Board Size

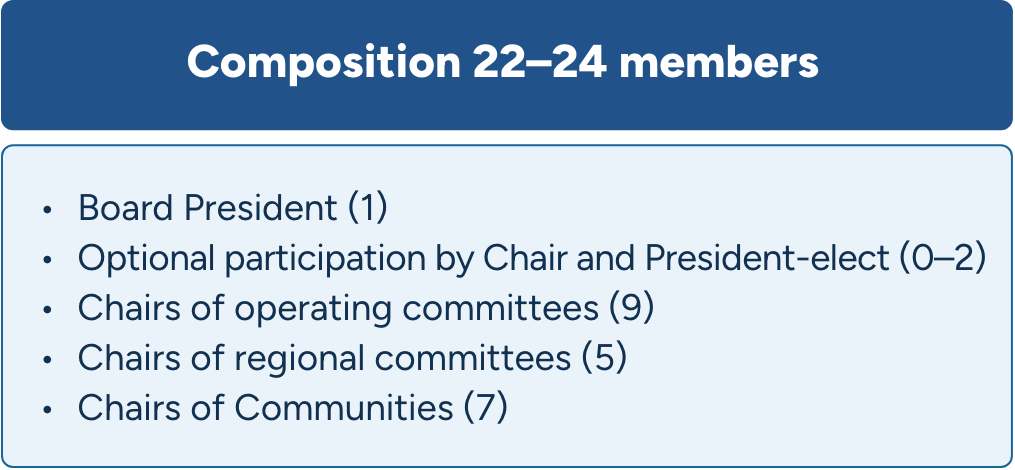

• Create Member Leadership Advisory Council

Challenge

Currently, the Board has 18 members, which is large compared to most association Boards and doesn’t align with leading practices. A large Board hinders effective participation and discussion and debate of key issues, leading to slower decision-making.

Recommendation

Create a smaller, more nimble Board. Studies and leading practices have shown that smaller groups are better strategic decision-makers.

Action

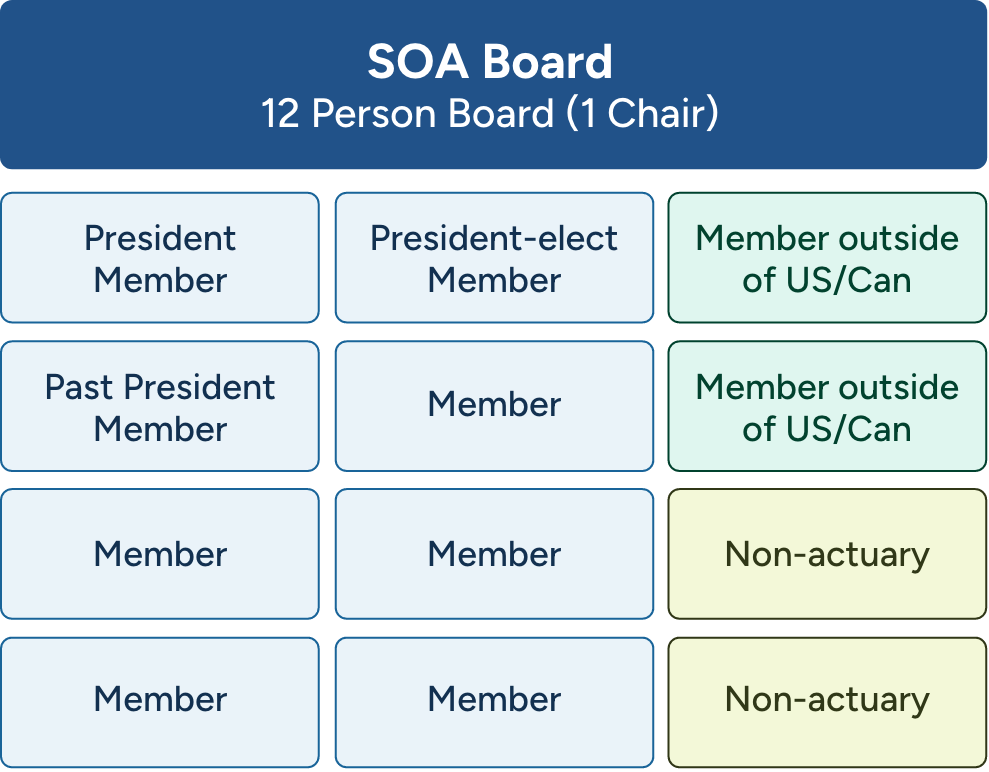

Reduce the size of the Board from 18 to 12 members. A smaller Board will foster in-depth discussion and rigorous debate, allowing the SOA to more rapidly address emerging opportunities and challenges for the organization and the profession.

Develop a Member Leadership Advisory Council

To address concerns about limited visibility and input into Board decision-making, a Member Leadership Advisory Council will be created. This group will provide more opportunities for meaningful dialogue between the Board and member leadership, offering broader and more diverse perspectives from key volunteers. Meeting three times a year, the Council will share feedback and discuss topics such as education pathways, market trends, and enhancing the member experience.

The Governance Review Task Force chose 12 members for several reasons. First, there is a need to maintain a three-year term for the President, so there will always be three presidential officers on the Board (President-Elect and Vice Chair, President, and Past President). Second, this structure allows for the inclusion of ASAs who have been members for 5 years or more and non-actuaries on the Board. Third, a majority of the Board should consist of regular Board members (and not presidential officers or the Board Chair). To keep everyone on three-year terms, having 12 members strikes a balance between the desire for a small Board and the need to bring in new perspectives. There could be a fluctuation of 10-13 as the exact number in any given year would depend on strategic needs and availability of qualified candidates to fill designated seats.

Diversity can be achieved in many ways, and a larger Board does not necessarily ensure it. For example, the current Board does not reflect the diversity of our membership. While 20% of members reside outside the U.S. and Canada, we typically only have 1 or 2 Board members from other markets. The Board generally has more U.S. members, consultants, retirees, and members practicing in life insurance than are represented in the member population. There are also no ASAs who have been members for 5 years or more on the Board, but they make up 30% of our membership. Reducing the Board size, combined with a more intentional skills- and experience-based evaluation process, can create a more diverse Board, with fewer members.