Indian Insurance Industry at a Glance

By Charu Gupta, Yogesh Goyal and Prabhkirat Singh

International News, November 2024

The insurance business started in the 19th century in India. The Indian Insurance Companies Act of 1928 enabled the government to gather statistical information about both life and non-life business transacted in India by Indian and foreign insurers, including provident insurance societies. The first comprehensive law, the Insurance Act of 1938, aimed to regulate the insurers and safeguard the interests of the public. Post-1956, state owned Life Insurance Corporation (LIC) mainly sold insurance products as tax saving tools.

With its robust growth and ability to adapt to evolving demographic and economic trends, the Indian insurance industry has grown to become a substantial player in the global insurance market.

The Indian insurance sector has grown significantly, becoming a key player in the global market, and adapting to demographic and economic shifts. There is significant potential for growth despite low penetration levels and a significant proportion of uninsured individuals, particularly in semi-urban and rural areas with rising awareness.

However, the market also faces several challenges. Regulatory complexities and distribution inefficiencies remain significant barriers. Moreover, incorporating modern technology to enhance operational efficiency and service delivery is another area that needs focus.

This article offers an overview of the Indian insurance industry, highlighting its structure, growth, outlook for actuaries, and ambitious goals for achieving universal insurance coverage in India.

Indian Insurance Industry at a Glance

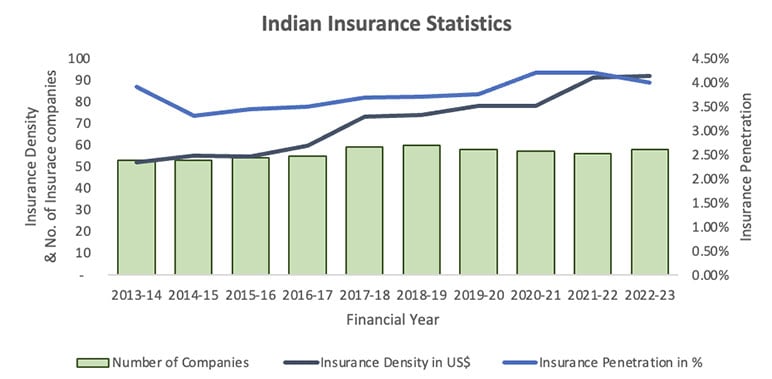

India's insurance industry has experienced substantial growth over the last decade, driven by socio-economic developments and regulatory reforms. The industry is characterized by its diversity— encompassing life, health, and general insurance sectors, each catering to the vast needs of the world's largest population. Here are some key statistics (see figure 1) that outline the industry's current landscape:

- The industry boasts over 58 insurance companies, including 25 life insurance and 33 general insurance firms.

- The total insurance penetration in India stood at approximately 4.2% of its GDP in 2023, with life insurance accounting for 3% and general insurance making up the remaining 1.0%.

- With a compound annual growth rate (CAGR) of about 14% over the past five years, the sector's expansion is propelled by increasing consumer financial literacy, innovative product offerings, and supportive government policies.

Source: https://irdai.gov.in/handbook-of-indian-insurance

The segmentation of the Indian insurance market reveals a structured approach to addressing the diverse risk protection needs of its population.

- Life Insurance

- Life insurance is the dominant segment, contributing about 75% of the premium income. The market has seen a surge in demand for term life and Unit Linked Insurance Plans (ULIPs), driven by a growing middle class and increased investment awareness.

- Health Insurance

- The health insurance segment has shown remarkable growth, especially post-pandemic, fuelled by heightened health awareness and expansive government health schemes such as Ayushman Bharat.

- General Insurance

- This segment includes a variety of policies such as motor, home and travel insurance. The demand for general insurance has seen a significant rise, particularly for travel and home insurance products in the wake of the COVID-19 pandemic.

In addition to domestic markets, India has emerged as a prominent destination for global actuarial services hub due to its large pool of skilled professionals, cost-effectiveness, and robust educational infrastructure. The country offers strong actuarial talent and a range of actuarial services to clients such as insurance companies, pension funds, and consulting firms for regions across the globe. The remainder of this article addresses the domestic market in India, rather than its position as a global hub for actuarial services.

Vision 2047: Insurance for all in the Indian Market

The Insurance Regulatory and Development Authority of India (IRDAI) aims to achieve “Insurance for All by 2047,” aligning this objective with the country’s 100th independence anniversary celebration. Insurance for All is a transformative initiative that aims to revolutionize the insurance landscape across the Indian population by the year 2047.[1]

This vision seeks to ensure that every individual, regardless of socio-economic status, has access to affordable and adequate insurance products, including health, life, and general insurance. This vision is driven by the recognition that insurance is a critical tool for financial security, risk management, and economic stability. Moreover, the initiative aligns with the United Nations Sustainable Development Goals (SDGs)—particularly those related to good health and well-being, and reduce inequalities.

The insurance industry will play a crucial role in this transformation, driven by advancements in technology, regulatory reforms, and innovative product offerings.

- Technological Advancements:

- Digital Platforms: Mobile apps, online portals and AI-driven customer service will enhance accessibility and affordability.

- Big Data and Analytics: Improved understanding of customer needs, personalized products and better risk assessment.

- Blockchain: Enhanced transparency, reduced fraud and streamlined claims processing.

- Regulatory Reforms:

- Simplified Regulations: Easier market entry and innovation.

- Microinsurance: Access to affordable insurance for low-income and rural populations.

- Public-Private Partnerships: Increased insurance penetration through subsidized premiums.

- Product Innovation:

- Customized Products: Tailored insurance for specific demographics like the elderly, farmers and businesses.

- Usage-Based Insurance: Premiums based on actual usage and behavior.

- Wellness Programs: Incentivizing healthy lifestyles to reduce health care costs.

- Financial Literacy and Awareness:

- Education Campaigns: Nationwide efforts to educate citizens on insurance importance.

- Community Outreach: Building trust and awareness in rural and underserved areas.

- Infrastructure Development:

- Health care Infrastructure: Supporting health insurance growth with quality medical services.

- Disaster Management: Reducing the impact of natural calamities to make insurance more viable and affordable.

Evolution and Future Outlook of Actuaries in India

Over the decades, actuaries’ role in the Indian insurance industry has evolved significantly, with professionals adapting to changing regulatory, economic, and technological landscapes. During this time, the Institute of Actuaries of India (IAI) was founded in 1944 with the goal of advancing and overseeing the actuarial profession in the nation.

The economic liberalization of the early 1990s and the establishment of the IRDA in 1999 opened the sector to private and foreign companies, increasing competition and innovation. Actuaries now play vital roles in product development, pricing, risk management, and financial reporting.

However, actuaries face challenges such as lack of supply for credentialed actuaries in India, evolving regulations, data quality issues, and the need to continuously update skills to keep pace with technological advancements. Based on the most recent data, India has a growing actuarial community, with over 9,000 student members pursuing actuarial certifications and about 400 fully trained actuaries.

The future of the actuarial profession in India is promising, driven by several key factors. The rapidly expanding insurance market, increasing penetration rates, and a growing middle class are creating more demand for insurance products. Regulatory changes and new insurance products are further increasing the need for actuarial expertise to ensure compliance and innovative design.

Actuaries will be the primary pillars and inspiration for IRDAI's VISION 2047. They can develop advanced insurance solutions—such as microinsurance for low-income groups—that are suited to the diverse needs of the Indian population. Actuaries can also lead digital transformation projects to enhance client experience and efficiency, such as AI-driven customer support and claims processing. Actuaries will play a crucial role in driving innovation by collaborating with data scientists and IT experts.

Technological advancements, such as artificial intelligence and big data analytics, are transforming the profession, enabling more accurate predictions and risk assessments. The digital transformation of the industry, driven by big data analytics, AI, and machine learning, is reshaping actuarial practices. The rise of Insurtech startups is opening new avenues for actuaries, particularly in non-traditional insurance models and personalized products. Additionally, the global focus on sustainability and climate risk assessment is influencing the Indian market, requiring actuaries to incorporate environmental factors into their models.

As the industry evolves, the demand for actuaries is expected to grow, making it a lucrative and dynamic career path in India with ample opportunities for growth and innovation.

Conclusion

The dynamic growth of the Indian insurance industry presents significant opportunities for actuaries and insurance professionals in risk management and product innovation. By understanding and adapting to the market's regulatory, economic, and cultural specifics, professionals can foster successful international collaborations. Insights from the Indian market will be crucial in shaping global insurance practices, making it an exciting time for those focusing on international markets which can pave the way for successful international collaborations and ventures. Insurance for All represents a bold and comprehensive strategy to ensure that every citizen of India has access to adequate and affordable insurance coverage. It will require concerted efforts from the government, regulatory bodies, insurers, and other stakeholders.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, Deloitte Consulting LLP, or any of the global Deloitte network of member firms.

Charu Gupta is a senior manager at Deloitte. She can be reached at chargupta@deloitte.com.

Yogesh Goyal, FIA, FSA, is a manager at Deloitte. He can be reached at yoggoyal@deloitte.com.

Prabhkirat Singh, FIA, is a senior consultant at Deloitte. He can be reached at prabhksingh@deloitte.com.

Endnote

[1] Source - https://irdai.gov.in/press-releases