Comparison of Risk Adjustment Programs—California Medicaid Managed Care Versus CMS Medicare Advantage, PART I

We know that risk adjustment programs are being used by the Centers for Medicare & Medicaid Services (CMS) for the Medicare Advantage program (Medicare Advantage) and also by the Department of Health Care Services (DHCS, part of the State of California) for the California Medicaid Managed Care program (Medi-Cal MC). In this article, we will compare and contrast these two risk adjustment programs.

What is Risk Adjustment and Why is it Needed?

Healthcare.gov defines risk adjustment as a statistical process that takes into account the underlying health status and health spending of the enrollees in an insurance plan when looking at their health care outcomes or health care costs.

The risk adjustment models used in the Medicare Advantage program function as a more comprehensive method of underwriting in which diagnoses and demographic information is used to adjust each enrollee’s monthly capitation rate to account for the expected cost associated with their age, sex, and the conditions they have. By risk adjusting the payments to Medicare Advantage plans, CMS reduces the incentives of these plans to risk select only the healthiest beneficiaries and avoids indirectly penalizing plans that provide care for the most seriously ill beneficiaries. The DHCS Medi-Cal risk adjustment program is similar to the Medicare Advantage risk adjustment program in that, using layman’s term, paying more to plans with higher risk members and paying less to plans with lower risk members.

As with any insurance design, risk adjustment is intended to be accurate at the group level and credibility needs to be considered.

Background—Program Size (Number of Beneficiaries)

The CMS Medicare Advantage program covered 31.2 million beneficiaries for April 2023, while the DHCS Medi-Cal Managed Care program covered 13.9 million beneficiaries for March 2023. In terms of enrollment, Medicare Advantage is roughly 2.2 times of Medi-Cal Managed Care.

Other enrollment information:

- Twenty percent of the US population is covered under Medicare (roughly 65 million Medicare beneficiaries out of 334 million total US population).

- Forty-eight percent of Medicare beneficiaries are covered under Medicare Advantage/Other Health Plan, while the remaining 52% of Medicare beneficiaries are covered through the Fee-For-Service (FFS) or Original Medicare program.

- Thirty-nine percent of California’s population is covered under Medi-Cal (California Medicaid serves 15 million out of California’s 39 million total population).

- Eighty-six percent of Medi-Cal beneficiaries are enrolled under Managed Care Plans instead of Medi-Cal Fee-For-Service.

Risk Models Used (Introduction)

CMS-HCC Risk Adjustment Model for CMS Medicare Advantage

CMS Medicare Advantage uses the CMS-HCC (Hierarchical Condition Categories) Risk Adjustment Model, which was developed and is regularly updated by CMS. It includes HCC, RxHCC, and ESRD (End-Stage Renal Disease) sub-models.

The MA risk adjustment models use data from a large pool of beneficiaries in the Medicare FFS program.

CMS has developed its risk adjustment methodology over time, modifying it to better account for differences in expected health expenditures. When changes are made to the model, they are proposed in the annual Advance Notice, then subsequently finalized in the Rate Announcement pursuant to section 1853(b) of the Social Security Act. In MA, all risk adjustment models in use for payment are HCC-based models.

CDPS+Rx Risk Adjustment Model for Medi-Cal Managed Care

The Medi-Cal Managed Care program uses the Chronic Illness and Disability Payment System plus Prescription Drug (CDPS+Rx) risk model. The CDPS+Rx risk model was developed and is regularly updated by the University of California San Diego, School of Public Health and Human Longevity Science.

The Chronic Illness and Disability Payment System (CDPS)[1] is a diagnostic-based risk adjustment model that is widely used to adjust capitated payments for health plans that enroll Medicaid beneficiaries.

CDPS uses International Classification of Disease (ICD) codes to assign CDPS categories that indicate illness burden related to major body systems (e.g., cardiovascular) or types of chronic disease (e.g., diabetes). Within each major category is a hierarchy reflecting both the clinical severity of the condition and its expected effect on future costs. Each of the hierarchical CDPS Categories is assigned a CDPS weight. CDPS weights are additive across major categories.

Medicaid Rx (MRX) is a pharmacy-based system that uses National Drug Classification (NDC) codes to assign MRX Categories based on types of pharmacotherapy. Each category is assigned an MRX weight.

CDPS+Rx is a combination of the CDPS and MRX models.

History of CMS-HCC and CDPS+Rx Risk Adjustment Models

CMS-HCC Risk Adjustment Model

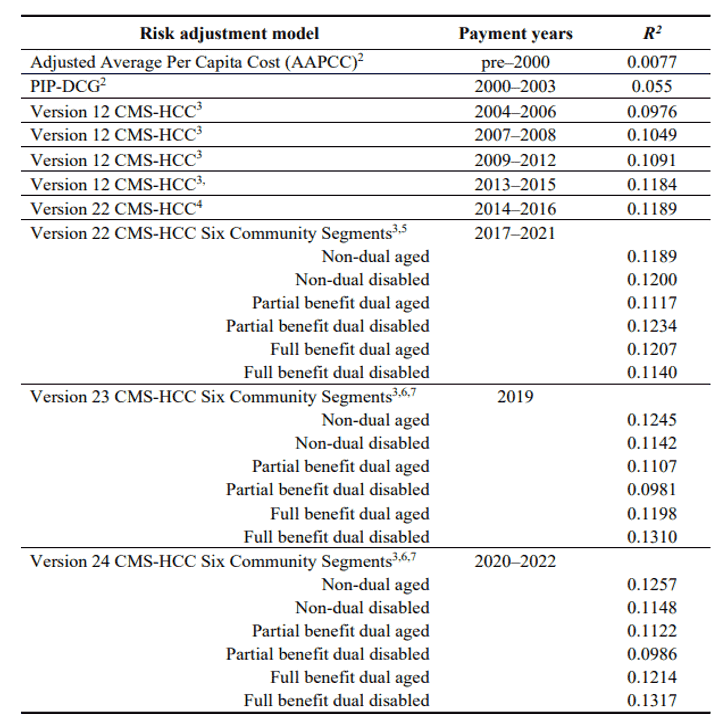

Table 1 presents a summary of the Medicare Advantage risk adjustment models and their explanatory power for individual beneficiary’s cost as measured by R2. It is followed by a description of each of the models.

Table 1

Summary of the Medicare Advantage Risk Adjustment Models

This table can be found at: https://www.cms.gov/files/document/report-congress-risk-adjustment-medicare-advantage-december-2021.pdf

UCSD CDPS+Rx Risk Adjustment Model

The UCSD CDPS model was developed in 2000 using data from seven Fee-for-Service (FFS) Medicaid programs. The model received major updates in 2009 (using national FFS Medicaid data from 2002–2005) and in 2014 (using additional national FFS Medicaid data from 2011). CDPS has also received regular annual updates to include the most recent ICD and NDC codes.

Version 7.0: The most recent update for Version 7.0 was just released on April 24, 2023.

UCSD has completed updating CDPS using data from three national Medicaid managed care plans from 2017–2019. Two main improvements are expected in the CDPS model:

- To the extent that new treatments and technology have changed how patients are treated, the relative weights estimated with 2011 data may not accurately reflect relative cost in 2019.

- To the extent that patients are treated differently in FFS versus managed care, the regression weights estimated with FFS data may not reflect patterns of care in managed care organizations.

Version 6.5: Released by UCSD in 2021, used by DHCS for Medi-Cal Managed Care 2023 capitation rates (first year of moving to the CDPS+Rx risk model).

Prior to 2023 capitation rate, DHCS was using the University of California, San Diego Medicaid Rx Only Risk Model, which uses pharmacy data only. (Example can be found here.)

Both are Prospective Risk Models

Both CMS MA and DHCS Medi-Cal Managed Care risk adjustment models use historical diagnosis codes data to calculate risk scores for rate setting for a future rating period; therefore, both models are categorized as Prospective Risk Models. For example, CMS MA uses CY 2022 diagnosis code data to calculate risk scores for CY 2023 payment rates. For CY 2024 Medi-Cal Managed Care capitation rate, DHCS plans to use part of 2022 and part of 2023 (date of services) diagnosis code and pharmacy NDC (National Drug Code) data to calculate 2024 risk score.

Another type of risk model is the concurrent risk model, which uses diagnosis codes from the same time period as the rating period. The Affordable Care Act (ACA) risk adjustment model is a concurrent risk model. For example, it uses CY 2023 diagnosis code data to calculate risk scores for CY 2023 payment rate.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.