Bridging the Gap—Actuarial and IT

By Paul San Valentin, Benjamin Hanley and Nathaniel Delit

Actuarial Technology Today, May 2021

Actuaries and their IT[1] counterparts are required to collaborate more frequently and on more complex projects than ever before. The recent accounting changes (LDTI, IFRS 17, PBR), investor demands for increased transparency, and competitive pressures have led to many insurers undertaking large actuarial and financial transformations. As a result, senior management is challenging their actuarial and IT leaders to develop new processes that use data in new and improved ways. The actuarial and IT functions are being tasked with not only delivering on changes to systems, processes, and data, but also with rethinking how their teams collaborate and interact.

The magnitude and complexity of large-scale actuarial transformation projects has heightened the importance of sharing knowledge and skill sets across actuarial and IT functions. Leadership needs to take deliberate action to increase coordination across both functional teams. These large initiatives and the inherent pressure to deliver, can drive a wedge between actuarial and IT if not managed appropriately. This article addresses the following questions facing insurers in the current environment:

- What are the stages of the IT development process?

- How do the skill sets/roles of actuarial and IT professionals differ? How are they aligned?

- What are key challenges in the way actuarial and IT interact?

- How can insurers “bridge the gap”?

Understanding how to bridge the gap first begins with understanding the development process that most IT teams are familiar with, what each party brings to the table, and the common challenges that arise.

Stages of IT Development

One of the most common frameworks for IT development is the systems development life cycle (SDLC). SDLC is a process for planning, creating, testing, and deploying an information system. Broadly, the SDLC process comprises five mutually dependent stages:[2]

- Planning stage: Estimate costs (including resource planning), assess benefits, and define objectives of the initiative.

- Analysis stage: Draft detailed implementation requirements for the initiative.

- Design stage: Translate the detailed requirements into technical specifications.

- Implementation stage: Develop and build solutions as per the specifications outlined in the analysis/design stage. Testing (including component, integration, and user acceptance testing) of the implementation will also take place in and around this stage.

- Cut-over stage: Industrialize the implementation. Use the newly developed solution and retire the prior process, when prepared.

Industry trends indicate SDLC is being executed through an agile delivery model with the analysis, design, and implementation stages typically carried out in agile sprints. Actuarial involvement has become increasingly important in stages like implementation and cut-over, where historically they have had a smaller role. Similarly, IT professionals have become more engaged in the analysis and design stages in order to understand, translate, and implement requirements. As transformation initiatives have become more complex, it is becoming progressively more important to establish the appropriate blend of roles and responsibilities during each stage of development.

Leveraging Complementary Skill Sets of Actuarial and IT Professionals

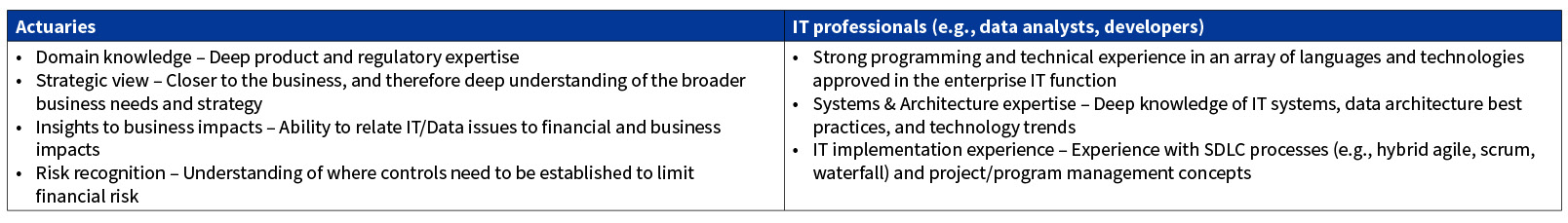

Actuarial and IT professionals share certain skill sets that are complimentary in nature, have an affinity for data, and help organizations derive key business insights. Both professionals apply their domain expertise and problem-solving skills to build business solutions. It is important to recognize that both actuarial and IT professionals possess complementary skill sets critical to the success of transformation initiatives. Figure 1 highlights some of these key skill sets:

Figure 1

Actuarial and IT—Collaborative Skill Sets

Where actuaries tend to understand the “what” and “why,” IT professionals understand the “how.” While actuaries today generally have knowledge of programming or code development, IT professionals understand what it takes to industrialize a specific process and integrate it into approved technologies that comply with enterprise IT architecture standards. Understanding the complementary nature of the differing skill sets and knowledge bases between actuarial and IT is important. Otherwise, it can lead to situations where nonstandard data solutions are being deployed.

Frequent Challenges Facing the Actuarial and IT Functions in Today’s Environment

Let’s take a look at some of the challenges that can drive a wedge between the actuarial and IT functions throughout the SDLC process.

Challenge #1—Insufficient Knowledge of Data and Source Systems

Many of the existing processes that actuarial and IT teams are looking to modernize have been in place for a long time. Knowledge of data, source systems, and their history is often fragmented throughout the organization. This creates unique challenges for the actuarial and IT resources tagged with developing requirements. As a result, the quality of requirements delivered to the IT development team often suffers, increasing the amount of rework activities and therefore adversely affecting timelines. Even worse, knowledge gaps of existing processes or data sources can lead to requirement development stalling out and reverting to the current state process or a manual process.

Challenge #2—Lack of Clearly Defined Roles and Ownership

In most insurance organizations, the chain of command is fairly hierarchical. The actuarial and IT functions typically report up to different executive leaders. Historically, insurers have been able to perform IT implementations by allowing the two functions to operate using existing informal channels. Actuaries were able to work relatively independently with limited IT support; frequently relying on tools or processes that they were familiar with. Due to the increasingly complex and data-intensive nature of many of the regulatory and reporting requirements seen in today’s environment, this is no longer a sustainable approach.

Challenge #3—Competing Priorities

Actuarial and IT professionals frequently have business as usual (BAU) tasks that they are responsible for outside of their responsibilities on special one-time implementation projects. Month-end, quarter-end, and year-end reporting tasks strain actuarial resources during those specific time frames. On large-scale initiatives, capacity constraints often prevent actuaries from investing the necessary time up front to assist in delivering high-quality IT build requirements to developers. It is very difficult to assess the relative value of competing priorities, particularly when faced with new and unfamiliar projects.

Bridging the Gap

Bridging the gap between the actuarial and IT functions can be supported by three key management actions taken prior to the onset of new initiatives.

1. Establishing a Well-defined Operating Model

Changes in optimal behavior require changes in how actuarial and IT operate. Accounting change, emerging technologies, an ever-evolving competitive landscape, and investor demands have led to an increasing number of actuarial and financial transformation projects at many insurers across the world. The forces driving this trend are unlikely to subside in the near future. Establishing or adjusting the current operating model for the actuarial and IT function such that it meets the needs of the current environment will help drive the right behaviors on new projects.

There is not one single operating model that works best for all. However, there are certain components that should be present in every suitable long-term operating model. Firstly, recent experiences have highlighted the importance of having a cross-functional team of actuaries and IT professionals dedicated to handling all actuarial data, systems, and process initiatives. This includes both BAU and one-time transformation projects. This team’s purpose is to deliver across the different phases of the SDLC process. Secondly, a Design Authority comprising actuarial and IT decision-makers should be set up with the purpose of evaluating key design decisions from an end-to-end perspective and ensuring new build requirements meet the business’s needs. The Design Authority provides visibility to higher risk implementation decisions and can be thought of as the “architect” of the ultimate solution. Their direction guides the day-to-day activities of the cross-functional requirements teams. Finally, no operating model is complete without a team leader and project manager (more on this in the following section).

As mentioned above, there are multiple viable approaches to setting up an operating model to support an organization’s transformation efforts. The first step is a management review of the current formal and informal relationships between actuaries, data analysts, and the IT developers. What is the current IT implementation process? Who is in charge? What has worked, and what has not? The answers to these questions differ by organization and influence operating model decisions. A couple of options that are prevalent in the industry include an IT team embedded within the actuarial function, or actuarial resources embedded within the IT function.

The selected operating model depends on what is the best fit in the organization and how stakeholders traditionally interact. The goal is to break down any defense mechanisms between teams, shifting toward a partnership built on joint accountability and trust. Without clearly defined roles and ownership holding teams accountable, insurers have seen breakdowns in relationships between stakeholders caused by the pressure to deliver change. Efforts to communicate progress and roadblocks to senior management can be disjointed where formal channels are not established. A clear delineation of roles, responsibilities, and expectations between all stakeholders is necessary to facilitate the level of coordination and interaction required for successful transformation initiatives.

2. Identifying a Dedicated Leader

Systems implementation projects require a singular leader whose sole focus and top priority is delivery. This designated team leader is responsible for managing the cross-functional team of actuaries and IT professionals defined in the operating model. They act as the liaison between the Design Authority, actuarial (valuation, modeling), IT function, finance, senior management and other key stakeholders. The team leader understands stakeholder timelines, has a constant pulse on project activities, and holds the requisite industry knowledge to be effective.

An ideal candidate must have significant experience with managing IT implementations as well as familiarity with the actuarial function. On large scale end-to-end actuarial and finance transformation projects, the team leader should identify project manager(s) to support him or her. A project manager’s tasks may include facilitating issue resolution, identifying dependencies, producing status reports for stakeholders, and defining key performance indicators for the project. Even during times where the team is operating in a BAU capacity, the team leader can benefit from having the support of a project manager.

Identifying a singular team leader responsible for maintaining the relationships and coordinating between the Design Authority, actuarial, IT, and senior management will enhance transparency, increase accountability, and reduce the frictions between teams. Their objective is keeping all stakeholders working in harmony with one another. One risk to avoid is having the identified leader get pulled into various competing initiatives, which can stifle progress. A focused leader is accessible to all stakeholders, effectively communicating progress and development hurdles as they arise.

3. Building Core Competencies/Cross-training Talent

As the push to modernize outdated insurance processes continues, the skill sets of actuaries and IT need to become more integrated. The complexity and frequency of change require actuarial members of the cross-functional team to develop IT expertise. Similarly, the IT professionals need to develop their knowledge of actuarial/insurance. Cross-training talent will increase team cohesion and reduce dependencies on one another throughout the SDLC process.

IT Core Competency Transfers to Actuaries

- Build knowledge of IT systems, data architecture best practices, and technology trends.

- Learn the skills necessary to produce unambiguous, development-ready requirements.

- Establish a fundamental appreciation for the rigors involved in the implementation process from requirement development to testing. Understanding the precision involved in industrializing a process.

- Develop testing capabilities and testing standards necessary to ensure requirements are met.

- Build knowledge of requisite project management development approaches (e.g., agile, scrum, waterfall).

- Develop an understanding of IT and project management terminologies and colloquialisms (e.g., code drop, scrum, etc.).

Actuarial Core Competency Transfers to IT Professionals

- Develop an understanding of the underlying intentions behind the actuarial processes (i.e., the “why”). For example, explaining new accounting standards may provide pertinent background information that informs requirement development or answers development questions before they arise.

- Educate IT professionals on insurance products, industry trends, and characteristics impacting data and processes.

- Build knowledge of the actuarial modeling and/or financial reporting process.

- Develop insights into the materiality of different business lines and their impact on strategic decision-making and corresponding controls development in the IT development process.

- Develop an understanding of actuarial terminologies and colloquialisms (e.g., unlocking, DAC).

The following are potential activities that the teams can employ to build core competencies and cross-train resources:

- On-the-job collaboration—The simplest approach. Expand skill sets by having an actuarial and IT resource work jointly on key activities, developing expertise through everyday tasks.

- Knowledge transfer sessions—Identify individuals with important skill sets or the knowledge base required by the cross-functional team and hold scheduled sessions to share knowledge and answer questions.

- Industry learning opportunities—Leverage actuarial and IT professional organizations, web-based learnings, or third-party consultants to provide education on key actuarial and IT concepts.

Developing a cross-trained team bridges the knowledge gap between actuarial and IT professionals. Outcomes of these activities include increased agility, increased motivation and morale, higher quality collaboration, and increased resiliency against the continuously evolving actuarial and IT landscapes. These internal capabilities can be harnessed on future actuarial IT implementation efforts.

Conclusion

Successfully “bridging the gap” requires these three critical management actions to be executed in unison, with the strategy communicated broadly to all key stakeholders. Recognition that changes to both formal and informal relationships in your organization may be necessary and will help drive desired behaviors between actuarial and IT stakeholders. Leadership must bring the teams together and create an environment where there is a shared focus toward a common goal. Developing dual-threat actuarial data/IT resources on an integrated team can help build the competencies needed to deliver on actuarial transformation projects in both the present and future.

The views expressed in this article are solely the views of Paul San Valentin, Benjamin Hanley, and Nathaniel Delit and do not necessarily represent the views of Ernst & Young LLP or other member firms of the global EY organization, or the Society of Actuaries. The information presented has not been verified for accuracy or completeness by Ernst & Young LLP and should not be construed as legal, tax, or accounting advice. Readers should seek the advice of their own professional advisors when evaluating the information.

Paul San Valentin, FSA, MAAA, is a senior manager at Ernst & Young LLP. He can be reached at paul.sanvalentin@ey.com

Benjamin Hanley, FSA, MAAA, is a senior at Ernst & Young LLP. He can be reached at ben.hanley@ey.com.

Nathaniel Delit is a senior at Ernst & Young LLP. He can be reached at nathaniel.c.delit1@ey.com.