By Michael L. Frank

Editor’s Notes: This article summarizes a presentation made by the author, Michael Frank, to the Government Finance Officer’s Association (GFOA) in New York on Dec. 6, 2018.

The ideas presented in this article reflect the author’s opinion and not necessarily those of the Society of Actuaries.

The title of the presentation was “Recent Developments in the Healthcare Market.” It was divided into the following sections:

- An overview of the health insurance market;

- recent trends with insurers and health care providers;

- developments in the self-insurance market;

- impact of technology on billing practices;

- billing practices and fraud;

- prescription drug discounts and rebates; and

- required changes to health insurance laws.

One of the key topics in the presentation was the "False Claims Act" (the Act) and similar laws involving health care provider billing fraud. Approximately 100 people attended the meeting and a good number shared their experiences as it relates to this law. Almost 80 percent of the group responded to surveys in the meeting that illustrated that they believed they were victims of fraud as defined in the Act.

Sample criteria from the Act that would highlight fraudulent health care billing include:

- Services not rendered;

- services performed on non-existing or phantom patients;

- “upcoding” or “code creep” whereby procedures are billed at levels more expensive than those actually performed;

- unbundling of costs whereby health care providers are itemizing billing services that should be part of bundled payments; and

- non-medically necessary services being performed.

As related to the above, also discussed was the Association of Certified Fraud Examiners which released information in 2013 on the 10 most common health care billing fraud schemes that are consistent with the criteria in the False Claims Act.

This high percentage is not surprising given the many cases in the public domain of violations to the Act. We discussed several of these cases in the session. It was noted that a couple of states have already passed laws regarding the False Claims Act and that all should consider doing the same. Many of the attendees at the GFOA conference were finance professionals working for municipalities, which interestingly enough, were partially insulated from some of the fraudulent billing practices, since they had low deductible and low copay costs.

In the context of billing fraud and need for further prevention, we discussed a variety of topics including areas necessary for change. Topics included the following:

- Member communication: Plan documents and summary plan descriptions do not provide pertinent consumer information to know what to do when a member becomes a victim of excessive billing and potential fraud. They only focus on when a claim is denied, not when potential acts of billing fraud. Employers should consider providing their employees with resources to combat fraud such as assistance to understand provider bills and what a covered member should do if they believe the insurance policy appeals process does not address the fraud issue.

- Need for Explanation of Benefits (EOB) Statements to include benchmark measures: Currently, provider bills and EOB statements do not include reasonable benchmarks which allow an individual to understand what items truly cost or reasonably should cost. Without them, how can a consumer determine whether the average length of stay of his recent hospital admission and related billed charges are reasonable?

- Increased transparency: Transparency was discussed numerous times in the presentation including steps to be taken prior to seeking care as well as steps that can be accomplished post-care. With post-care, members are not provided the ability to reverse engineer a medical bill so that they can understand the costs involved. Members would need to know how the members’ charges compare to the insurance company contract agreed upon and the member would need to get access to the number of units (e.g., visits, PT/OT utilization, number of implantable devices, infusion drugs, etc.) so they know how they are applied and can see if any upcoding has taken place. Most EOBs do not include units for certain codes like implantable devices, infusion drugs, etc., so members are unable to reasonably review a bill.

- Savings and cost benchmarks should be based on a percentage of Medicare costs: Frequently, savings are calculated as a percentage of billed charges. Bill charges are infrequently used with reimbursement of insurance contracts with PPO networks, so they become less relevant. Websites like Healthcare Blue Book and Fair Health can help to determine whether or not billed charges are reasonable, but since these websites rely on market data, which include fraudulent claims, their usefulness is arguably limited (or will become less limited as fraudulent claims continue to grow). Costs as a percentage of Medicare is probably the best cost benchmark available in the U.S. because it is not subject to this type of manipulation. To illustrate, I shared my own case, which was a one-day hospital stay for a two-hour hip procedure that generated $140,000 in billed charges and $80,000 in approved charges. According to the bill the discount was approximately 45 percent, but the reality is that the approved costs by the insurance company were close to 500 percent of Medicare.

- Pharmacy claims should have an EOB: Currently, EOBs do not exist for pharmacy, and pharmacy claims are one of the biggest mysteries to consumers. It remains to be seen whether CVS/Aetna, ExpressScripts/CIGNA, Walmart/Humana and others decide to create transparent EOBs that include details on drug claims.

- Slow down claims payments: For contractual reasons, insurers frequently reimburse providers too quickly. Usually the claim is paid even before the consumer sees the first bill. As a result, the insured has no opportunity to validate services and charges, provide feedback about his/her experience with the providers (e.g., online questionnaire, phone app, etc.), and in general, be serviced in an environment of transparency. Furthermore, insurers may want to consider investing in claim prevention initiatives which, by their very nature, require processing time to be effectively slowed down.

- Enforce existing laws and expand the reach of others: If each state and the federal government were to enforce the False Claims Act (dates back to the 1860s, so 150+ years ago), health care cost could be reduced by 30 percent to 50 percent. Additional savings would be realized if benchmarks were to be included in provider invoices and EOBs, if claims were to be checked for accuracy before being paid. Keep in mind that the use of technology is imperative to keep regulation effective.

- Many health care class action lawsuits are coming: Due to administration costs, every dollar of claims fraud results in $1.20 to $1.25 in premium to the consumer. A lot of money is at stake. Those who are unwilling to become victims of billing fraud will protect themselves and, if injured, will seek compensation. With a growth in high deductible plans, more individuals are feeling the effects financially from excessive billing practices. The government has encouraged private citizens to come forward as “whistleblowers” and could participate in a “Qui Tam” action, which involves individuals known as “relators” to assist the government in identifying these matters. These relators or whistleblowers may be entitled to financial remedy if the government is able to successfully convict or recover funds from potential violators of the False Claims Act.

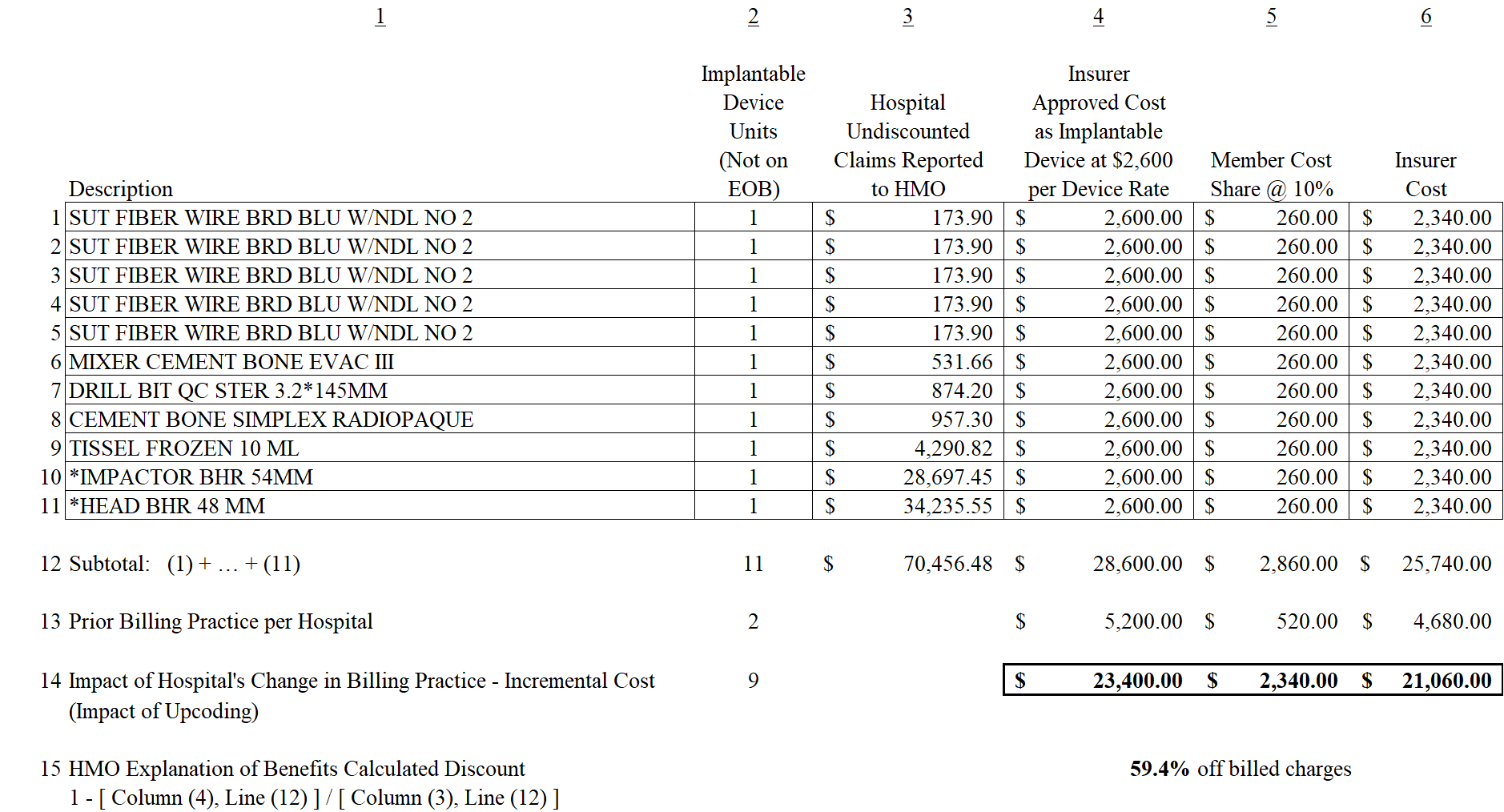

As part of the discussion, we discussed various large claims and how those claims potentially could apply to the False Claims Act criteria of fraud. In the table below, we show how billing changes in billing patterns can inflate medical bills. In the session, we discussed how certain costs that were normally billed as sterile supplies have become billed as implantable devices by some hospitals (e.g., services moved from service codes 272 to 278 and 279). The example below was used to show how changes in billing practice will influence claims reimbursement.

Some key highlights to the above example are:

- The hospital’s true cost for items 1-11 combined were under $2,000, since the above items included five sutures and cement (items traditionally part of code 272 and not reimbursed since part of a case rate). These items were all reclassified as implantable devices and reimbursed at $2,600 per device (note the billed charges for those items were $173.90).

- Items 10 and 11, which are the higher cost items above, cost the hospital approximately $1,500 for the combined two items (per hospital and medical supply company).

- Billed charges for the 11 items were greater than 35 times the true cost to the hospital (the hospital billed more than $70k for them) while the insurance company approved reimbursement for 14 times the true cost (more than $28k) due to the impact of artificial intelligence and recoding (or in this case upcoding).

- The consumer (claimant) did not have any of the above information since units and detail were not provided. The EOB provided to the claimant showed billed charges over $70,000 and approved charges over $28,000, resulting in a 59.4% discount (savings) off of billed charges. The importance of a benchmark like Medicare would be beneficial to the consumer since it would show the approved claims were more than 10 times Medicare.

Some information not illustrated in the above example was discussed in the conference. For example, we compared the amounts reimbursed per suture ($2,600) or five sutures at $13,000 approved charges, to the fees approved and reimbursed for the physicians in the two hour surgery, i.e., $2,562.05 for the orthopedic surgeon and $2,145.00 for the anesthesiologist.

The above example is important to actuaries and insurance professionals since it highlights how medical billing practices continue to evolve, and how artifical intelligence is being used and potentially manipulated. At the GFOA conference, we discussed how changes in billing practices are occurring with some organizations as sterile supplies are becoming implantable devices (e.g., codes 272 being billed as 278 and 279 as described above). The above example shows how $28,600 for 11 units is approved for payment as compared to the prior reimbursement of $5,200 (note that the $5,200 was at 2.6 times the true cost). Implantable supplies discussed include hips, knees, pacemakers, shoulders, stents, etc.

Similarly, other services were discussed including physical therapy and occupational therapy (e.g., codes 420-434), infusion drugs (e.g., codes 636) and other professional services that have experienced similar changes. If you are interested in more details on any of the above, feel free to contact the author.

Michael L. Frank, ASA, FCA, MAAA, is president and actuary at Aquarius Capital ( www.aquariuscapital.com). He can be reached at michael.frank@aquariuscapital.com.