Is It Really Different This Time?

by Mary Pat Campbell

Risks & Rewards, December 2020

Betteridge’s Law says, “Any headline which ends in a question mark can be answered by the word no.”[1]

In addition, how many times have we heard “This time it’s different!” right before one finds out that, no, it’s not different this time.[2]

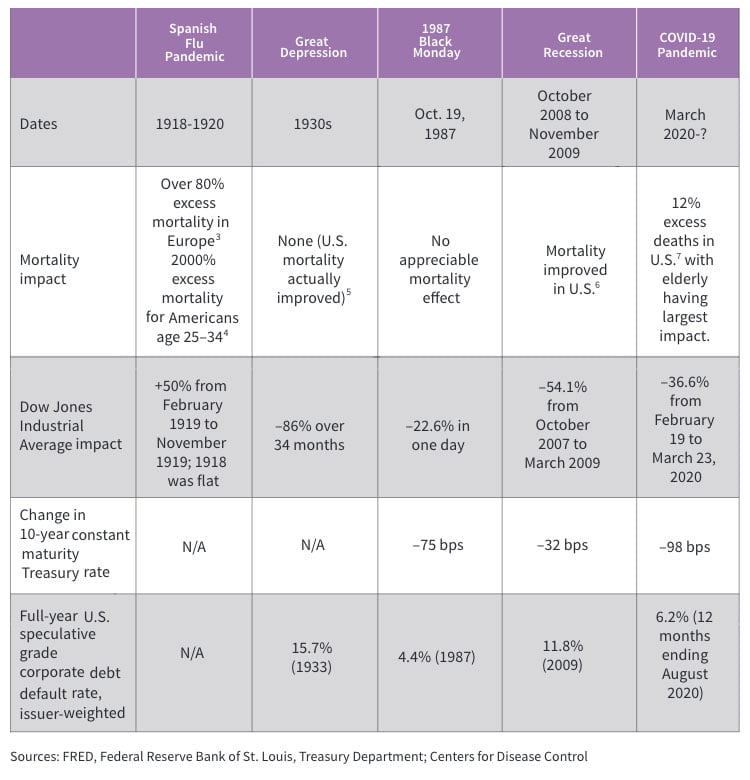

However, the current pandemic crisis has elements to it that make it different from prior financial crises and pandemics. The following table details five crises from the past century measured on different dimensions. In general, mortality and financial risks did not move in the same direction. Indeed, during both the Great Recession and Great Depression, mortality actually improved.

In the 20th century, there were two serious flu pandemics that occurred after the Spanish flu pandemic: the “Asian Flu” in 1957-1958 where about 116,000 Americans died[3], and the “Hong Kong Flu” in 1968 where about 100,000 Americans died.[4] In both of those pandemics, most deaths were among people 65 years old and older, just as with COVID-19 now. However, neither of those pandemics disrupted the global economy at the time.

CHALLENGING OUR ASSUMPTIONS

The pandemic is an opportunity for actuaries to challenge their assumptions in asset/liability modeling and management. There are many implicit assumptions built into the structure of these models, and most frequently they are structured assuming that certain liability risks are uncorrelated to asset risks.

In particular, most models assume that mortality and economic factors are independent. Obviously, that is not exactly the case currently, though the connection is not straightforward.

Most of our models have been calibrated statistically, and are intended to capture a reasonable range of behaviors. Some may produce extreme situations, but the complicated dynamics of correlations can be difficult to capture, and there may be surprising results.

In “Compound Perils—Is Wildfire Season Having an Impact on New COVID-19 Cases in the U.S.?”[5] Sara Goldberg wrote about compound perils interacting in unsuspected ways. The items in the headline—wildfires and COVID-19—may seem to be unrelated until you consider the following: COVID-19 restrictions have led to more outdoor parties … which could then lead to a wildfire when your gender reveal device explodes.

Goldberg notes that the causality of the interaction can also work in the opposite direction: lost homes from wildfires may lead to more people being bunched up in shelters, thus facilitating the spread of COVID-19. Indeed, Goldberg found a weak correlation between the fires in California and growth of COVID-19 cases in the state.

When reconsidering model structure and interactions, it may be that extreme cases should not be incorporated into “normal” models for long-term ALM and investment strategy. Perhaps developing crisis scenarios that incorporate multiple dimensions of risk for scenario-testing will be sufficient.

However, this is a good time to question whether these “extreme” scenarios are really that unlikely. Perhaps coronavirus pandemics or other infectious diseases may revert to pandemic patterns experienced before the past century, such as with plague. The current crisis may shift markets so that some individual sectors are permanently affected, such as certain areas of commercial real estate.

ANTICIPATING AND MANAGING RISK

While ALM actuaries may incorporate learnings on mortality and economic risk factor interactions from the current crisis, they will want to be proactive with model adjustments. They should be communicating with a broad range of experts in their organizations to capture multiple views on risk and anticipating the nature of the next crisis, whether it comes in two years or 20.

Stephen Strommen wrote, “As a matter of professional judgment, one should be careful when using models that do not reflect relationships that one believes to be true.”[6] As an example, Strommen cited how many economic scenario generator (ESG) models assume a lack of correlation between interest rate levels and equity returns. The specific ESG model he mentioned, one developed originally by an American Academy of Actuaries (the Academy) working group, had reasons for maintaining the assumed lack of correlation. As Strommen himself notes, the economic data used by the Academy working group showed no such correlation in the statistics.

But let us consider the following graph of 10-year constant maturity Treasury rates, going back to the early-1950s.

Source: Federal Reserve Bank of St. Louis [12]

One of the reasons for the lack of correlation between equity market returns and interest rate levels may be the very strong secular trend observed in interest rates. Starting in the 1960s, rates go up, reach a peak in the early 1980s, and then slide down. When the Academy ESG was calibrated, a specific time period was chosen, which may have biased the results. It can be that the two are strongly correlated during some time periods, and weakly correlated during others—just as we are currently seeing with mortality and market behavior.

Are the models your company is using missing important interactions? Are there variables included that do not interact at all?

AN OPPORTUNITY FOR INTERACTION

The most important interaction of all is one that may also be missing: people in different functional areas of the company sharing their risk views.

As mortality and asset values interact, investment managers need to work more closely with product managers. Models that were developed separately by each group need to be integrated so that asset-liability interactions are more reflective of current dynamics. As Florian Richard pointed out in the July 2020 issue of the Joint Risk Management Section newsletter, “Managing pandemic risk requires a coordinated effort across all risk functions and all product lines.”[8]

In that piece, Richard referenced a Chairperson’s Column from Risk Management newsletter that preceded the pandemic. In May 2019, then chairperson of the Joint Risk Management Section Mario DiCaro wrote: “ERM teams should be actively looking for intersecting zones of responsibility to see that risks aren’t falling through the cracks.”[9] Did the pandemic-interest rate interaction fall through the cracks in your company’s model?

Answering this question while the pandemic still continues is a challenge, but actuaries may not have the luxury of waiting for the crisis to abate before addressing these problems. As I write at the beginning of October 2020, there is a second or perhaps third wave of COVID-19 cases in various countries and states, while a consequential U.S. election looms. Additional surprises may be in store for 2020—after pandemics, wildfires, riots, and more, there are further cataclysms one could anticipate. (Extraterrestrial invasion, anybody?)

Of course, the specific piling of disasters is not unusual in historical records. For example, London had its last great plague breakout in 1665[10] which involved many of the same issues we see in the COVID-19 pandemic, albeit with a much higher mortality effect. The Great Fire hit London the following year, resulting in disaster upon disaster. Both events involved great dislocation of people, significant mortality, and material economic damage at the time.

While the current crisis may be different this time, if one looks back far enough, perhaps it is not. It is just simply different from the most recent crises that have been studied, which stretch back only 100 years. The COVID-19 pandemic gives actuaries an opportunity to assess different ways risk may interact, and thereby adjust the profession’s work for the future.

Mary Pat Campbell, FSA, MAAA, is VP Insurance Research at Conning. She can be reached at marypat.campbell@gmail.com.