Rethinking LTC Insurance: The Role of Housing Wealth

By Katja Hanewald and Hazel Bateman

International News, July 2025

Accessing housing wealth could be a game-changer in long-term care (LTC) financing, especially in aging societies with high homeownership and limited public LTC insurance coverage.

This article summarizes findings from a recently published peer-reviewed study in the Journal of Risk and Insurance (Hanewald et al., 2025),[1] which examined how access to housing wealth affects stated demand for LTC insurance in China. We conducted a survey of homeowners aged 45–64 across 49 cities in China and found that offering reverse mortgages or home reversion products significantly increased stated demand for LTC insurance. This article highlights the study’s key results and implications for insurers, actuaries, and policymakers.

The Challenge of Long-Term Care Financing

LTC costs are rising rapidly as populations age, placing growing pressure on individuals, families, and public systems. Yet in many countries, public LTC coverage is limited, and private insurance markets remain small and underutilized. At the same time, homeownership is widespread among older adults, and many express a strong preference to “age in place.” This context raises an important question for policymakers and product providers: Could enabling access to housing wealth help bridge the LTC financing gap?

Survey Design

To investigate this question, we conducted an online survey of 1,200 urban Chinese homeowners aged 45–64. Participants came from 49 major cities, evenly split between Tier 1 and Tier 2 urban areas. Our sample reflected variation in wealth, home value and education.

Participants were introduced to a hypothetical LTC income insurance product: a joint-life plan that pays monthly benefits when one or both spouses qualify for LTC. We presented three financing options for purchasing the insurance:

- Product S (Savings): The premium is paid from savings.

- Product R (Reverse Mortgage): The premium is paid using a reverse mortgage, where homeowners borrow against home equity and make no repayments until the home is vacated.

- Product H (Home Reversion): The premium is paid by selling part of the home’s future value in exchange for an upfront payment, while retaining the right to live in the home.

Each participant was assigned a hypothetical financial profile based on their self-reported savings and home value. For each product scenario, they completed an interactive choice task where they specified how much of their available wealth they would use to purchase LTC insurance. This allowed us to measure stated demand under each financing method.

Access to Housing Wealth Increases Demand for LTC Insurance

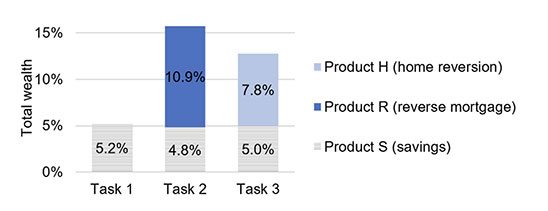

A key finding from the study was that access to housing wealth led to a substantial increase in stated demand for LTC insurance. On average, participants allocated:

- 5.2% of their total wealth when using savings only (Product S).

- 15.7% when savings and a reverse mortgage were available (Products S + R).

- 12.8% when savings and home reversion were available (Products S + H).

The differences across funding sources were statistically significant and suggest that home equity could play an important role in helping households prepare for future care needs.

Figure 1

Average Demand for LTC Insurance, Based on Participants’ Stated Preferences under Three Financing Scenarios

Source: Hanewald, K., Bateman, H., Fang, H., & Ho, T. L. (2025). Journal of Risk and Insurance.

Reverse Mortgages Preferred Over Home Reversion

LTC insurance demand was higher when a reverse mortgage (Product R) was available than when home reversion (Product H) was offered as a funding option. Reverse mortgages allow homeowners to retain full ownership of their property and typically include a no-negative equity guarantee, which protects borrowers if the eventual sale value of the home falls below the loan balance.

What Drives or Inhibits Demand?

Our regression analysis highlights several factors that influenced LTC insurance demand across the different product scenarios:

- Product understanding: Participants with higher self-rated understanding of the insurance products were significantly more likely to allocate funds to LTC insurance.

- Trust in insurers: Higher trust levels were positively associated with demand in all scenarios.

- Bequest motives: A strong desire to leave an inheritance reduced demand, especially when housing wealth could be used.

- Family expectations: Participants with a daughter, often seen as a potential future caregiver, were less likely to purchase LTC insurance.

- Perceived care needs: Those who expected to need formal care, particularly at home, showed greater willingness to buy LTC coverage.

Interestingly, self-assessed understanding of the products was more strongly associated with demand than objective knowledge, as measured by a product knowledge quiz. This suggests that confidence and perceived clarity may be more important in decision-making than actual comprehension.

Barriers to Uptake: Not Just About Money

Among participants, the main reasons given for not purchasing more LTC insurance were:

- “I think I can manage LTC risks.”

- “My children/grandchildren will care for me when I’m old."

- “The product is too complex.”

- “The product is not a good deal.”

These responses highlight that cultural norms, perceived self-reliance, and simplicity are perhaps even more important than affordability.

Implications for Policy, Product Design and Practice

Our findings suggest several opportunities for innovation in product development, regulation and public-private coordination:

- Product design: Joint-life LTC income products funded by reverse mortgages or home reversion arrangements may appeal to older homeowners. Features such as heir protection and flexible payout options can enhance acceptability.

- Framing and education: Clear explanations, simplified product descriptions and relatable case studies help improve understanding. The survey results also suggest that the order in which options are presented can influence stated demand.

- Public-private partnerships: Government-backed reverse mortgage schemes, such as Australia’s Home Equity Access Scheme, could serve as models for supporting LTC financing.

- Market relevance: These insights are especially relevant for countries with high homeownership and underdeveloped LTC insurance markets, including those in East Asia, Australia, and parts of Europe.

Lessons for Actuaries

Actuaries are well placed to contribute to this space through:

- Designing and pricing income-style LTC insurance products

- Modelling consumer behaviour, including lapse and take-up rates under different financing scenarios

- Advising on regulatory frameworks for housing-linked LTC solutions

- Supporting the development of tools and materials that enhance product understanding and decision-making

Conclusion: A Practical Path Forward

Our study shows that allowing older homeowners to access housing wealth can increase stated demand for LTC insurance. Reverse mortgages and home reversion arrangements may offer viable options in settings with high homeownership and limited LTC insurance coverage.

For actuaries and insurers, these findings highlight opportunities to support innovation in LTC financing. Carefully designed products, appropriate consumer protections, and clear communication will be essential to ensuring that housing-based solutions can meet the diverse needs of ageing populations.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Katja Hanewald, PhD, is an associate professor in the UNSW School of Risk and Actuarial Studies and a vice president of the Asia-Pacific Risk and Insurance Association (APRIA). She can be reached at k.hanewald@unsw.edu.au.

Hazel Bateman, PhD, is a professor in the School of Risk & Actuarial Studies, UNSW Sydney, and president of the International Pensions Research Association (IPRA). She can be reached at h.bateman@unsw.edu.au.

ENDNOTES

[1] This article summarizes the paper: Katja Hanewald, Hazel Bateman, Hanming Fang and Tin Long, “Housing wealth and long‐term care insurance demand: Survey evidence,” Journal of Risk and Insurance (2025): 1–27. https://doi.org/10.1111/jori.70006