Actuarial Guideline XLIX (AG49): Past, Present and Future

By Richard Hoffer, Katie van Ryn and Alexander Tall

Product Matters!, June 2023

Earlier this year, the National Association of Insurance Commissioners (NAIC) adopted a “quick fix” to AG49-A, addressing concerns over the state of Indexed Universal Life (IUL) illustration practices. The fix, affectionately (though incorrectly) referred to as “AG49-B” by many, represents the third attempt at creating uniform standards around IUL illustrations.

This article will provide a history of the regulation and recent changes along with numerical examples around the impact of changes in the regulation on illustrated values.

History of AG49

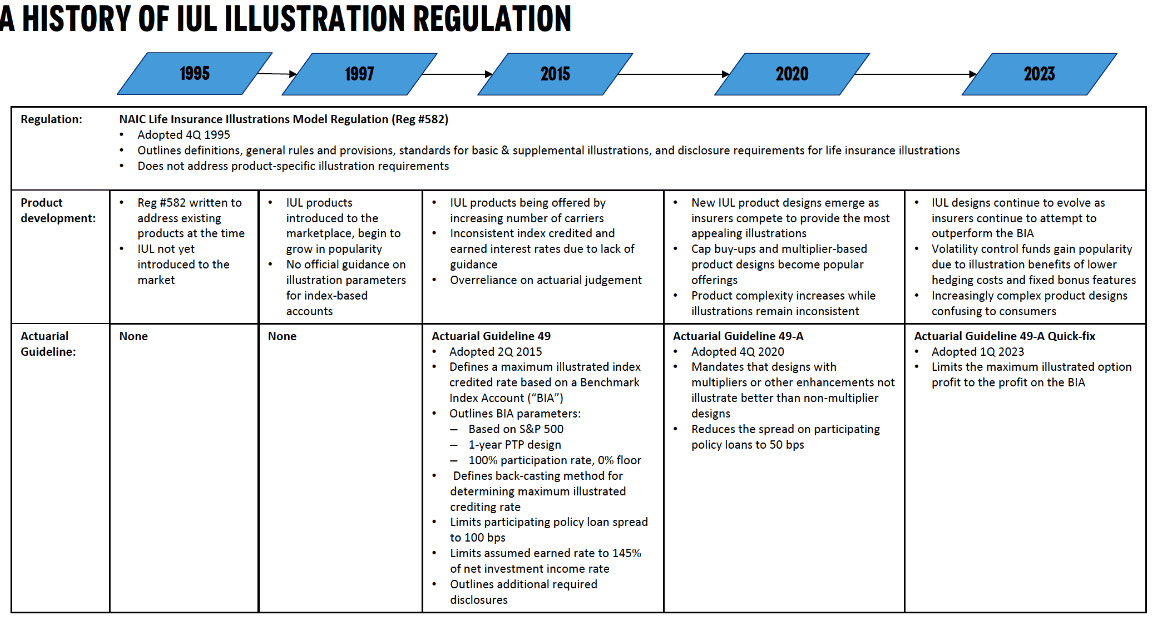

Figure 1 provides a regulatory timeline of IUL illustration requirements. This section contains further commentary on the changes.

Figure 1

Evolution of IUL Illustration Regulation

AG49 Adoption (2015)

Prior to the initial adoption of AG49, the NAIC’s Life Insurance Illustration Model Regulation (#582) provided prevailing requirements for illustration practices. This regulation was developed before the introduction of indexed life insurance products and contained little guidance to use in determining the illustrated rate of index credits, leading to a wide range in practices across the industry.

In 2015, the NAIC’s Life Actuarial Task Force (LATF) developed AG49 with the goals of providing consistency and transparency in customer illustrations for IUL products. It provided guardrails around the maximum illustrated rate of index credits and definitions which increased the consistency of illustrations across carriers.

AG49 Optimization and Regulatory Adjustments

AG49-A Adoption (2020)

Innovations in IUL led to product designs that utilized fixed bonuses; these bonuses were not initially addressed by the regulation. As these product designs grew in popularity, LATF noted that AG49’s goals of consistency and transparency were no longer being met. This led to the 2020 adoption of AG49-A, which imposed further limits on IUL illustrations and additional definitions.

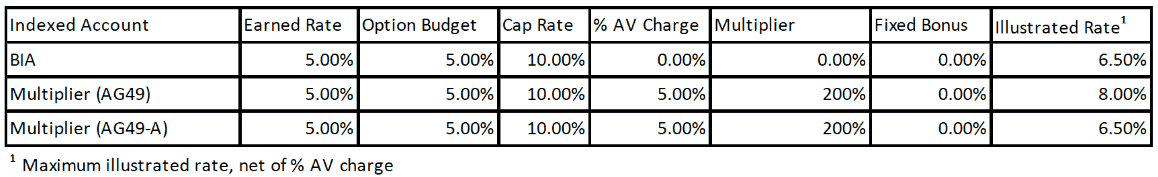

Table 1 provides a simple example on the impact of AG49-A on illustrated values for a product feature that provides a 200% multiplier for index credits in exchange for an account value charge of 5%.

- Prior to AG49-A, multipliers and bonuses were able to illustrate leverage (i.e., index credits in excess of the cost of hedges). In the example a 5.0% account value charge increases the illustrated rate by 6.5% (1.5% after netting out the account value charge).

- AG49-A made it so leverage on bonuses and multipliers could no longer be illustrated. In the example, the 5% account value charge increases the illustrated rate by 5.0% (no impact after netting out the account value charge).

Table 1

AG49-A Example

AG49-A “Quick-Fix” (2023)

Innovation tends to outpace regulation, and once again, developments in product designs not captured by the regulation led to continued inconsistency amongst IUL illustrations. These would eventually lead to the AG49-A quick fix, which applies to IUL policies issued on or after May 1, 2023.

The quick fix was issued in response to the rise in popularity of volatility-controlled indices in IUL product design. Volatility-controlled indices are cheaper to hedge than the BIA due to reduced volatility and historical data limited to recent lower-volatility market periods. The savings realized on option budgets are then reallocated into fixed account bonuses, leading to more favorable illustrations than the BIA without those bonuses.

The quick fix adds section 4ciii, which states the maximum illustrated leverage (option profit) shall be the leverage on the benchmark account. This prevents companies from illustrating benefits from reducing the option budget below that of the BIA. If they spend less on options, their illustrated rate must proportionately decrease as well.

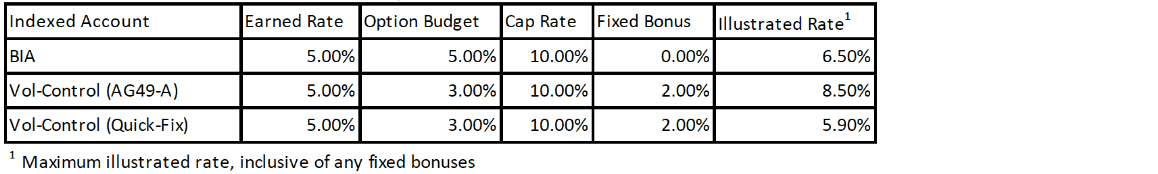

Table 2 provides an example of the impact of the AG49-A quick fix on illustrated values for a product leveraging

- Prior to the AG49-A quick fix, option budget savings due to utilization of volatility-controlled funds could be used to increase the illustrated rate through fixed bonuses. In the example, a 2% option budget savings compared to the BIA increases the illustrated rate on a one-to-one basis from 6.5% to 8.5%.

- The AG49-A quick fix prevents leveraging any option profit above that of the BIA by reducing illustrated option profit by the ratio of the BIA illustrated rate and the BIA option budget. In the example, the 3% option budget is multiplied by 6.5%/5% (the BIA leverage). Even after adding the 2% fixed bonus, the total illustrated rate is 5.9%, slightly lower than that of the BIA.

Table 2

AG49-A “Quick-Fix” Example

Looking Ahead

After the adoption of AG49-A, the popularity of multiplier-based designs quickly diminished; however, the impact of the AG49-A quick fix may not have the same impact to the popularity of volatility-controlled indices. These indices offer benefits to insurers beyond IUL illustrations, as the lower volatility and reduced cost of hedging can still provide writers more stability than traditional indices.

From a regulatory perspective, areas of AG49-A not targeted by the “quick fix” solution are expected to spark continued discussion. Fundamental aspects of the original AG49, such as the 145% cap on earned rates and controversial aspects of the BIA lookback approach, continue to be raised in discussions surrounding the guideline.

As such, consideration has been given to going back a step further and revisiting the original Life Insurance Illustrations Model Regulation (#582); however, given the coverage of Model 582 to other insurance products beyond IUL, it would be a difficult undertaking to cover product-specific issues directly within the model regulation itself.

How quickly, if at all, can we expect to see further changes to illustration rules for IUL in 2023? With other hot topics like the ESG field test and AG 53 taking spotlight at the Spring NAIC meeting, the industry will need to wait and see.

Regardless, insurers will continue to revise product designs and will inevitably encounter situations that were not imagined when the current iteration of AG49 was adopted. While the immediate impact on product design is yet to be realized, IUL continues to be a key offering by carriers in 2023 and we haven’t seen the last of AG49.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Richard Hoffer, FSA, MAAA, is a senior manager with the Actuarial Practice of Oliver Wyman. He can be reached at Richard.Hoffer@OliverWyman.com.

Katie van Ryn, FSA, MAAA, is a senior manager with the Actuarial Practice of Oliver Wyman. She can be reached at Katie.vanRyn@OliverWyman.com.

Alexander Tall, FSA, MAAA, is a manager with the Actuarial Practice of Oliver Wyman. He can be reached at Alexander.Tall@OliverWyman.com.