The Evolution and Future of Voluntary Benefits in the Health Insurance Space

By Josh Hammerquist and David Dillon

Health Watch, September 2025

One of the major factors a person looks at when considering employment is the benefits package. Voluntary benefits supplement major medical coverage by helping employees manage health care expenses not regulated by federal or state insurance mandates.

Common voluntary benefit products include:

- Accident insurance. Provides financial support for costs related to accidental injuries. These policies cover expenses such as emergency room visits, medical transportation or rehabilitation therapies that may not be fully covered by primary insurance. Additionally, they offer cash benefits to help with nonmedical expenses like childcare or lost income during recovery.

- Critical illness insurance. Offers lump-sum payments when diagnosed with severe medical conditions like cancer, heart attack or stroke. These payments can be used to cover deductibles; medical treatments not covered by primary insurance; or nonmedical expenses such as mortgage payments, utilities or travel for specialized care.

- Hospital indemnity insurance. Provides fixed cash benefits for hospital stays, including inpatient care, surgeries and sometimes outpatient treatments. These payments help offset the rising costs of hospitalization, including deductibles, copays and ancillary expenses, offering employees peace of mind during extended or unexpected hospitalizations.

- Dental and vision insurance. Covers routine care such as cleanings, fillings, eye exams and prescription eyewear. While dental and vision services are often excluded from major health plans, their affordability, high utilization and focus on preventive care make them popular additions to voluntary benefits packages.

Voluntary benefits have evolved into a critical component of employee benefits strategies, offering supplemental coverage that can bridge gaps in primary health insurance or offer affordable alternatives. As the health care landscape has changed over time with rising medical costs and laws such as the Affordable Care Act (ACA), voluntary benefits are playing an increasingly important role in society. This article explores their development, current role and future potential.

Initialization and Development of the Voluntary Benefits Market

Voluntary benefits first emerged in the mid-20th century, initially offering accident, life and disability insurance. These employee-paid options gained popularity due to their affordability and accessibility. From the 1980s to the 2000s, before the implementation of the ACA, the voluntary benefits market grew rapidly, driven by several key factors.

Rising Health Care Costs

The late 1900s to early 2000s saw escalating health care expenses that outpaced income growth, impacting insurance companies, employers and employees:

-

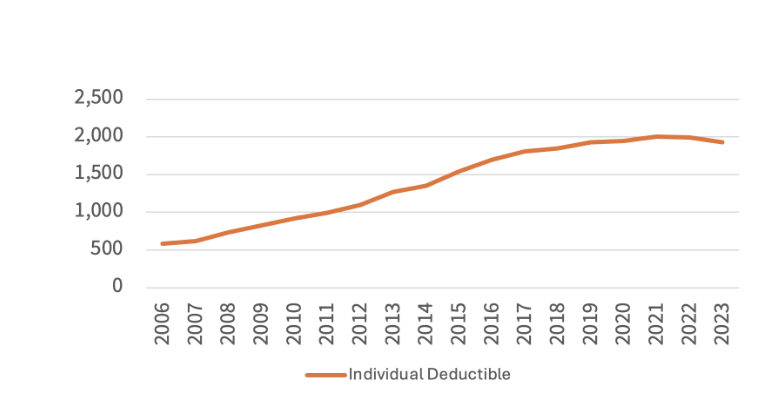

Cost shifting to employees. To manage rising health care costs, employers raised deductibles and copays, shifting more financial responsibility to employees. This is illustrated in Figure 1, which is based on data from the Kaiser Family Foundation’s deductible trend indicators and employer-sponsored insurance statistics.[1]

This increased demand for supplemental products like hospital indemnity, dental and vision insurance to cover out-of-pocket gaps. Insurers responded with a broader range of voluntary benefits—such as critical illness insurance—to help address serious medical conditions. These plans, adopted by employers with minimal added cost, gave employees access to expanded coverage beyond core health plans.

Figure 1

Average Annual Deductible in Employer-Based Health Insurance

- Cafeteria-style benefits plans. To manage expenses, employers began offering voluntary benefits in a cafeteria-style model, enabling employees to select only the benefits that matched their personal healthcare needs. This customization helped employees optimize their coverage while allowing employers to control costs.

- Demand for affordable supplementary plans. Employees sought other more affordable supplementary healthcare plans to provide financial protection. Accident insurance, for example, became a popular option, covering costs related to unexpected and sometimes very serious injuries.

Personalization and Consumer Choice

As knowledge of the health care industry grew, so did consumers’ desire to play a more active role in managing their medical care. Shifting cultural dynamics and increasingly diverse workplaces encouraged consumers to seek coverage tailored to their unique lifestyles, health needs and financial preferences. This ability to personalize benefits made voluntary plans an attractive option for both employees and employers.

Technological Advancements

The rise of online enrollment platforms, payroll deduction systems and digital distribution networks made voluntary benefits easier to access and integrate into employer-sponsored plans.

Regulatory Changes

Several regulatory changes during this period also influenced the voluntary benefits market. For example, the Health Insurance Portability and Accountability Act (HIPAA) of 1996 introduced new standards for health insurance coverage, including provisions for preexisting conditions and portability, but didn’t eliminate all gaps in coverage.

The economic and societal changes that occurred from the 1980s to the 2000s solidified voluntary benefits as essential tools for managing health care costs and providing employees with financial security. These developments also laid the foundation for the ACA, which emphasized the importance of offering universal benefit plans to all consumers and protecting them from rising health care costs.

The ACA’s Impact on the Voluntary Market

The Affordable Care Act, enacted in 2010, brought major reforms to the U.S. health care system—mandating essential health benefits (EHBs), prohibiting exclusions for preexisting conditions and requiring minimum essential coverage. Voluntary benefit plans, however, were largely exempt from these rules and reclassified as excepted benefits, as they were not required to meet EHB or affordability standards.

While the ACA reduced catastrophic gaps, it also led to rising deductibles and narrower provider networks, increasing out-of-pocket costs for employees. This sustained demand for voluntary benefits, which helped cover financial shortfalls in primary coverage. Though not directly targeted by the ACA, voluntary benefits gained new relevance as employers and insurers adapted their offerings to complement ACA-compliant plans rather than replace them.

Voluntary Benefit Market Post-ACA Era

As the ACA reshaped the health care landscape, it created both new opportunities and new challenges to the voluntary benefits market.

Opportunities

- Growth in supplemental coverage offerings. The ACA tightened restrictions on plans that contained required benefits, insurers shifted their focus to excepted benefit products. This flexibility allowed insurance companies to design and market a wider range of voluntary benefits to employers.

- Filling gaps in HDHPs and everyday expenses. As high-deductible health plans (HDHPs) become more common, voluntary benefits serve as a financial cushion. Products like hospital indemnity, accident and critical illness coverage provide cash flow during medical events. Additionally, many plans help cover nonmedical but essential costs such as childcare, transportation and lost income—needs that traditional plans overlook.

- Personalized protection for diverse needs. ACA plan designs in their current form can result in different levels of exposure to financial risk for different employees. Voluntary benefits can help some employees with higher financial exposure mitigate those risks.

- Technology-enhanced solutions. Post-ACA digital platforms have improved enrollment, education and benefit selection. Employees are now better able to evaluate how voluntary products integrate with their primary insurance and meet their personal risk profiles.

Challenges

- Perceived redundancy and awareness gaps. Despite rising out-of-pocket costs, some employees question the need for voluntary benefits due to the ACA’s comprehensive baseline coverage. Many are unaware of how voluntary benefits complement their primary plans.

- Operational complexity for insurers. While exempt from many ACA rules, voluntary plans must navigate a complex patchwork of federal and state regulations. Insurers face added administrative burdens, from compliance reviews to product customization and onboarding.

- Tax implications. Cash-based benefits can raise unexpected tax burdens for employers and employees. Misunderstandings about reporting can result in compliance risks or back-end tax liabilities.

- Affordability for low-income workers. Even modest premiums can be a barrier. Many employees prioritize housing, food and childcare over optional coverage. In 2023, 25% of insured adults delayed care due to cost.

- Disconnect in coverage relevance. Employees often need help with routine health care costs—doctor visits, urgent care, prescriptions—more than large lump-sum benefits. This mismatch can lower perceived value and reduce participation. If someone can’t afford a $3,000 deductible or skips care due to cost, then a $25,000 benefit for a heart attack may not address their most pressing financial concerns. Instead, these employees may benefit more from benefits that help manage moderate, recurring health costs or provide immediate financial relief.

Future Directions: Aligning Voluntary Benefits with Health Care Trends

Interest in supplemental insurance continues to grow. A Gallagher study found 67% of employers are exploring ways to expand these offerings, while 63% of employees would consider changing jobs for better benefits.[2] Broadly appealing plans have been linked to higher retention and productivity.

The COVID-19 pandemic, inflation and legislation like the No Surprises Act have reshaped how employees view benefits, reinforcing the need for voluntary plans that fill gaps in coverage and financial protection. However, complexity remains a barrier. A Voya study found that while 70% of employees value voluntary benefits, only 49% actually enroll—often due to confusion or perceived overlap with existing coverage.[3]

There’s also a disconnect between what employers think employees want and what employees actually find helpful. While many employers prioritize mental health support, just 35% of employers rate those resources as effective.[4]

To stay relevant, voluntary benefits must be personalized, easy to understand and seamlessly integrated into the broader health care experience.

Key strategies include:

- Product innovation. Expand voluntary offerings to reflect evolving employee needs—such as mental health support, wellness incentives and preventive care. Customizable plans that align with personal priorities, including flexible payment options, improve satisfaction and retention, making them a valuable part of any benefits package.

- Leverage in the job pitch and during the onboarding process. Employers should highlight comprehensive benefits packages, as employees increasingly value them when choosing jobs. Offering a wide range of benefits shows care for employees’ well-being beyond the workplace. To support new hires, employers can provide resources to explain available benefits, help personalize packages and guide employees through the enrollment process.

- Simplification. Develop user-friendly, automated systems to simplify benefits enrollment and administration. According to a 2025 article, bundling voluntary benefits with core insurance plans and integrating claims data are emerging strategies to enhance employee value; streamline claims; and support retention, satisfaction and overall well-being.[5] As insurance options grow more complex, integrating major medical and voluntary benefits into a single onboarding process can reduce confusion, boost adoption and highlight how these offerings work together to support employee health.

- Enhanced customer service. Investing in well-trained, human-centric support teams ensures a positive experience for employees as they navigate their benefits, ask questions and file claims. In an increasingly digital world, access to knowledgeable representatives can set insurers apart and boost engagement.

- Advertising and continued education. Create clear materials or tools that highlight how voluntary benefits complement major medical plans. The growing number of supplemental insurance products makes it difficult for employees to compare and understand their options. Insurers and employers must prioritize education initiatives to redefine voluntary benefits from “optional” to essential coverage.

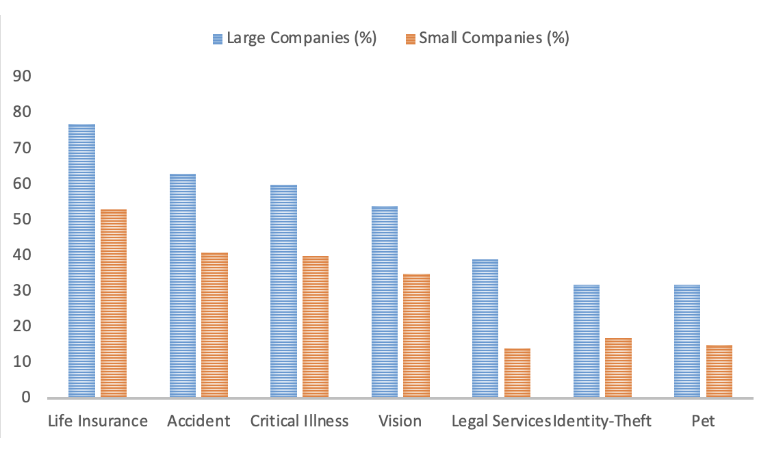

- Market expansion. Expanding voluntary benefits across multiple states and among different organizations increases accessibility and broadens the potential customer base. Since excepted benefits face fewer regulatory hurdles than major medical plans, insurers can leverage this flexibility to reach underserved populations and reduce health care disparities through public-private partnerships. A survey published in a 2021 International Foundation of Employee Benefit Plans article showed that currently, larger companies have a leg up on smaller companies when it comes to offering a wider range of these benefits, as illustrated in Figure 2.[6]

Figure 2

Voluntary Benefits Offered by Company Size

- Improvements in data collection. As technology evolves, employers and insurers can use machine learning and analytics to tailor benefits to employee demographics and preferences. Analyzing large datasets improves pricing, participation and plan design. For example, accident insurance may appeal to high-risk jobs, while hospital indemnity is more relevant for health care workers. Benchmarking and employee surveys help close communication gaps, ensuring offerings match real needs and boost engagement.

- Emphasizing cost saving. Companies need to educate employees on how voluntary benefits can offset rising out-of-pocket costs and provide financial protection against unexpected medical expenses. Framing these plans as tools for financial stability—both for emergencies and everyday needs—can boost enrollment and drive long-term value.

Conclusion

Voluntary benefits have become an essential component of today’s health care landscape, providing employees with financial security and personalized coverage while helping employers attract and retain talent. The flexibility of excepted benefits has played a key role in this growth, allowing insurers to design affordable, customizable solutions that complement major medical plans.

To remain relevant in a rapidly evolving health care system, insurers and employers must continue prioritizing innovation, education and seamless integration with primary health coverage. By enhancing accessibility, streamlining enrollment and expanding offerings to meet diverse workforce needs, voluntary benefits will continue to serve as a critical tool for financial protection and employee well-being.

Looking Ahead

As health care policy, workplace dynamics and employee expectations continue to evolve, voluntary benefits will play an increasingly strategic role in shaping total rewards. Future success will depend on how effectively insurers and employers adapt—by embracing data-driven design, investing in employee education and aligning offerings with the financial and wellness priorities of a modern, diverse workforce.

This article is provided for informational and educational purposes only. Neither the Society of Actuaries nor the respective authors’ employers make any endorsement, representation or guarantee with regard to any content, and disclaim any liability in connection with the use or misuse of any information provided herein. This article should not be construed as professional or financial advice. Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Josh Hammerquist, FSA, MAAA, is a vice president and principal at Lewis & Ellis. Josh can be reached at jhammerquist@lewisellis.com.

David Dillon, FSA, FCA, MAAA, is a senior vice president and principal at Lewis & Ellis and President-Elect and Vice Chair for the SOA. Dave can be reached at ddillon@lewisellis.com.

Endnotes

[1] Matthew Rae, Nirmita Panchal and Gary Claxton, “Snapshots: The Prevalence and Cost of Deductibles in Employer-Sponsored Insurance,” KFF, November 2, 2012, https://www.kff.org/health-costs/issue-brief/snapshots-the-prevalence-and-cost-of-deductibles-in-employer-sponsored-insurance/;

Kaiser Family Foundation, “Average Annual Deductible per Enrolled Employee in Employer-Based Health Insurance for Single and Family Coverage,” KFF, n.d., https://www.kff.org/other/state-indicator/average-annual-deductible-per-enrolled-employee-in-employer-based-health-insurance-for-single-and-family-coverage/.

[2] Arthur J. Gallagher & Co., “2024 Voluntary Benefits Benchmarking,” Gallagher, 2024, https://www.ajg.com/-/media/files/gallagher/us/campaigns/2024/2024-voluntary-benefits-benchmarking.pdf.

[3] Voya Financial, “Almost three-quarters of benefit-eligible Americans are more likely to work for an employer offering voluntary benefits” [press release], Voya, February 10, 2022, https://www.voya.com/news/2022/02/almost-three-quarters-benefit-eligible-americans-are-more-likely-to-work-employer.

[4] Society for Human Resource Management (SHRM), “2023–2024 State of the Workplace Report,” SHRM, 2024, https://www.shrm.org/content/dam/en/shrm/research/2023-2024-State-of-the-Workplace-Report.pdf.

[5] Dawn Kawamoto, “5 Key Voluntary Benefits to Watch in 2025,” HR Executive, August 19, 2024, https://hrexecutive.com/5-key-voluntary-benefits-to-watch-in-2025/.

[6] Justin Held, “9 in 10 Employers Offer Voluntary Benefits: Here Are the Most Common,” International Foundation of Employee Benefit Plans, October 11, 2021, https://blog.ifebp.org/voluntary-benefits/.