Find Your Path

As an actuary with the Society of Actuaries (SOA), Ritu has found a career that offers success, stability, financial security, and respect within the industry. She’s inspired every day by the opportunity to think critically, solve meaningful problems, and make a real impact.

Actuaries find and apply the truth

An actuary is a professional expert on analyzing risk. Actuaries think three-dimensionally using both qualitative and quantitative data analysis. By measuring the risks ahead, actuaries help clear paths to decisions and progress, so everybody wins.

Industries include finance and investments, retirement planning, insurance, health care, energy, education, technology, government and more.

Being an Actuary is a great career

In a world of risk, your future is secure as an actuary.

Consistently rated among top careers by U.S. News and World Report, actuaries have high salaries, an array of paths for growth and advancement, and a satisfying work/life balance.

(We know you’re a numbers person, so we brought some data.)

Use your math skills for good!

In an uncertain world, actuaries bring clarity to the confusion. We take on the world’s greatest challenges, reducing risk and increasing opportunity. The solutions we pursue clear a path to progress and a brighter future.

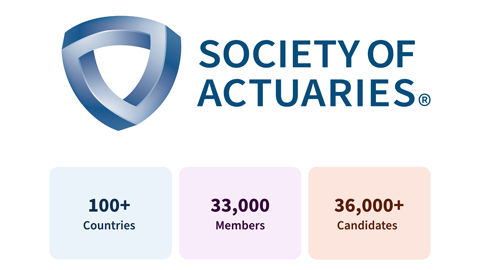

SOA Designations know no boundaries

As an SOA actuary, you can see the world solving problems you care about. We’re proud to be the world’s largest actuarial organization. With roots dating back to 1889, the Society of Actuaries has 33,000+ members in over 100 countries. As a global leader with worldwide recognition, we have the designations for any destination.

Actuaries are bold. You can be bold too!

In today’s world, finding the truth is a bold move. Actuaries are the fact-seekers and truth-tellers the world needs. It is a career where you analyze data to find equitable solutions to complex problems. Actuaries make an impact as executive business leaders in boardrooms and in real lives across the globe.

A History of Excellence

We are the largest professional society for actuaries in the world, with 33,000+ members and 36,000+ candidates across 100+ countries.

For over a century, we’ve advanced actuaries as leaders in measuring and managing risk to improve financial outcomes for individuals, organizations, and the public. We strive to help candidates and members keep their skills relevant and marketable, offering:

- Continuing education opportunities

- A supportive professional community

- Cutting-edge research

Join a Premier Math Profession

Actuaries work in a wide variety of industries. Much of the business world depends on actuaries to manage risk and drive important decisions. It’s the backbone of financial security. These are just a few examples of industries actuaries work in today.

Insurance Companies: Actuaries calculate costs and set prices. They make sure that auto, health, business, and home insurance companies are financially sound and can cover their payouts to customers.

Banking & Financial Services: Actuaries help banks and financial services companies with product portfolio, capital management and risk analysis.

Consulting Firms: Actuaries help companies design pension and benefit plans, evaluate insurance company assets and liabilities, and stare down risk alongside top executives.

Government Offices: Actuaries manage programs and oversee public companies to ensure compliance with regulatory laws.

Free Affiliate Membership Benefits

The benefits are built to help anyone get ready for their next step. Whatever questions you have, this membership can get you the answer.

A road without stop signs: Find a university and navigate the exam process.

Library without late fines: A digital library at your fingertips.

Network without the work: Connect with the actuarial community.

Live events without pressure: Learn about the profession.

Mentoring without limits: Get answers through the mentoring program.