Biosimilars, Part 6: Maximizing Adoption

By Gregory Warren and Tony Pistilli

Health Watch, January 2024

This article has been edited and updated since its original publication on the Axene Health Partners website.

To achieve savings benefits from the coming wave of biosimilars, these products must be adopted by prescribers, members and payers (through their formulary strategies). While previous biosimilar launches have produced some initial savings by driving down the price of the reference product without realizing significant biosimilar utilization, the most competitive biosimilar markets have robust utilization. Without the adoption by all three of the following groups, the use of biosimilars will be suboptimal, as will their realized savings.

- Prescriber adoption: Persuade clinicians to prescribe biosimilars to new patients and move existing patients to biosimilars

- Member adoption: Address consumers’ concern about efficacy/safety and encourage members to seek out biosimilars

- Payer adoption: Employ various strategies to steer usage toward biosimilars with formulary design

Driving Prescriber Adoption

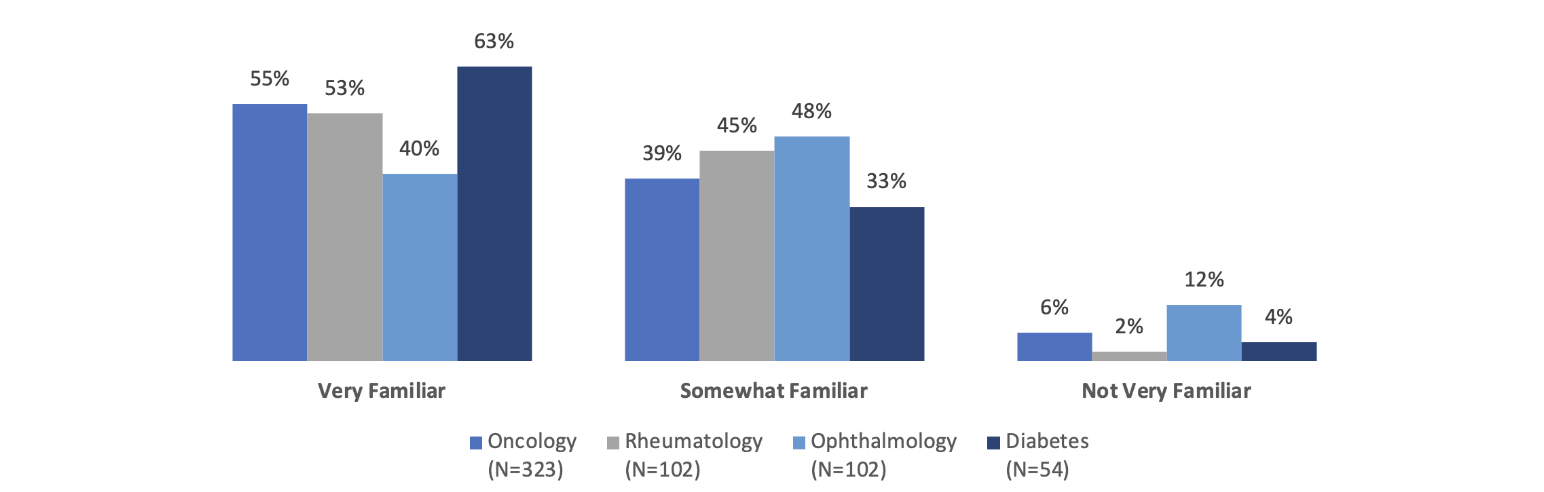

What does it take for clinicians to be comfortable prescribing biosimilars? First, they must be familiar with these products. Although many prescribers seem to be familiar with biosimilars, the level of familiarity varies somewhat by specialty. Across the specialties of oncology, rheumatology, ophthalmology and diabetes care, around 90 percent or more of the prescribers surveyed in one 2020–21 study were either very familiar or somewhat familiar with biosimilars (Figure 1).

Figure 1

Prescriber Familiarity with Biosimilars by Specialty

Source: Data from https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-2022-biosimilars-report.pdf.

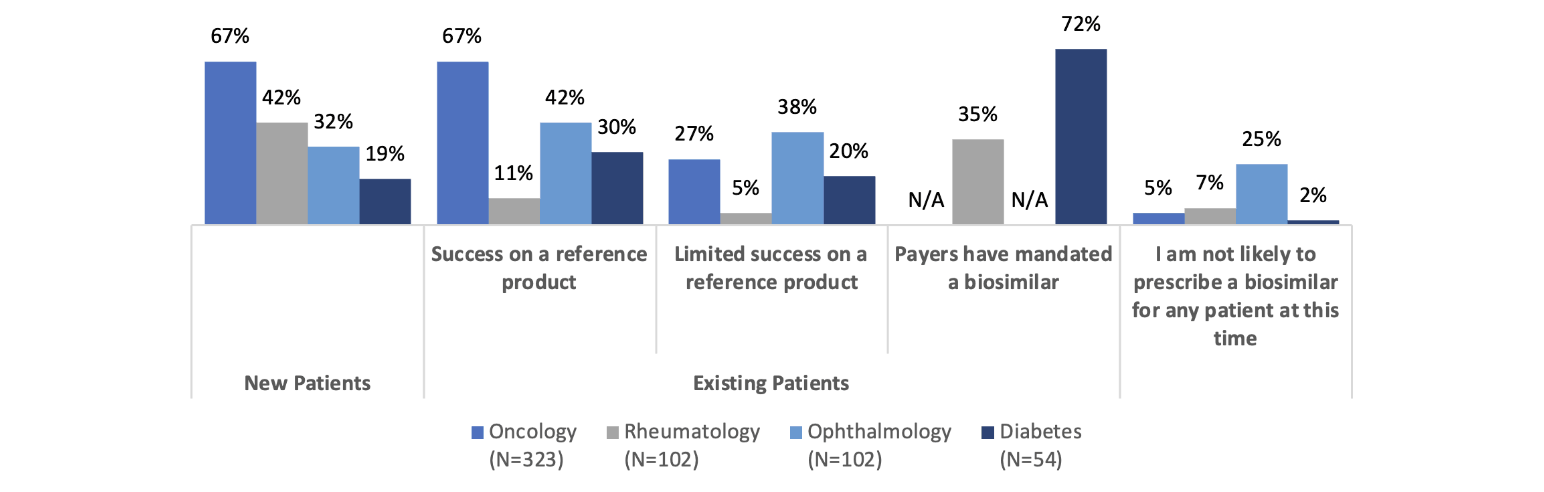

So, most clinicians are at least somewhat familiar with biosimilars, but what about their prescribing patterns? According to the same 2020–21 study, these also vary by specialty (Figure 2).

Figure 2

Prescribing Patterns for Biosimilars by Specialty

Source: Data from https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-2022-biosimilars-report.pdf.

In oncology, we see a greater likelihood to prescribe biosimilars for new patients and existing patients who are having success on a reference product. Only 27 percent of oncologists are likely to prescribe a biosimilar for patients who have limited success on a reference product. These data points seem consistent and are presumably because the oncologists recognize the biosimilar as acting therapeutically similarly to the reference product. Some have suggested that oncologists are more familiar with rapid innovation because of the historically rapid development of new chemotherapy products. In addition, oncology pharmacy purchasing decisions may be made by a facility’s formulary review board, whereas in an office setting, the drug will be obtained from a retail pharmacy where the payer/PBM’s formulary will apply. Also, oncology patient panels can turn over rapidly due to the nature of the disease being treated.

The familiarity with and willingness to prescribe biosimilars in rheumatology, ophthalmology and diabetes care seems to be lower. That said, 72 percent of prescribers are likely to prescribe a biosimilar to treat diabetes if it is mandated by the payer, which shows a possible path toward accelerating biosimilar uptake. Of course, payer mandates are not always viewed favorably by patients and prescribers and need to be considered thoroughly from the clinical and patient disruption perspectives before being applied.

Rheumatologists are much less likely to prescribe biosimilars for existing patients who are having success on a reference product than they are to prescribe a biosimilar to new patients. Does this represent the hesitance to “change what’s working” for rheumatology patients? Let’s dig a little deeper into rheumatologists’ perspectives on biosimilars.

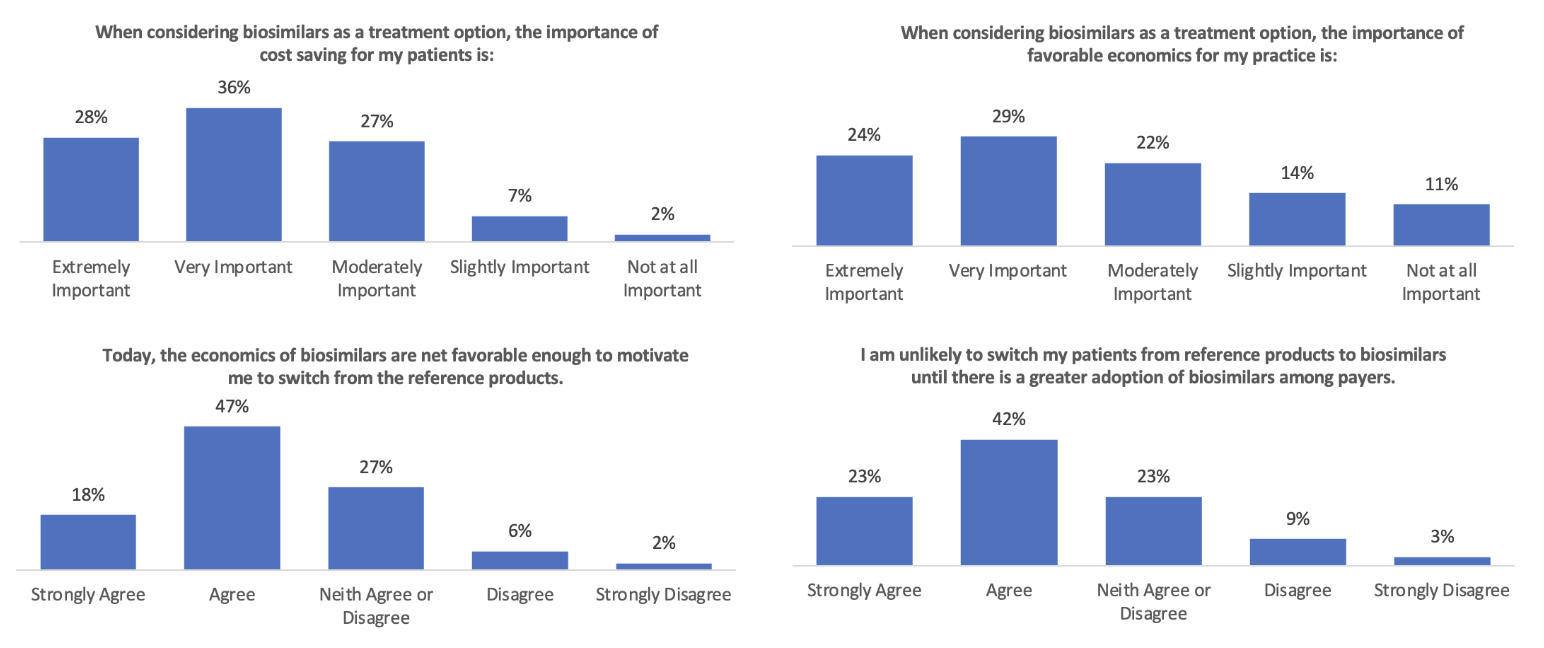

The survey results in Figure 3 show that while rheumatologists thought the economics of biosimilars were important, they did not think they were favorable enough (in 2022) to motivate them to “switch from the reference products.” It will be interesting to see if that changes in 2024 with many more Humira biosimilars available. That increase in competition will presumably drive net prices down.

Figure 3

Rheumatologists’ Views on the Economics of Switching to Biosimilars

Source: Data from https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-2022-biosimilars-report.pdf.

Whether that occurs primarily through rebates (where the economic impact on patients is less but can produce significant revenue for providers that are 340[b] qualified entities) or through significant declines in list prices (where patients are more likely to benefit significantly) could make a big difference. Whether or not Humira prices follow suit may also affect whether rheumatology prescribers feel the cost savings of biosimilars are enough to motivate a change from reference products.

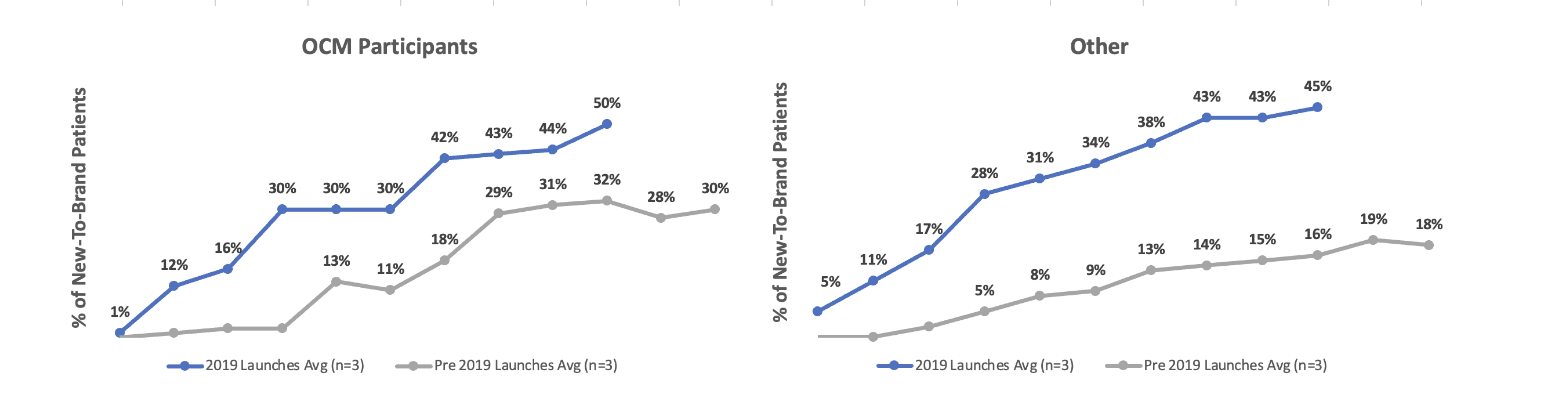

It is also not clear whether “the economics” refers to those for the patient or those for the prescriber. If payers want to motivate biosimilar uptake, they will need to consider prescriber economics and how to ensure they are aligned with the rest of the biosimilar strategy. For example, in one study on the use of biosimilars inside and outside the Centers for Medicare and Medicaid Services (CMS) Oncology Care Model (OCM), it appears that financial incentives for oncologists do increase their likelihood of prescribing biosimilars (Figure 4).

Figure 4

Pre- and Post-Launch Biosimilar Adoptions Related to Provider Financial Incentives and Education

Source: Data from “IQVIA Analysis Highlights Role of Reimbursement Policy.”

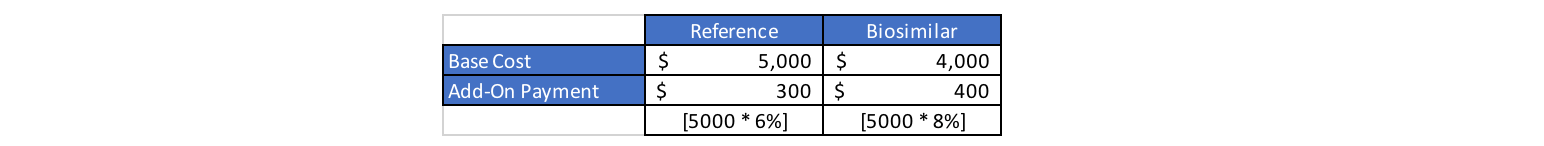

Medicare Part B drugs (administered and paid through the medical benefit instead of through the pharmacy benefit) are reimbursed at 106 percent of average sales price (ASP). The 6 percent “add-on” payment is meant to cover providers’ acquisition, storage and dispensing costs. Under the Inflation Reduction Act (IRA), biosimilars will be reimbursed at 108 percent of the reference drug’s ASP (Figure 5).

Figure 5

Calculations for Medicare Reimbursement of Biosimilars and Reference Drugs

This increases the current reimbursement for biosimilars administered and paid through Medicare Part B by at least an additional 2 percent—and the additional margin amount if providers are able to obtain the biosimilars at a lower cost than they can obtain the reference biologic. The IRA is creating a financial incentive for providers to prescribe and administer biosimilars since the margin for those who administer biosimilars would be at least 2 percent more than it would be for administration of the reference drug.

Driving Patient Adoption

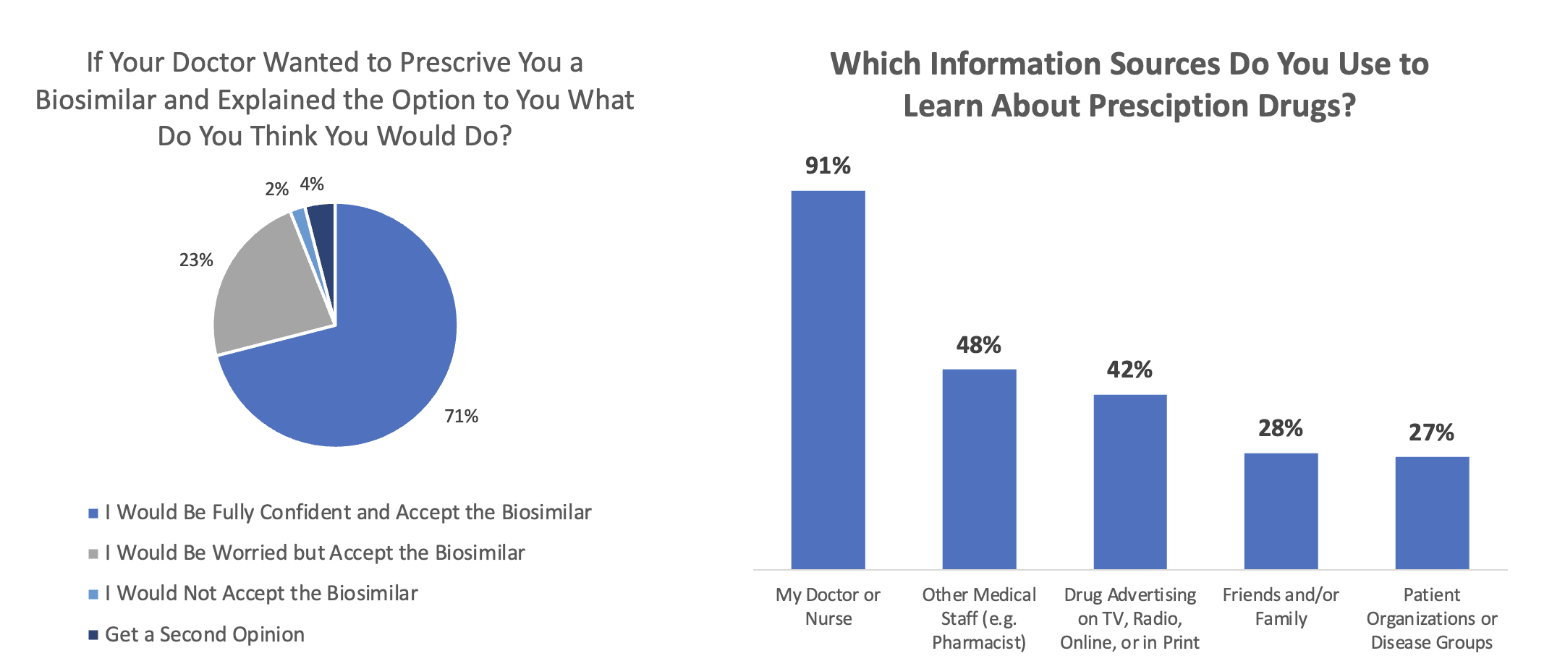

Patients look to their physicians for guidance in moving to biosimilars. A survey by NORC at the University of Chicago found that patients are highly likely to follow their doctor’s recommendations regarding the prescribing of biosimilars (Figure 6). Ninety-four percent of respondents said they would switch to a biosimilar even if they were “worried” about it (23%).

Figure 6

Sources of Patient Acceptance and Knowledge of Biosimilars

Source: Data from https://www.norc.org/PDFs/Biosimilars/20210405_AV%20-%20NORC%20Biosimilars%20Final%20Report.pdf.

Driving Payer Adoption

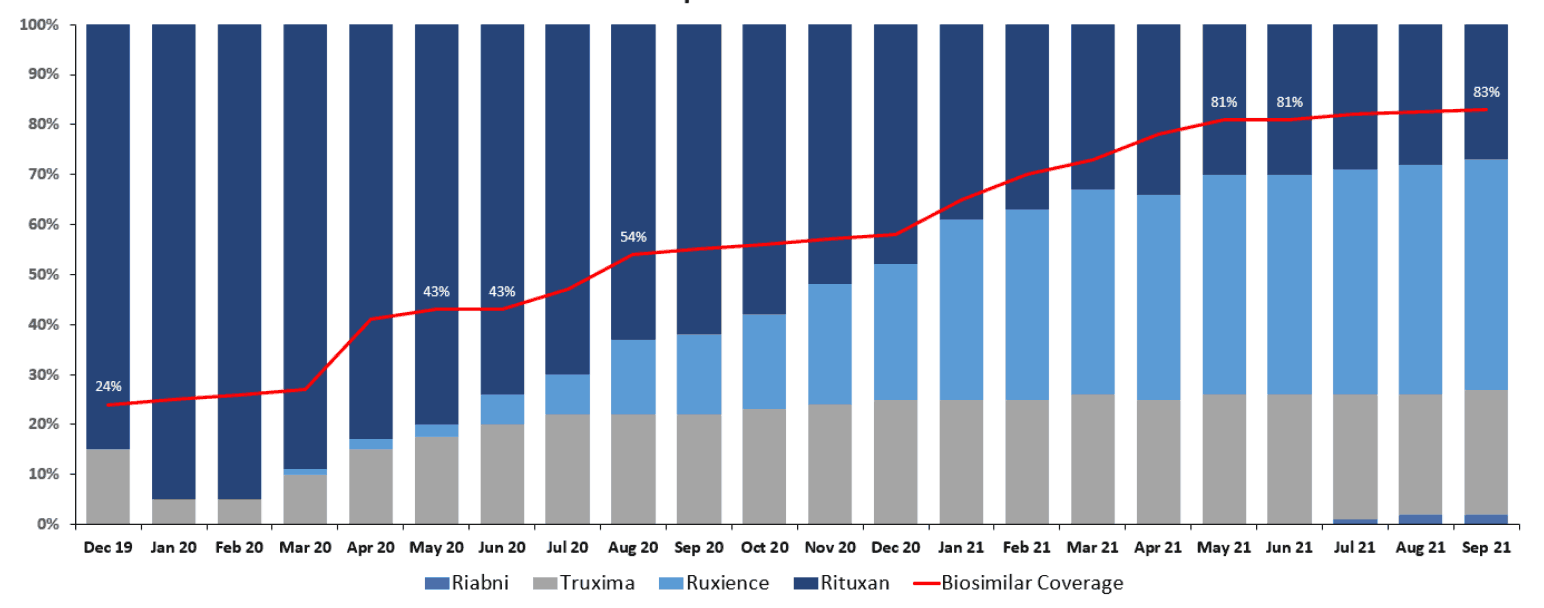

Even if prescribers and patients are motivated and incentivized to utilize biosimilars, the payer has to enable that through placing the biosimilars at parity or in preferred positions to the reference drug on their formularies. For example, Figure 7 shows the correlation between the adoption of Rituxan biosimilars and the percentage of plans that cover those biosimilars at parity or better.

Figure 7

Rituxan Biosimilars Adoption Versus Percentage of Covered or Better Status

Source: Managed Markets Insight & Technology, LLC (MMIT) Analytics, https://www.mmitnetwork.com/ (accessed November 2021) and IQVIA National Sales Perspective (NSP) SMART data, https://www.iqvia.com/ (accessed October 2021).

It is uncanny how closely the red line (percentage of plans placing a biosimilar at parity or preferred to a reference drug) corresponds to biosimilar adoption and the related decline in reference drug market share.

Payers have a number of tools they use to drive biosimilar adoption:

- Indication-based formulary: manage formulary strategy for each of a reference drug’s indications

- Step therapy: require members to “step through” other drugs before providing preferred coverage

- Preferred/nonpreferred tiers: cover reference product on a nonpreferred tier that is still “covered” on the formulary but with less advantaged cost sharing than the preferred tier

Indication-based formularies have not been highly prevalent, but with Humira being approved in nine indications, more of these formularies may emerge. You may see other biologic drugs preferred in different indications where there is more competition, while still seeing Humira preferred where it is needed for a more unique indication.

Summary

The year 2024 will be fascinating. Biosimilar uptake is the key to whether savings materialize for payers and patients. Ultimately, prescribers became more familiar with the Humira biosimilars throughout 2023. Payer formulary and clinical program strategies will drive utilization. Will they drive biosimilar uptake? Time will tell.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Gregory Warren, FSA, MAAA, FCA, is a partner and consulting actuary at Axene Health Partners. Greg can be reached at greg.warren@axenehp.com.

Tony Pistilli, FSA, MAAA, FCA, CERA, CPC, is a consulting actuary at Axene Health Partners. Tony can be reached at tony.pistilli@axenehp.com.