Biosimilars, Part 1: A Brief Introduction

By Gregory Warren and Tony Pistilli

Health Watch, September 2023

This article has been edited and updated since its original publication on the Axene Health Partners website.

The coming market introduction of several significant biosimilars is predicted to bring a wave of change to the pharmacy benefits status quo. As health care consultants, we have been watching the swell develop and have put together this primer to help educate and prepare the health care system for the coming changes and opportunities. This is the first in a series dedicated to biosimilars aimed at providing background and an overview of biologics and biosimilars. These market changes are poised to revolutionize the pharmacy benefits industry by making medicines more accessible and affordable for all.

Introduction to Biologics

Most of us are familiar with molecular drugs. These comprise most of the medications we commonly use and see. They are designed to interact with and target specific molecules in the body to treat illnesses. Examples of molecular drugs include antibiotics and antihistamines. Biological drugs, on the other hand, are drugs derived from living organisms, such as bacteria and viruses. They are designed to interact with specific proteins or cells in the body to treat illnesses. Examples of biological drugs include monoclonal antibodies and interferon. They are used to treat a wide range of diseases, including cancer, autoimmune diseases and certain infections. Biologics work by targeting specific parts of the body’s immune system to stop a disease from progressing.

Biologics can help treat and manage a variety of medical conditions and diseases, such as asthma, arthritis and cancer. Biologics can help reduce the amount of medication needed since they are often more effective than traditional medications. Benefits of using biologics include improved patient outcomes and reduction in the risk of serious side effects since they are made up of natural substances that work with your body’s system. Biologics can also help reduce the number of doctor visits needed and take strain off the health care delivery system.

Introduction to Biosimilars

To continue the comparison to the molecular drug market with which we are familiar, biosimilars might be thought of as the “generic” counterpart to biologics. But this is not an accurate model as there are some notable differences. Generic molecular drugs are made from the same active ingredients as brand-name drugs. They are regulated by the Food and Drug Administration (FDA) and must meet the same standards of quality, safety and effectiveness as the brand-name drug. Biosimilars, on the other hand, are made from living organisms, such as bacteria or yeast. They are designed to be similar to a brand-name drug but may not be exactly the same.

Because of the complexity of making a biosimilar, the FDA has special regulations to ensure that they meet quality, safety and effectiveness standards. Biosimilars may be less expensive than the original medicine and can be used to treat the same medical condition. Additionally, they can be developed faster and more easily than the original biologic drug.

Marketplace Conditions

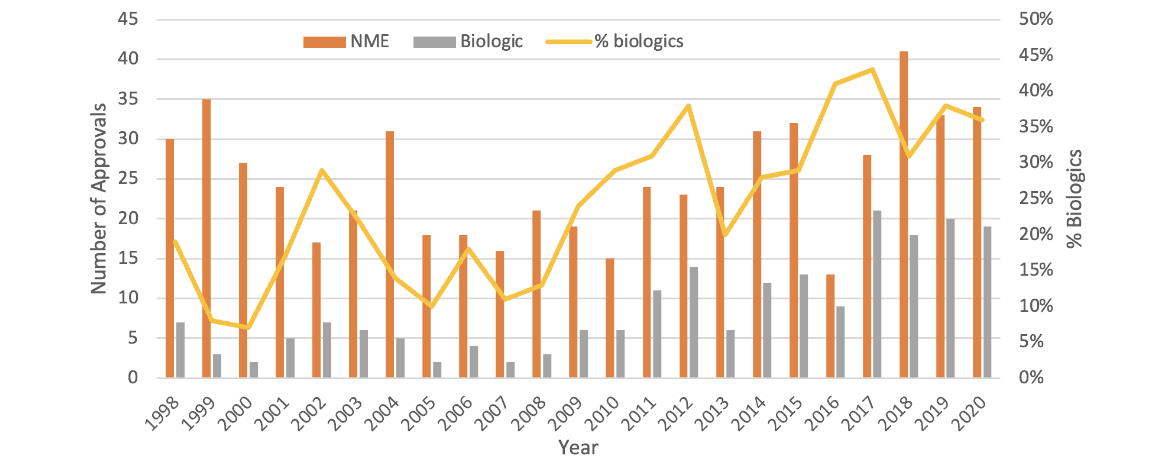

We have seen biologics continue to be an increasing proportion of new drug launches year after year, such that now many plan sponsors see specialty drugs account for about half their prescription drug costs (Figure 1).

Figure 1

FDA Approvals of Drugs and Biologics in 2020

Source: Data from John Hodgson, “Refreshing the Biologic Pipeline,” Nature Biotechnology 39 (2021): 135–43, https://www.nature.com/articles/s41587-021-00814-w.

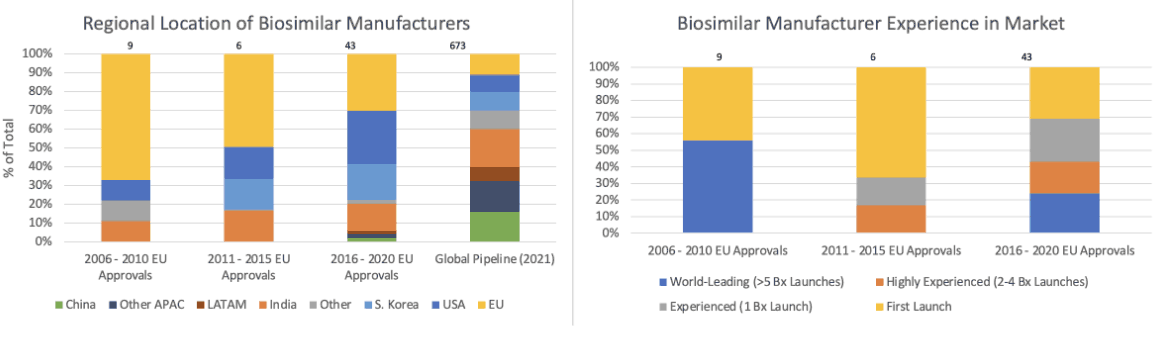

There is hope that an accelerated arrival of biosimilars will bring cost relief. A number of biosimilar drugs have either launched, been approved or are in an early phase of development. And there’s been a real diversification of biosimilar manufacturers preparing to bring biosimilars to market (Figure 2).

Figure 2

Composition of Biosimilar Manufacturers

Source: Data from Per Troein, Max Newton, Kirstie Scott and Chris Mulligan, “The Impact of Biosimilar Competition in Europe,” IQVIA, December 2021, https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/the-impact-of-biosimilar-competition-in-europe-2021.pdf.

Biosimilars cannot launch until either patent claims from the reference product expire or settlement is reached. New patent filings can extend reference product exclusivity periods and complicate litigation. This is where we start to see patents piling up on each other.

Interchangeability and Exclusivity

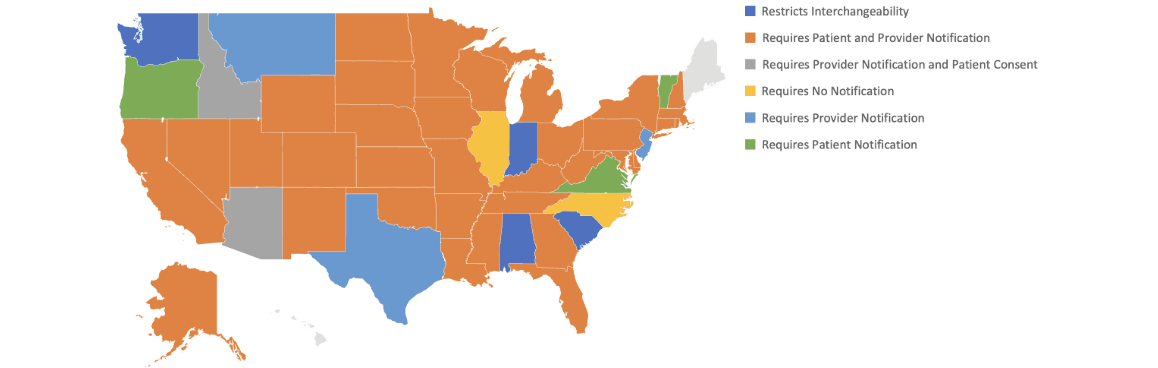

Only biosimilar drugs approved for interchangeability can be substituted for the reference drug by a pharmacist at the counter. Any other change would require a revised or new prescription from the prescribing physician. Interchangeability is of high importance, and the process can vary by state (Figure 3).

Figure 3

Interchangeability Laws by State as of January 1, 2023

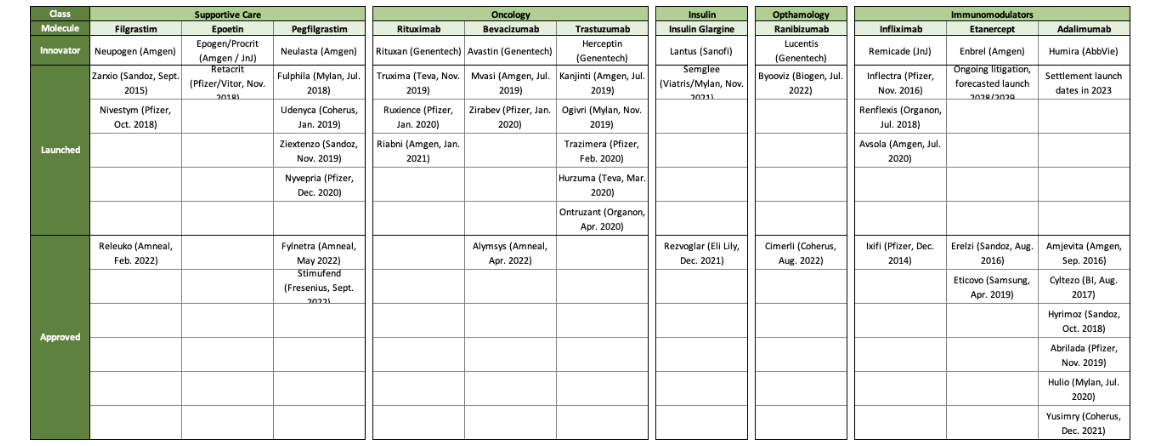

The exclusivity process for biosimilars allows the first biosimilar approved by the FDA for interchangeability for a specific dose and strength combination to have one year of exclusivity as the only biosimilar at that strength and dose to be granted interchangeability. Figure 4 shows nine biologics that currently have biosimilars, but only two have interchangeable biosimilars.

Figure 4

Current Biologics with Biosimilars

Summary

Biologics have been a growing sector in the health care system and have become an important part of modern medicine. They are changing medicine by providing new treatments that are made from living organisms or natural materials. They provide treatments that are often more effective and have fewer side effects than traditional medicines. Now biosimilars are bringing competition to the biologic market, which promises increased affordability and access for patients who need them.

Now that we have some background on what biologics and biosimilars are, how they work and some of the key points related to their use and distribution, part 2 of this article (also in this issue) will look at the financial impacts of the coming wave of biosimilars.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Gregory Warren, FSA, MAAA, FCA, is a partner and consulting actuary at Axene Health Partners. Greg can be reached at greg.warren@axenehp.com.

Tony Pistilli, FSA, MAAA, CERA, is a consulting actuary at Axene Health Partners. Tony can be reached at tony.pistilli@axenehp.com.