Climate Risk Modeling: What You Need to Know to get Started

By Steve Bochanski and Graham Hall

Risk Management, June 2022

Climate risk modeling is taking center stage. With businesses increasingly expected to show how they assess, adapt to, and mitigate the risks of climate change, companies are asking: What is the right climate risk modeling approach for our business?

Here we provide a high-level overview of available options and tools. We also share examples of how leaders are using climate risk modeling to tell the story of climate change impacts on their business as well as adaptation and mitigation strategies.

The Case for Climate Risk Modeling

Companies have long used various modeling techniques to assess their risk profiles across many dimensions. Incorporating climate into those efforts today is an important step forward in building a more resilient tomorrow to protect your facilities, resources, investments, and people.

In the US, companies are awaiting new climate reporting rules from the Securities and Exchange Commission (SEC), which is drafting climate-related financial disclosures. Globally, the number of organizations that support reporting of climate-related risks and opportunities in line with the Task Force on Climate-related Financial Disclosures (TCFD) has almost doubled within a year. According to TCFD’s data published in October 2021, more than 2,500 organizations with a combined market capitalization of over $25.1 trillion support its recommendations.

Beyond disclosures, positioning the organization to be compatible with a low-carbon future has become an operational necessity for companies. More frequent and severe wildfires, floods and heat waves also underscore the need for businesses to become more resilient to physical risks of climate change. As society responds to climate change, businesses face a host of new risks and opportunities with shifts in technologies, markets, and regulation.

Within companies, new quantification approaches are evolving to assess the economic and financial impact of climate change, and show where decarbonization is opening new avenues for growth. Companies can choose from a growing array of tools to help model climate risks and opportunities, and share that information with investors and other stakeholders, while also using it to help shape business and risk management strategies.

Modeling Physical and Transition Risks of Climate Change

Companies embarking on climate risk modeling should keep in mind that TCFD recommends a broad analysis encompassing both physical and transition risks of climate change. Here’s how climate risks are normally divided into those two broad categories:

Physical Risks

Acute physical risks, or those arising from extreme weather events, like floods, storms and wildfires, are the risks most companies typically prepare for. These are becoming more frequent and severe because of climate change, and even in the most optimistic scenarios, that’s not expected to reverse itself. But it’s just as important to model the severity and trajectory of chronic physical risks that emerge over a longer period of time—such as higher mean temperatures or rising sea levels—and the impact those can have, for example, on agricultural production or the transmission of diseases.

Climate modeling tools incorporate future climate change projection data to provide a view of likely physical risks that can have a material impact on businesses. Some of these tools, such as high-level risk ranking models, assign risk scores for locations, but without factoring in how climate change might affect the risk scores over time. In contrast, climate-adjusted peril risk score models incorporate climate change. For example, they assign risk scores based on the threat posed by floods, wildfires, and droughts both today and in the future under different warming scenarios. Catastrophe modeling tools, used by the insurance industry, incorporate additional exposure information to provide a view on metrics like physical losses and business interruption.

Transition Risks

Transition risks are risks inherent in the large-scale transformation required to shift to a low-carbon economy. Companies face the risk of stranded assets, or assets that turn out to be worth less than expected as a result of the transition to a low-carbon economy. Transition risks also arise from changes in policy, such as a carbon tax, or changes to markets, for example, changing consumer behavior. In a recent survey 76 percent of consumers told us they will discontinue relations with companies that treat the environment and communities poorly. On the flip side, climate transition also opens up opportunities like business models built on new technologies and solutions, as well as the potential reputational benefits of being a sustainability leader.

The more robust tools in this category are risk models that assess the potential economic and financial impact of the transition. Others include: Alignment models that assess the extent of misalignment with a transition scenario and uses that as a proxy for transition risk exposure; impact models based on greenhouse gas (GHG) emissions associated with a certain business activity; and target-setting models designed to help investors define a climate strategy for investing.

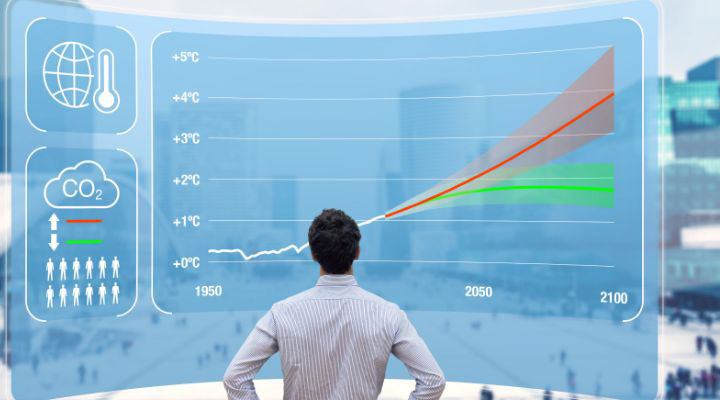

In any model, scenario analyses should be used so that companies can be prepared to modify strategies to be resilient no matter what the future looks like. The scenarios range from the best-case one of limiting temperature rise to 1.5° Celsius (compared to pre-industrial temperatures) to the worst-case “business-as-usual” scenario. (See Table 1)

Table 1

A Range of Climate Change Scenarios

|

|

International Energy Agency (IEA) |

Intergovernmental Panel on Climate Change (IPCC) |

Network for Greening the Financial System |

|

Organizational overview |

The IEA collects, assesses, and disseminates energy statistics on supply and demand, compiled into energy balances. |

The IPCC is the United Nations body for assessing the science related to climate change, focusing on physical climate change. |

The NGFS is a group of central banks and supervisors willing, on a voluntary basis, to share best practices and contribute to the development of environmental and climate risk management in the financial sector and to support the transition to a low-carbon economy. |

|

Number of scenarios |

Every year the IEA releases its World Energy Outlook report. The latest report includes 4 scenarios:

|

The IPCC regularly releases its Assessment Reports, the most recent being Assessment Report 6. The most recent IPCC report contains 5 scenarios:

|

The NGFS releases updated scenarios on a regular basis. The latest group of phase 2 scenarios contains 6 scenarios in three groups:

Disorderly transition scenarios

Hothouse world scenarios

|

|

Factors covered |

|

|

|

|

Applicability |

Used for energy modeling to understand the impact on the global economy and the future financial impact on corporate entities |

Used for physical risk modeling, including both extreme (acute) event modeling and chronic occurrence modeling |

Used by financial institutions to understand the economic impacts on their businesses |

Source: PwC analysis

How to Increase Resilience With Climate Risk Modeling

Climate risk modeling serves many goals, including illuminating risks and opportunities in investment portfolios, incorporating adaptation strategies, and enhancing disclosure and management of climate impacts.

Here’s how we are working with companies to help them model climate risk:

- A global fertilizer company in pursuit of greater resilience: We helped the company assess the impacts of climate change risk and opportunities across its global operations. Our physical risk scenario analysis modeled how climate change could affect the frequency and severity of perils under different climate scenarios and time horizons, and quantified the potential impact at each business location. Our transition risk scenario analysis quantified the impact of direct carbon taxes implemented on the company’s GHG emissions under defined climate scenarios and time horizons. We helped the company assess potential savings associated with reducing GHG emissions and its impact on overall business strategy.

- An insurance company looking to assess the exposure of its investment portfolio to climate change risk: The firm took into account the many levers of climate risk under different scenarios to create a risk score for each asset. This analysis gave the company a view of the risks and opportunities in its portfolio in different business areas and regions.

- A global communications telecommunications company integrates climate risk management as an integral component of strategy, culture, and business operations: We helped the company with its goal to be transparent regarding climate-related risks and opportunities and played a key role in publishing the company’s TCFD report. We performed a deep-dive into the company’s governance, risk management, strategy, metrics, and targets to review the company’s short- and long-term business risks and opportunities related to climate change. As part of this initiative, we performed a pilot physical risk modeling assessment for a sample of the company’s strategic assets. The modeling helped the company understand how climate-related perils may intensify at these locations over time and under the two selected future climate scenarios. We also examined the impact of climate perils, such as hurricanes, wildfires, and floods on these locations. Our analysis laid the groundwork to build out strategic plans for climate risk management, highlight new opportunities and provide perspective of how to integrate climate risks within existing enterprise risk management approaches, business strategy, operations, capital management, and business continuity planning.

- A global energy company modeling climate risk to support disclosure under the TCFD framework: We modeled the impact of a carbon price on a portfolio of close to 100 generation assets across the globe, as well as various complex strategic growth platforms in order to demonstrate the strength of the company’s transition plan to investors. We also simulated a portfolio of future assets against variations in the effects of climate change around the world, while also considering the company’s strategic approach in selecting future asset locations.

Climate Modeling as a Strategic Advantage

While expectations around climate risk disclosures are the most common driver for action, leading companies have started using climate risk modeling results to inform strategic decisions—whether this means thriving in a low-carbon future or withstanding the physical impacts of a warming climate. Understanding the potential risks and opportunities your company faces from climate change is an evolutionary process, but here are five steps every business can take today:

- Monitor evolving regulatory and stakeholder expectations.

- Identify top risks and opportunities to your business by conducting a qualitative risk assessment.

- Explore available options for data sources, tools, and vendors to support a quantitative scenario analysis exercise.

- Formulate your strategy for understanding and disclosing to internal and external stakeholders risks and opportunities related to climate change.

- Begin to develop your plan—roadmap, business case, funding, etc.—to implement a robust assessment of climate change risk and opportunity.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Steve Bochanski, FSA, MAAA, CERA, is PwC's US climate risk modeling leader and global actuary of the future leader. He can be reached at steve.bochanski@pwc.com.

Graham Hall, FIA, is a director at PwC and a member of the CAS Climate Change Task Force. He can be reached at graham.hall@pwc.com.