It Takes a Village: Insurance Product Development in the Digital World

By Erika Dochney

NewsDirect, May 2023

It is widely accepted that actuaries in product development and pricing roles need to work closely with underwriting, marketing, and data analytics teams. A prudent actuary will carefully consider the details of underwriting or marketing programs in their work and will develop strong working relationships with these experts. They will also work closely with data partners to measure success and identify beneficial product changes.

While the baseline need for collaboration among these experts has remained unchanged, recent trends in the insurance space have made this close working relationship even more crucial in 2023. An insurance product can no longer be considered simply the policy language on the page and the premium rates in the system, but the entire customer and advisor experience, from quote to claim.

As Millennials (the generation who have had Amazon Prime 2-Day Shipping available for most of their adult lives) reach financial maturity, they have rapidly become a larger share of the life insurance marketplace. While many in this generation still value the insight of an advisor,[1] they highly value convenience.[2] This shift has challenged the life insurance industry to rise to these expectations with digital processes and shorter app-to-issue times with no medical exams.

This article will review the perspectives of an actuary working with marketing, underwriting, and data analytics partners through the product development cycle, highlighting areas of interconnectedness necessary for success.

Product Design

The first imperative to successful collaboration in product design is clearly establishing the target market and distribution channel for the product. The target customer should not only come into play when designing a marketing strategy, but every part of their experience. Some questions that should be answered are:

- What product features, such as conversion options, liquidity, or living benefits would appeal to this customer?

- What is their budget? How does that compare to their coverage needs?

- What are their expectations for the purchase process? Will they be working with an advisor?

- What underwriting and other data is likely to be available for these customers?

- Which other product options is this customer likely to be comparing to?

Marketing Strategy

A natural next step from identifying a target customer is to consider how that customer will be acquired. Two identical customers coming to the same product through different marketing channels may have different expectations and carry different risks. For example, an advisor can support a customer who is considering lapsing coverage early by explaining the importance of maintaining coverage. A direct-to-consumer customer may be more or less likely to compare multiple offers.

While customer behavior and response to different strategies is difficult to predict, some expectations to set may include:

- How much will it cost to obtain a customer? Will this be commissions paid to an advisor or marketing spend?

- How much support will a customer need during the application process?

- What sources will customers be coming from? How casual or serious are they likely to be?

- What information does a customer need to make an informed decision? What features are important to them and how can they be represented?

Underwriting Design

Understanding the underwriting program that will be used for a given product is necessary not only to evaluate the mortality risks of the policies sold, but also to align the purchase experience with customer and advisor expectations. A robust, 45-day underwriting cycle including a medical exam for a small face-term policy on a healthy young woman is likely to be not only inefficient, but a poor experience for the customer compared to other options available.

Some considerations that the underwriting, actuarial, and marketing team should review:

- What proportion of the expected applicant pool is likely to be approved for coverage? At what risk classes (if applicable)?

- Does this expectation align with the customer’s expectations and the company’s pricing assumptions?

- What is the expense associated with the underwriting data or human review required to make a final decision?

- How many customers will get an underwriting offer without the need for labs or a medical exam? How much protective value does this step add, and how likely is the customer to complete the process with or without this requirement?

- How will reinsurance partners (if any) evaluate the proposed program? Can reinsurance partners provide insights or recommendations?

It may be difficult to assess some of these questions for a brand-new program or with a new population of target customers. This challenge highlights the importance of the next topic- monitoring and evaluating success.

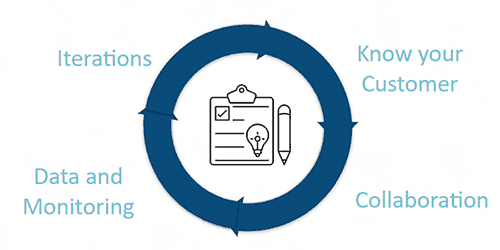

Success Monitoring and Iterations

Peter Drucker, management theorist, coined the adage “what gets measured gets managed.” Actuarial, marketing, and underwriting teams cannot separately manage their respective areas of expertise and expect to iterate to a successful product. Teams should reference a single source of the truth for a given metric and collaborate on how to handle learnings from measurement in order to work effectively.

Some examples of key metrics to reference could be:

- Ratio of customer engagements to applications completed,

- ratio of applications completed to offers or policies issued,

- cost to acquire a customer through different channels,

- underwriting cycle times, and

- early lapse rates.

(See Figure 1)

Figure 1

Success Monitoring Process

Measurement begins at the earliest stages of the product development process and involves another important stakeholder—analytics. Some questions that should be answered before a product launches include:

- What key metrics will each team reference? Is there a common understanding among teams of what they mean and how they are used?

- What data elements will be needed to develop these metrics?

- For experience that evolves over a long period of time, such as lapse or mortality, what leading indicators exist?

- How often will the product teams meet to review experience?

- Which metrics are most critical to managing risk? What level of deviation from expected would require escalation, and to whom?

- Who will champion any changes needed?

Key Takeaways

As the pace of change within the insurance industry continues to accelerate, collaboration within product development, underwriting, and marketing teams is more important than ever. Decisions cannot be made or evaluated in silos if a company hopes to keep pace with competitors and customer expectations.

If you haven’t connected with your marketing, underwriting, or analytics team in a while, it might be time to do so!

To hear more on this topic, you are encouraged to review the recording of “Simplifying the Insurance Purchase Process: Actuarial Perspectives,” from May 10th, 2023, a webinar hosted by the SOA Marketing and Distribution Section.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Erika Dochney, FSA, is a product innovation actuary at Haven Technologies. She can be contacted at erika@haventech.us.