Recent Developments in Qualified Annuitization

By John Blocher

Product Matters!, August 2024

SECURE 2.0 included provisions related to qualified annuitization under the heading Section 201. Remove Required Minimum Distribution Barriers for Life Annuities. Now allowed are:

- Constantly increasing payments up to but not including 5% per year.

- A lump sum payment that results in a shortening of the payment period with respect to an annuity or a full or partial commutation or accelerates the receipt of annuity payments that are scheduled to be received within the next 12 months, regardless of whether such acceleration shortens the payment period.

- Dividends on participating annuities.

- A final payment upon death that does not exceed the excess of the total payment of the consideration paid for the annuity payments, less the aggregate amount of prior distributions or payments from or under the contract.

These provisions increase flexibility for both insurers and contract owners and increase the attractiveness of qualified annuitization. The first provision enables a potential for some protection against inflation over the potential decades of payments, the second commutation of benefits that may arise from various circumstances, the third allows participating annuities to operate as intended, and the fourth enables life with cash refund.

Anyone with a qualified account, including someone with a qualified annuity, uses IRS-published tables and worksheets to calculate a Required Minimum Distribution (RMD). An annuity contract owner might use systematic withdrawals to satisfy RMD requirements throughout their lifetime, or for several years then annuitize the remainder, or annuitize when they reach the attained age RMDs would start.

The IRS maintains Publication 590-B “Distributions from Individual Retirement Arrangements (IRAs).” Tables important for this discussion:

- Table I covers single life expectancy for use by beneficiaries.

- Table II covers joint life and last survivor expectancy for use by owners whose spouses are more than 10 years younger and are the sole beneficiaries of their IRAs.

- Table III covers unmarried owners, married owners whose spouses aren’t more than 10 years younger, and married owners whose spouses aren’t the sole beneficiaries of their IRAs.

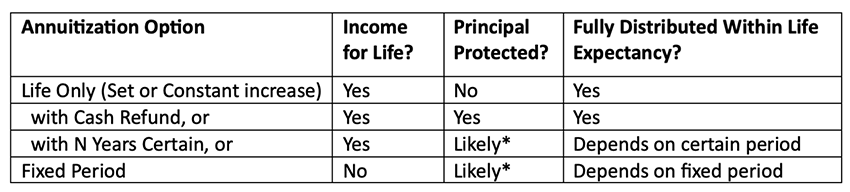

The IRS interest is that the qualified account is fully distributed within the IRS-calculated life expectancy. The IRS wants the taxable income that has been long deferred recognized within the life expectancy. This interest leads to product design implications and limits what may be offered in an annuitization. In Table 1 (below) assume both single and joint payouts are available:

Table 1

Annuitization Basic Options

*Principal protected if sum of guaranteed payments ≥ initial amount annuitized.

At first glance, an insurer might offer Life with Cash Refund to a contract owner interested in principal protection or Life Only when not. Most contract owners want principal protection, however, Life Only is preferable for certain money management strategies where any reduction in payments for principal protection is detrimental.

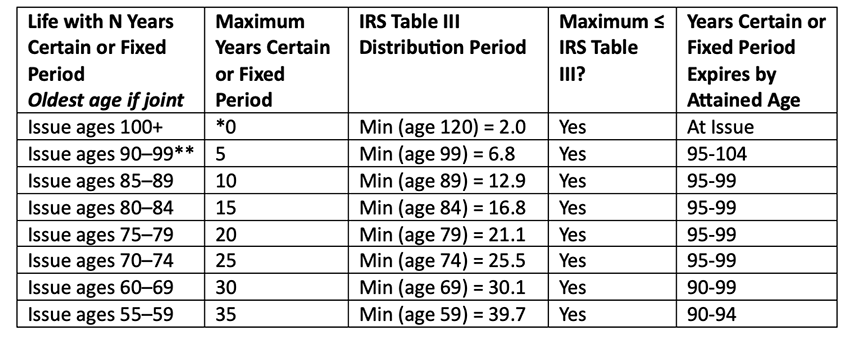

Setting the maximum fixed period and life with N years certain by issue age might be approached by comparing to IRS Table III distribution periods where they are equal to or less than the minimum distribution period within an issue age range where the contract is fully distributed at least as quickly as the shortest distribution period allowed in that age range. Issue age is the age at which qualified annuitization occurs, not the age at which a deferred annuity may have been issued. While maximum issue ages vary by insurer, insurers issue non-life contingent annuitization at a higher maximum issue age than for life contingent annuitization. Consider the following in Table 2 as one potential answer to setting maximum fixed period and life and N years certain:

Table 2

Annuitization Detailed Options Meeting IRS Table III Distribution Period Limits

*When available, Life with 0 Years Certain is Life Only (Life with Cash Refund might be available). Fixed Period = 0 means Fixed Period annuitization is not available.

**For life contingent annuitization a common maximum issue age is 95.

Table 2 is one answer for making the maximum years certain or fixed periods decrease as issue age increases understandable to agents and contract owners while offering partial or complete principal protection and fully distributing the contract within the life expectancy. Other answers are also possible while complying with fully distributing the contract within the life expectancy by comparing against the IRS Table III distribution period. The table is expanded, including annuitization after a disability or any other reason that may occur much earlier than the attained age when regular RMD distributions start. Most insurers would opt to use a comparatively simplified table.

IRS Table III distribution periods originate from IRS Table II where the younger annuitant is exactly 10 years younger (IRS Table II lookup of ages 69 & 59 = 30.1, or ages 74 & 64 = 25.5 same as IRS Table III distribution period for age 74). IRS Table III is built as if the contract owner has a joint annuitant exactly 10 years younger, which is why the IRS life expectancy in the table is considerably longer than a single life expectancy.

Most contract owners who annuitize will annuitize in their 70s at the earliest as RMDs are required to start then. A few contract owners might annuitize earlier due to early or disability retirement. Those who annuitize later likely take RMDs for several years prior to annuitization. It is becoming more common for people to consider their various qualified accounts and annuities as a portfolio and reduce lowest earning qualified assets first through RMDs (based on the entire amount of remaining qualified balances) and highest earning qualified assets last. This frequently results in an annuity being drawn last.

Beneficiaries use IRS Table I and amounts to be received by beneficiaries must be distributed within their single life expectancy. In most cases, there is a further restriction that beneficiary interest be distributed within five years from the date of death(s). There are additional technical rules and limitations about distributions to beneficiaries to consider.

Both “Setting Every Community Up for Retirement Enhancement” (SECURE) acts of 2019 and 2022 amended various laws including laws governing qualified annuitization. Review the law before making any changes to any product used for qualified annuitization. There are provisions in the law beyond this discussion.

Paying attention to qualified annuitization may help position an insurer as qualified annuity contract owners continue toward retirement and decide they want life contingent or non-life contingent annuitization over continued use of RMDs. An insurer with good annuitization options available may attract more qualified annuitization than an insurer lacking some of the options.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

John Blocher, FSA, MAAA, is chief risk officer, vice-president and actuary at Liberty Bankers Insurance Group. He can be reached at john.blocher@lbig.com.