Results of the 2024 SOA Reinsurance Section Life Reinsurance Survey

By Anthony Ferraro and Lloyd Spencer

Reinsurance News, September 2025

ABOUT THE SURVEY

The SOA Reinsurance Section has completed its 2024 Life Reinsurance Survey, an annual assessment of the individual life and group life reinsurance market data of U.S. and Canadian life insurers. Survey results are based on financial information self-reported by the reinsurers of their reinsurance business assumed, and include new business and portfolio production and in-force figures broken into the following categories:

- Recurring reinsurance: Conventional reinsurance covering insurance policies with issue dates in the year reinsured. For example, insurance policies issued and reinsured in 2024.

- Portfolio reinsurance: Reinsurance covering insurance policies with issue dates in a year prior to the year in which they were reinsured (whether traditional or financial reinsurance). For example, consider a group of policies issued from the period 2020–2022 but reinsured in 2024.

- Recurring Retrocession reinsurance: Reinsurance of business not directly issued by the ceding company, with issue dates in the year in which it was retroceded (for example, insurance policies issued, reinsured, and retroceded in 2024).

- Portfolio Retrocession reinsurance: Reinsurance of insurance policies with issue dates in a year prior to the year in which they were retroceded (for example, issued prior to 2024 but retroceded in 2024).

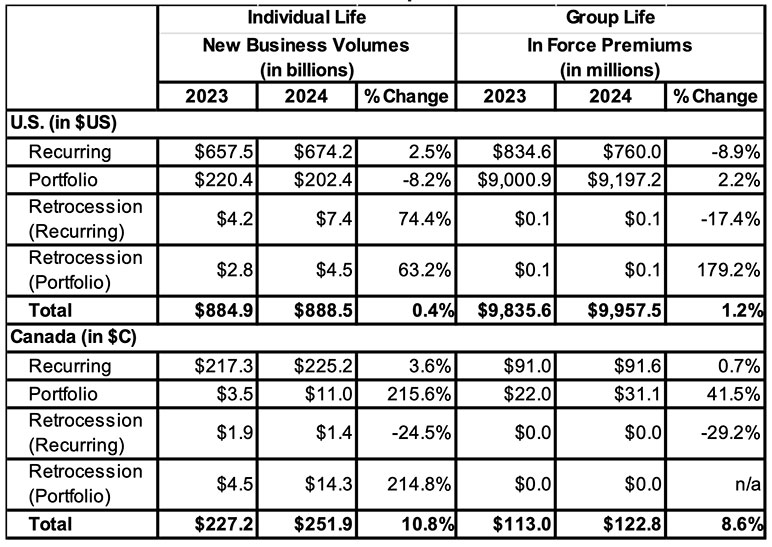

The latter two categories represent business that is usually ceded by a reinsurer and can be thought of as “reinsurance of reinsurance,” or retrocession. Individual life results are based on net amount at risk, while group life results are based on premium in force. The figures are quoted in the currency of origin. All traditional life reinsurers in North America were contacted and all reinsurers (with the exception of one Canadian reinsurer) chose to participate in this year’s survey. Table 1 summarizes the results from the 2024 SOA Reinsurance Section’s Life Reinsurance Survey.

Table 1

U.S. and Canadian Reinsurance Landscape

* NOTE: The Canadian Group Retrocession amounts (Recurring and Portfolio) are too small to display

The remainder of this article discusses this year’s results in more detail, analyzes overall life reinsurance trends, and looks ahead to issues to be considered in future surveys.

UNITED STATES — INDIVIDUAL LIFE

Recurring New Business

Recurring individual life new business volume in 2024 grew for the ninth consecutive year, from U.S.$657.1 billion in 2023 to U.S.$674.2 billion in 2024 (a 2.5% increase). One contributing factor to the increased volume of U.S. individual life reinsurance is the continued growth in accelerated underwriting programs and the expansion of face amounts available under these programs. These factors elicit support from reinsurers in product and program development, as well as in risk sharing.

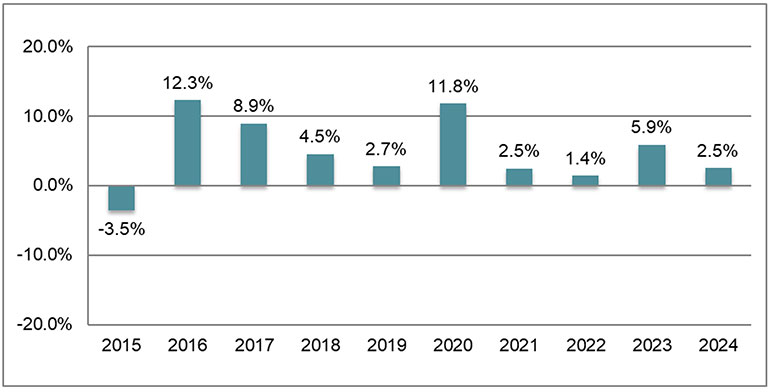

Figure 1 shows the annual percentage change in U.S. recurring new business production over the last 10 years, illustrating nine consecutive years of positive growth in the U.S. individual life reinsurance market. Since the end of the most recent decline in the U.S. individual life reinsurance market in 2015, individual life recurring new business has grown at a compound annual growth rate of just under 5%.

Figure 1

U.S. Percentage Change in Recurring New Business 2015 – 2024

In 2024, just under 85% of recurring new business volume was yearly renewable term (YRT) and just over 15% was coinsurance, reflecting the highest percentage of YRT reinsurance since this data was first collected in 2013.

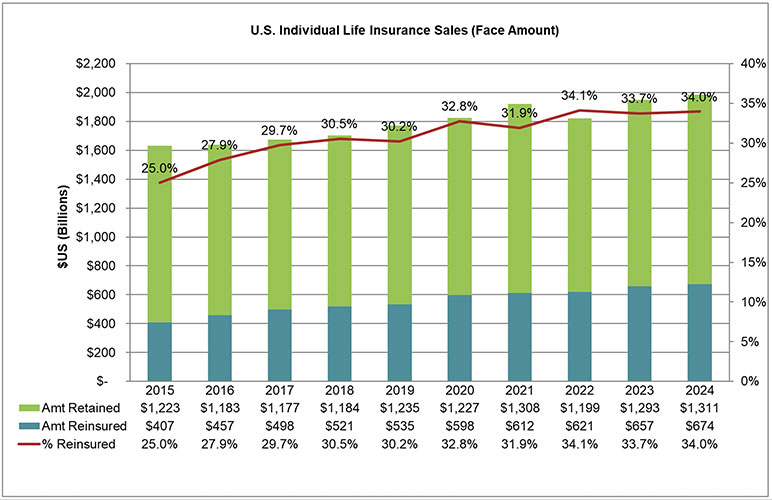

To estimate an overall cession rate for the life reinsurance industry, we compare new direct life sales to new recurring reinsurance production. According to LIMRA,[1] direct individual life insurance sales in 2024 rose by 1.8% (based on face amount). Combined with the surveyed life reinsurance production levels, this results in an estimated cession rate for the industry of 34% for 2024, matching the rate observed in 2022 and 2023. As seen in Figure 2, the estimated cession rate increased steadily from a low of 25% in 2015 to 34% (first observed in 2022).

Figure 2

U.S. Individual Life Insurance Sales ($US Face Amount)

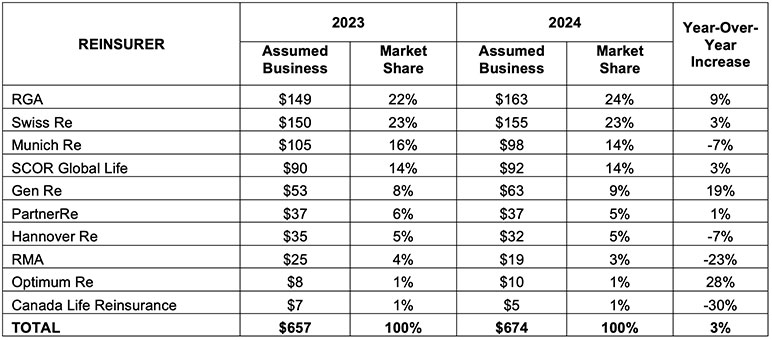

The top five U.S. individual life reinsurers by market share represent 85% of 2024 reinsurance production, up 2 percentage points over the 83% market share this group held in 2023 — see Table 2 for the information by reinsurer.

Table 2

U.S. Recurring Individual Life Volume ($US billions)

RGA claimed the market share lead from Swiss Re in 2024 with new business volume of U.S.$163 billion, a 9% increase over their 2023 sales (24% market share). Swiss Re is now second with new business volume of U.S.$155 billion (23% market share), while the next three largest reinsurers by market share were Munich Re ($US 98 billion, 14% market share), SCOR (U.S.$92 billion, 14% market share) and Gen Re (U.S.$63 billion, 9% market share). Six reinsurers reported increases in recurring new business volumes versus 2023.

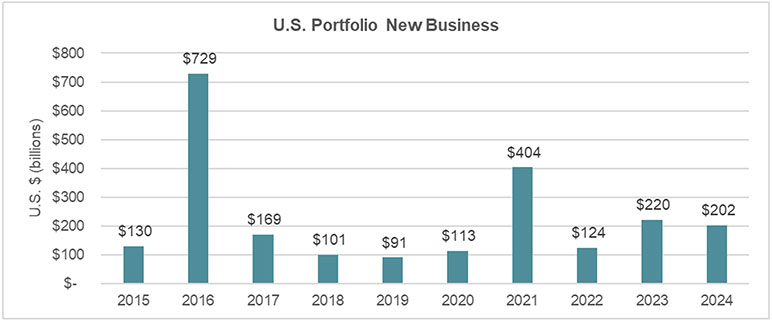

Portfolio New Business

For the purposes of this survey, portfolio reinsurance is defined to include in-force blocks of business as well as financial reinsurance transactions. This definition can produce large fluctuations from year to year in reported portfolio new business results. Portfolio new business production fell in 2024, from U.S.$220 billion in 2023 to U.S.$202 billion in 2024. RGA accounted for U.S.$94 billion (47% market share) of the 2024 portfolio new business followed by Swiss Re at U.S.$55 billion (27% market share) and Munich Re at U.S.$49 billion (24% market share).

Figure 3 illustrates the portfolio new business written over the last 10 years, which highlights the volatility of the volume of portfolio new business written in any particular calendar year.

Figure 3

U.S. Portfolio New Business Trend

Recurring Retrocession

The 2023 Survey was the first to split the retrocession results into two reporting categories — recurring retrocession and portfolio retrocession. Recurring retrocession volumes are considerably smaller than recurring new business and portfolio new business volumes. 2024 recurring retrocession volume was just over U.S.$7 billion, up from the U.S.$4 billion of volume reported in 2023. The primary recurring retrocessionaires in the U.S. market include Berkshire Hathaway Group and Equitable.

Portfolio Retrocession

The 2023 Survey also included the first separate reporting of portfolio retrocession. 2024 portfolio retrocession volume was reported at U.S.$4 billion, up 63% over the 2023 reported volume of U.S.$3 billion. The only reinsurer active in the 2024 portfolio retrocession market was Pacific Life Re.

CANADA — INDIVIDUAL LIFE

Recurring New Business

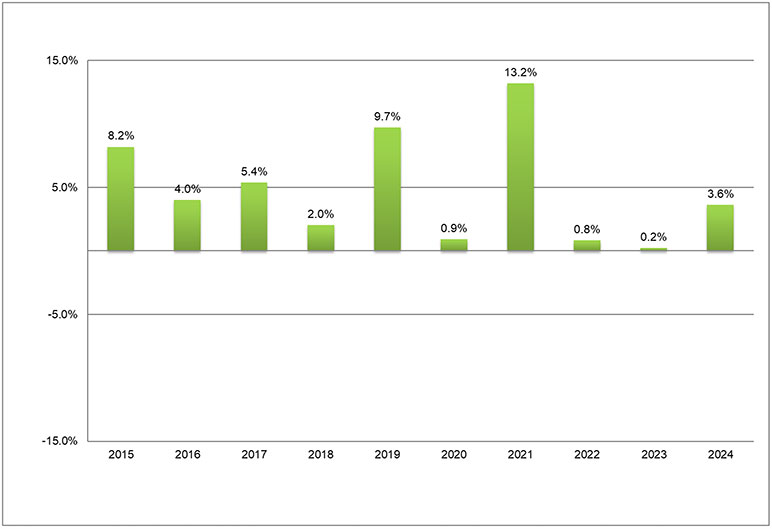

Recurring individual life reinsurance new business in Canada increased for the 10th consecutive year in 2024, growing from C$217 billion in 2023 to C$225 billion in 2024 (up 3.6%). Figure 4 shows the annual percentage change in recurring reinsurance new business over the last 10 years. Since 2015, recurring Canadian new business has grown at a 4.4% compound annual growth rate.

Figure 4

Percentage Change in Recurring Canadian New Business 2015 – 2024

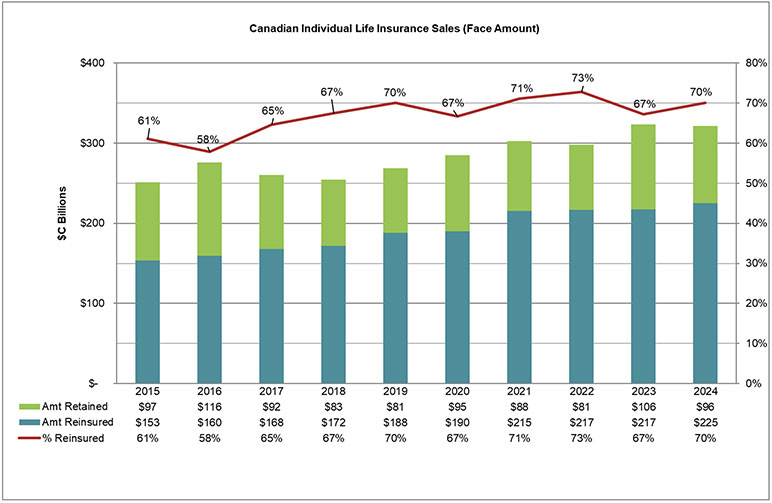

According to LIMRA,[2] Canadian direct individual life sales (on a face amount basis) decreased slightly in 2024 when compared to 2023, by 0.7%. The estimated cession rate for 2024, which is based on a comparison of direct life sales to recurring reinsurance volumes, was up in 2024 to 70% (versus 67% in 2023). Canadian cession rates continue to be much higher than the levels reported in the U.S, as is illustrated in Figure 5. Nearly 98% of the Canadian recurring reinsurance production was on a YRT basis.

Figure 5

Canadian Individual Life Insurance Sales (Face Amount)

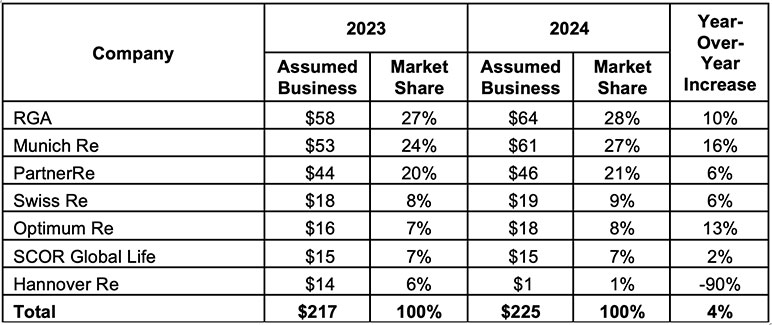

The top three individual life reinsurers in the Canadian market during 2024 (based on market share) were RGA, Munich Re, and PartnerRe. Together, these three reinsurers hold a 76% market share. RGA topped recurring new business writers by reporting C$64 billion of written volume in 2024 (up 10% over 2023). Munich Re followed with C$61 billion (16% increase from 2023), followed by PartnerRe with C$46 billion (6% increase from 2023). Of the seven reinsurers reporting in the 2024 survey, six reported increases in recurring new business volumes from 2023 to 2024. Table 3 summarizes assumed volumes and market share by reinsurer for 2023 and 2024.

Table 3

Canada Recurring Individual Life Volume ($C billions)

Portfolio New Business

RGA and Munich Re both reported portfolio new business in 2024, totaling C$11 billion. RGA reported C$8.9 billion of volume and Munich Re reported C$2.1 billion.

Recurring Retrocession

The recurring retrocession market in Canada is limited. Berkshire Hathaway reported C$1.4 billion in volume written in 2024, down from the C$1.9 billion they reported in 2023.

Portfolio Retrocession

The portfolio retrocession market in Canada is also limited. Pacific Life Re reported C$14.3 billion in volume written in 2024, up over 200% over the C$4.5 billion volume they reported in 2023.

UNITED STATES — GROUP LIFE

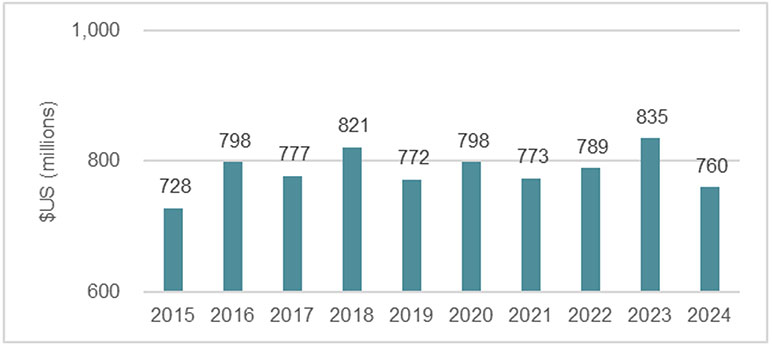

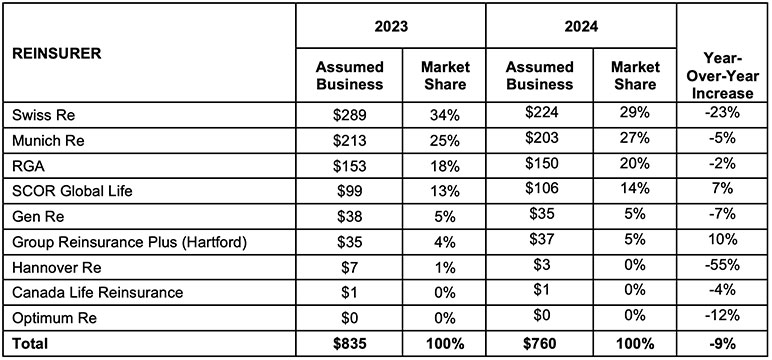

Group life reinsurers reported U.S.$10.0 billion of total in-force premium at the end of 2024, up 1% from the U.S.$9.8 billion reported at the end of 2023. Recurring in-force business accounted for U.S.$0.76 billion of the total, down 9% when compared to 2023 (see Figure 6).

Figure 6

U.S. Recurring Group Premium In Force

As illustrated in Table 4, the top four reinsurers in the recurring new business segment are Swiss Re, Munich Re, RGA and SCOR. Collectively, these reinsurers account for a 90% market share.

Table 4

U.S. Recurring Group Premium In Force (U.S.$ Millions)

Portfolio group premium in force totaled U.S.$9.2 billion in 2024, up 2% from the U.S.$9.0 billion reported in 2023. Canada Life Reinsurance reported U.S.$8.7 billion in portfolio premium in 2024, up slightly from the U.S.$8.5 billion reported in 2023. Munich Re reported U.S.$0.45 billion in 2024, down slightly from its reported 2023 value of U.S.$0.46 billion.

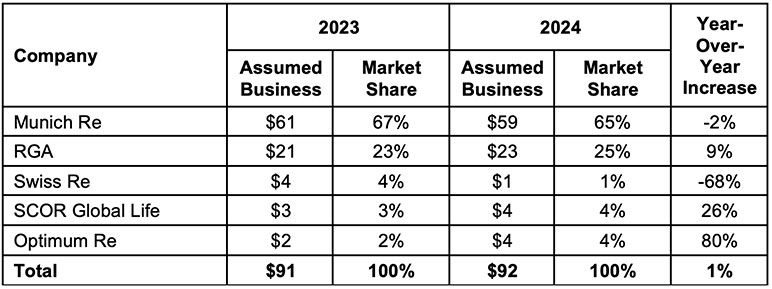

CANADA—GROUP LIFE

Group life reinsurers reported C$92 million of total in-force premium at year-end 2024, up 1% when compared to year-end 2023 levels. The group life market in Canada is led by Munich Re and RGA, who together account for a 90% market share (see Table 5). Of the five reinsurers reporting material volume, three reported increases in their in-force premium at year-end 2024 versus year-end 2023.

Table 5

Canada Traditional In-Force Group Premiums (C$ Millions)

A very small amount of recurring retrocession in-force premium was reported by Berkshire Hathaway in 2024, that was flat when compared to reported 2023 in-force premium.

CONCLUSION

Future life reinsurance financial results in 2025 and beyond will be influenced by a range of factors, including the continuing evolution of U.S. and Canadian mortality experience, developing economic factors such as inflation and interest rates, expansion of accelerated underwriting programs, changing technology, regulatory, legal and accounting landscapes, and continued mergers & acquisitions activity in the individual life insurance and annuity space. Life reinsurers are positioned to provide effective support for direct life insurance companies in addressing the challenges posed by these factors. Reinsurers’ expertise goes beyond traditional mortality and risk selection and includes financial reinsurance as well as value-added expertise in areas such as product development, underwriting operations, predictive analytics and risk selection, post-issue monitoring, and risk management. This expertise and support can be invaluable to direct writers as many look to expand their offerings, improve their outreach to consumers, and enhance controls. Reinsurance also remains a valuable tool for efficient capital and volatility management. Financial reinsurance structures and reinsurance of in-force blocks, either for non-core businesses or as a means to manage profitability, also continue to be attractive levers for direct writers.

In recent years, the life reinsurance market has begun to evolve as new entrants have begun to assume portfolio annuity and portfolio individual life insurance blocks of business. These entrants use reinsurance as a tool to bring new assets to their investment portfolios while providing capital and surplus relief to the direct life insurance company from which the business is reinsured. Often backed by private equity, these companies have not historically participated in the Society of Actuaries Life Reinsurance Survey because they were not considered to be traditional life reinsurers. The SOA Reinsurance Section Council continues to explore ways to assess this emerging market.

Thank you to all the reinsurers that participated in this year’s survey. Complete results are available on the Munich Re website.

Note that Munich Re prepared this survey on behalf of the Society of Actuaries Reinsurance Section as a service to section members. The contributing companies provide the data in response to the survey. The data is not audited, and Munich Re, the Society of Actuaries and the Reinsurance Section take no responsibility for the accuracy of the figures.

This article is provided for informational and educational purposes only. Neither the Society of Actuaries nor the respective authors’ employers make any endorsement, representation or guarantee with regard to any content, and disclaim any liability in connection with the use or misuse of any information provided herein. This article should not be construed as professional or financial advice. Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Anthony Ferraro, FSA, MAAA, is senior vice president, Individual Life Reinsurance at Munich Re Life US. He can be reached at aferraro@munichre.com.

Lloyd Spencer, FSA, CERA, is senior market intelligence lead, Individual Life Reinsurance at Munich Re Life US. He can be reached at lspencer@munichre.com.

Endnotes

[1] LIMRA’s “U.S. Individual Life Insurance Sales, Industry Estimates (1975 – 2024),” published in 2025

[2] LIMRA’s “Canadian Individual Life Insurance Sales Technical Supplement, Fourth Quarter 2024,” published in 2025