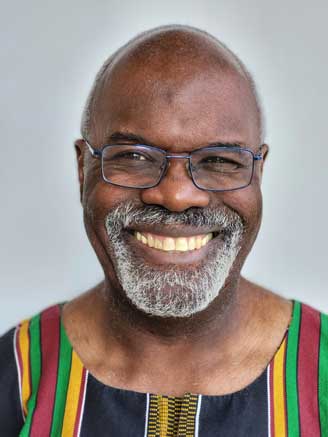

Meet Your President-Elect and Vice Chair John Robinson, FSA, MAAA, FCA

By Kwesi Acquah and Nathan Pohle

Actuary of the Future, May 2022

For decades John Robinson has served as a leader within the actuarial community and a dedicated volunteer of the Society of Actuaries (SOA). We recently sat down with John to get his perspective on the actuarial career, and where he sees the actuarial profession evolving over the next few years, particularly in relation to Diversity, Equity, and Inclusion (DEI).

Kwesi Acquah and Nathan Pohle (KA/NP): You’ve had an impressive career. Can you tell our readers a little bit about your career thus far?

John Robinson (JR): I have been quite fortunate to have had a career that has spanned a significant length of time, from a professional and leadership perspective. I have worked as an actuary for 35 years, in seven companies, and two countries, starting in Jamaica in 1982 with R. Watson & Sons, and ending in 2021 with the Minnesota Department of Commerce where I served as a life insurance regulator.

John Robinson (JR): I have been quite fortunate to have had a career that has spanned a significant length of time, from a professional and leadership perspective. I have worked as an actuary for 35 years, in seven companies, and two countries, starting in Jamaica in 1982 with R. Watson & Sons, and ending in 2021 with the Minnesota Department of Commerce where I served as a life insurance regulator.

Diversity and inclusion has always been close to my heart. I have held several leadership roles over the last 22 years, some to mention are: Chair of Nationwide’s Actuarial Diversity Committee, IABA-vice president and president, SOA Board of Directors member, and the Actuaries Without Borders Committee.

KA/NP: You have recently been elected as SOA president-elect and vice chair. What priorities do you have for your term as SOA president and chair?

JR: I’m less focused on my individual agenda and more focused on helping the SOA achieve its goals, because my vision needs to intertwine with the Board’s vision in order to champion the SOA’s efforts.

The SOA has a long-term strategy that has strongly considered the challenges the industry faces and what the organization should be doing as it moves forward. This long-term strategy sets the guard rails for our shorter-term strategic plans, ensuring that there is a continual achievement of goals, and that the overall vision is not swayed whenever a new president takes over to serve their term.

Long-Term Growth Strategy

Our long-term strategy covers the areas of data science, artificial intelligence, changes in skill development and credentialing, strengthening member engagement, our future growth, and diversity, equity, and inclusion.

Data Science—This discipline has grown tremendously in the last few years and has created job competition such that we are faced with a loss of candidates to this area. Candidates out of college hear that to be an actuary you have to spend 10 years studying and taking quite a number of exams, whereas they could get entry-level jobs in data science that pay more than they would start out as an actuary. This is causing us to lose out on a lot of entry-level talent.

Artificial Intelligence (AI)—The fear is that AI may replace some of the work done by our entry-level candidates today. Entry-level candidates learn a lot by going through fundamental steps in the process, and this provides a great source of learning. By digging into formulas, you learn how things are tied together and develop your own intuition. These judgements you develop through learning on the job are critical to real actuarial judgement down the road. If machines are now doing this work in the future, this potentially eliminates the learning our entry staff would have on the job. So therefore, the challenge becomes, “what do we do to either replace what has been taught before or push back against some of these developments?”

Changing Nature of Skill Development and Credentialing—The marketplace wants people to be able to apply what they’ve learned to new and different challenges. Credentialing used to take some time to achieve back in my day. I have a friend I was talking to today, who completed their FSA after 20 years. In my generation, it was deemed a badge of honor that you stuck with it so long and got it done. That was the same for me; I started in 1982 and finished in 1994. The younger generation just don’t see it the way we did. They don’t want anything that will take 10 to 15 years to finish, and so we have to make it more appealing to folks by giving them options.

Member Engagement—Participation in SOA sections has reduced significantly in the last few years. These sections have really been the only device that we’ve had for building community. So, the question becomes “if sections are not working, what do we do to build up member engagement?” This year we’re piloting a Community model, which may be used to retire SOA sections, and will hopefully create a lot of flexibility. This model will allow anyone to form a group with people who share a similar interest. Membership is not tied down to a certain number of years, and so these groups can exist indefinitely or only for a few months, depending on the will of the members. The interests don’t have to be anything related to the profession—it could be something as simple as “actuaries who love skiing.”

We’ve found in recent years that sections have a lot of members, but only a handful of members within those sections participate regularly, and so this approach for driving engagement hasn’t trickled down as much to the SOA members as well as it should.

When I was running for election, I asked people what they wanted changed and there was one comment that stuck with me. One person said to me that every time they attended SOA meetings all of the topics were introductory, or intermediate, but there was nothing advanced. We feel that the Communities will fix this, because if there were people that really wanted to get deep into the technical details, they could set up a community and do just that.

We are hoping that this new forum will allow the building of more community and drive-up engagement around our member population, given the flexibility that it will offer.

Our Future Growth—The SOA is one of the largest actuarial organizations in the world. We currently have slightly under one-third of the 110,000 fully qualified actuaries globally within our ranks, and so we are relatively large. But as we look at our growth, it’s apparent to us that most of our growth in the years to come will be from actuaries working outside North America. As such, we expect to have a lot of efforts to foster more growth in various countries and regions, e.g., Ghana, Kenya, Middle East, Asia, and South America.

Diversity, Equity, and Inclusion—DEI is a key part of our SOA strategy that will enable us to succeed both within the workplace and the broader actuarial profession as the world becomes more and more global.

2022–2024 Strategy

Our short-term strategy through 2024 encompasses the following:

- Emphasizing Skills

- Accelerating our International Growth

- Spotlighting our Purpose

- Cultivating Community

Emphasizing Skills—The SOA seeks to provide skill-focused education that recognizes the importance of lifelong learning.

Accelerating our International Growth—Our vibrant international membership is supported by SOA services that are customized to meet local needs. We have members and candidates all over the world and increasingly local staff to support them, e.g., Beijing, Hong Kong, Singapore, India, etc. Within these regions, the country’s actuarial population in certain cases, may not be aligned to the SOA curriculum. We are seeking to build relationships with key stakeholders, including universities, local actuarial associations, employers and regulators, to encourage understanding and alignment, where it makes sense. In addition, we are evaluating where we can adapt and localize our SOA offerings in a way that supports the growth of the actuarial profession and highlights the positive impact that actuaries can make in growing economies.

Spotlighting our Purpose—In today’s world, being strong in mathematics is a pull for Actuarial Science. However, entry levels are asking, “How do I contribute to society?” The work that actuaries do for financial service companies all around the world brings valuable actuarial insights to the public and to regulators alike, which creates an invaluable contribution to society.

Cultivating Community—The SOA continues to seek to provide a place of belonging and community for all actuaries and members, regardless of race, ethnicity, or background.

KA/NP: There has been tremendous focus on DEI area in the last year. How does the industry sustain the right focus on this so that it’s not “a flavor of the month” but is long standing and is part of the ethos or guiding beliefs that characterize ideology?

JR: It’s been established empirically that DEI is good for business, and people generally accept that. The key in the long run will be for DEI to be institutionalized so that it’s part of everything an organization does. Companies need to recognize that if we forecast out populations there will be a different mix of the make-up of populations in years to come, It is important that the company’s leadership either has a very strong conviction in the DEI initiatives, or has experienced things in their past which can help them shepherd their organization in the right direction.

I have the faith that successive generations will be able to make headways in the area of diversity improvement better than the one before, and as long as it’s continued, there will be a difference made.

KA/NP: What has been the SOA’s role in the actuarial industry related to DEI, and how do you envision the SOA’s role evolving in the years to come?

JR: I think the primary role is just to continuously create awareness. The SOA as an employer has a staff of about 150 individuals. We have DEI sessions at every SOA meeting. What we do is provide material and moral support to affinity groups and I’m quite thrilled to see that occur.

We’ve had new affinity organizations spring up spontaneously over the last two years—sort of like a mushroom effect. What’s neat about these organizations, from my perspective, is that they are quite agnostic as to which organization their members belong. A few of them are ethnic specific - and there are some others that are gender specific, and it’s really great to see that. This will be a trend in the right direction to the extent that we continue to make that possible.

KA/NP: The SOA is a large organization with over 30,000 actuaries spanning several countries/continents. Do you feel that the SOA leadership is representative of the population it serves? In what ways can the SOA leadership improve from a representation standpoint?

JR: Thinking specifically of the Board, the short answer is of course no, because the SOA leadership has 18 members, and the SOA has members in over 80 countries. As such, it will be impossible to have representation on a country-by-country basis.

We could do a better job of representation by continent, and I think that there are some great ways to do that. In the SOA we self-nominate, so as long as there are people willing to serve, by self-nominating, we could close some of these gaps.

Secondly, we have the ability to set aside reserved seats within the SOA Board for certain attributes. By using this option, we can ensure that there is broader representation by country/continent on the Board.

KA/NP: There are some people in the industry that do not feel DEI should be such a prominent topic. What would you say to these individuals?

JR: This is a tough one. History is replete with examples of one group defining another group as “the other.” Every human is capable of this type of behavior, especially in a group setting. However, building societies that are “just” requires us to try to resist those human urges in the best interest of society. DEI is part of resisting those human urges, and every citizen should participate.

KA/NP: Is the SOA collaborating with the CAS and other actuarial organizations, to be able to take action on DEI initiatives more broadly for the actuarial profession?

JR: Yes—the SOA collaborates with the CAS through the Joint Committee for Inclusion, Equity, and Diversity (JCEID). This committee started as the Joint Committee on Minority Recruiting in 1977. Its role has evolved over the years and will likely continue to evolve as the landscape of affinity groups changes.

Separately, the SOA, CAS, and other organizations each have their own independent diversity committees that pursue their own unique objectives.

KA/NP: Given the impacts of COVID, DEI, emerging technology, and data science, how do you see the future of the actuarial profession changing? E.g., assumption setting by demographic (removal of possible biases)?

JR: The fundamental objectives of the actuarial profession will not change. Actuaries are and will continue to be in the business of supporting sound financial systems within our field of influence. There has been a push for actuaries to lend their skills to banking. South Africa is possibly the only country where such an actuarial role is not viewed as “non-traditional.” COVID-19 and climate change, however, make our lives a little more difficult.

The COVID-19 pandemic continues to be very fluid and makes it difficult to get a good read on what’s going on in such a way that you can project the future—which is an integral part of what we as actuaries do.

Climate change continues to evolve. The past may not be a good predictor of the future, which presents a unique challenge for actuaries—particularly if you consider how our mortality tables and other best-estimate assumptions are structured by leveraging the use of historical data. This creates challenges we will need to overcome.

Data science has shown us that the value of an actuary does not come from how good of a data scientist they are, but value is driven by the business insight that they provide to the principal. Actuarial managers need to know enough about data science to be able to direct those that know how to use these tools.

Big Data has revolutionized data analytics—enabling the ability to sift through vast datasets. Vast datasets, however, can contain biases that create an equity problem in any application that is based on that originally biased data. In this, as most things in life, the solution of one problem has created others, and we need to be careful of how we apply the solutions to address problems faced in our day-to-day work.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Kwesi Acquah, FSA, MAAA, is a senior manager for Deloitte. He can be contacted at kacquah@deloitte.com.

Nate Pohle, FSA, CERA, MAAA, is a senior manager for Deloitte. He can be contacted at npohle@deloitte.com.