Asset Liability Management (ALM) represents one of the most critical functions within insurance operations, encompassing the strategic coordination of assets and liabilities to optimize risk-adjusted returns while maintaining regulatory compliance and policyholder obligations. The emergence of negative credit spreads may fundamentally challenge traditional ALM frameworks, forcing insurance companies to reconsider their investment strategies, hedging approaches, and risk management methodologies.

Higher budget deficits across developed markets have pushed long-dated Sovereign bonds to decades-high yields. Fiscal hawks have long promulgated such a scenario of steeper curves led by the long end. Life insurance firms have in the past dealt with non-standard scenarios—negative shorter maturity interest rates in Europe and negative swaps spreads starting in 2008 to cite a few. Japanese insurers have operated in low and negative-interest-rate environments for extended periods. In the past, such tightening of credit spreads was also an artifact of excessive easing by the Central Banks followed by liquidity and arbitrage opportunities that arose therefrom.[1]

In June 2025, yields on bonds of larger investment grade firms like Airbus, AXA and LVMH have fallen below those of French Sovereign bonds of comparable maturity, as reported by FT recently.[2] Market participants think that this indicates that French Sovereigns can no longer be truly considered risk-free. Recent Fitch Ratings downgrade of France’s credit indicates as much.

In September 2025, in the US too, the Wall Street Journal (WSJ) noted that two pristine-rated bonds from Microsoft as well as from J&J traded at lower than similarly traded treasury bonds.[3] These companies are flush with cash and only have smaller long-term debt outstanding.

In this article I examine the implications for insurers' balance sheet management, regulatory capital requirements, and long-term financial sustainability. I explore how negative credit spreads disrupt conventional risk-return relationships, create unprecedented challenges for liability matching, and necessitate innovative approaches to portfolio construction and risk mitigation.

The analysis reveals that negative credit spreads present both significant challenges and unique opportunities for insurance companies. While they compress margins and complicate traditional spread-based investment strategies, they also create potential for capital gains and alternative revenue streams for insurers willing to adapt their ALM frameworks accordingly.

Introduction to Insurance Asset Liability Management

The fundamental objective of insurance ALM is to ensure that assets are sufficient to meet liability obligations while optimizing risk-adjusted returns for shareholders and maintaining appropriate capital buffers for regulatory compliance. This involves managing multiple dimensions of risk, including interest rate risk, credit risk, liquidity risk, and market risk, all while considering the specific characteristics of different insurance product lines.

Traditional ALM approaches have relied heavily on duration matching, where the duration of assets is aligned with the duration of liabilities to minimize sensitivity to interest rate movements. This strategy has been complemented by credit spread optimization, where insurers seek to capture additional yield through exposure to corporate credit risk while maintaining appropriate credit quality standards.

The insurance industry's ALM practices have evolved significantly over the past several decades, driven by regulatory changes, market developments, and advances in risk management technology. The implementation of risk-based capital frameworks, such as Solvency II in Europe and similar regimes globally, has placed greater emphasis on economic capital management and stress testing, requiring insurers to develop more sophisticated ALM capabilities.

Understanding Negative Credit Spreads

Credit spreads represent the additional yield that investors demand for holding corporate bonds over risk-free government securities of similar maturity. Historically, credit spreads have been positive, reflecting the higher risk associated with corporate debt compared to sovereign debt. However, in recent years, certain market segments have experienced negative credit spreads, where high-quality corporate bonds trade at lower yields than comparable government securities.

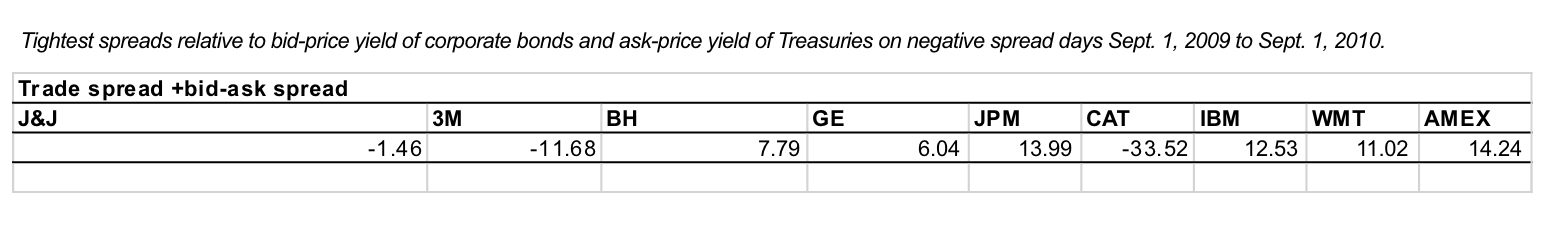

Several factors can contribute to negative credit spreads, including central bank quantitative easing programs that distort relative pricing, regulatory requirements that create artificial demand for certain types of bonds, differences in liquidity between corporate and government securities, and supply constraints in high-quality corporate debt markets, as happened during late 2009–2010 period.[4] (See Table 1)

Table 1

Tightest Credit Spreads on Large Investment-Grade Bonds During 2009–2010

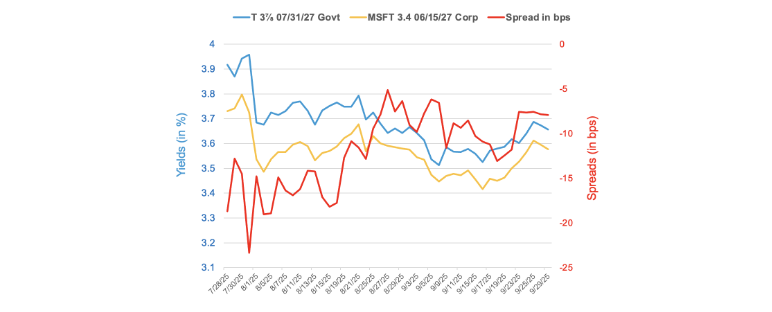

The phenomenon of negative credit spreads is most commonly observed in highly rated corporate debt, particularly from issuers with strong balance sheets, stable cash flows, and systemic importance. Government-sponsored enterprises, supranational organizations, and certain multinational corporations have occasionally seen their debt trade at negative spreads to government bonds, reflecting investor preference for their credit profiles or specific technical factors affecting their bonds. In the recent September 2025 edition, WSJ cites further reasons for negative spreads: Corporate bond indexing, a reach for yields and the demand from pension funds.[5] Such negative spreads also tend to occur at the short end of the curve and were observed for Apple and Microsoft in 2024.[6] (See Chart 1)

Chart 1

Microsoft June 27 Bond Yields and US Treasury July 27 Yields

Some highly rated emerging market corporates credit spreads also trade tighter than their Sovereign spreads: BBVA Bank Mexico Units USD bond has traded at a tighter spread to its Mexican Sovereign USD Bond. Petrobras Brazil USD Bonds has traded tighter than Brazil USD bond. But this phenomenon is more common for their USD-denominated bonds and not local currency bonds.

Impact on Insurance ALM Strategies

The emergence of negative credit spreads fundamentally disrupts traditional insurance ALM strategies in multiple dimensions. Most significantly, it undermines the basic premise that credit risk should be compensated with additional yield, forcing insurers to question whether exposure to corporate credit risk is justified when it actually reduces portfolio yields relative to risk-free alternatives.

Duration matching strategies become more complex in negative credit spread environments because the traditional relationship between credit quality and yield is inverted. Insurers may find that achieving desired duration targets requires accepting lower yields or assuming greater credit risk than historically necessary. This complicates the optimization process and may force trade-offs between duration matching and yield enhancement objectives.

Liability matching strategies also face significant challenges when credit spreads turn negative. Many insurance products, particularly long-term savings and annuity products, incorporate guaranteed minimum returns that may become difficult to achieve when high-quality fixed income yields are suppressed. This creates pressure to extend duration, reduce credit quality, or explore alternative asset classes to generate required returns.

The impact extends to regulatory capital management, as many risk-based capital frameworks incorporate credit spread risk into their calculations. Negative credit spreads may create situations where reducing credit risk actually increases regulatory capital requirements due to the mechanics of spread risk calculations, creating skewed incentives for insurers. These adjustments can have significant implications for profitability and competitiveness.

Risk Management Considerations

Managing ALM risks in a negative credit spread environment requires enhanced sophistication and new approaches to traditional risk metrics. Interest rate risk management becomes more challenging when the relationship between credit quality and interest rate sensitivity is altered by negative spreads. A period of extremely tight US Credit spreads may also indicate an underpricing of risk.[7].

Credit risk assessment takes on new dimensions when spreads are negative. Traditional credit analysis focused on default risk and loss given default must be supplemented with analysis of spread volatility and mean reversion potential.

Liquidity risk management requires special attention in negative spread environments, as these conditions often reflect market distortions that may unwind rapidly. Concentration risk takes on new importance when the universe of attractive investments becomes constrained by negative spreads. Insurers may find themselves concentrated in specific sectors or geographies that continue to offer positive spreads, creating unwanted exposures that must be carefully managed.

Regulatory Implications

Regulatory frameworks governing insurance ALM were generally developed during periods of positive credit spreads and may not adequately address the risks and opportunities created by negative spread environments. Solvency capital requirements may produce counterintuitive results when applied to portfolios with negative spread exposure, potentially penalizing prudent risk management decisions.

Risk-based capital calculations may need adjustment to properly reflect the altered risk-return dynamics in negative spread environments. Traditional spread risk factors may overstate or understate actual risks when spreads are negative, leading to inappropriate capital allocation decisions.

Regulatory stress testing frameworks may need updating to include scenarios involving prolonged negative spreads or rapid normalization of spread levels. These conditions create unique risks that may not be captured by existing stress scenarios based on historical experience.

International regulatory coordination becomes important when negative spreads affect global insurance markets differently. Inconsistent regulatory treatment across jurisdictions could create competitive disadvantages or regulatory arbitrage opportunities that undermine the effectiveness of ALM oversight.

Strategic Adaptations and Solutions

One common adaptation involves shifting focus from spread capture to total return optimization. Rather than seeking to earn the spread between corporate and government bonds, insurers may focus on capital appreciation potential, liquidity premiums, or other sources of return that remain attractive even when spreads are negative.

Geographic and currency diversification strategies have gained importance as negative spreads may be concentrated in specific markets or currencies. Insurers with global operations can potentially shift asset allocation to regions where credit spreads remain positive, though this approach introduces currency and jurisdictional risks that must be carefully managed.

Alternative asset allocation has become a key component of many insurers' response to negative credit spreads. Increased exposure to real estate, infrastructure, private equity, and other alternative investments can help maintain portfolio yields when traditional fixed income returns are constrained. However, these strategies introduce new risks, including illiquidity, valuation uncertainty, and operational complexity.

Dynamic hedging strategies have evolved to address the unique characteristics of negative spread environments. Rather than static duration matching, some insurers employ active hedging approaches that adjust exposure based on spread levels and market conditions. This requires enhanced operational capabilities and risk management systems.

Product innovation represents another avenue for adaptation, with insurers developing new products that better align with the low-yield environment created by negative spreads. Variable products, unit-linked policies, and other structures that transfer investment risk to policyholders can help insurers manage the challenges of guaranteeing returns in challenging market conditions.

Portfolio Optimization and Allocation

Portfolio optimization algorithms must be updated to handle the mathematical challenges created by negative spreads. Traditional mean-variance optimization may produce unstable or counterintuitive results when fundamental risk-return assumptions are violated, requiring alternative approaches or constraint modifications. I suggest putting in a mild credit steepener and a mild treasury flattener if such a negative credit spread continues for a longer time.

The bonds with negative credit spreads mostly hold AAA ratings, whereas the U.S. has been downgraded by all major credit-rating agencies. In the event that the government encounters difficulties in raising funds, it could theoretically leverage its taxation authority to extract funds from top-rated companies.[8] Therefore, I find it more logical to invest in treasuries rather than these top-rated companies, especially as credit spreads continue to tighten. (See Table 2)

Table 2

Hypothetical Portfolio Allocation During Negative Credit Spreads

Some investors have noted that credit spreads appear to look tighter versus Sovereigns, but do not appear in comparison as tight to their historical levels when compared to swaps. I think that such analysis is flawed when compared to swaps in the last five years, which are based on secured swaps (Risk Free Rates like SOFR, SONIA, TONAR etc.), whereas historically, swaps were unsecured and IBOR-based (LIBOR, GBP Libor, JPY Libor etc.) and hence are not an exact comparison.

I also borrow on learnings during periods of negative swap spreads for the allocation matrix. .In the past, insurers have been seen adapting to negative swaps spreads by using total return swaps on treasuries, i.e., use treasuries more versus swaps to favor higher carry and roll. I think insurers may adapt to such changes if corporate credit spreads turn negative by allocating more to treasuries. Furthermore, investors also need to find out if persistent negative credit spreads versus Sovereigns are due to deterioration of Sovereign credit quality or due to regulatory changes (causing the funding for Sovereigns to be higher). If it is the latter, then investors may demand regulator overhaul to remedy that and continue investing in treasuries.

Finally, risk measurement and attribution systems need enhancement to properly capture and explain the sources of risk and return in negative spread environments. Traditional risk metrics may be misleading when applied to portfolios with significant negative spread exposure, necessitating new measurement approaches.

Future Outlook and Recommendations

The outlook for negative credit spreads remains uncertain,[9] with potential for either normalization or persistence depending on monetary policy decisions, economic conditions, and structural market changes. Insurance companies must prepare for multiple scenarios and maintain flexibility in their ALM approaches.

Regulatory developments are likely to address some of the challenges created by negative spreads, but these changes may take time to implement and could create transition risks. Insurers should actively engage with regulators to ensure that evolving frameworks adequately address the realities of operating in distorted market conditions.

Collaboration within the insurance industry can help develop best practices and share insights on effective approaches to managing negative spread challenges. Industry associations, regulatory bodies, and academic institutions can play valuable roles in advancing understanding and developing solutions.

Conclusion

The implications of negative credit spreads extend beyond individual insurers to the broader insurance industry and regulatory framework. Collaborative efforts to understand and address the challenges created by negative spreads will be essential for maintaining the stability and effectiveness of insurance markets in these unprecedented conditions.

The analysis reveals that negative credit spreads present both significant challenges and unique opportunities for insurance companies. While they compress margins and complicate traditional spread-based investment strategies, they also create potential for capital gains and alternative revenue streams for insurers willing to adapt their ALM frameworks accordingly.

This article is provided for informational and educational purposes only. Neither the Society of Actuaries nor the respective authors’ employers make any endorsement, representation or guarantee with regard to any content, and disclaim any liability in connection with the use or misuse of any information provided herein. This article should not be construed as professional or financial advice. Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Arnab Sarkar is a senior vice president/derivatives trader—fixed income and equity at AllianceBernstein LP in New York City. He can be contacted at Arnab.Sarkar@alliancebernstein.com.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio management teams.

Endnotes

[1] Bhanot, Karan & Guo, Liang, Negative Credit Spreads: Liquidity and Limits to Arbitrage, The Journal of Fixed Income, Summer 2011, 21(1) 32 - 41

[2] Smith, Ian, Herbert, Emily and Storbeck, Olaf. French companies’ borrowing costs fall below government’s as debt fears intensify, Financial Times, September 14, 2025.

[3] Mackintosh, James, Why Microsoft Has Lower Borrowing Costs Than the U.S., The Wall Street Journal, September 28, 2005.

[4] Bhanot, Karan & Guo, Liang, Negative Credit Spreads: Liquidity and Limits to Arbitrage, The Journal of Fixed Income, Summer 2011, 21(1) 32 - 41

[5] Mackintosh, James, Why Microsoft Has Lower Borrowing Costs Than the U.S., The Wall Street Journal, September 28, 2005.

[6] Wiltermuth, John. Microsoft and Apple are safer bets than the U.S. government? Bond investors seem to think so. MarketWatch. April 25, 2024.

[7] Norland, Erik, Are Extremely Tight U.S. Credit Spreads Underpricing Risk?, CME Group, February 26, 2025.

[8] Krantz, Matt. 2 Companies Now Have Credit Ratings Higher Than The U.S. Investors Business Daily. May 21, 2025.

[9] Unmack, Neil, Freakish credit markets could get weirder still. Reuters. September 24, 2025.