Electronic Health Records in the Age of Coronavirus: The Covid Crisis Has Accelerated Real-World Adoption

By James Timmins

Actuarial Technology Today, October 2021

As with most things in the world, early 2020 seems like ancient history. In late January last year, I had just finished a white paper for the SOA[1], stating confidently that Electronic Health Records, or EHRs, were not likely to have a major impact for several years amid slow adoption by executives—with significant strategic differences among stakeholders and little signs of compromise.

Then in February came COVID-19, and the urgent need to move rapidly to telemedicine for both COVID and non-COVID afflictions. Government authorities moved quickly to relax restrictions on interstate telehealth, allowing payer coverage for the transfer of sensitive material online and over mobile networks—including Facebook Messenger, Apple Facetime, and Zoom.[2] Although not permanent while a public health emergency, this created an unexpected precedent for interoperability, the Holy Grail of seamless cross-talk of health data between HIPAA-regulated IT systems.

How will these events accelerate data availability for actuaries? Let’s explore the changes from the crisis:

The Tens of Billions of Dollars Invested by the Private and Public Sectors in EHR Will Come to Fruition Sooner

No longer are health care executives and vendors complaining about deadlines (Accenture survey, 2019).[3] They are instead now forced to share health outcome data over generally available IT systems to avoid still-possible liability threats for not responding appropriately under pandemic conditions.

Frontline health care workers and the public have also been aroused by the current system’s lack of real-time EHR access, as fatalities were highlighted in the media from both COVID and from afflictions—both physical and mental—that were exacerbated by lack of personal access to medical expertise. As per Medicare’s goal, EHRs should “make (medical) information available instantly and securely to authorized users.”[4]

New Large Non-EHR Players Have Heightened Importance—From the Biotech and Consumer IT Sectors

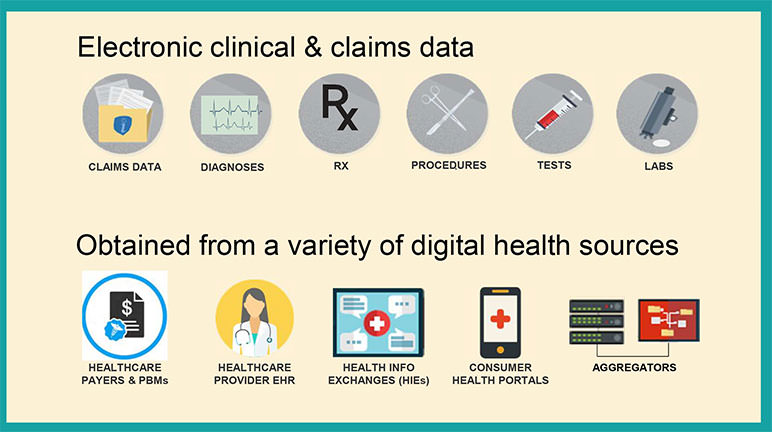

Apple and Google had already begun providing consumer apps and non-HIPAA platforms for sharing health data. During the crisis, they joined forces to assist in de-identified contact tracing with EHRs not far behind. Zoom and other secure videoconference tools were allowed for virtual visits. A second tier of new players such as genomics (e.g., 23andMe) and disease-specific portals are also gathering EHR-quality data. These non-EHR tech sectors initiatives may thus offer actuaries possibilities for data aggregation alliances, apart from EHR vendors. (see Figure 1)

Figure 1

Electronic Clinical and Claims Data

©2020 RGA. All rights reserved.

Sources of EHR data. For actuaries, expanded use of claims data, plus innovator health portals (e.g., genomics companies), offer a potentially rich source for health data mining, aggregation, and analysis.

Consensus on the Use of Fast Health Care Interoperability Resources (FHIR) for EHR Standardization

This nonprofit-driven IT Interoperability Standard is growing in popularity and government endorsement, and should be monitored closely by actuarial groups. The latest version (2019), FHIR 4, includes an application programming interface (API) for exchanging EHR data that include images, financial accounts, and decision support. The government is further accelerating APIs for both consumers and payers.[5] As one example, if a health care provider can prove decision support allowed a provider to follow evidence-based guidelines, this may allow a payor to waive costly administrative programs that are in place to help reduce unnecessary or low-value clinical services (e.g., utilization management/payment integrity programs).

Patient Access API platforms—Now Being Enforced by CMS as of July 2021

CMS is now enforcing implementation of Patient Access API implementation by providers, as of July 2021[6]. One hundred percent patient EHR access could now allow creative aggregation opportunities for actuaries, by consumer volunteerism. Consumers can now fully access their EHRs and offer by simple disclosure to any third party—disease portals, genomics companies, others—actual information from their health records. Partnering with these third parties outside of EHR vendors, along with parallel consumer incentive programs, may now be an option for actuaries. Figure 2 maps the regulated (left), versus the newer unregulated (right) domains for EHR information.

Figure 2

Regulated Versus Unregulated Domains for EHR Information

Genomics and epigenetics companies may be particularly attractive platforms, due to many consumers’ strong interest in parallel of genetic impacts on themselves and their families. Epic—a leading EHR vendor—is also moving in this direction with nine health care systems, labeling the program (COSMOS) as “medical research.”[7]

COVID-19 Related Claims Data—Tip of a Looming Iceberg?

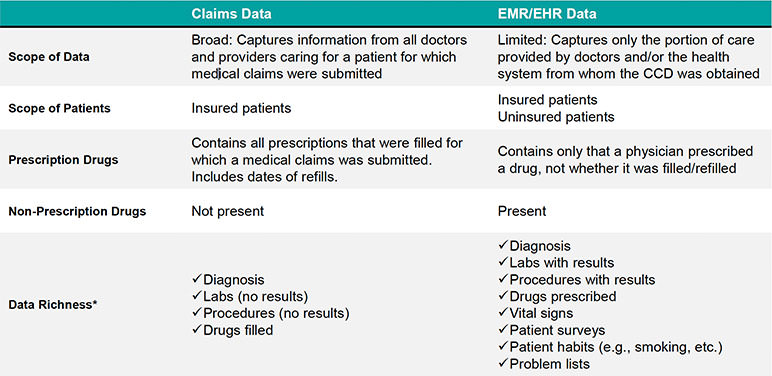

Much remains unknown about the secondary effects of COVID-19, beyond respiratory failure and immune system overload. However, there is likely a significant spike in claims related to COVID-19 building within the insurance industry. It may be important for the insurance industry to monitor these secondary afflictions, at minimum through the claims process (see Figure 3), although the best digital approach to obtain that evolving health information remains unclear at this time. Genomics and epigenetic vulnerability could be a rich data area here.

Figure 3

Claims Versus EMR/EHR Data

If insureds would be willing (or mandated) to provide their immunization history to payors, directly or indirectly, this could be a significant asset for actuaries in evaluating this ongoing phenomenon. Claims data also can include non-prescription drug information, which could provide additional clues of COVID exposure.

EHR Implementation Will Continue to Meet Resistance and Inaccuracy Claims—Also Driving Alternative Data Sourcing

My report found that many doctors and nurses eschew the EHR systems they have been forced to adopt, and the AMA has cited it as a prime reason for burnout.[8] In contrast, AMA has welcomed the loosening of restrictions for telemedicine since the beginning of the pandemic and are lobbying for keeping them.[9]

Opportunities for Actuaries in the Post-COVID World

In summary, as seen above, new non-traditional routes to data aggregation appear to be opening for actuaries—due to COVID-19, consumer freedom to finally access and potentially share their EHRs, and by partnering with the biotech and consumer tech sectors.

Below are also some additional suggested areas where actuaries could benefit, if EHRs become more accessible:

- Waiving of requirements for an underwriting physical for life insurance policies, thereby reducing administrative costs (or sending a nurse to do a physical).

- Use of lab results/vital signs in underwriting.

- Measuring in aggregate how health insurer programs will affect member health, e.g., through proxy metrics such as lab results/vital signs. For instance, will a senior savings program for insulin improve A1C results? Does statin adherence improve cholesterol in reality? Can epigenetic monitoring correlate to lung cancer risk? And importantly, will these have any measurable downstream impact on a health insurer’s financials?

- Reducing adverse events to save a health insurer—or any payor including the government—on claims cost.

- Allowance of stratification of high performing doctors/clinic facilities to prompt higher quality of care.

- Using volunteered genomic EHRs, alert insureds to risky behaviors avoidance of which would increase their quality of life and avoid expensive health care events.

As with any crisis, the COVID-19 global pandemic may bring in positive behavioral changes for the industry.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

James Timmins, MBA, is a health care consultant for the SOA. He can be contacted at jim@breakthroughdevelopment.com.