Inclusive Insurance: A Different Game

By Jules Gribble and Jeff Blacker

International News, July 2024

Introduction

About 4 billion of the world’s current 9 billion population may benefit from inclusive insurance initiatives, but this potential market may not be easy to access from a traditional insurance perspective.

This risks leaving a large group of people without access to insurance who, with access, could improve their lives by utilizing formal inclusive insurance products. Not only can insurance products support recovery of losses from adverse events but, perhaps more importantly, they provide the confidence to take risks to advance economic growth. This positive economic role of insurance is encapsulated in the following, attributed to Henry Ford on the Empire State Building: “The whole world relies on insurance. Without it, every person would keep their money without investing it anywhere for fear of losing it, and civilization would have ground to a halt a little past the Stone Age.”

It is well established that increased access to inclusive financial services, including insurance, helps to reduce poverty and can leverage social and economic development. This then provides the confidence to undertake riskier commercial activities and protection when adverse risks events occur. These supports are especially valuable to those living near the poverty line when one adverse event risks pushing them, and their families, permanently below the poverty line.

Inclusive Insurance

The “IAA Risk Book” chapter on Inclusive Insurance[1] defines inclusive insurance as:

“Insurance products through which adults have effective access to insurance and savings products offered by insurers through formal providers.”

Effective access is explained as the involvement of convenient and responsible service delivery, at a cost affordable to the customer and sustainable for the provider, resulting in financially unserved or underserved customers being able to more effectively access and benefit from formal financial services in preference to other existing informal options.

Inclusive insurance products include all insurance products aimed at unserved or underserved markets. These markets typically are insurance markets in developing countries (from an insurance perspective) but are not restricted to such countries. Microinsurance is a subset of inclusive insurance focussing on lower income populations.

However, there are also unserved or underserved markets in developed countries, and inclusive insurance approaches and products can also be relevant to those economically disadvantaged groups. Most developed insurance markets, including the US, have growing underserved market segments whose customers can benefit from having access to inclusive insurance while also presenting sustainable commercial opportunities to insurance providers.

Scale of the Challenge

The overall scale of the underinsurance challenge is highlighted by "MAPFRE GIP 2023: Global Insurance Potential Index",[2] which states:

- The world insurance deficit grows by 14.3% and comes to USD 7.8 trillion (equivalent to about 7.8% of global GDP).

- More than 77.6% of the current insurance gap is in emerging markets, a reflection of their great potential for growth.

- Currently, China, the United States and India are once again leading the ranking of the countries with the greatest insurance potential in both the life and non-life segments.

More specifically, in the United States:

- A recent Swiss Re study,[3] suggested the average American household needs an additional $500,000 in life insurance coverage to meet financial obligations following the loss of a breadwinner. This represents a $25 trillion mortality protection gap.

- The number of non-elderly individuals without health insurance was 27.5 million in 2021.[4] The majority of the uninsured said they lacked health coverage due to the high cost of insurance.

The Inclusive Insurance Market in Developing Countries

The inclusive insurance landscape is evolving rapidly. The most recent Micro Insurance Network (MIN) annual global survey reviewing inclusive insurance in developing countries[5] highlights both the extent of coverage and the scope for expansion.

The survey notes that, in the countries included, about 330 million peoples are covered by microinsurance products. This is only about one ninth of the population that could benefit from these products.

This supports the commentary that “results of this study point to a significant market opportunity for insurers, alongside a pressing need for governments to consider the need to close this substantial protection gap as a key enabler to meet wider development agendas.”

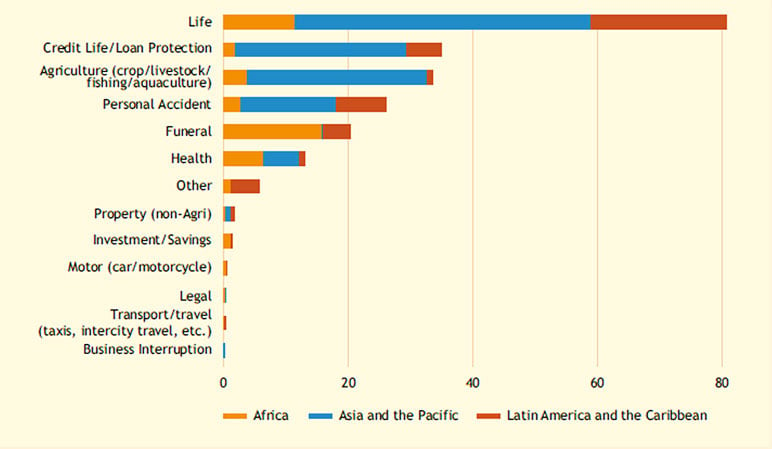

One measure of insurance coverage is by number of policyholders (see Figure 1).

Figure 1

Coverage by Number of Insured in Developing Countries

From "The Landscape of Microinsurance 2023," with permission

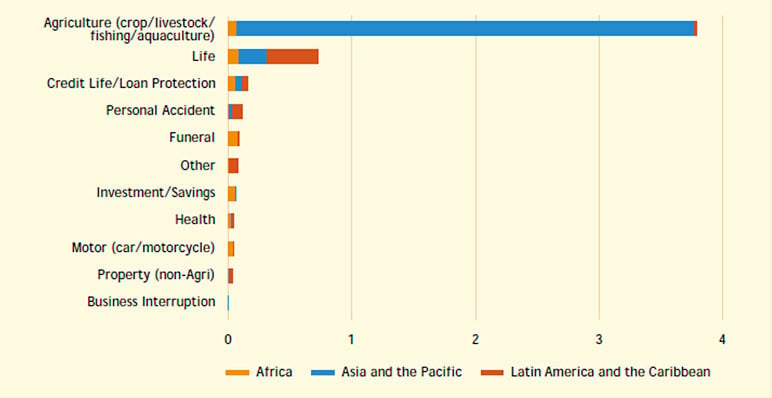

The need to take a balanced perspective on insurance coverage data is illustrated by comparing the messages that may be taken from Figures 1 and 2 in isolation. While agriculture is the third largest product in terms of people covered, it is responsible for more collected premiums than all other products combined. It is not uncommon for agriculture insurance premiums to be subsidized by governments.

Figure 2

Coverage by Total Premium in Developing Countries

From "The Landscape of Microinsurance 2023," with permission

Differences between Inclusive and Traditional Insurance

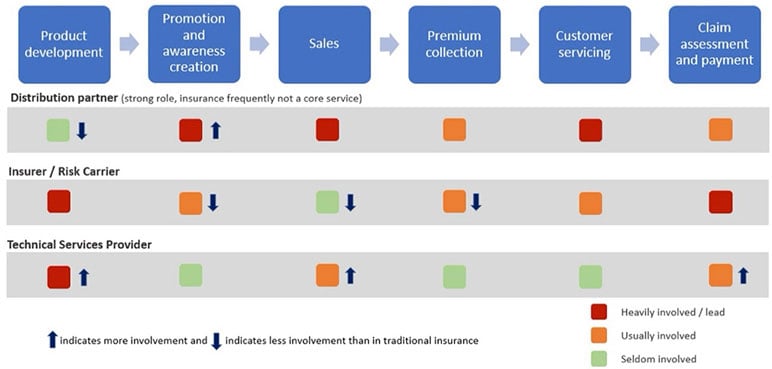

At a high level, there are three key roles in the insurance value chain:

- Distribution partner: Any player that has a role in the distribution of insurance. There may be several distribution partners working together or sequentially to distribute insurance to the customer.

- Insurer or risk carrier: Any party that accepts financial risk in return for payment of the insurance premium.

- Technical services provider (TSP): Provides technical services to a distribution partner, insurer, or any other party in the insurance value chain. These services can include actuarial services, technology and data services, international development services or country and market-specific knowledge on how to reach a type of consumer. TSPs are often the “glue” that holds the multiple partners of an inclusive insurance initiative together.

Adaptability and responsiveness to customer needs is a trademark of many inclusive insurance providers.

The following figures, taken from "Inclusive Insurance," in the IAA Risk Book,[6] summarize the significant differences between traditional and inclusive insurance. As these value chains are indicative there will be variations in practice reflecting local conditions. The differences and the changes in the importance of various players are highlighted by the arrows in Figure 4.

Figure 3

The Value Chain for Traditional Insurance

Source: IAA 2023, page 20.

Figure 4

The Value Chain for Inclusive Insurance

Source: IAA 2023, page 21.

TSPs typically play a significantly stronger role in inclusive insurance than in traditional insurance, bringing inclusive insurance skills and experience that more traditional insurers and distributors may not have. Multiple stakeholders are often involved in delivering key aspects of inclusive insurance, and some of these stakeholders (such as telcos) may be outside the insurance industry, something that differentiates inclusive and traditional insurance and often complicates effective inclusive insurance delivery.

Actuarial Preconditions

From an actuarial perspective, the differences noted above reflect the context of actuarial work. In traditional well-developed insurance markets like the United States, a number of pre-conditions are typically presumed:

- A ready supply of actuaries, the availability of actuarial education and the presence of robust professional standards;

- The availability of relevant, timely and appropriate data;

- Access to systems through which data can be collected and analyzed by providers, the industry and at the national level; and

- A regulatory framework that is reasonably well-developed and understood by market participants.

We note that the above pre-conditions implicitly assume that coverages are available. With the increasing impacts of climate change emerging, for example through floods and rising sea levels, compounded by increasing levels of material wealth to be protected and longevity, this assumption may be called into question. This may present more systemic issues to be addressed.

In many inclusive insurance markets, the reality may well be different and one or more traditional pre-conditions are frequently not met:

- The supply of actuaries and the actuarial profession may be limited or non-existent. The same applies to other insurance skills;

- Data may not be available or not readily collectable (this could, for instance, lead to a lack of insurance mortality and morbidity tables);

- Systems for collecting and analyzing data may not be well-developed or integrated;

- Customer understanding of insurance may be limited, especially for first-time customers of inclusive insurance;

- Trust in insurance may be lacking; and

- Regulation that is appropriate for inclusive insurance may not be in place, or conversely existing regulation may act as a barrier to inclusive insurance.

These issues are discussed further in “Addressing the Gap in Actuarial Services in Inclusive Insurance Markets,”[7] and some examples of how these issues could be addressed are given in Actuaries in Microinsurance: Managing Risk for the Underserved.[8] A recent, high-level structured approach to assessing the extent to which key success factors of inclusive insurance are addressed is given in “The Life & Health Insurance Inclusion Radar–Why markets are more, or less, inclusive.”[9] Many of these drivers are not directly related to traditional actuarial considerations or to specific lines of insurance, but need to be addressed if inclusive insurance initiatives are to succeed.

There is a risk that standard actuarial tools and approaches may not be appropriate in inclusive insurance markets, and that their application may lead to unintended outcomes, such as inappropriate premiums or claims processing.

For more information on the “Risk Book” Inclusive Insurance chapter, you can review the chapter itself or you can watch the two webinars delivered in February 2023[10] which reflect on the findings from this chapter.

Conclusion

Globally, there is a great need for inclusive insurance products. Actuaries can play an important role in the efficient, effective and sustainable delivery of these products. To achieve this, actuaries need to be aware of the differences between traditional and inclusive insurance products, reflecting their environment and their consumers. They also should apply a flexible and holistic approach to achieve their ultimate objective of providing consumers with confidence and protection when significant adverse risk events occur. An example of this flexibility is the development of index-based insurance.

The challenge for actuaries is how to take traditional actuarial knowledge and transfer it into an environment in which traditionally expected pre-conditions, actuarial and more broadly, are not met. This will require flexibility and resilience from actuaries and the capacity to apply underlying principles, as distinct from standardized, “textbook,” traditional practices. This challenge is compounded by the need to reflect the specific circumstances in specific countries. “Assessing Risk and Proportionate Actuarial Services in Inclusive Insurance Markets—An Educational Paper and Toolkit”[11] provides some more insights that may assist actuaries considering pursuing inclusive insurance further.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Jules Gribble, FIAA, CERA, PhD, is a principal at PFS Consulting, based in Sydney, Australia and is a member of the IAA’s Risk Book Editorial Board. He can be reached at julesgribble@pfsconsulting.com.au.

Jeff Blacker, FSA, MAAA, is a consulting actuary with life and health insurance experience in the U.S., Latin America, Africa, and India. He can be reached at jblacker@globalinsuranceconsulting.com.

Endnotes

[1] International Actuarial Association, “Inclusive Insurance,” in the IAA Risk Book (Ottawa, Ontario: International Actuarial Association, 2023), https://www.actuaries.org/IAA/Documents/Publications/RiskBook/IAARiskBook_InclusiveInsurance_2023-02.pdf.

[2] Fundación MAPFRE, “MAPFRE GIP 2023: Global Insurance Potential Index,” (Madrid: MAPFRE Economics, 2023), https://documentacion.fundacionmapfre.org/documentacion/publico/es/media/group/1122068.do.

[3] Swiss Re, “Closing the protection gap in the Americas,” (Swiss Re, 2023), https://www.swissre.com/reinsurance/life-and-health/reinsurance/america-lh.html.

[4] Tolbert, J., P. Drake and A. Damico. “Key Facts about the Uninsured Population,” (KFF, 2022), https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/.

[5] Micro Insurance Network, “The Landscape of Microinsurance 2023,” (Micro Insurance Network, 2023)

https://microinsurancenetwork.org/resources/the-landscape-of-microinsurance-2023.

[6] International Actuarial Association, “Inclusive Insurance,” in the IAA Risk Book (Ottawa, Ontario: International Actuarial Association, 2023). https://www.actuaries.org/IAA/Documents/Publications/RiskBook/IAARiskBook_InclusiveInsurance_2023-02.pdf.

[7] International Actuarial Association, “Addressing the Gap in Actuarial Services in Inclusive Insurance Markets,” (Ottawa, Ontario: International Actuarial Association, 2014), https://www.actuaries.org/iaa/IAA/Publications/Papers/Inclusive_Insurance/IAA/Publications/Inclusive_Insurance.aspx?hkey=20718186-6e51-457d-abde-cb1f7181a865.

[8] Blacker, J., ed., Actuaries in Microinsurance: Managing Risk for the Underserved (Winsted: ACTEX Publications, 2015).

[9] Swiss Re, “The Life & Health Insurance Inclusion Radar–Why markets are more, or less, inclusive” (Swiss Re Institute, March 2023), https://www.swissre.com/institute/research/topics-and-risk-dialogues/health-and-longevity/life-health-insurance-inclusion-radar-publication.html

[10] International Actuarial Association, IAA Webinar: The inclusive insurance risk book chapter, Sessions 1 and 2, https://www.youtube.com/watch?v=l_j2bK-AdEI and https://www.youtube.com/watch?v=YTr3n7wPVS

[11] International Actuarial Association, “Assessing Risk and Proportionate Actuarial Services in Inclusive Insurance Markets—An Educational Paper and Toolkit,” (Ottawa, Ontario: International Actuarial Association, 2018), https://www.actuaries.org/iaa/IAA/Publications/Papers/Inclusive_Insurance/IAA/Publications/Inclusive_Insurance.aspx?hkey=20718186-6e51-457d-abde-cb1f7181a865.