Interest Rates and Sumo

By Mary Pat Campbell

International News, July 2022

Back on March 16, 2022, the Federal Reserve’s Open Market Committee released a statement that they were raising the federal funds rate from the then target of 0 to 25 basis points up to the range of 25 to 50 bps. The vote of the committee was almost unanimous. One committee member, James Bullard, did not go along with the rest—he desired a 50-basis point increase.

I am writing this piece at the end of April 2022, so by the time this piece is published there may have been additional increases to the federal funds rate. It has been quite the year so far, hasn’t it? You would think after two event-packed years we might get a respite, but not as of yet. What with economic events, business deals, wars and rumors of wars, and so forth, one may be peering at the street corner, looking for the proverbial prophet carrying a sign proclaiming “THE END IS NIGH!”

But let us step back from the brink for a moment. If this article has been published, and if you are reading it, clearly the world has yet to end. We have a few moments to consider other possibilities.

Being a life actuary who keeps tabs on General Account investments of the U.S. life-annuity industry, it has been a grinding decade in which portfolio rates have continued to fall post-financial crisis of 2008–2009. For many years, life insurers had been hoping that rates would finally rise in a sustained way, and while we have seen some interest rate increases since 2016, the key rates that drive life insurer portfolios had been struggling to increase.

For life-annuity lines of business, we tend to look at longer-term Treasury rates as drivers of portfolio rates. The 10-year Treasury rate in particular is key, as we have often found insurer bond portfolios have averaged a maturity of about 10 years. While the 10-year rate had come up some in recent years, even before the pandemic we had seen it start decreasing and there had been some yield curve inversions in which the 10-year rate had gone lower than the 2-year rate. Then, when the pandemic hit in 2020, the 10-year rate plummeted.

Years before this, on the Actuarial Outpost (which no longer exists), a group of us keeping track of interest rate trends had noticed that the Bank of Japan was now having nominal interest rates go negative! The European Central Bank had negative interest rates as well, starting in 2014. Japan followed in 2016.

The United States did not follow this path, though real (not nominal) interest rates have been negative. Various factors prevent the Federal Reserve from declaring nominal negative interest rates, both legal and practical.

In figure 1, you can see 10-year yields for U.S. and Japanese government bonds, using the Federal Reserve Bank of St. Louis’s resource called FRED. If you’ve not made a friend in FRED, I highly recommend it—lots of free economic time series to be had!

Figure 1

10-year Government Bond Yields

DATA SOURCES:

Japanese bond yields: https://fred.stlouisfed.org/series/IRLTLT01JPM156N

U.S. 10-year treasuries: https://fred.stlouisfed.org/series/dgs10

You need to get your fun from getting the free data, because you’re not going to get much fun looking at government bond yields. For all we may have our stochastic models, there has been one story for the developed nations: down, down, down in a burning ring of fire….

Switch to Sumo

Now for an abrupt switch to my favorite sport: sumo! (Don’t worry, we’ll be getting back to interest rates soon.)

Part of my discussion on interest rates in Japan had just been an excuse to transition to sumo, as it is a traditional Japanese sport.

No matter when you’re reading this article, it’s never very long until there’s another grand sumo tournament, because that is held every other month. It’s in the odd-numbered months, so the last completed tournament I watched was in March 2022, which was held in Osaka, called the “Haru Basho” (literally, the “Spring Sumo Tournament”). There are four main levels of professional sumo, but the one I mostly watch is Makuuchi—the highest level of sumo.

The Makuuchi tournament lasts 15 consecutive days, and there is a pattern to the match-ups, but you generally don’t know who will wrestle whom until the night before. The wrestlers come out with either a “winning record” (eight or more wins) or “losing record” (eight or more losses), and whoever wins the most matches wins the entire tournament. There can be play-offs at the end, and the organizers try to set up matches so the winner isn’t determined until the last day.

There had been a very dominant wrestler, Hakuho (the “GOAT!” or “greatest of all time”), who retired from sumo in 2021. He holds many records in sumo, but the two most impressive are 45 tournament championships—the person in #2 position won only 32—and 16 of those 45 wins were ones where nobody defeated him (15 bout wins, at least).[1] While some fans have complained since Hakuho retired, I think this has opened up the competition to more uncertainty over who will ultimately win. The March 2022 championship is a case in point, leading to an exciting play-off between Takayasu and Wakatakakage.

There are so many appealing aspects to the sport. First, the rules are very easy to understand (well, generally). The wrestlers are trying to get the opponent to either touch the ground with a body part other than the bottom of their feet, or touch the ground outside the ring. There are some forbidden moves (such as grabbing the top knot). It can be difficult to see, when the bodies go flying, who exactly left the ring first. There is a list of winning moves, called kimarite. Luckily, there are about four of them used for most wins (pushing out of the ring in different ways, pushing or throwing to the ground), but some get to be a bit of a mouthful.

I watch sumo matches via NHK World broadcasts or fellow sumo fan edits, and if you’re not watching live (which is in the wee hours of the morning for me, but I wake before the sun does), all the matches from one day can generally fit in a half hour. In live action, the matches take longer due to traditional rituals of ring-entering, advertising banners from sponsors, and breaks for the wrestlers and umpires (called gyoji).

Before jumping back to a discussion on Japan, the U.S., and interest rate assumptions, I want to talk about the biggest misconception about sumo: it’s just a bunch of fat guys pushing each other around.

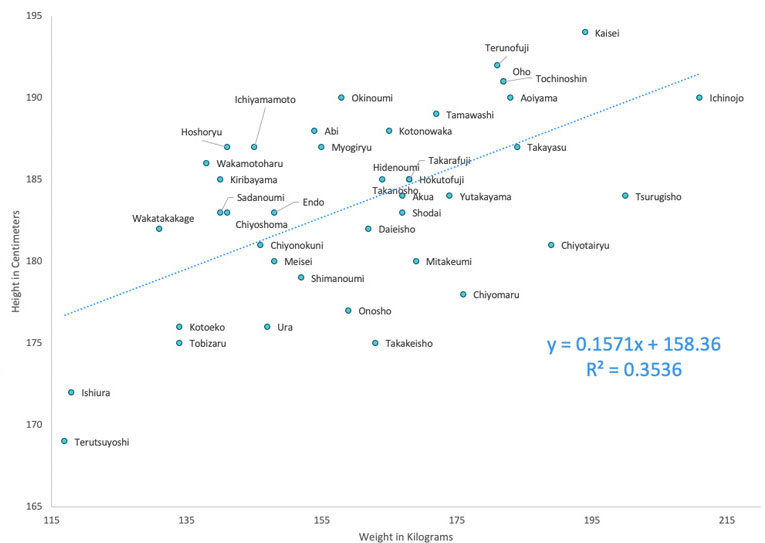

A scatter plot of top sumo wrestlers by weight and height can be seen in figure 2, data thanks to Fred Pinkerton[2] and @SumoFollower.[3]

Figure 2

May 2022 Makuuchi Wrestlers

To be sure, rikishi (sumo wrestlers) such as Ichinojo are huge—tall and massive. Terunofuji is not as heavy, but he is taller than Ichinojo, and he is the current sole Yokozuna. That is the highest rank a sumo wrestler can attain.

There are no weight or height classes in sumo. To reach Makuuchi, you have to have fought up the ranks to reach there. When you see someone as short and light as Ishiura on that graph, you know he is very skilled, but that he can’t use bulk to achieve his ranking.

Wakatakakage was the champion for March 2022. He is the third lightest wrestler on this graph, at 131 kg (289 lbs) though of a good height (182 cm; almost 6’). He won against Takayasu in the play-off on the final day. Takayasu is 184 kg and 187 cm. At about the same height, but over 100 pounds lighter than Takayasu, Wakatakakage used some agile footwork at the edge of the ring to win the match.

Some of the lighter but taller guys win against heavier and shorter guys via throwing moves. Some of the short and light guys are fast on their feet and trip up the massive wrestlers. And sometimes, the big guys will just pick up the little guys and set them outside the ring. (Yes, that’s amusing to see.)

Yes, many times, the larger man will win. But the larger man often has trouble moving rapidly in the ring, and often has more injuries, especially around his knees and ankles. Some wrestlers improved in their performance after losing some weight. Sumo is applied physics, and one must work with the frame one has and the particular opponent one is against. One should not assume it will always work out one way.

Considering Assumptions

To return to the interest rate assumptions, we have seen a single trajectory in long, secular terms. If we push back U.S. interest rates farther, we will see they had increased from the 1950s up to a peak in the early 1980s, and have trended down to where we see them today.

For many years, we had been hearing from people: “the rates must go back up!”, and I looked at the Japanese curve and wondered if they could keep going down, even into negative territory. There is no natural law that interest rates have to follow that says they must go up at some point. Similarly, while there are physical laws sumo wrestlers obviously follow, there is no natural law that says the bigger wrestler will win.

So maybe we will see those ten year rates start climbing up in a sustained way, and maybe we’ll have a 1950s–1980s cycle recapitulate. Or maybe we will be like Japan and see the rates turn back downward again.

Either way, I know I’ll be watching sumo in a few months.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Mary Pat Campbell, FSA, MAAA, is vice president, Insurance Research, for Conning in Hartford, Conn. She can be contacted at marypat.campbell@gmail.com.