The Next Horizon of Value-based Care: An Opportunity for Actuaries to Become Pioneers in Health Care

By Sean Zhao

Innovators & Entrepreneurs, August 2023

The continued momentum toward value-based care (VBC), including specialty-based value-based care (as opposed to primary-care based) in the U.S. has consistently been a top-of-mind topic for all health care stakeholders, including payers, providers, regulatory bodies, investors, and consumers. Broadly defined, VBC revolves around a shift away from payment to providers for volume (i.e., fee for service) to a broad range of different payment structures that reward the providers for meeting cost and/or quality-based benchmarks (e.g., bundled payments, shared savings with up or up/down-side risk, full capitation).

There is extensive debate and discussion around the merit and direction of VBC. One perspective that has not been talked about as much, however, is that the growth of VBC may be producing a unique opportunity for actuaries to emerge as pioneers in the space.

There are three themes that support this:

- The momentum toward VBC, including specialist-based VBC, is clear;

- actuarial analytics is foundational to the success of the specialist VBC space; and

- the competitive market is nascent, with space for disruptors.

Actuaries should capitalize on this opportunity and establish themselves as true leaders in the space, including as potential founders and investors, to unlock value in the next horizon of VBC.

The brief below provides high-level evidence and observations that support the themes above, while the last section aims to serve as a simple worksheet for problem-solving the ways in which actuaries can impact the space.

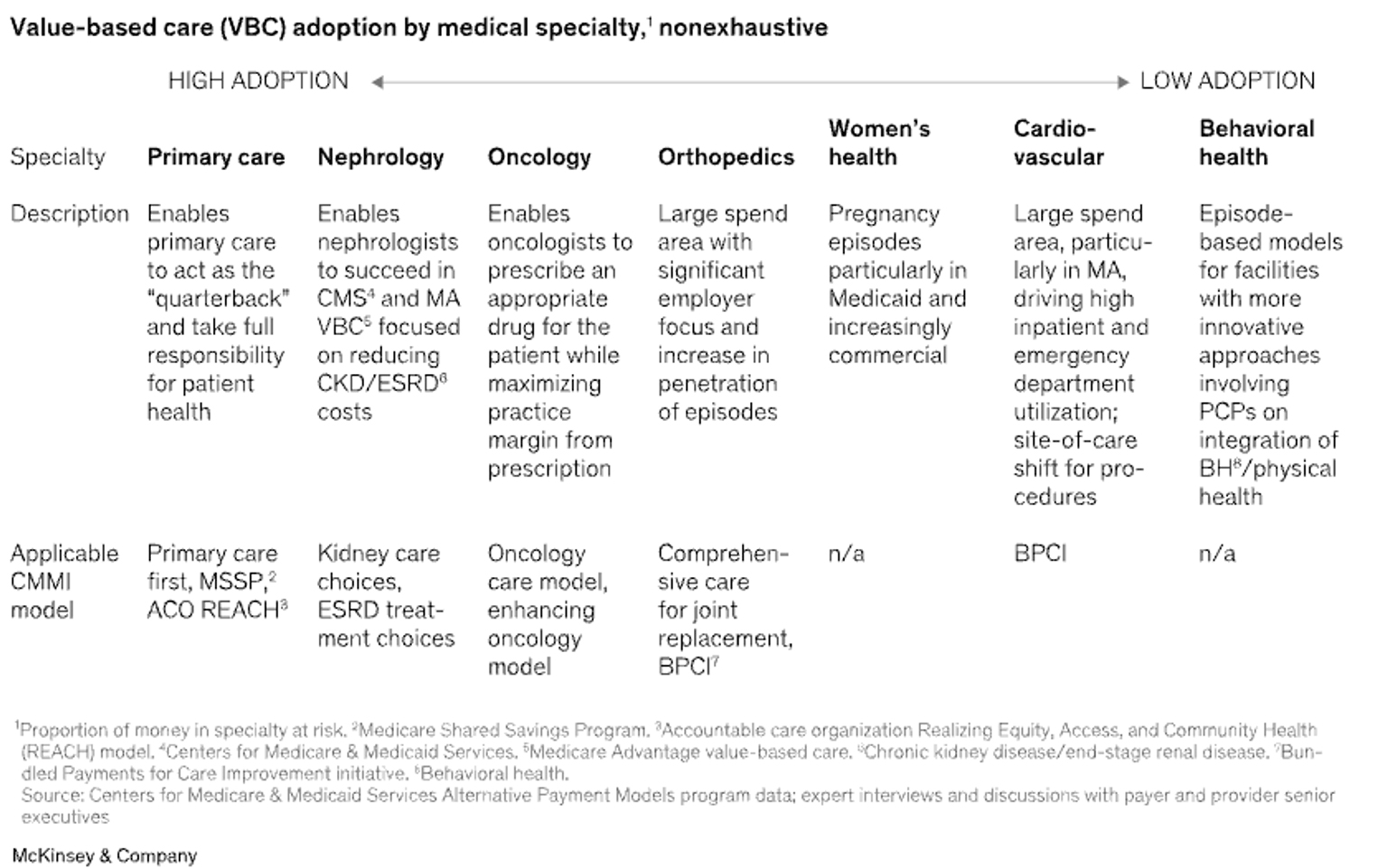

Theme A: The Momentum Toward VBC and Specialist VBC is Clear, but the Paths are Not

- CMS’ intention to make VBC the norm is clear, as outlined in the CMMI Strategy Refresh.

- Specialty-focused VBC is top of mind for CMS, as explicitly called out in strategy reports and blog posts.

- While there is a clear direction, the specifics of how specialist VBC will be unlocked remains unclear. Multiple directions are possible and will be tested, as outlined by CMS.

- There are several areas of focus that have been identified:

- Integration of at-risk PCPs and specialists;

- Medicare remains top focus, while Medicaid is gaining momentum;

- there is a near-term focus on specialist data—including quality and cost (measuring specialist quality is challenging); and

- while “e-consults” and “enhanced referrals” are near-term focuses, financial risk is the clear long-term goal.

Implications

- There is very little doubt that the space will grow.

- Since the paths are not clear, there will likely be a variety of different plays, most of which will require actuarial analytics as a foundational capability. Examples of the variations within how players may choose to play within specialist VBC include:

- Provider angle versus risk aggregator versus payer versus other,

- single specialty versus multispecialty, and

- venture companies versus new ventures from existing companies such as PCP risk bearing providers/health plans.

Exhibit 1

More Than 50M Americans Will Move to VBC Over the Next Five Years[1]

Exhibit 2

Research Suggests Growing Adoption of VBC in Specialty Care[1]

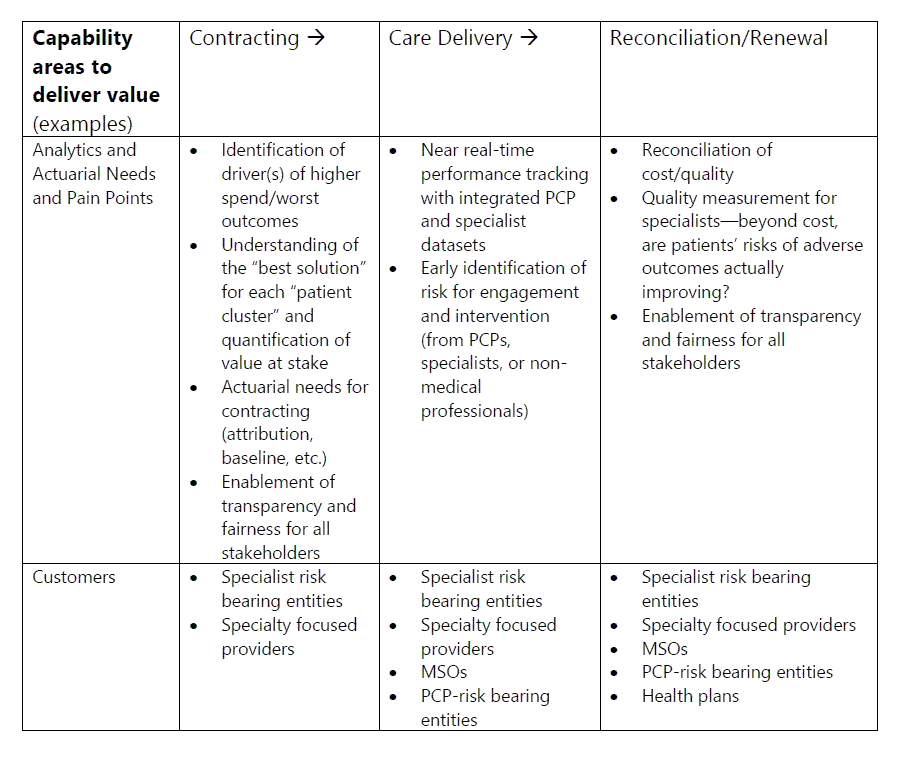

Theme B: Actuarial Analytics Will Have an Outsized Value Along This Journey

- While the evolution from PCP-based to specialist-based risk is natural, the economics required to succeed (and required to improve value for the patients) may be drastically different.

- Specifically, the majority of the value might need to come from reduction in spend/mitigated adverse outcomes as opposed to risk coding, as risk-coding opportunities may be relatively less impactful by the time specialists take over depending on the condition (especially if members are already engaged with capitated providers at the PCP level).

- Additionally, the analytics become significantly more complex as the economics for each condition or sub-condition will be different. This is further complicated by the need to manage individuals with co-morbidities, as well as payment model challenges such as partial capitation arrangements (e.g., taking risk on part B but not part D drugs).

- The analytics that would unlock value require heavy actuarial understanding (both technical and contextual), including which patients could best benefit from which types of providers/specialty vendors.

- There already exists a specialist focus from the care delivery side, including many PE/VC funded or created companies, particularly in CKD, but also growing in other areas (Oncology, MSK).

- For these companies, actuarial capabilities at large, including value-based contracting, are a source of significant challenge. Companies are now moving from “hire an actuary when we need one” to “let’s start the company with an actuary from day one”—as a co-founder or one of the first employees.

Exhibit 3

Actuarial Analytics Span Across Multiple Areas of the Value Chain

Implications

- For organizations (up and downstream) to succeed in this space, actuarial analytics is key to unlocking the business case—and this needs to be understood day one.

Theme C: Existing Analytics Solution Space is Still Being Shaped, With no Clear Winners

- While there are a growing set of players in the market, the space is still nascent (>60% funding from VCs) and there is no clear winner in the space yet.

- Challenges for analytics solutions today are multi-fold from what I observe. They include:

- For smaller orgs that are more willing to vend out/partner, budget can be constrained (i.e., admin cost challenges), especially in a PMPM model;

- for health plans, there is (and should be) internal competition; and

- data is often a challenge (incomplete, inaccurate, lagged, etc.)

- Among the competitors, there are no clear winners or players with competitive moats.

Implications

- There is space for new players to disrupt the current state.

- However, at the same time, the new player may need to come with more than just analytics given how many companies have tried (e.g., some kind of risk arrangement).

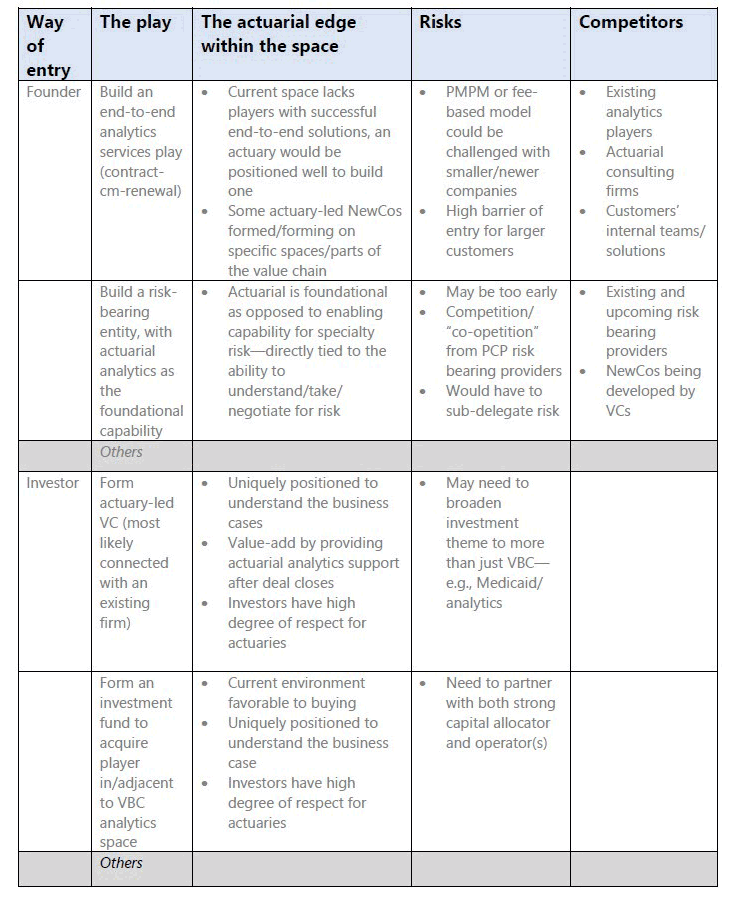

Ways for Actuaries to be Leaders in This Space

I have considered two main ways of entry into the space, as founders or investors.

- The founder approach would include launching a company independently, with another entity (e.g., existing firm, VC), or within another entity.

- The investor approach would include joining existing investment firms, starting a new firm independently, or as a part of another organization.

These two ways of entry are uncommon for actuaries based on my observations. However, with the themes above I think this could change. Other professions (e.g., medical doctors) have found success with these two ways of entry, and I believe actuaries can, too.

Exhibit 4

Worksheet (With High-Level Examples)

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Sean Zhao, FSA, CERA, MAAA, is the co-founder of CareForward Partners. Sean can be contacted at sean@careforwardpartners.com, LinkedIn, or https://www.careforwardpartners.com/.

Endnote

[1] Exhibits from “Investing in the new era of value-based care,” December 2022, McKinsey & Company, www.mckinsey.com. Copyright (c) 2023 McKinsey & Company. All rights reserved. Reprinted by permission.