Term Product Innovation: Customizing Death Benefits

By Brian Clark

Product Matters!, November 2024

You can personalize your coffee order at Starbucks. You can customize every detail when purchasing your new car. Auto insurance has always been customized, but today’s technology enables your premium to be tailored to your personal driving habits.

Now, technology advancements make it possible to customize a term life policy’s death benefit. As a result, consumers soon may be able to design a face amount schedule—increasing and/or decreasing—that reflects their expected (or desired) coverage as they age. The possibility creates far-reaching advantages for consumers and carriers. And the relevance is obvious to actuaries responsible for product design and pricing.

Life Insurance Needs vs. Wants

To understand how customizing death benefits can serve consumers, let’s distinguish life insurance wants vs. needs. Some consumers may want life insurance for the tax-advantaged cash value growth. The death benefit is secondary and having a level death benefit serves the purpose. Purchasing a policy to bequest a charity is another example.

Other people buy life insurance to fulfil a financial void created by the insured’s death. They need life insurance to protect those depending on the insured’s income or services, and the coverage needed is dynamic—increasing and decreasing as they move through life stages.

A traditional product with a level death benefit can leave the insured under-protected when the need for coverage increases and over-insured when the need for coverage decreases. Existing strategies for better matching protection to a policyholder’s dynamic needs are neither efficient nor economical. These include swapping policies in and out and choosing optional riders.

A Classic Example: Protecting Future Income

A major reason people buy life insurance is to protect the family from losing the income support of a parent. The buying process often starts with the difficult “How much to buy?” question. Agents, online calculators or articles by financial planners may suggest crude rules of thumb like income multiples or a comprehensive evaluation of current expenditures. Traditional calculators provide a static answer (e.g., here’s the coverage you need) without forecasting future needs.

Suppose a 37-year-old makes $75,000 a year. A traditional calculator might suggest buying $750,000 of coverage (e.g., 10X gross income). This approach ignores income taxes and the portion of income supporting only the insured (both of which reduce the coverage need), as well as potential wage inflation (which increases the coverage need).

Compare this to coverage analysis based on the human value method: projected income after taxes as if the insured lived to a target retirement age while recognizing some of that income supports the insured (e.g., expenses that stop when the insured dies). The key assumptions:

- $75,000 pre-tax annual income

- Protect 55% of gross income (100% less 20% income taxes and 25% insured’s personal expenses)

- Wage inflation of 8% until age 50 then 4% thereafter

- 4% after-tax investment yield on death benefit

Based on these assumptions:

- The current value of this 37-year old’s financial contribution to his family until retirement is $1,870,000.

- Coverage needed is projected to peak at $2,040,000 at age 45, then start declining as shown by the blue curve.

- At age 67 when the insured begins their last year of work, they’ll need $220,000 of coverage (i.e., 55% of their projected annual income at age 67).

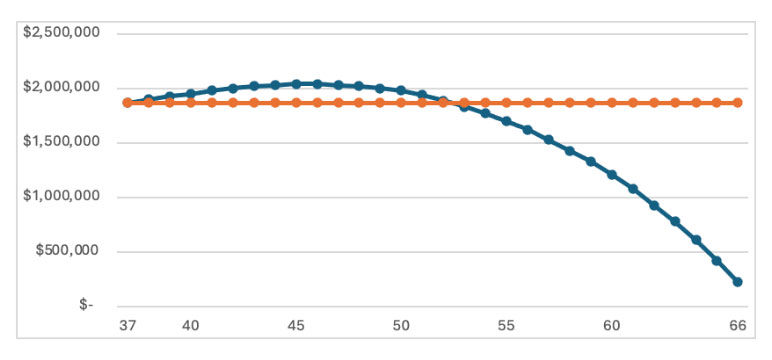

A traditional calculator recommending 10X gross income would cover less than half the value of this individual initially. A traditional calculator using this human value method would recommend $1,870,000 level face amount 30-year term as illustrated in orange. This traditional approach will leave the insured under-protected until age 53 and then increasingly over-insured precisely when the annual cost of mortality is ramping up and the underwriting benefits to the carrier are wearing off (see Figure 1).

Figure 1

Face Amount Comparison: Traditional Level vs. Customized

Unlike the traditional level face-amount product, a policy with a customized face amount that automatically increases and decreases in line with projected needs (and/or wants) as shown by the blue curve, can provide the customer with optimum coverage and cost.

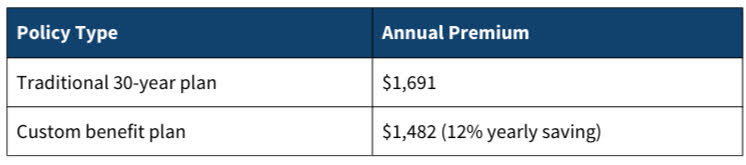

Let’s compare the level annual premium to age 67 for the two benefit plans under the same set of commission rates, expenses, mortality rates for a healthy non-smoker, risk-based capital requirements, and discount rate. The only pricing assumption difference is the expected lapse rates, which it is assumed to be higher for the customized policy when the face amount is lower/decreasing (see Table 1).

Table 1

Annual Premium Comparison: Traditional Level vs. Customized

Helping consumers save 12% ($209) every year, as well as receiving more coverage when they need it most (until age 52), is material to most people—especially since many live paycheck-to-paycheck. Eliminating the unneeded coverage after age 52 drives the overall lower premium and pays for the additional coverage in the early years. A different underwriting class could have significantly different premium savings for the consumer (e.g., 35% saving for smokers).

Protecting future income has different comparisons by issue age. Younger people may see fewer cost-savings versus level face amount coverage but have more protection in their younger years; older issue ages will see greater cost savings with a benefit plan decreasing earlier.

Insurer Considerations for Creating a Customizable Benefit Plan

User Interface

While protecting the insured’s future income is often the major reason for needing life insurance, there are a variety of other categories of which could be considered needs or wants. An insurer’s user interface for a customized benefit plan could be comprehensive and designed with such versatility to include any combination of benefit needs including:

- Future income protection

- Paying off debts

- Funding college tuition

- Supporting elder care for parents

- Paying final expenses

- Paying the income tax liability on inherited IRAs

- Benefits designated for a charity

- And more

A user interface can allow the consumer and agent to “stack” multiple coverage needs and wants, some of which may be rising over time (e.g., tax liability on IRA), remaining level (e.g., flat amount for a charity), decreasing (e.g., mortgage balance), or increasing and then decreasing (e.g., future income as shown in the prior example). The final benefit plan represents the year-by-year sum of the coverages selected.

The benefit creation model could include or exclude projected assets as an offset to the coverage needed, as well as related assumptions such as savings rate, 401(k)/IRA contribution levels, and investment returns.

Current user interface technology enables consumers and/or agents to change any assumption and observe updated projected benefit needs/wants and level premium quotes in real-time. Clearly, the future will be different than the assumptions projected, but consumers already face this situation with traditional level benefit products. A customized benefit policy can deliver the best hope, thus far, of providing the “one-and-done” solution that both consumers and agents prefer.

Actuarial Assumptions and Considerations

Empowering agents and consumers to custom design a benefit plan and get a level premium quote requires special consideration to several key aspects in the product development process.

1. Pricing

The primary consideration is establishing lapse rates based on the shape of the benefit curve, which also have implications for statutory reserving and mortality rates.

Lapse rates: Consideration is given to:

- The reasonable lapse expectation for the new face amount each policy year, possibly influenced by the change in face amount since issue and/or the change from the prior year’s face amount.

- How persistency is affected by customer psychology (i.e., coverage is decreasing, but premium isn’t) or economics (i.e., the value of future death benefits versus the cost of the remaining level premiums).

Statutory reserving: The lapse rates appropriate for setting statutory reserves need to be considered.

Mortality deterioration: Establishing mortality deterioration assumptions may be different than today’s models since lapse rates may be influenced by the customer psychology or economic factors identified above.

2. Product design

Empowering consumers to customize their future coverage requires limits on either the inputs or the net benefit curve to manage the insurer’s risk. Areas of consideration are:

Underwriting requirements: An insurer’s long-term mortality risk is different as the underwriting wears off between a traditional level term policy versus a customized benefit (which will typically be decreasing as retirement age approaches). For example, underwriting requirements may not be the same for a 30-year $1 million term policy versus a custom benefit policy which is $1 million in year one and gradually declines to $100,000 in year 30. Consideration needs to be given to how this is applied to underwriting requirements, if at all.

Nonforfeiture values: Attention needs to be given to establishing minimum face amounts at the end of the level premium period (relative to the prior year’s face amounts) to ensure required cash values are not generated.

Maximum increase in the face amount: A limit on the pre-set increase in the face amount needs to be established, and the underwriting requirements may reflect the maximum face amount ultimately requested in the custom benefit.

Constraints on decreases in face amount: Decreasing face amounts in the early policy years may present a persistency risk that is too high. The benefit calculation algorithm may force an alternative benefit pattern.

Boundaries on the design inputs: Explicit limits on the benefit model inputs such as wage inflation need to be considered.

Minimum and maximum level premium period: With today’s technology, it is possible to allow the customer to select their level premium period, and insurers will need to decide minimum and maximum period allowances and if the limits vary by issue age and shape of the benefit curve.

Living benefits: A popular feature with consumers, consideration should be given to whether the eligible living benefits base amount is linked to the face amount at the time of activation (which can change yearly) or a separate fixed amount independent of the custom death benefit.

3. Policy Administration

The insurer’s policy administration system needs to be able to handle each policy’s unique face amount, the consumer-selected term period, and the premium calculated for that policy.

Conclusion

Enabling consumers and agents to custom design a life insurance benefit plan is a significant departure from cookie cutter, level death benefit policies. Technology barriers prevented the industry from implementing the custom benefit design plan approach and developing the advanced pricing models needed to support it. That is no longer the case. Today’s technology makes it possible and gives insurers the needed capability to price a policy at an individual consumer level. With obstacles removed, now is the time for the industry to consider the idea of these type of personalized term life insurance plans.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Brian Clark, FSA, is the founder and CEO of kmōdo, a life insurance innovation company. Brian can be contacted at brian.clark@kmodo.ai.