From Distress to Distinction: A New Look at Valuation Through Option Pricing

By Chris Droussiotis

Risks & Rewards, April 2025

In my 30-plus years of experience in banking, particularly in managing leveraged finance loans for major regulated banks, I have witnessed firsthand the high-stakes environment surrounding distressed companies. Loans made to these firms are often considered among the riskiest in a financial portfolio, and when they underperform, the emotional response can be intense. The immediate reaction is often to explore selling the loans in the secondary market or, if that isn't feasible, to engage in a blame game targeting management or the private equity firm that owns them.

However, if one can strip away the emotional turmoil and focus on the fundamental questions, one can better evaluate not only the debt that needs restructuring before bankruptcy but also the potential value of the firm post-bankruptcy. After transitioning from banking to advising startup businesses, I have come to realize that distressed companies and startup businesses often share similar traits: Negative cash flows paired with the hope of recovery. This understanding is crucial in developing effective valuation methodologies for distressed entities, allowing investors to see beyond the immediate challenges and identifying pathways for such entities to generate future value.

In my current role advising startups on how to commercialize their ideas, I often refer to the first one to two years of the investment horizon as "the Death Valley." During this critical phase, startups require a substantial amount of cash investment to navigate toward commercialization. I employ a probability approach to assess whether these companies can successfully make this transition. This involves estimating the likelihood of moving from concept approval to successful commercialization.

Interestingly, the same methodology can be applied to distressed companies facing periods of negative cash flow due to high leverage. If the underlying business has merit, the transition to deleveraging is often like that of a startup transitioning to commercialization. By evaluating the probability of a successful turnaround, one can better understand the potential for these companies to resume operations and thrive in the future. This parallel highlights the importance of strategic investment and careful analysis in both cases, ultimately paving the way for recovery and growth.

Distressed Company Valuation Overview

To effectively value distressed companies, various methodologies are utilized to capture the complex financial dynamics involved. Each approach provides unique insights into the company's potential for recovery and its ability to manage existing debt. The discounted cash flow (DCF) method offers a forward-looking analysis by estimating future unlevered cash flows, which aids in determining the present value of both equity and debt. Meanwhile, the option pricing method, based on the Black-Scholes model, assesses the probability of recovery and estimates the sustainable debt capacity of the company. Together, these methodologies create a robust framework for appraising distressed companies, allowing stakeholders to make well-informed decisions regarding investment and recovery strategies. In the remainder of this article, the DCF and option pricing methodologies will be applied to a real-world case study of Spirit Airlines' recent bankruptcy. By combining these two approaches, one can determine the appropriate restructured debt level for the company post-bankruptcy.

Description of Valuation Methods

DCF Method: This estimates the company's value based on its strategic plan spanning three to five years, focusing on unlevered cash flows (i.e., assuming no debt). By applying an appropriate discount rate, the present value of both equity and maximum debt can be determined. Note that cash flows in the initial one to two years are likely to be negative, primarily due to the necessity of additional investments to facilitate business recovery.

The DCF valuation provides an estimate of the enterprise value of the firm, which represents one of the variables for the option pricing methodology discussed below.

Option Pricing Method: This approach utilizes the Black-Scholes model to assess the probability of recovery for a distressed company. It also helps determine the optimal amount of debt the company can sustain, considering the potential for recovery and the associated risks.

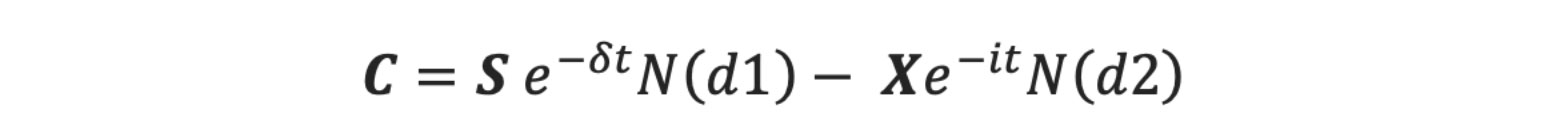

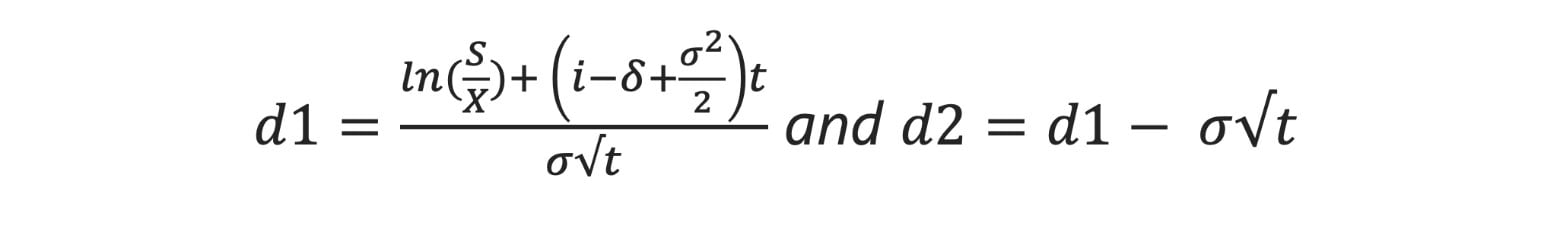

Using stochastic calculus, Black and Scholes came up with an approach to estimate the probability of future value or future payoff even if the intrinsic value of a call option today is out of the money. Their famous formula for calculating the up-front bet or premium for a European-style call option (C) on a stock is

Where S is the current price of the stock, is the exercise price at expiration, i is the risk-free rate and t is time to expiration. The formulas for calculating the probability factors d1 and d2 applied to S and the discounted value of the exercise price, respectively, are as follows:

Where σ is the standard deviation of S (usually estimated based on historical values) and δ is the stock’s dividend yield. N(d1) and N(d2) refer to the values calculated at d1 and d2 from a normal distribution of returns with mean i-δ and standard deviation σ.

Case Study: Spirit Airlines Corporation

The study uses Black-Scholes to value the equity for a company that is currently in distress or bankruptcy. Of course, the equity value of such a company is expected to be close to zero or negative as the liabilities reported are higher than the assets of the company. Option pricing theory estimates the total value of the enterprise and its equity based on the present value of future cash flows post-bankruptcy. The following text box contains a news brief that describes the key financial parameters of Spirit’s bankruptcy restructuring filing.

Spirit Airlines Files for Chapter 11 Bankruptcy RestructuringSpirit Airlines (SAVE) said Monday it has entered into Chapter 11 bankruptcy restructuring with the support of a supermajority of its debtors. The bankruptcy, filed with the U.S. Bankruptcy Court for the Southern District of New York, will result in the likely delisting of the company from the New York Stock Exchange and the cancellation of its shares, the company said. The discount airline said it has received commitments for $350 million in equity investments and $300 million in financing from existing debtors. The company will also equitize $795 million in debt. The company said flights, ticket sales, and reservations as well as payments to employees, vendors, and secured debtors are to continue as normal during the bankruptcy proceedings. The airline's Free Spirit loyalty program and Saver$ Club perks and credit card terms for its customers will also continue, it added. The restructuring of finances is meant to reduce debt, provide financial flexibility, and provide investments in passenger services, the company said. The company said it expects to complete the financial restructuring process in Q1 of 2025. MT Newswires. Mon, Nov. 18, 2024, at 12:02 p.m. EST |

Spirit Airlines Corporation Case Study Parameters

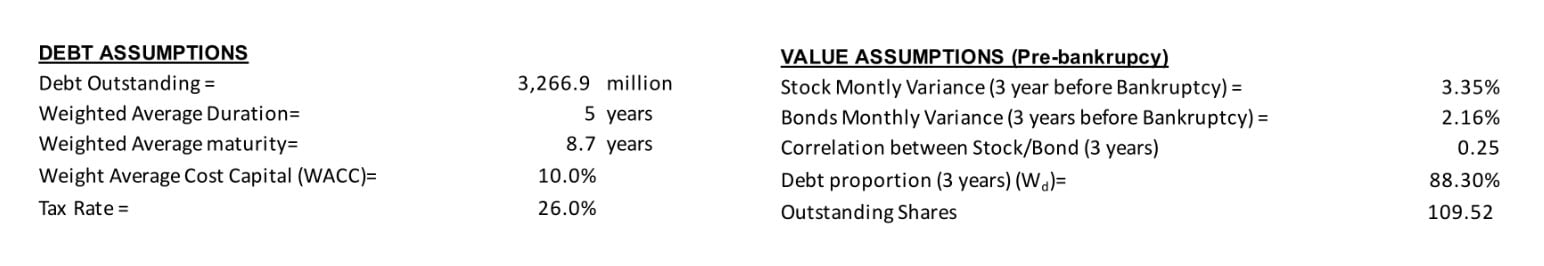

At the time of the filing, the amount of debt outstanding was $3.3 billion with a weighted average duration of five years. This represents the exercise price X in applying Black-Scholes, as Spirit’s equity investors will receive residual enterprise value after paying creditors, if any remain. To establish the (unlevered) value of Spirit’s equity, enterprise value needs to be calculated.

Table 1

Debt and Equity Value at a Time of Bankruptcy

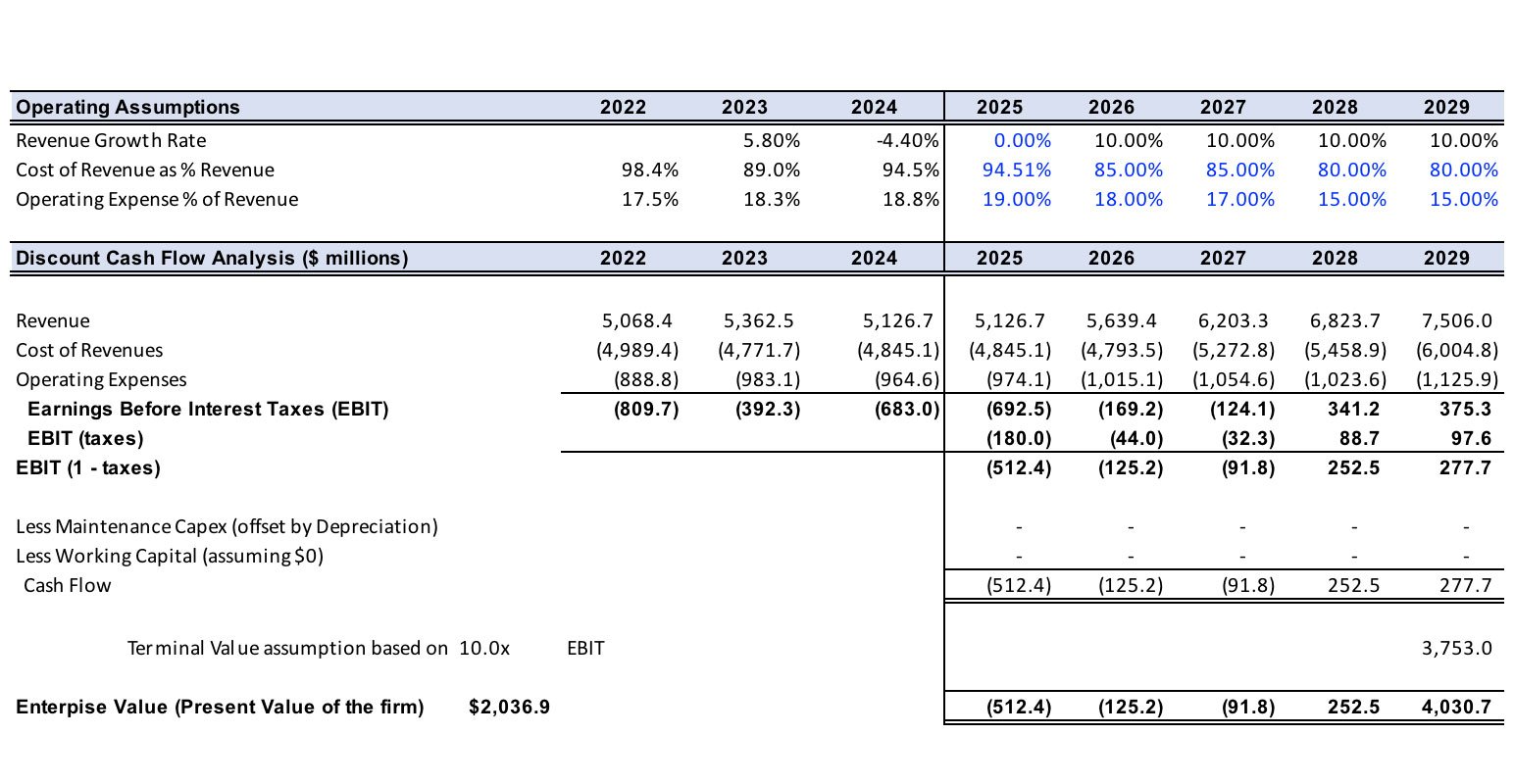

Spirit’s management put together a business plan including five years of financial projections (see assumptions in Table 2 below). In the first year, the company plans to spend more money on restructuring costs and downsizing. Based on the five-year projection, the equity analyst can calculate the present value of future cash flows, plus an estimated terminal value, discounted at the firm’s weighted average cost of capital of 10.5%.

Table 2

Proposed Financial Projections post Bankruptcy

Applying the Option Pricing Model Framework

Equity investors in the distressed company essentially own a call option in the distressed company with a strike price equal to the value of the company’s debt. Therefore, the payoff formula or intrinsic value of the option is as follows:

Option payoff = Max (0, S − X)

where S is the stock price and X is the exercise price.

To calculate the enterprise value (EV) of the firm:

EV = E + D − C or EV = E + net D

Where E is the equity value, D is the value of debt and C is the amount of cash available. D − C represents net debt (net D) and represents the amount of debt remaining after paying down debt with cash on hand.

Solving for equity:

E = EV − net D

The equity in a firm is the residual value after the company defaults. That is, the equity is at the bottom of the waterfall from any proceeds from selling the firm. These proceeds are used to pay the debt and other financial claims first, and anything that is left over is payable to equity holders.

Putting It All Together

To calculate the present value of the equity of the firm during distress where the current value of equity is negative, that is the debt is higher than the enterprise value or in option terms S − X < 0, the analyst can use the Black-Scholes model based on future cash flows post-debt restructuring or bankruptcy.

The equity can be viewed as a call option (C) premium, which can be valued whereas the debt and other financial claims can be viewed as the exercise price (X) and the enterprise value can be viewed as the current stock price (S). Since the debt of the firm has a maturity date, the equity investors can liquidate the firm at any time prior to that date, analogous to exercising a call option any time before the option expires (American-style option).

The following steps perform the necessary calculations for Spirit Airlines.

Step 1 - Find the annualized variance in the firm’s stock and bond prices:

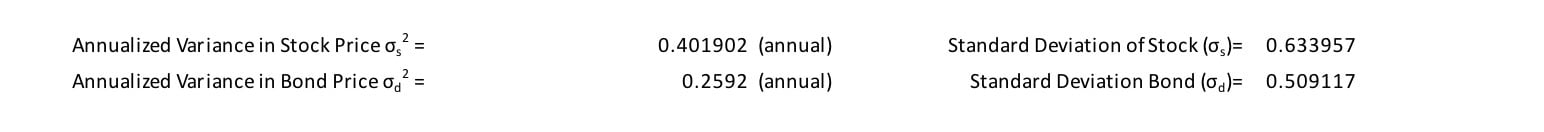

Step 2 - Find the annualized variance in firm value (σ)

The five-year bond rate (corresponding to the weighted average duration of 5.1 years is 6.0%

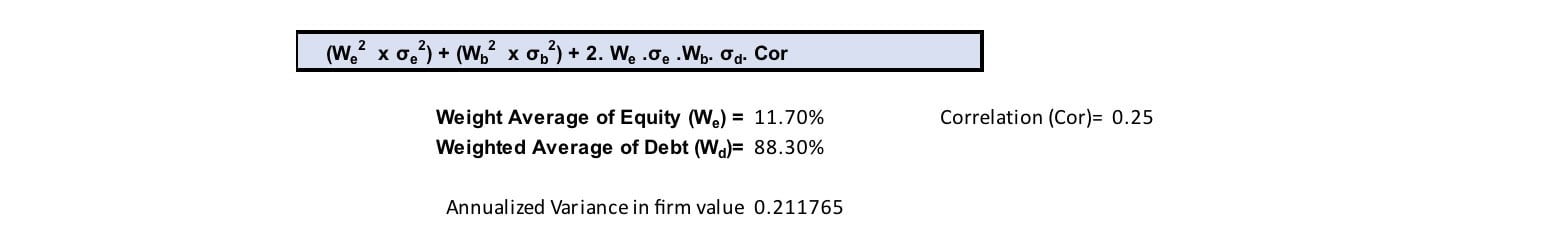

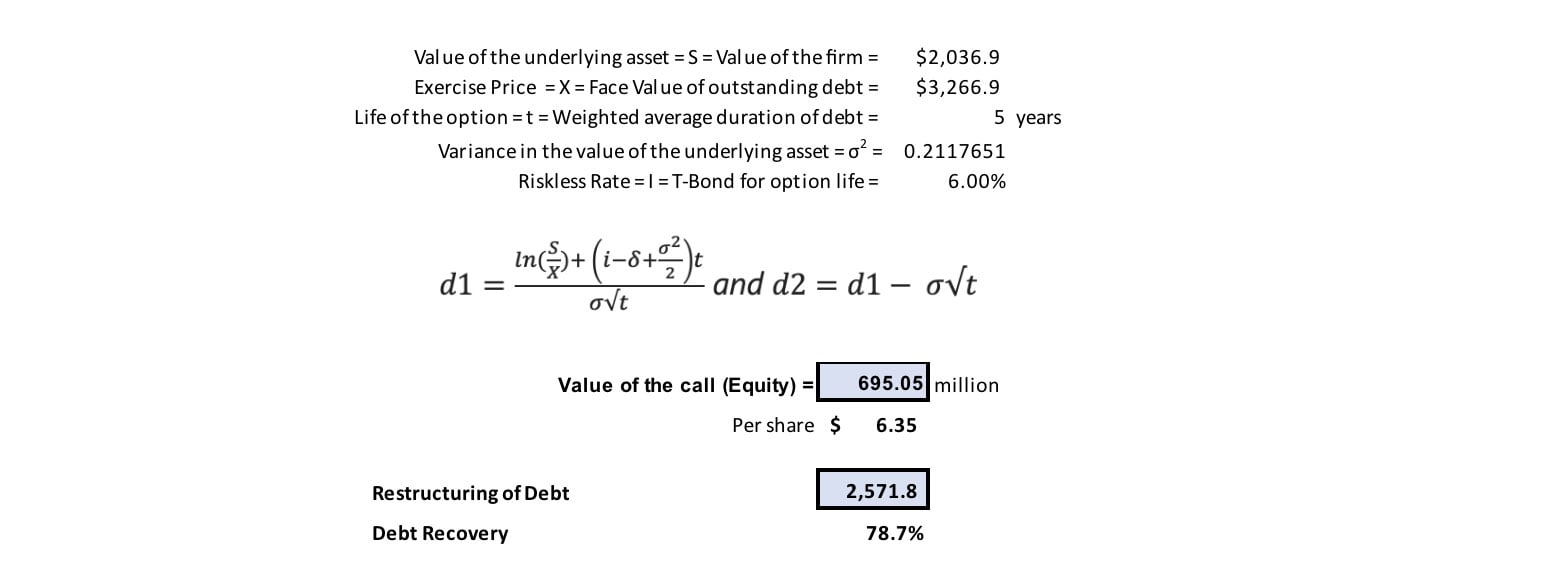

Step 3 - Find the value of call based upon the following parameters of equity as a call option

Even though the current value of Spirit’s equity is approximately -$1.2 billion (Enterprise Value of $2.1 billion − Debt $3.3 billion), indicating that the implied call option is out of the money, the present value of equity at maturity is estimated to be $695 million. Subtracting this amount from the current pre-bankruptcy debt of $3.3 billion results in approximately $2.6 billion of debt value that needs to be restructured, translating to an expected recovery rate of 78.7% ($2,571.8/$3,266.9).

Concluding Thoughts

Valuing any entity with a narrative involves a variety of methodologies. For instance, a startup that requires significant investment but currently has no revenue may present a compelling story about how its innovative idea could yield substantial returns for investors once fully developed. Conversely, a company may retain value even after experiencing negative cash flow that leads to bankruptcy, provided that its substantial debt obligations can be restructured, allowing the company not only to survive but also to thrive.

Regardless of whether one is evaluating an emerging startup or a distressed company, the valuation process can be successfully executed by considering three critical questions that guide the assessment:

- How is the company performing compared to the previous year or over the past few years, indicating a trend toward success? This is known as “trend analysis.”

- How does the company measure up against its peers? This is referred to as “peer analysis.”

- How is the company performing relative to established expectations of success? This is called “expected analysis.”

By effectively addressing these three questions, the valuation process can be streamlined. Various methods, including DCF analysis to assess trends, peer analysis to evaluate competitive positioning, and options-based approaches to gauge expectations of success, can then be utilized to produce a comprehensive assessment.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Chris Droussiotis, MBA, is senior managing director and managing partner of Kinisis Ventures and part-time lecturer in the Enterprise Risk Management program at Columbia University. He can be reached at cdroussiotis@kinisisventures.com.