ASA and CERA Curriculum Changes Fact Sheet

Posted June 28, 2016

Background

The SOA’s Learning Strategy Task Force presented a set of initiatives to the Society of Actuaries (SOA) Board of Directors in June 2015. One of them was a complete review of the curriculum for the Associate of the Society of Actuaries (ASA) designation. The ASA Curriculum Review Task Force began its work in August 2015.

To understand stakeholder views, the Task Force circulated a draft proposal and a survey to key sections, employers, academic institutions, other associations, and the SOA’s member and candidate survey panel. The results of the survey showed broad support with about 80 percent indicating they favor or strongly favor the proposal. The survey revealed some concerns and preferences, which were incorporated into later drafts. The syllabus work of the International Actuarial Association (IAA) also informed the proposal.

After an initial SOA Board review of the proposal in March 2016, there were further meetings of the Task Force and additional feedback received from employers and actuarial associations. There was approval of the transition rules and Chartered Enterprise Risk Analyst (CERA) requirements by the Education Executive Group.

At its June 2016 meeting the SOA’s Board of Directors approved the proposal and the accompanying transition rules for implementation.

Key Drivers of the Curriculum Changes

Predictive Analytics

The use of predictive analytics has spread to most areas of actuarial practice. While there may be disagreement on what constitutes predictive analytics (or even if that is the best name), there is a clear consensus that actuaries need to know more than the basic regression and time series methods that are the focus of the current ASA curriculum. The new curriculum will incorporate predictive analytics topics to better prepare SOA trained actuaries for today’s opportunities.

Short-term/Long-term Insurance Balance

Short-term insurance coverages (e.g., health and general insurance) have been increasing in importance, particularly in global markets. The new curriculum will provide a better balance between short-term and long-term topics.

New Curriculum

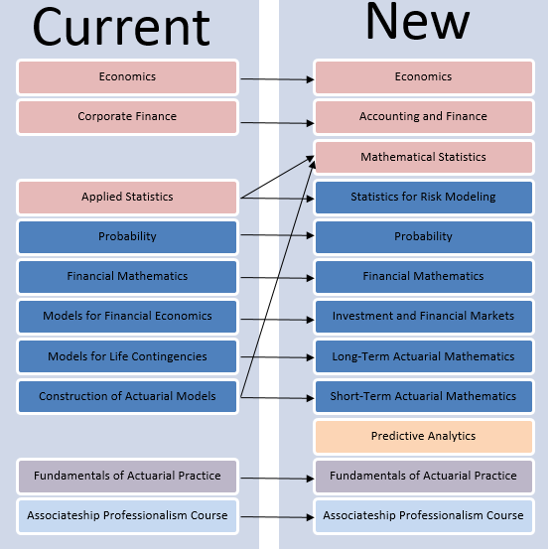

In total, the number of components will increase from the current ten [three Validation by Education Experience (VEE) subjects, five formally examined subjects, FAP, and APC] to twelve components, with three VEE subjects, seven formally examined subjects, FAP, and APC. While there are modest changes to the learning objectives throughout, the major changes are:

- VEE Applied Statistics is replaced with VEE Mathematical Statistics

- Addition of accounting to the Corporate Finance VEE

- Addition of pricing and reserving of short-term insurances to Exam C, with some current topics moved to other exams

- Less emphasis on derivatives and more on investment in the Investment and Financial Markets exam

- Addition of an exam on the basics of applied statistics (Statistics for Risk Modeling)

- Addition of an exam on predictive analytics

Validation by Educational Experience

Economics

This subject is unchanged. It covers microeconomics and macroeconomics at the level of a first undergraduate course.

Accounting and Finance

There are two changes here with respect to the current Corporate Finance VEE requirement. One is the addition of accounting. This will ensure candidates have an accounting background for their fellowship work. The finance requirement will be somewhat lighter than the current VEE requirement as the more advanced topics that were previously listed are covered in later components.

Mathematical Statistics

With the addition of more general predictive analytics, it is appropriate to return mathematical statistics to the curriculum in full.

Formally Examined

In the following, CBT refers to computer-based testing. While in their ultimate state, CBT exams provide instant unofficial results, it should be noted that when there is a substantial change in an exam’s syllabus offering instant results must be suspended while the item bank is recalibrated.

Probability Exam

This component contains all of the current Exam P probability topics. There are some minor changes in learning objectives. It will continue to be assessed by CBT.

Financial Mathematics Exam

This is the interest theory portion of the current FM (Financial Mathematics) exam with some minor changes. It is similar to the revised FM exam starting in June 2017 with the addition of a few corporate finance topics pulled from the current Corporate Finance VEE requirement. It will continue to be assessed by CBT.

Investment and Financial Markets Exam

There is a change from the current Exam MFE (Models for Financial Economics) in two directions. Stochastic calculus has been reduced as have some of the other deeper mathematical topics (effective with the July 2017 changes). The eliminated topics will be on fellowship exams as appropriate for each track. The syllabus adds some corporate finance and portfolio theory topics not covered in the other finance-related components. It will continue to be assessed by CBT.

Long-Term Actuarial Mathematics Exam

This is a replacement for the current Exam MLC (Models for Life Contingencies). A few topics from the current syllabus have been removed (e.g., yield curves and diversifiable risk) while some estimation topics that are currently on Exam C have been moved here. Universal Life coverage details will be moved to FAP while a section on life and annuity products will be added. This exam will continue to be a combination of multiple choice and written answer responses.

Short-Term Actuarial Mathematics Exam

This is the replacement for the current Exam C (Construction of Actuarial Models). Of the current exams, this one will undergo the largest change. The basic material on estimation has been moved to the Mathematical Statistics VEE subject and specific material on life table estimation appears in the Long-Term Actuarial Mathematics exam. These topics are replaced with more product-oriented information relating to short-term insurance (e.g., health, property, and liability). In particular, the basics of pricing and reserving will be added. This exam will continue to be CBT.

Statistics for Risk Modeling (SRM) Exam

This is one of the two components on the new curriculum that is devoted to predictive analytics education. It provides the transition from mathematical statistics as presented in the Probability Exam and Mathematical Statistics VEE to predictive analytics and its applications. It covers the regression and time series topics formerly in the Applied Statistics VEE subject. This exam will add the generalized linear model. This exam will be CBT and will be a formal prerequisite for the Predictive Analytics Exam.

Predictive Analytics Exam

This is a completely new topic for the ASA curriculum. Candidates will use computer packages to analyze data sets and then communicate their findings. To achieve this, the task force recommends two elements that have not been part of preliminary education. The first is an e-Learning module that will take the candidates through the modeling process allowing them the opportunity to work through case studies that will illustrate the various methods. The second is an assessment using a fully-functioning computer that will allow for the use of software and the ability to write a report.

FAP and APC

Fundamentals of Actuarial Practice e-Learning Course

The basic structure of FAP will not change. The adjustment of a relatively small number of topics may occur as the rest of the curriculum is developed.

Associateship Professionalism Course

The structure of APC is not expected to change.

Relationships Between New Curriculum Components