Biosimilars, Part 2: The Coming Wave

By Gregory Warren and Tony Pistilli

Health Watch, September 2023

This article has been edited and updated since its original publication on the Axene Health Partners website.

There is a big wave of changes coming to the pharmacy market. The extent of the impact this wave will bring is not yet fully known, but there are trends we can follow that help predict what this change will look like. We know biosimilar uptake is key to driving savings, but it can take a while to ramp up and become material. Biosimilars bring competition, and there’s going to be a lot of opportunity to drive competition to an extent that we really haven’t seen with previous biosimilars.

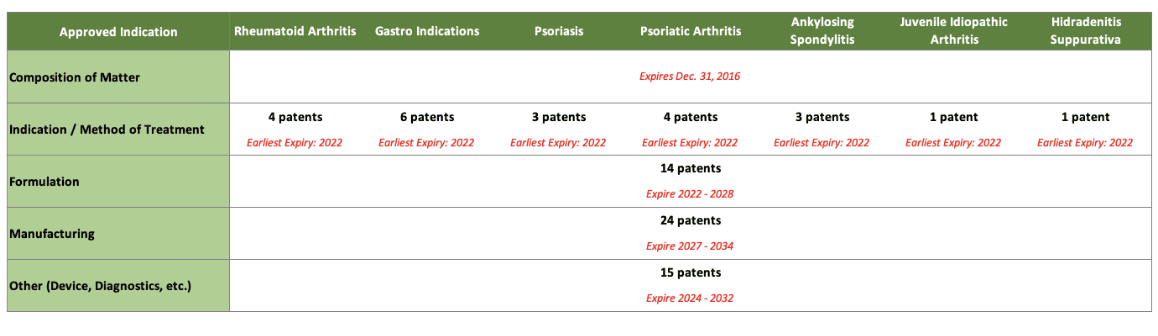

Biosimilars cannot launch until patent claims from the reference product expire or a settlement is reached. Patents can extend the reference product’s exclusivity period and complicate litigation challenging patents. Humira may have the most extensive patent estate of any product (Figure 1).

Figure 1

Broad U.S. Humira Patent Estate

Source: Richard Gonzalez, “AbbVie Long-Term Strategy” (PowerPoint presentation, investor conference call/webcast, Chicago, IL, October 30, 2015). https://investors.abbvie.com/static-files/af79eef2-5901-4b62-9354-982d2d95404e.

Technically, the patent for Humira (adalimumab) itself expired seven years ago. However, later patents filed for over 30 different indications are still in place, as are dozens more patents around the formulation of the product and its manufacturing and other patents related to the administration device, diagnostics, and so on. Humira rolled out citrate-free versions, different dosage forms and different needle sizes. So, so many patents.

There are a lot of reference products with biosimilars in development. The reference product with the highest annual spend is, again, Humira with about $20 billion. There are over a dozen Humira biosimilars at various stages of the development pipeline. Humira is followed by insulin glargine as the reference product with the second highest annual spend at about $2 billion. Insulin glargine has two biosimilars that have launched or been approved. Overall, nearly 30 reference products each accounted for over $1 billion in annual spend in 2019.

It is also interesting to see how the composition of biosimilar developers and manufacturers is changing over time. There have been many more manufacturers launching biosimilars in the last five years than in prior years, and those manufacturers are much more regionally diverse than they used to be. While most biosimilar manufacturers were based in the European Union, the United States or India, about 50 percent of the global biosimilar pipeline had corporate headquarters in South Korea, China, other Asia-Pacific nations or Latin America.

Conclusion

There is a big wave of biosimilars coming. They are expected to bring a significant increase in competition to the markets for biologics and potentially help drive better affordability as a result. But it is not clear yet what their full effect will be. The “big event” occurring in 2023 is the launch of Humira biosimilars, which will begin to accelerate that effect and our understanding of it.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Gregory Warren, FSA, MAAA, FCA, is a partner and consulting actuary at Axene Health Partners. Greg can be reached at greg.warren@axenehp.com.

Tony Pistilli, FSA, MAAA, CERA, is a consulting actuary at Axene Health Partners. Tony can be reached at tony.pistilli@axenehp.com.