How Does the Emerging Principle-based Reserving Framework for Non-variable Annuities Compare to Market Risk Benefits Under Long-duration Targeted Improvements?

By Ryan Laine, Paul San Valentin, Sean Abate, Angela McShane and Ben Hanley

The Financial Reporter, June 2023

The focus and attention of many senior leadership teams across the US insurance industry has been dominated by accounting change for several years. Is the end finally in sight? After countless hours spent developing accounting policy and actuarial methodology, building new actuarial models, and enhancing end-to-end financial reporting processes, public companies are going live with US GAAP Long Duration Targeted Improvements (LDTI). Private and mutual insurers are not far behind, with an effective date of Jan. 1, 2025. However, as one accounting implementation winds down for many, another is on the horizon.

The NAIC has introduced a principle-based reserving (PBR) framework for statutory valuation to better align with the evolving nature of insurance products. The Annuity Reserve and Capital Working Group (ARCWG) has developed a proposed PBR framework for non-variable annuity (VA) products that builds on the existing VM-22 standard. Currently, the proposed project timeline targets the VM-22 update for non-VA annuity products to be adopted in 2025, with an effective date of Jan. 1, 2026. The current exposure draft of VM-22[1] proposes the requirements be applied prospectively with a three-year transition period starting Jan. 1, 2026.

Under US GAAP LDTI, some non-VA products contain features scoped in as “market risk benefits” (MRBs), which are required to be measured at fair value. For US insurers, the question becomes “How does the emerging PBR framework for non-variable annuities compare to the fair value framework for MRBs under LDTI?” This article provides a comparison between these two new measurement models and highlights key considerations as companies plan for adoption. These considerations should inform a company’s strategy as it pertains to things like:

- Accounting policy and actuarial methodology decisions;

- actuarial modeling;

- pricing;

- hedging programs;

- financial reporting and governance;

- assumption setting, including the management of economic scenarios; and

- operational processes and data needs.

Understanding the relationship between VM-22 and MRBs will allow companies to proactively make business decisions based on a comprehensive evaluation of both measurement models. Companies are not simply building new actuarial models and concluding their implementation programs. Accounting change has served as a catalyst for more widespread organizational change to systems, processes, and data. The cost of making incorrect strategic decisions in isolation is too high.

LDTI Treatment of MRBs

LDTI defines an MRB as a “contract or contract feature in a long-duration contract issued by an insurance entity that both protects the contract holder from other-than-nominal capital market risk and exposes the insurance entity to other-than-nominal capital market risk.”(ASC 944-40-25-25C) When calculating MRBs, insurers either determine an amount of attributed fees associated with the MRB or establish an offsetting amount to have no gain or loss at issue. Companies measure the MRB at fair value at the transition date with subsequent changes recognized in net income (except for amounts arising from changes in the insurer’s nonperformance risk, which are recognized within other comprehensive income (OCI)).

The introduction of MRB for valuation of these features has several common impacts on companies. First, LDTI expands the scope of features that are measured at fair value. Many of the common features scoped in as MRBs were valued under a real-world framework prior to LDTI. The expansion of fair value may increase the volatility of earnings for these products and features. Second, there are operational impacts as the stochastic nature of fair valuation calculations requires more complex modeling and methodology. Third, there are accounting and earnings emergence impacts. Companies must re-evaluate the existing accounting policy and actuarial methodologies for GAAP. Financial impact analyses are often required to inform decision-making and understand the implications of accounting policy decisions.

Proposed Upcoming VM-22 Regulation Enhancements

The NAIC has introduced the PBR framework for statutory valuation to better align with the evolving nature of insurance products. Consequently, the ARCWG developed a proposed PBR framework for non-VA products that will enhance existing VM-22 regulation. The proposed PBR framework is still evolving and will be subject to industry field testing, expected to occur in 2024, before being officially adopted. The current draft of VM-22 enhancements applies prospectively and allows for a three-year transition period, similar to how VM-20 was implemented.

Per Valuation Manual Section II, Subsection 2 of the latest exposure draft, all annuity contracts that do not fall under VM-21 would be subject to VM-22 if issued after the new standard becomes effective.[2] Generally, this is expected to include products such as single and flexible premium deferred annuities, fixed indexed annuities, market-value-adjusted annuities, and payout annuities. Guaranteed investment contracts, synthetic guaranteed investment contracts, and other stable value contracts are not in scope for VM-22.

The proposed VM-22 regulation leverages a similar framework to VM-20 and VM-21. In the proposal, the minimum reserve for contracts falling within scope of VM-22 equals the stochastic reserve (SR) plus an additional standard projection amount unless a VM-22 exception is satisfied and applied.

- The SR is determined based on stochastic asset and liability projections using company-specific prudent estimate assumptions. The SR equals the average of the greatest present value of accumulated deficiencies (GPVAD) in the worst 30% of scenarios (CTE70).

- The additional standard projection amount is a reserve where the company uses prescribed assumptions to calculate the reserve. The intent of this reserve would be a guardrail against potential outlier assumptions. The standard projection methods are still to be decided at this time.

The reserve is determined both pre-reinsurance and post-reinsurance. Groups of contracts within different Reserving Categories may not be aggregated together. The three being proposed for VM-22 are:

- Payout Annuity Reserving Category,

- Longevity Reinsurance Reserving Category, and

- Accumulation Reserving Category.

The current draft of VM-22 allows companies to exclude one or more groups of contracts from the SR calculation if the stochastic exclusion test (SET) is satisfied. The SET being proposed follows concepts similar to the SET for PBR for other products. A deterministic reserve (DR) would be calculated instead of the SR. The DR would only be acceptable for contracts not influenced by policyholder behavior that can vary in different economic conditions.

The effect of the company’s current hedging strategy is reflected in the proposed reserve calculation. The SR recognizes all risks, associated costs, imperfections in the hedges, and hedging mismatch tolerances associated with the hedging strategy. Similar to VM-21, the company will need to calculate the “CTE70 (best efforts)” reserve based on incorporating the modeling hedges and then calculate a “CTE70 (adjusted)” reserve based on the calculation, assuming no future hedging purchases except those to hedge interest credits and hedge assets held by the company on the valuation date.

The requirements of VM-22 are still undergoing industry feedback and are subject to change depending on the outcomes of the VM-22 field tests. Nevertheless, these new requirements will most likely be here sooner rather than later and companies would be wise to consider VM-22 when making decisions about their future state end-to-end financial reporting process, especially when updates are already being made for LDTI.

Comparison of Proposed VM-22 Regulation and Market Risk Benefits

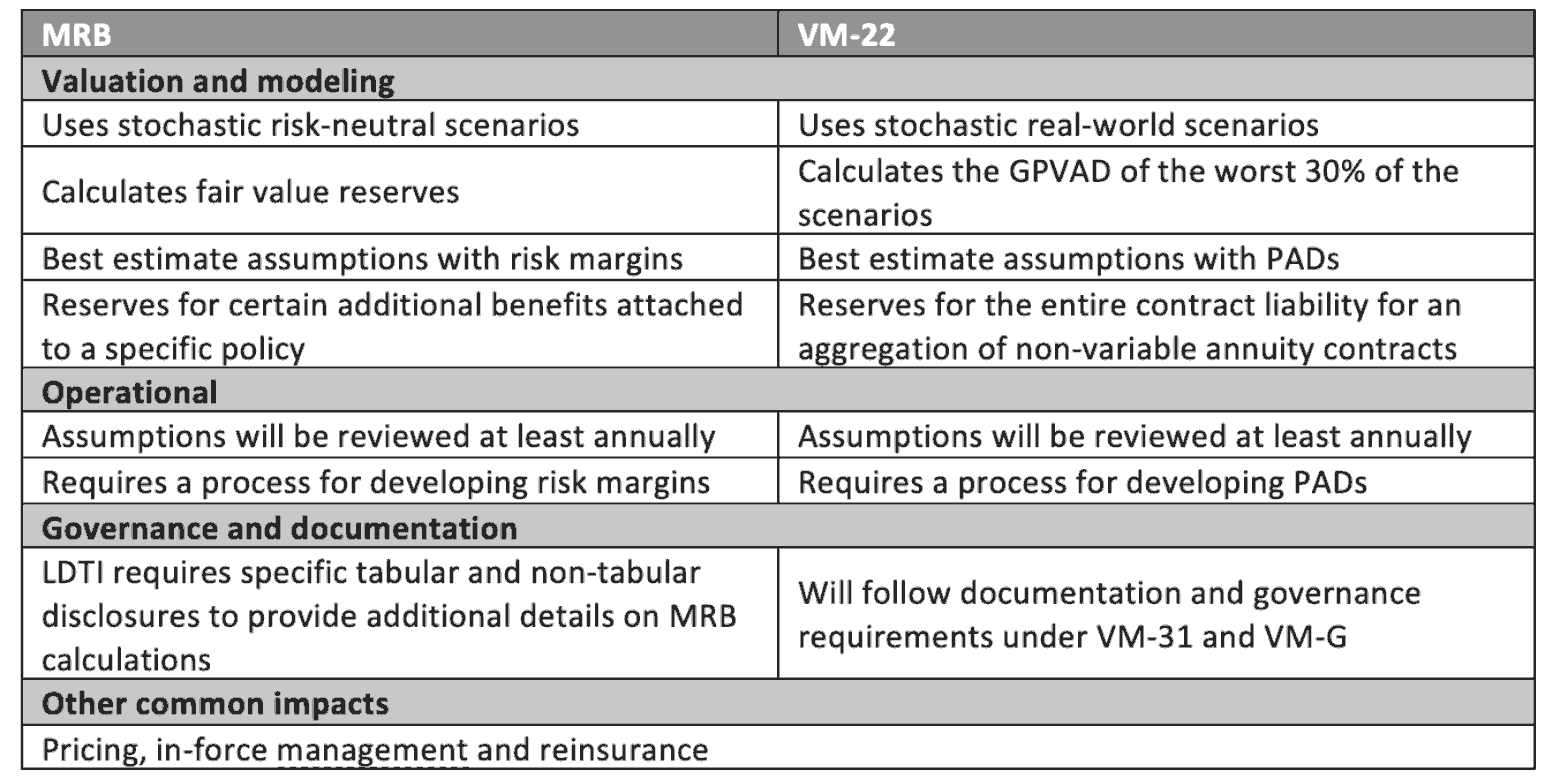

With the experience gained from the recent public company LDTI implementation, we wanted to compare the proposed VM-22 regulation to MRBs. (See Table 1)

Table 1

Comparison of Proposed VM-22 and MRBs

Valuation

Both LDTI and the proposed VM-22 standard utilize scenario generators in their respective measurement models. The LDTI approach uses scenarios to determine the fair value for certain additional benefits, whereas VM-22 uses scenarios to capture tail risks inherent in non-variable annuity products. Where LDTI MRB calculates fair value reserves on a contract basis, the proposed VM-22 requires the calculation of a pretax CTE70 of the GPVAD and allows aggregation of policies if business/risks are managed together. MRBs require the use of risk-neutral scenarios, but the source of the scenario generator is not prescribed. On the other hand, PBR requires the use of real-world scenarios. There are also similarities on the assumptions that will be used; as expected on a statutory reserving regime, prudent estimate assumptions would be required for VM-22, whereas best estimate assumptions with risk margins will need to be utilized for MRBs.

Operational

We find more similarities in the operational considerations for MRB and the proposed VM-22. Both require significant changes to the assumption setting, modeling, and valuation processes surrounding these products. Unlike in the previous valuation regime (i.e., Actuarial Guideline XXXV), VM-22 assumptions will need to be reviewed annually. The constant update of assumptions will require companies to establish more robust controls and governance around the assumption setting process. Companies can leverage the best-estimate assumption setting process that is utilized for MRBs and layer on adjustments for VM-22. Similarly, the process for developing MRB risk margins could be leveraged in development of prudent estimate assumptions that will be used for VM-22.

Modeling

Certain balances that were previously classified as insurance benefit features with reserves following SOP 03-1 guidance require model conversion efforts to move to a fair value model under LDTI. We expect that the previous policy-level models defined in Actuarial Guideline XXXV (AG35) will require significant modeling changes to prepare for VM-22. The use of multiple scenario runs for both reserve calculations will also require significantly more computing and data storage capabilities. Finally, we expect that both of these reserve changes will serve as a catalyst for the rationalization of the operating model of valuation and modeling teams. Previously, the models might be owned by the valuation units, but the changes in the new regime might require the more specialized modeling skills and infrastructure of a centralized modeling unit and the valuation teams will spend more time analyzing the results.

Governance and Documentation

Both LDTI and VM-22 will require insurers to provide more documentation and disclosure information regarding the reserve balances and the assumptions and methodologies used. LDTI requires specific additional tabular and non-tabular disclosure information that will provide users of the financial statements additional context on the MRB reserve calculations. Similarly, VM-22 reserves will be under the scope of the reporting requirements under Valuation Manual (VM-31), which include information on the assumptions and margins, models, sensitivity tests, results of the exclusion tests, and other pertinent information for the block of business in scope. With non-variable annuities coming in scope of PBR, this will also pull them in scope of the governance requirements laid out in Appendix G – Corporate Governance Guidance for PBR (VM-G) of the Valuation Manual. Even though VM-22 is still in exposure draft stages, companies should start thinking about the process and governance involved for them to successfully comply with VM-31 and VM-G requirements. These extensive reporting requirements could be consequential to companies with outdated reporting processes. Companies with a modernized reporting process will be in a better position to make timely decisions and have resources focus more on value-add activities.

Other impacts

Finally, both LDTI and VM-22 will affect the way insurance companies price and manage their business. Both of these new reserve calculations might factor into the pricing and design of the products moving forward. Both of these new reserve calculations will bring additional volatility to the financial results that might require additional coordination with the hedging team. Finally, this change might lead to additional activity for reinsurance. Previously some companies were ceding the redundant reserves inherent in the conservatism of AG35, but this might need to be reconsidered under VM-22. On the other hand, VM-22 and LDTI may introduce additional volatility to both the statutory and GAAP balance sheet, and companies might consider entering into transactions to manage the blocks of business.

Conclusion

Overall, both LDTI and VM-22 will require significant changes to not only companies’ reserve calculations, but also to operations, reporting processes, governance, and strategic decisions. While there is still time before VM-22 is adopted, companies should begin thinking about the future changes and how to prepare by leveraging the areas where LDTI has similar requirements.

The views reflected in this article are the views of the author(s) and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization, and are not necessarily those of the Society of Actuaries, or the newsletter editors.

Ryan D. Laine, FSA, MAAA, CERA, is a senior manager at Ernst & Young. He can be reached at Ryan.Laine@ey.com.

Paul San Valentin, FSA, MAAA, CERA, is a senior manager at Ernst & Young. He can be reached at Paul.SanValentin@ey.com.

Sean Abate, FSA, MAAA, is a senior manager at Ernst & Young. He can be reached at Sean.P.Abate@ey.com.

Angela McShane, FSA, MAAA, CERA, is a senior manager at Ernst & Young. She can be reached at Angela.McShane1@uk.ey.com.

Ben Hanley, FSA, MAAA, is a manager at Ernst & Young. He can be reached at Ben.Hanley@ey.com.