Toto, I’ve a Feeling We’re Not in Kansas Anymore: How AI Can Guide Actuaries Along the Yellow Brick Road

By Ronald Poon Affat

Reinsurance News, September 2025

The insurance industry is at a pivotal moment. Artificial Intelligence (AI), once confined to tech labs and futurist conferences, is now embedded in our everyday tools and workflows. Across all sectors, AI is no longer just a buzzword—it’s a competitive necessity. And for actuaries this shift represents both a profound challenge and an extraordinary opportunity. This article dives into the opportunity for actuaries to not only adapt to AI but lead its creative implementation across the insurance ecosystem.

OK, let’s set the stage for where we’re headed.

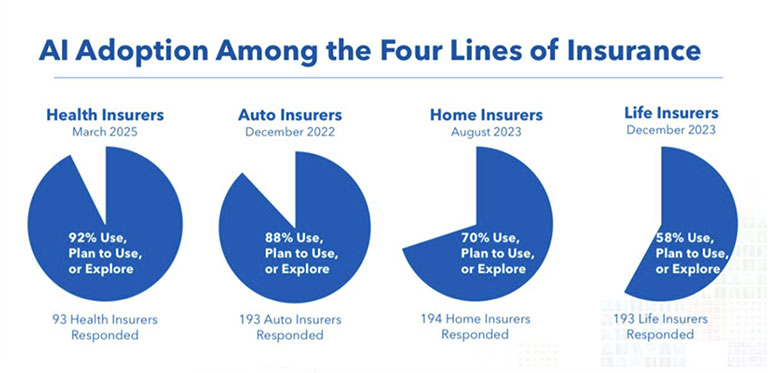

The insights in Chart 1 come from extensive surveys coordinated by the National Association of Insurance Commissioners (NAIC) and were presented at their 2025 Spring National Meeting. The results reflect how insurers across the four major lines of business—health, auto, home, and life—are planning for and engaging with AI.

Chart 1

NAIC AI Survey Results[1]

As of March 2025, 92% of health insurer respondents were already using, planning to use, or actively exploring AI solutions. As of December 2022, auto insurers were already at 88%, reflecting strong momentum in areas such as telematics, automated claims systems, and behavior-based underwriting. In late 2023, home insurance adoption stood at 70%, while life insurance showed the lowest uptake, with 58% of carriers reporting engagement with AI.

These figures suggest that AI adoption is accelerating most rapidly in sectors with high data velocity and operational complexity.

Across the board, insurers are signaling that AI is no longer a futuristic experiment—it’s becoming an operational necessity. And for actuaries, this isn’t just a technology shift—it’s a professional inflection point.

This Time It’s Different

AI is not new, but Generative AI capabilities of processing large amounts of unstructured data and creating things are unprecedented. The genie is out of the bottle with generative AI—and it isn’t going back in.. Skeptics in the risk transfer business might roll their eyes. After all, we’ve seen plenty of shiny new toys come and go: Blockchain promising to revolutionize policy and claims administration; peer-to-peer insurance models pitching community over capital; and a wave of startups with slick branding, VC backing, instant quotes, and lofty mission statements. So why should AI be any different?

I’d like to offer a few reasons why actuaries may end up embracing AI the way Gen Z took to food delivery apps.

Can’t Get You Out of My Head

AI is literally all over the place—on billboards, cable TV, podcasts, social media posts, etc. We haven’t seen such a rise of the machines since the launch of TikTok. When the music is playing, everyone wants to dance.

The impact is personal and pervasive

AI has shown that it can put personal productivity on steroids. And it’s only a matter of time before our inherent laziness starts provoking our subconscious into thinking … “Hmmm, maybe I can use this thing for work?”

Data is King … but Still Wears a Crooked Crown

No matter where you sit in the insurance ecosystem, data still reigns. And yet, much of what we rely on—usually received at the 11th hour—remains riddled with inconsistencies. In the past, seasoned actuaries might only spot these landmines after results were published. But today, even the most code-averse actuary can throw a few well-structured prompts at raw data and watch AI surface the gremlins—before the modeling begins, saving both time and face. This prompt, for example: “Examine this dataset and flag any rows with missing values in key columns like policy number, date of birth, sum insured, or premium. List the row numbers and the missing fields.”

Too long; didn’t read (TL;DR)

AI makes it remarkably easy to compare reams of paperwork. One practical use: Reviewing renewal proposals against existing contracts to ensure continuity of coverage, terms, and conditions across the insurance ecosystem. This includes alignment among interconnected agreements between insurers, brokers, reinsurers, and retrocessionaires. The days of squinting at fine print are finally over.

Run the AI before the AI Runs You

Even if actuaries are not yet applying AI to traditional activities such as preparing statutory returns, pricing, or valuation, there is always an end result—and AI excels at comparing outcomes against countless prior exercises. Actuaries should recognize that AI is already being used to compare actuarial results by their companies’ finance and investor relations teams, and externally by rating agencies, Wall Street analysts, regulators, and reinsurers. It is therefore far better for actuaries to run those comparisons themselves first.

Ethics and Standards

Actuaries must adhere to professional guidelines that include Actuarial Standards of Practice (ASOP), such as ASOP No. 56 on modeling, ASOP No. 23 on data quality, and ASOP No. 12 on risk classification—all of which emphasize transparency, accountability, and fairness. As AI becomes an increasingly proven tool for analysis and decision-making, failing to leverage it in core actuarial functions may pose a risk of being viewed as unprofessional and out of step with evolving practice.

The NAIC Survey

Results show impressive interest in AI across all lines. To continue to influence decision-making at the highest levels, actuaries must take the lead in guiding the responsible use of AI in insurance.

Mona Lisa versus the Printing Press

Everyone wants to know what the next big breakthrough AI will deliver is going to be. Genius can be defined as the interaction of high intelligence and creativity. I would argue that creativity rests with humanity. So maybe these unicorn-chasing investors who are pouring zillions into AI Large Language Models (LLM) might be looking in the wrong place.

Walter Isaacson, in his New York Times bestselling biography of Leonardo da Vinci, paints a vivid portrait of a man whose genius emerged not only from natural brilliance but from relentless curiosity. Da Vinci’s intellectual reach extended across anatomy, engineering, hydraulics, art, and flight—fueled by a deep desire to understand the underlying systems of the world around him.

Much of that knowledge was probably made possible because da Vinci was one of the earliest individuals in Europe to build a personal library—a remarkable feat in the 15th century. Born just two years after Gutenberg’s printing press appeared, Leonardo capitalized on this transformative technology. Though born out of wedlock and without the benefit of a classical elite education, he assembled more than 100 books, gaining access to ancient texts, scientific treatises, and humanist ideas. In many ways, he became an early adopter of democratized knowledge—proof that tools matter, but what matters more is how imaginative minds choose to use them.

The printing press may well have been the 15th-century equivalent of AI—a monumental breakthrough that reshaped civilization. But in the end, it’s the Mona Lisa that draws millions to the Louvre, not a replica of Gutenberg’s press.

The actuarial profession had its own da Vinci moment in the 1970s—when one individual saw emerging technology not as a tool for automation, but as a catalyst for rethinking the emergence of actuarial liabilities. (Editor’s note: Keep reading for the answers to all your questions!)

From the Renaissance to Rewiring the Actuarial Profession

Today’s actuaries use advanced tools—real-time Asset Management Liability (ALM) platforms, economic scenario generators, machine learning for lapse prediction, and stress testing frameworks on par with those of global banks.

But what’s often forgotten is that the intellectual foundation for many of these capabilities was laid more than 40 years ago, when one actuary quietly began to rewrite the rulebook.

That actuary (mentioned above) was James C. H. Anderson, ASA, who served as global president of Tillinghast from 1972 to 1985. Anderson harnessed the emerging field of computer science to propel the actuarial profession beyond static formulas. He pioneered cash flow testing and expanded it into full scenario-based modeling—incorporating factors like interest rate volatility, liquidity stress, lapse dynamics, and asset-liability mismatches. This approach laid the groundwork for unbundling the savings and insurance components within a single policy. This innovation led to the development of Universal Life insurance.

This work laid the groundwork for what we now recognize as modern ALM. His thinking anticipated many of the core principles that underpin today’s enterprise risk management frameworks, risk-based capital requirements, and principles-based reserving. His legacy runs through nearly every business planning model, ALM framework, and solvency tool used by insurers today.

I was fortunate to have worked at Tillinghast, Nelson & Warren in London during the time when Anderson still led the global practice. Back then, a role in the London office was arguably one of the hottest tickets in the actuarial world. We were the cool kids on the block—coding Fortran on mainframes, running state-of-the-art models on cutting-edge servers, and applying this pioneering new methodology that was reshaping the profession.

In the 1970s, running an actuarial model meant feeding punch cards into a mainframe, going home, and hoping the job didn’t crash overnight. Yet James C. H. Anderson reimagined what actuarial science could be—using the early power of computing to shift the profession from fixed calculations to dynamic, forward-looking analysis.

Today, the tools are infinitely more powerful. And it’s only a matter of time before one of us fully leverages AI to push actuarial practice to heights we’ve never seen. The opportunity is real. Ask ChatGPT.

Reimagining Value using AI: A Collective Reset Across Industry

Chart 1 from the National Association of Insurance Commissioners at the start of this article makes one thing clear: AI is poised to play a pivotal role across the insurance ecosystem.

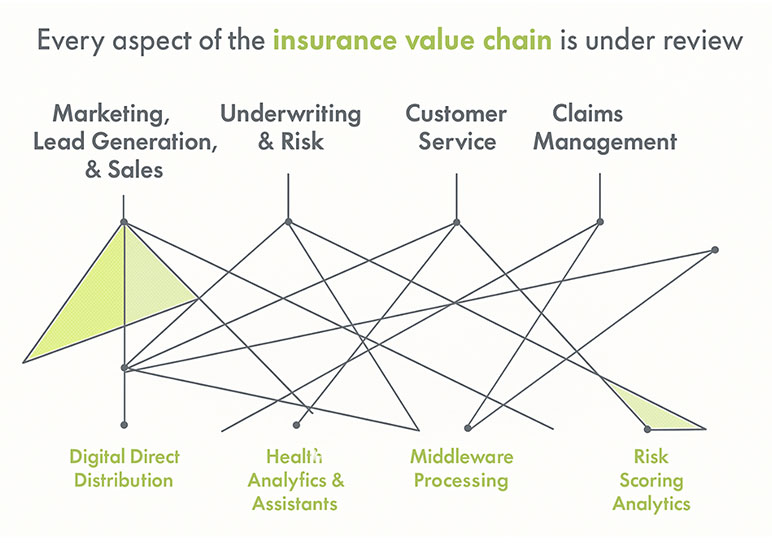

But the true opportunity lies in something deeper—a complete reimagining of the insurance value chain, with AI embedded not just as a supporting tool, but as core infrastructure across every function, from underwriting and pricing to claims and customer service. (See Chart 2)

Chart 2

The Insurance Value Chain

In The Experimentation Machine—an Amazon #1 bestseller in "Robotics & Automation"—Harvard Business School professor Jeff Bussgang explores how today’s most innovative companies use a structured, AI-driven process of experimentation to solve their most pressing challenges. One standout idea is the “hair-on-fire” problem: A need so urgent and painful that customers aren’t comparison-shopping—they’re desperate for an immediate solution.

Let’s see what the insurance industry can learn from Professor Bussgang’s process by applying that lens to our world.

Imagine an insurer giving its product range a full AI-powered makeover, guided by Bussgang’s framework. Picture someone whose hair is literally on fire—they’re not reading brochures or waiting for approval emails. They need help immediately. That’s the level of urgency great products are built around.

In the venture capital world, these kinds of problems are seen as golden opportunities. They signal:

- A customer who is already aware of the need,

- immediate engagement,

- minimal sales friction, and

- high urgency and strong follow-through.

The demand already exists—it just needs the right solution.

Creating a “hair-on-fire” insurance product doesn’t require more complexity; it requires eliminating delays. It means designing with urgency in mind and repositioning insurers from passive risk-bearers to active, real-time problem-solvers. How do you know you’ve succeeded? Look for speed, conversion and retention. If customers rush to buy, tell others, and stick with the product—you’ve nailed it.

A real-world example that comes close to a “hair-on-fire” insurance product was Y2K coverage. In the late 1990s, as global anxiety over the millennium bug escalated, a leading insurer introduced a policy to cover losses tied to software failures when the clock struck midnight on Jan. 1, 2000. It reflected many of the same dynamics: High urgency, broad awareness, and minimal need for persuasion. It wasn’t just about offering protection—it was about moving swiftly to meet a clearly defined, time-sensitive risk. As such, it stands as an early model of what a responsive, time-sensitive AI-enhanced insurance product might look like.

Redesigning Risk—With Fairness Built In

Undoubtedly, AI will enable a new class of dynamic, precision-targeted insurance products designed for risks that traditional tools can’t keep up with. The insurance industry is currently grappling with major, rapidly evolving risks—climate change, cyber threats, longevity, pandemics, terrorism, mental health trends, and emerging tech liabilities—many of which outpace the reach of traditional models and legacy underwriting practices.

As we turn our attention to the emerging risks of the future, we must also acknowledge and address the long-standing structural challenges that have limited the insurance industry’s reach and impact. These issues are not tangential—they affect how effectively and fairly the industry serves society as a whole.

For the general public, protection gaps remain significant, especially in life and health insurance. Many individuals still face barriers to accessing meaningful financial coverage

For people seeking insurance, differences in underwriting and pricing practices may still result in varying outcomes across demographic and income groups. Many encounter the industry not as a source of security, but as a gatekeeper.

For claimants, the process is often opaque. Complex procedures, long delays, and inconsistent communication erode trust at the very moment when support is most needed.

For those working within the industry, internal challenges remain. Limited representation in leadership roles may affect the industry’s ability to reflect and engage with the wider population.

Artificial intelligence offers a rare opportunity to address these persistent issues and fulfill the promises our industry was built to keep.

Courage! As Long as You’ve Got It, You Needn’t Worry About a Thing

It is important to remember that AI, for all its power, is still just a tool—much like the printing press was in Leonardo da Vinci’s time. What made that era transformative wasn’t the press itself, but what brilliant minds did with it.

In our profession, James C.H. Anderson, ASA, played a game-changing role—reimagining actuarial science through the lens of early computing. The same will be true for AI. Its value won’t lie in the algorithms alone, but in the clarity, curiosity, and courage of those who put it to work—not just to improve what we’ve always done, but to tackle the problems we’ve long been challenged by.

We’re not in Kansas anymore. To navigate this new landscape, actuaries must begin treating AI not merely as a tool, but as a thought partner in reshaping how we explore uncertainty. If we embrace this moment with courage and creativity, we won’t just adapt to the future of insurance—we’ll define it.

Ronald Poon Affat, FSA, FIA, MAAA, CFA, HIBA, is an independent board director, cross-continental actuary, and senior consultant. Ronald can be contacted at rpoonaffat@soa.org.

Footnote: This marks the final edition of the Society of Actuaries’ Reinsurance newsletter, Reinsurance News, a publication with a proud 40-year legacy. I’ve had the privilege of serving on its editorial team for over a decade. I’m deeply grateful to the many authors who shared their insights, the CEOs who contributed to the “View from the Top” series—offering their journeys and perspectives on how actuaries can have an even greater impact—and to the dedicated Society of Actuaries staff who made it all possible.

Sometimes, work and pleasure do coincide—and this long-standing labor of love has certainly been one of those rare and joyful juxtapositions. There’s so much more I could say, but I’ll leave it here. “The soup is getting cold.”[2]

Endnotes

[1] https://content.naic.org/sites/default/files/national_meeting/Materials-Big-Data-AI-WG032625_0.pdf

[2] Bonus points to any reader who uses AI to discover where I shamelessly plagiarized that last line from.