By Michelle Krysiak

With today’s aging baby boomers, insurance companies are looking for new and innovative ways to offer products that provide value to their customers and that distribution channels are excited to sell. A number of different product types are being offered or considered by insurance companies. This article will discuss one particular category called living benefit riders or accelerated death benefit riders. The purpose of this article is to discuss a number of these benefits and their nuances and to outline some of the differences between each type. The specific riders to be discussed are:

- long-term care insurance (LTCI) accelerated benefit rider (ABR) with or without an extension of benefits rider (EBR);

- terminal illness rider (TIR);

- critical illness rider (CIR); and

- chronic illness rider (CHR).

The abbreviations above were chosen for simplicity and are not necessarily used across the industry. All of these options will be discussed and compared as riders to life insurance products (as opposed to stand-alone products or riders to annuity products) for consistency and clarity. Keep in mind that the LTCI ABR and EBR can be added to annuity contracts as well as life insurance products and that the CIR can be offered as a stand-alone product as well as a rider.

LTCI ABR And EBR Riders

Typically, LTCI ABR and EBR are added to contracts that accumulate some sort of policy value. These riders and the products to which they are attached are referred to as combination products or combos, for short. In today’s market, these riders can be added to or part of a universal life (UL), an indexed UL, a whole life, or an annuity contract. An ABR will typically accelerate a percentage of the death benefit on life policies (or account value on annuity products) upon the occurrence of a long-term care need for a certain number of months. For example, a $120,000 life policy with a four-year ABR could allow a maximum benefit of $2,500 to be paid each month for 48 months while the insured is using long-term care services. The amount being accelerated will reduce the death benefit on the contract dollar for dollar. The policy value will generally be reduced in proportion to the death benefit reduction.

The EBR begins after the benefits have been exhausted for the ABR, thus, it is not an acceleration benefit. At this point, the death benefit and policy value will technically be zero, but most contracts offer a residual death benefit, to be paid in the event of death after the ABR benefit period. The EBR provides additional monthly benefit payments if the insured is in need of LTC beyond the ABR benefit period. For the $120,000 policy above, that also includes an EBR. The maximum EBR monthly benefit payment would also be $2,500, the same amount as the ABR benefit, and the benefits could extend for a period up to the maximum EBR period originally chosen by the policyowner. The ABR and EBR can be sold alone or in combination, but it is not common practice to offer the EBR without having the ABR precede the EBR.

The services covered can include care provided at a nursing home, at an assisted living facility, and/or at home or other situses such as an adult day care facility. In order to receive benefits, a licensed health care professional must certify that the insured individual is either unable to perform a certain number out of a minimum of six activities of daily living (ADL’s) with a condition that is expected to last at least 90 days and/or is severely cognitively impaired. The number of ADL’s for which impairment is required before benefit triggers are met is limited to three, at most, per the NAIC LTCI Model Regulation. Common practice utilizes two of six ADL’s. The six ADL’s outlined in the regulation are bathing, continence, dressing, eating, toileting, and transferring.

The benefit payments can be structured as reimbursement of expenses up to the maximum monthly (or daily) benefit or the rider may simply provide the maximum for each month the individual qualifies for the benefit. Any benefit amount that exceeds the greater of the per diem limitations under 7702B (often referred to as the HIPAA LTC limits) or the expenses incurred shall be includible in gross income. Benefit payments below the greater amount are excluded from the insured’s taxable income if the policy is a tax-qualified LTCI contract. In order for an agent to sell these riders in most states, the agent must have an accident and health license.

The cost of the riders can be funded through separate rider premiums or by applying cost of insurance (COI) charges against the policy value. Certain states (Florida, for example) require the premiums and/or COI rates for these riders to be level for the duration of the charges.

Standards For Accelerated Benefits (NAIC) And Accelerated Death Benefits (IIPRC) (Non-LTCI Benefits)

There are two primary standards/regulations that address non-LTCI accelerated benefits, the National Association of Insurance Commissioner’s (NAIC) Accelerated Benefits Model Regulation (Model Regulation) as of April 1998 and the Interstate Insurance Product Regulation Commission (IIPRC) Standard for Accelerated Death Benefits (ADB) adopted Feb. 28, 2007 and effective May 31, 2007. Notice the Model Regulation refers to the benefits as accelerated benefits while the IIPRC Standard refers to them as accelerated death benefits. Both terms will be used interchangeably, but the abbreviation ADB will be used most often throughout the remainder of this article.

According to these standards, accelerated death benefits are advance payments of life insurance death benefits payable during the insured lifetime at the time of a qualifying event that reduce the death benefit otherwise payable and are fixed at the time of acceleration.

According to the NAIC Model Regulation, a qualifying event means one or more condition that:

- drastically limits the insured’s lifespan, to 24 months or less;

- requires extraordinary medical intervention (major organ transplant or artificial life support) without which the insured would die;

- requires continuous confinement in an eligible institution for the rest of the insured’s life;

- results in a drastically limited life span, without medical intervention; or

- is a qualifying event the commissioner shall approve.

According to the IIPRC Standard, a qualifying event is one that drastically limits the insured’s lifespan (i.e., a terminal illness, which is a required trigger which must be included as part of any policy which offers ADB approved under the IIPRC Standard). The insurance company is left to define the limit but the regulation sets the minimum at “six months or less” and the maximum at “24 months or less.” The standard also allows the insurance company options to include other conditions such as:

- A medical condition requiring extraordinary medical intervention (such as a major organ transplant or artificial life support, without which the insured would die);

- A condition requiring confinement in an institution for the rest of the insured’s life;

- A specified medical condition resulting in a drastically limited life span, without medical intervention; and

- A chronic illness being the permanent inability to perform a specified number of ADL’s and/or having a permanent severe cognitive impairment.

The IIPRC and NAIC definitions of qualifying event are very similar. Notice that the chronic illness definition in the IIPRC Standard is not included in the NAIC Model Regulation unless it falls under a situation that the commissioner would approve as a qualifying event. Also, the chronic illness definition in the IIPRC Standard is almost identical to the LTCI triggers except it includes an expectation of permanence of the condition.

The final three ADB alternatives or living benefit riders listed in the first section of this article are derived from the qualifying events above. Terminal illness coverage uses the limited lifespan definition. Critical illness coverage defines specific conditions required to receive ADB benefits. Chronic illness coverage is, as stated, related to the inability to perform a specific number of ADL’s or having a severe cognitive impairment (IIPRC Standard only). The differentiation is discussed in each of the following sections while similarities are discussed in the remainder of this section.

The benefit payments can be limited to a certain dollar amount or percentage of the base contract’s death benefit. The insurance company has a choice of benefit designs:

- Pay specified portions of the death benefit with corresponding dollar for dollar reductions to the remaining death benefit.

- Pay a discounted death benefit. The discount rate or discount methodology being used needs to be specified. The Model Regulation states that the maximum interest rate shall not be greater than the greater of the current yield on 90-day treasury bills or the current maximum statutory adjustable policy loan rate.

- Treat the accelerated payment as a lien against the death benefit. If interest bearing, the lien interest rate must not exceed the policy loan interest rate stated in the policy on lien amounts up to the cash value. Expense charges may be added to the lien. The Model Regulation states that the maximum interest rate shall not be greater than the greater of the current yield on 90-day treasury bills or the current maximum statutory adjustable policy loan rate.

The benefit payment options must include a lump sum payment and can include a periodic payment for a period certain. In practice, most states allow an annual lump sum option, which helps assure compliance with federal tax law definitions of chronically ill individuals. The periodic payment cannot require continued survival or institutional confinement per the IIPRC Standard. There can be no restrictions on the use of the benefit proceeds. This has significant pricing and benefit implications since it implies that benefits may be payable even if only informal care, such as that provided by a family member, is received. If the insured dies prior to the date when accelerated benefit payments are to begin, the acceleration can be cancelled and the death benefit proceeds can be taken instead.

Since the accelerated benefit payments are simply early death benefit proceeds, are they treated as such under state and federal tax laws? The typical insurance company response would be to advise the policy holder to consult their tax advisor. There is federal guidance for terminal and chronic illness ADB in Section 101(g) of Internal Revenue Code (IRC) which discusses “treatment of certain accelerated benefits.” It specifically states that amounts paid in these two situations under a life insurance contract “shall be treated as an amount paid by reason of death of an insured.” The code does not reference critical illness conditions. Chronically ill insureds are further required to comply with specific sections of IRC 7702B.

Under the Fairness section of the IIPRC Standards for ADB’s, it states, “Products subject to these standards shall not be described as long-term care insurance or as providing long-term care benefits.” Section 6.B. (Disclosures) of the NAIC Model Regulation has very similar wording. Most companies believe that this implies that since these riders cannot be referred to as LTCI, agents do not need an accident and health license to sell these riders. Agents must, however, be properly licensed to sell the life insurance products to which they are attached.

The cost of the riders can be funded through separate rider premiums or by applying COI charges against the policy value. No premium or COI charge can be made for the limited lifespan (terminal illness) qualifying event. If either benefit design 2 (discounted death benefit) or 3 (lien approach) listed above is used, the rider may be funded through the interest component, and design 2 allows for mortality based discounts. Companies are also allowed to deduct a reasonable expense charge upon acceleration.

Terminal Illness Riders

Terminal illness riders generally only include the limited lifespan qualifying event. The insurance company defines the length of remaining lifespan for the benefit, anywhere between six and 24 months (or less). No premiums or COI’s can be charged for this benefit. An expense charge may be deducted from the proceeds.

Chronic Illness Rider

Chronic illness riders provide benefits if the insured is unable to perform a specified number of ADL’s, and/or has a severe cognitive impairment. All of these conditions must be considered permanent under the IIPRC to qualify for benefits. The terminal illness qualifying event must be included in addition to having the chronic illness benefit triggers under the IIPRC regulations. Premiums or COI’s can be charged for this rider or it can be funded through the discount rate or interest charged on the lien, depending on the method chosen by the insurance company. Again, it is important to notice that the chronic illness definition in the IIPRC Standard is not included in the NAIC Model Regulation unless it falls under a situation that the commissioner would approve as a qualifying event.

Critical Illness Riders

Critical illness riders generally pay a lump sum benefit upon diagnosis of a list of specified critical illnesses. The list depends on the company and can include such conditions as heart attack, cancer, stroke, renal failure, or major organ transplant. Like chronic illness, the terminal illness qualifying event may be offered in addition to having the critical illness benefit triggers. Premiums or COI’s can be charged for this rider or it can be funded through the discount rate or interest charged on the lien, depending on the method chosen by the insurance company. As mentioned earlier, critical illness is often sold as an independent benefit with no relationship to the acceleration of any death benefit. In that situation, the independent products fall outside of the IIPRC Standards and NAIC Model Regulation being discussed in this article.

Disclaimer

As with all insurance products, agents and actuaries read and interpret the regulations as appropriate for their situation. Not all specifics of the regulations were outlined in this article. Links to the cited regulations and other sources are listed at the end of this article.

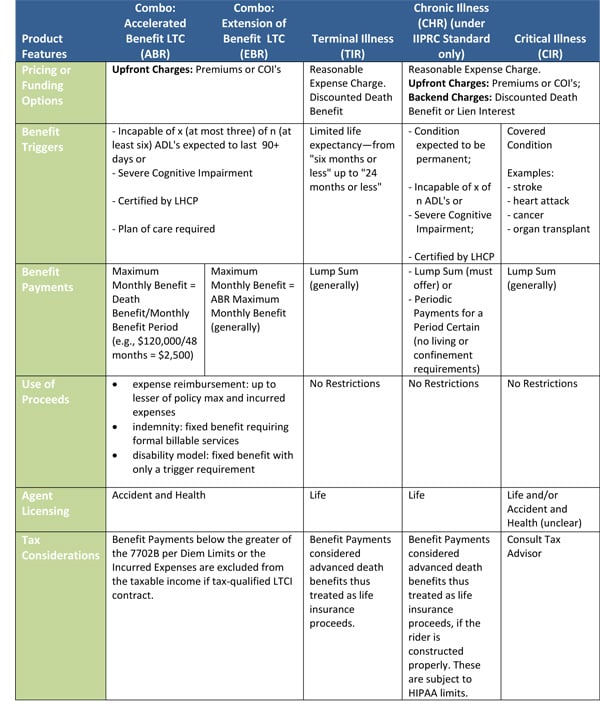

Summary Of Accelerated Death Benefit Rider Options

Michelle Krysiak, FSA, MAAA is a consulting actuary with Milliman, Inc. She can be contacted at michelle.krysiak@milliman.com.

Links to Sources:

IRC Section 7702B Qualified LTCI Treatment

IRC Section 101

IIPRC Standards for ADB

NAIC AB Model Regulation

NAIC LTCI Model Regulation

NAIC Viatical Settlements Model Regulation