environment places competitive pressure on organizations to try to “be all things to all people”—forcing them to step back and review the service and support they provide to both traditional and contemporary advisors. However, it would seem that organizations have been more focused on quantity than quality. Advisors receive more support services today than they did in 2004, but many of these services are not highly valued. Today’s advisors have raised the bar, requesting more specialized services in point-of-sale support, technology management, development and coaching, remote sales support, marketing services, and new-business processing.

Organizations must align their strategies and provide the services and support that best position them for profitable growth today and in the future, while recognizing the value that certain services provide to an advisor’s practice. The competition for sales talent and the business of today’s advisors is particularly fierce. Financial services organizations operating in both affiliated and third-party (i.e., independent distribution) channels must provide a value proposition beyond compensation that aligns with the needs of their top performers—but that also appeals to advisors with other firms as they look to place their business. This exhibits itself in the following ways:

- The need for specialized service and support,

- The changing role of field leadership,

- The growth of second-line management and product/functional specialists, and

- The increased demand for wholesalers (especially point-of-sale wholesaling) and the growing importance of sales desks.

The Opportunities

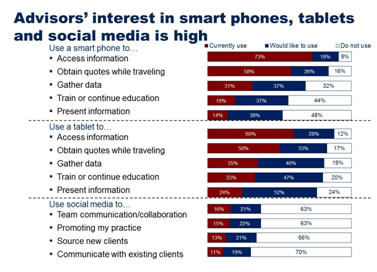

Forces of change among manufacturers, distributors, advisors, and consumers have reshaped the distribution landscape, which has driven companies to reevaluate their distribution strategies and create new approaches that leverage the business dynamics in play. In today’s environment, organizations and their advisors can deploy four best practices to gain clarity and position themselves for success: client specialization, retirement planning, knowledge of client life events, and team-based business models (Figure 3).

Figure 3

*Click To View LargerSource: LIMRA and McKinsey & Company (2013)Client Specialization

Currently, 43 percent of advisors incorporate client specialization and segmentation into their practice model. And, according to our research, those who do so can expect to increase production by an average of 15 percent. When segmenting their clients, advisors tend to use level of affluence, occupation, age, and life events as the primary dimensions.

As advisors themselves become more specialized, the resulting demand for specialized support (particularly both in-person and remote sales support) increases. In addition, support from product specialists, sales desks, and wholesalers has become increasingly critical to advisor success. Collaboration and team-based business models are approaches that allow advisors to integrate their resources and serve their clients in a consistent manner.

Retirement Planning

Our research further shows that advisors who engage in retirement planning activity can increase production 5 percent. It is common knowledge that the growing retirement market presents tremendous opportunity to meet the accumulation, protection, payout, and wealth transfer needs of today’s consumers. The retirement market includes not only current retirees, but also pre-retirees who are accumulating retirement assets and preparing to enter the payout phase, leveraging those assets to fund their retirement years. Adding to the retirement dynamic are concepts such as “phased” retirement and part-time retirees, those individuals who take on second careers in retirement.

While there is significant opportunity in the retirement space, there also are challenges. Of the estimated 50 million pre-retirees today, many lack understanding of retirement risks, most find it difficult to communicate goals and concerns, and two-in-three clients who have advisors still fail to create a plan. In addition, many advisors don’t know how to frame the retirement income discussion. Further, according to LIMRA’s Advisor Perspectives on Retirement Planning study, half of retired clients will switch to a new advisor in retirement.

It is clear that advisors who employ retirement planning as part of their business model have higher net incomes than those who do not (Figure 4). In addition, advisors find that formal written plans can bring benefits such as fostering client relationships and directing discussions toward product solutions. Once a plan is established, it follows that the advisor would provide the means to put the plan into action. Advisors feel that these plans can help them build assets under management through rollovers and referrals. Recent LIMRA research shows that about seven-in-10 of them use software packages to generate plans—a tool that saves time and also enhances the professionalism of the finished product.

Figure 4: Impact of Retirement Plans on Advisor Net Income ($000)

*Click To View Larger1Pre-retirees=45-54Source: LIMRA and McKinsey & Company (2013)Knowledge of Client Life Events

According to our research, advisors can increase production almost 4 percent through building awareness of their clients’ life events. Developing knowledge of events such as retirement, marriage/divorce, a receipt of a large sum of money, serious health issues, the birth of a child, and unemployment can help advisors better align product and services solutions to meet their clients’ needs. However, this approach means engaging clients at a new level that requires more time—putting pressure on advisors’ ability to manage a large number of clients effectively.

LIMRA research of life insurance shoppers (reported in the Buyer-Nonbuyer study) supports this approach. More than two-thirds of life insurance shoppers ultimately purchased a policy when experiencing certain life events or triggers, including:

- Changed marital status.

- Purchased a home.

- Started/expanded a business.

- Had/adopted a child.

- Received substantial assets.

As such, advisors who are proactive in identifying current and new prospects experiencing life events can position themselves nicely for current and future sales opportunities.

Team-Based Business Models

Our results also show that regularly partnering with other advisors can increase production 15 percent. The growth of team-based business models not only represents a change in philosophy, but also a change in culture that has implications for recruiting, talent management, client service, and practice support. The financial services industry to date has been built around a solo distribution model, where advisors build their own practice and their organization provides a compensation and support model that drives success.

Team-based models can alleviate pressures on advisor practices and help them succeed, and advisors in team-based practices cite several reasons for employing them:

- They wanted to grow the practice and increase productivity.

- It evolved from informal partnering/joint work.

- They sought ways to better serve clients.

- It was necessitated by the growing complexity of the business.

Team-based models fit nicely into today’s business environment and address challenges around sales capacity and business transition. Advisors entering the business today seek a team approach in their sales model. And according to our study, those placed in team-based business models are more likely to succeed than those in traditional solo practices.

Specific advantages to team-based business models include:

- Allowing for an orderly business transition to the next generation of advisors.

- Providing a work culture of success where new advisors are not overwhelmed and can rely on their team members for support.

- Addressing complex client needs through the various specializations of team members.

- Allowing the practice to engage and manage a large number of clients effectively (While practice leaders focus on clients with more complex needs, they can allow junior advisors to address clients with more modest needs—clients who otherwise might not be served.).

A New Distribution Landscape

Challenges in distribution economics, advisor business models, and consumer preferences have created an environment where the economics of distribution are under pressure. This is driven by the increasing cost of supporting and serving a limited number of advisors, as well as managing the demands of multichannel sales and distribution. As such, there is a new distribution landscape, one that financial services organizations have the opportunity to leverage to benefit them. While the clock is ticking on addressing issues around sales capacity, recruiting new sales talent, and an aging field force, nimble organizations have their eye on the clock and are taking steps to address these challenges and position themselves for profitable growth in the future.

Patrick T. Leary, MBA, LLIF, is assistant vice president, Distribution Research, LIMRA. He can be contacted at pleary@limra.com.