The Latest Trends in Actuarial Tech and Automation: A Snapshot of the Landscape Today and Hypotheses for the Future

Section 1: Software Landscape for Pre-Model and Post-Model

In the past five years, most insurance companies have made significant investments in the “pre-model” and the “post-model” environments surrounding actuarial core models where data is enriched, transformed, and analyzed. Companies usually have more than one goal for these investments, such as better analytics, faster financial close, decreased dependence on IT, or fewer iterations on the data provided by other functions. Rising to the top, as the most frequently stated goal, is the desire to minimize the time actuaries spend manually adjusting data.

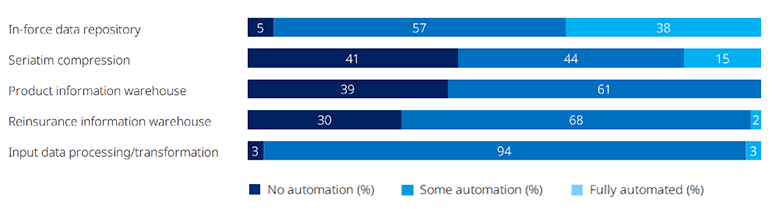

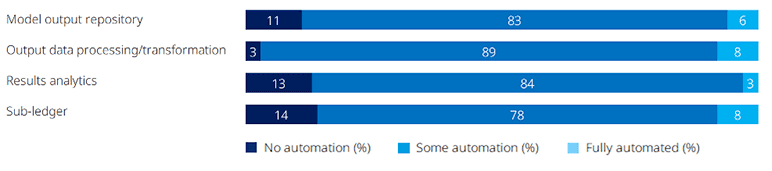

However, automation has remained an elusive goal for most firms. Below, we share results from Oliver Wyman’s 2022 US Modeling Survey (with 40 respondents), which visualize the platforms used and level of automation achieved.

Pre-Model

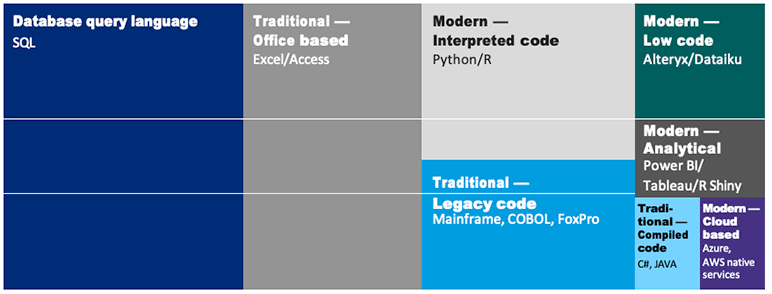

Exhibit 1

Prevalence of Key Data Management Software for Pre-Model Processes

Exhibit 2

Level of Automation Across Pre-Model Processes, In percent

Post-Model

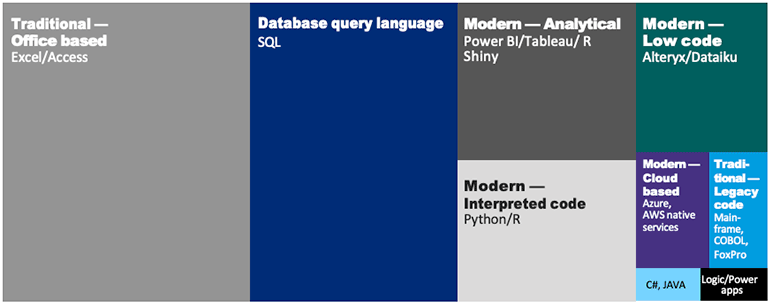

Exhibit 3

Prevalence of Key Data Management Software for Post-Model Processes

Exhibit 4

Level of Automation Across Post-Model Processes

In percent

Enhancing actuarial modelling processes, or also referred to as transformation, is more top-of mind these days with insurers across the Americas. LDTI and IFRS17 implementations are drawing to a close and while some have integrated these new reporting processes well, much more is to be done to streamline reporting, reduce manual efforts, improve controls, and add automation allowing teams to spend more time analyzing the results.

Section 2: The Role of Software for the Core Model Versus for the Pre- and Post-Model

Core Model Software as a One-Stop-Shop

For the most common core model platforms (AXIS and Prophet), the actuarial software acts as a one-stop-shop. Those platforms are typically used for:

- Valuation and projections for various basis and use cases: Stat, GAAP, IFRS17, BMA, economic value, embedded value, etc.;

- pricing;

- sensitivities;

- storage and update of assumptions; and

- run scheduling.

The implication of this is that most companies are moving to consolidate onto a single actuarial core modeling platform. While they may not always spend the money to convert legacy business onto the primary platform, they are typically selecting a single platform for go-forward modeling across lines of business and financial reporting bases.

Much Less Consolidation Among the Pre-Model and Post-Model Software Options

However, companies are not finding that they can serve all the needs of the pre-model and post-model processes with a single software. For each function (for example, data pipelines, data storage, reference data management, workflow approvals, data transformation and financial system integration), there are a handful of software options that can be a good fit, though it isn’t a simple one-to-one relationship.

- For example, Cloud based platforms such as Databricks or Snowflake can be used for workflow, data storage, and transformations, but generally are not as useful for visualization (and are generally paired with Power BI/Tableau).

- A low code platform like Alteryx is a popular choice amongst actuaries who want flexibility in designing their own processes, however it does not have its own data storage. Companies often connect Alteryx to their data lakes (for example, SQL server, AWS Redshift, etc.).

- The data in section one notes that the average company is using four different softwares for the pre-model and three for the post-model for data management (excluding governance tools).

The landscape of options is complex enough that no one person knows it all. When we perform projects to select the best software stack for a company, a small team of experts is required to summarize the capabilities and pros and cons of each software. Examples include:

- Data transformation (options include Alteryx, SQL, DBT, python);

- data storage (options include SQL Server, AWS S3/Redshift);

- workflow orchestration (options include Apache airflow, Control M);

- dashboards and analytics (options include Tableau, PowerBI, Quicksight); and

- subledger (options include Aptitude, Moody’s Risk Integrity, SAP products).

Note that some software related to functions such as data governance, security and deployment have not been mentioned above but also add to the software stack as well.

It’s worth noting as well that some core model software vendors have begun to offer add-on services related to data transformation, orchestration, and dashboards. However, they have not significantly displaced the platforms listed above for pre-model and post-model functions.

Section 3: What Does This Mean as Companies Look to Increase Automation and Advance Their Technology?

Most insurance companies report that actuaries are spending up to 50% of their time on manual work surrounding the pre-model, core model, and post-model. We have a pressing need to automate the end-to-end workflow so that actuaries can spend their time adding strategic value for the company. However, as shown in section one, 90% of companies have not been able to do this, and the continued fragmentation of the pre-model and the post-model across several technologies is a contributing factor.

A few hypotheses about how the landscape will evolve over the next five years:

|

1 |

Companies that have a single end-to-end software stack will progress faster on automation |

It takes time and effort to define and implement an approach to automation, and so companies that have several different software platforms (for example, PolySystems, AXIS, Prophet, ALFA) will need to do this multiple times Companies that can define one approach to automation, and use a consistent team to drive deployment across the org, will progress faster |

|

2 |

Software vendors that can satisfy all or most of the functions of pre- and post-model processes in a single package will gain a larger market share |

For example, broader data engineering platforms that provide transformation, storage, workflow and governance all in one solution, for example, Databricks, Snowflake are gaining market share Another example is where we the entire stack based on Microsoft tools that work well with each other: Azure data lake, PowerBI, Azure Data factory, Office 365, Azure Devops |

|

3 |

With increasing volumes of data, generative AI, and a frequently changing universe of software we see a trend towards using more cloud based and portable/open- source solutions. The following would make a transition to a new solution easier in the future |

For example, companies can manage their code in master repos using git, while only executing them on the cloud (such as in Databricks) Companies can also abstract their query-able data models within their data lake and only minimally transform any data within the analytical/ dashboarding tool |

In conclusion, we see that companies have a significant array of choices to draw from, and new breakthrough software that have a specific niche come online very frequently. Also, internally companies may have certain lines of segregation leading to different choices of software across these segregated functions. Thus, companies looking to drive long lasting automation will need to review their internal operating model and select software that can bring scale, provide a whole host of functions, have open-source features, and align with their future state operating model.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.