Market Trends and Product Designs in a Rising Interest Rate Environment

By Yiru Sun, Stephanie Moench, Dylan Strother, Christopher Ruscito Lee, and Jeffrey Mu

Product Matters!, November 2021

Introduction

In the past 20 years, several cycles of slow-but-steady increases in interest rates have occurred, each following a sharp decline. After the economic downturn from November 2018 to August 2020, interest rates have again been trending up. As of June 2021, the 10-year treasury rate has increased by about 110 bps relative to August 2020 (although it is still well below 2 percent).

This article does not attempt to estimate the duration or magnitude of the current interest rate increase, nor speculate as to when rates might drop again. Instead, the focus is on current market trends for long-duration products—including life insurance, annuities, and long-term care (LTC) insurance—following an extended period of low interest rates, and lessons carriers can learn from historical periods of rising interest rates.

Where Are Carriers Today with Historically Low Interest Rates?

Profitability for most long-duration insurance products is, at least in part, dependent on the investment income a company can earn to support its product guarantees and pricing targets. The current sustained low interest environment has slowly, but substantially, shifted the long-duration insurance market landscape. It has put pressure on writers to find ways to manage profitability on existing business and may lead management to explore external asset management partners, offshore solutions and/or divestiture. Carriers have also had to search for innovative products that strike a balance between competitiveness and profitability.

As the low interest rates have persisted over the last several years, especially since the start of the COVID-19 pandemic, several trends have emerged:

Life Insurance

- Premium rates have increased for most products, especially term insurance, though both term insurance and whole life sales growth has been steady or slightly increasing and these products remain strategic offerings.

- Product innovation and policyholder participation in equity markets through indexed universal life (IUL), registered indexed universal life and the resurgence of variable universal life.

- Multiple companies have either divested or plan to divest in the life insurance market all together with at least three major carriers pausing ULSG offerings or exiting the ULSG market as part of their 2021 go-forward strategy.

- Active management of non-guaranteed elements, including raising cost of insurance charges (even though this may lead to litigation) as well as evaluation of programs to increase retention of profitable business in post level term periods.

Annuities

- New products focus less on long-tailed secondary guarantees and more on accumulation.

- Registered index linked annuities (RILA) market expansion due to current volatility structure and low interest rates has led to beneficial pricing relative to other annuity products.

- Reduced VA market share along with competition in the general account space led by private equity (PE) backed companies; a few companies have exited the VA market and a handful of others are reassessing their VA strategy.

- Fixed annuity (FA) and FIA writers have increased the use of reinsurance. Examples include (i) redundant reserve financing treaties utilized to aid profitability and (ii) offshore reinsurance transactions utilized to better recognize asset-liability-management and allow for access to a broader range of investment options (e.g., alternatives and long dated assets).

- FA sales growth has occurred during periods of credit spread widening, flow reinsurance mechanics and new capital injection from PE backed companies.

- Active management of non-guaranteed elements, such as current crediting rates on fixed deferred annuities.

Long-Term Care Insurance

- Carriers continue to exit the standalone LTC market, with one recent departure citing dependency on interest rates as a driver.

- New standalone LTC products focus on simpler designs, less rich benefits (e.g., shorter benefit periods), or cost-sharing features such as co-pays and/or deductibles. Some mutual companies have introduced participating standalone LTC policies that pay dividends to insureds under favorable market conditions, shifting some market risk from the company to the policyholder.

- Carriers have expanded LTC combination product offerings, which combine traditional LTC insurance with life insurance or annuities to leverage the natural hedge that exists between coverages.

- Carriers have introduced a new LTC combination product chassis, particularly variable universal life, which mitigates interest rate risk to insurers.

- Carriers continue to invest in in-force management, including premium rate increases (particularly if there have also been adverse deviations in other key assumptions) and more recently wellness initiatives.

As interest rates start to slowly rise, carriers in the long-duration insurance market may be prudent to react given past interest rate trends. Leveraging lessons learned during prior periods of rising interest rates can better position carriers for long-term competitiveness and profitability, which is the focus of the remainder of this article.

What Can Carriers Learn from Prior Periods of Rising Interest Rates?

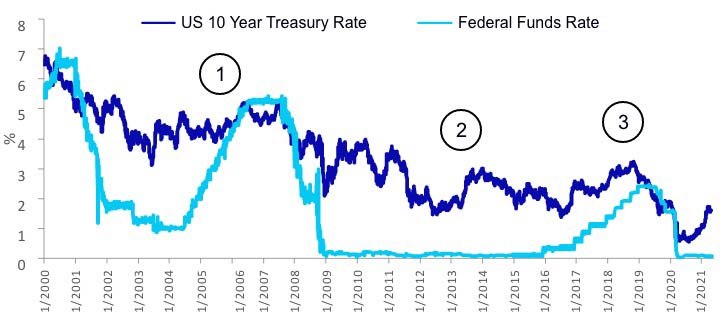

Prior to the current rising interest trend, there were three periods of increases in the U.S. 10-year treasury rates over the past 20 years as shown in Figure 1: (1) 2003 to 2006, (2) 2012 to 2013, and (3) 2016 to 2018. Among these periods, the federal funds rate also increased during 2003 to 2006 and 2016 to 2018.

Figure 1

Interest Rates over the Past 20 Years

Sources: https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

These three periods, excluding the most recent rising interest trend, have two key things in common:

- The 10-year treasury rate only increased around 1 percent to 1.5 percent over approximately two years, and

- Each period was followed by a sharp decrease in interest rates.

Two potential implications if these trends are repeated with the current interest environment are: (1) the increase in rates may not have a significant impact on the portfolio rate and thus would not ease pressure on insurers’ profit margins, and (2) interest rates may only continue to increase in the short-term, versus over an extended period of time. From August 2020 to Q2 2021, 10-year treasury rates have increased 1.2 percent, approaching the maximum increase observed during the last three waves.

The following sections outline three key lessons that can be learned from these previous, and even earlier, waves of rising interest rates.

Lesson 1: Focus On Product Designs That Perform Well In Rising Interest Rate Environments

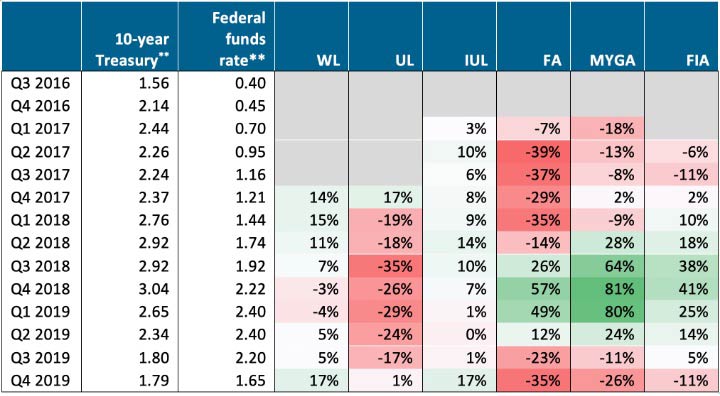

Table 1 summarizes the sales change patterns for a handful of key life and annuity products during the last rising interest rate period (2016 to 2019). The rates listed are annual sales growth rates. For example, the rate in Q1 2018 represents the change of sales volume from Q1 2017 to Q1 2018.

Table 1

Annual Sales Growth Rates for Key Life Insurance and Annuity Products*

* Sales data is from www.WinkIntel.com. While WinkIntel does not provide term life insurance sales data, we found term life insurance sales were stable during 2016 to 2019 based on LIMRA, with an annual increase of about 2 percent to 4 percent

** 10-yr Treasury and Federal funds rates represent the average rates for each quarter

The sales trends shown in Table 1 illustrate that whole life (WL) products are generally more stable in dramatically changing interest rate environments. This is likely driven by (1) the simple and compatible design, and (2) the illustration of WL using portfolio pricing instead of new money pricing. IUL products also showed a moderate increase in sales between 2016 and 2019. In contrast, products that are more interest rate sensitive, including ULSG products, tend to have lower sales as these products are more expensive for policyholders to keep in force when interest rates are low.

Further, the marketability of FA and multi-year guaranteed annuities (MYGA) will be undermined by equity-based insurance products when the current level of interest rates are low.

Products that have the potential to gain higher returns with other market indices, such as indexed products (e.g., IUL, FIA) and VA, also performed well in past rising interest rate environments. For example, FIA sales soared in 2004 when the surge of the equity market coincided with modest increases in interest rates, and many companies started to enter IUL market in 2005.[1]

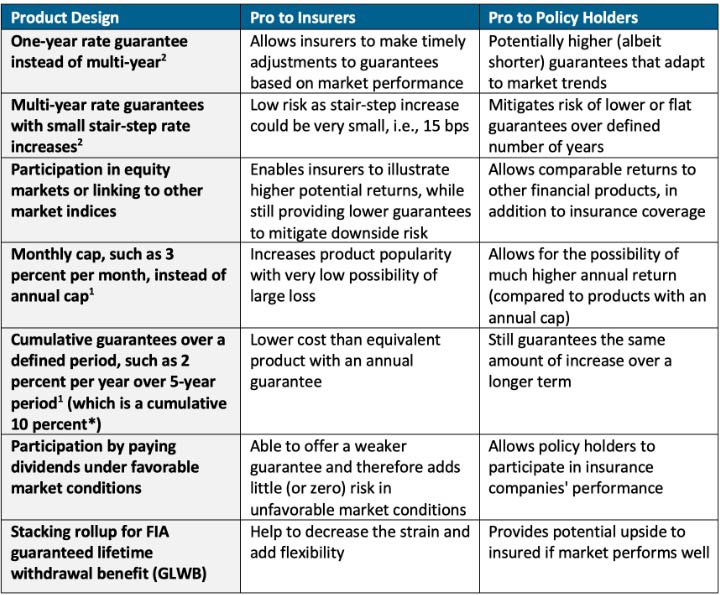

Flexible designs also proved critical to the popularity of certain product offerings and were used to stabilize profitability for insurers from 2003 to 2006, after the 10-year treasury rate dropped from 7 percent to 3 percent and began to slowly increase. Table 2 summarizes some of the flexible features that emerged, which could also work in today’s market.

Table 2

Flexible Product Designs to Promote Sales and Mitigate Interest Risk

* The keyword is “cumulative” as index gains would have to be less than 10 percent at the end of five years for the guarantee in this example to be in the money.

In addition to enhanced flexibility, continued creativity in product designs is essential to boosting sales and helping insurers stand out relative to their competitors. In several economic environments, the creation of new insurance products has historically re-shaped the long-duration insurance market. Examples include the birth of UL in the early 1980s and the introduction of IUL in the early 2000s. More recent creative ideas include combinations of various long-duration products. A particularly successful example is the combination of LTC and life insurance. This design leverages synergies between the two separate products to mitigate inherent risks while providing policyholders with a wide range of benefits including cash value accumulation, a death benefit, and LTC protection.

Lesson 2: Be Mindful of New Money Rate Implications on Portfolio Returns

A key similarity between the current interest rate environment and the environment during 2003 to 2006 is the low but increasing interest rates coupled with increasing equity markets. However, a key difference is that as of 2021 interest rates have been low for 20 years (the 10-year treasury rate has been constantly less than 5 percent). As higher-yield long-term assets have matured, insurers’ portfolio rates have decreased relative to the early 2000s. Even if interest rates continue to rise over the next few years, if the rate of increase remains slow as the Fed intends,[3] insurers’ portfolio rates will likely continue to decrease, stressing profit margins even further.

Carriers will want to be mindful of the potential impact on profitability as they assess potential reactions to the current rising interest rates. In particular, some recommendations for insurers to consider are:

- Be prudent in providing higher credited rates and/or longer guarantees;

- Consider reducing non-guaranteed benefits and costs (e.g., sales representatives’ compensation);and

- Closely monitor product features where profitability is interest sensitive, such as return of premium riders (low interest rates with level premiums may erode profit expectations relative to pricing).

Products such as UL insurance that use a credited rate concept were designed to allow management to maintain a reasonable level of profitability and minimize market value loss on the sale of fixed income by adjusting credited rates to suit moderate interest swings. However, asset earned rates typically lag interest rate fluctuations, depending on the duration of the assets. Although insurers may consider lowering credited rates as a means of generating higher spreads in low interest rate environments, they risk higher lapses and negative cash flows as a result of interest rate volatility. To effectively mitigate this risk, insurers must be mindful of the potential impact to earnings posed by long-duration assets and assess profitability in volatile interest rate scenarios.

Lesson 3: Pay Close Attention to Long-Term Impact and Tail-Risk Scenarios

If we look back further than the last 20 years to the early 1980s, we find another example of a rising interest rate scenario. During that time, short-term interest rates increased significantly but long-term interest rates remained lower than short-term rates. The UL products introduced around that period included a generous long-term investment component (based on market yields) in addition to traditional protection components. To take advantage of higher short-term rates, UL writers in the 1980s reduced the duration of their portfolios by about 10 years.[4] When short-term interest rates dropped materially in the late 1980s, insurers could not generate sufficient earnings to support their high crediting rates. In response, UL writers allocated assets to higher risk investments (e.g., real estate and junk bonds), a strategy that provided excellent returns until a market collapse in the early 1990s.[4]

Ultimately three large life insurers went insolvent with mass UL policy surrenders.[4] The damage of decisions made in the 1980s took 10 years to fully unfold. As long-duration insurance carriers look to take advantage of the current rising interest rate environment, this example serves as a reminder to consider the financial impact of tail-risk scenarios.

Conclusion

While the current rising interest trend may ease stress on the profitability of existing business and new product offerings, it is unlikely to substantially increase insurers’ portfolio rates due to its moderate magnitude. If insurers can gain insights from product designs and features introduced during similar historical interest environments, they may be able to leverage these insights to better position themselves in the current rising interest rate environment.

In particular, focusing on innovative and flexible product features will continue to be essential. When designing or modifying product features, insurers should consider profitability in a wide breadth of interest rate scenarios and be particularly mindful of the impact crediting rates and asset durations will have on earnings.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Yiru Sun, FSA, MAAA, PhD, is a consultant at Oliver Wyman. She can be reached at Eve.Sun@oliverwyman.com.

Stephanie Moench, FSA, MAAA, is a senior consultant at Oliver Wyman. She can be reached at Stephanie.Moench@oliverwyman.com.

Dylan Strother, FSA, MAAA, is a principal at Oliver Wyman. He can be reached at Dylan.Strother@oliverwyman.com.

Christopher Ruscito Lee, is a consultant at Oliver Wyman. He can be reached at Christopher.Ruscitolee@oliverwyman.com.

Jeffrey Mu, FSA, MAAA, is a senior consultant at Oliver Wyman. He can be reached at Jeffrey.Mu@oliverwyman.com.