The Society of Actuaries Research Institute Retirement Risk Surveys are an important part of its retirement research, offering continuity and a framework used for much of the research of the post-retirement risk effort. These surveys have been conducted biennially since 2001, by telephone until 2011, and online since 2013—the SOA partnered with Deloitte for the 2024 survey the 12th in the series—which was sponsored by the FINRA Investor Education Foundation and SOA Retirement Section. The survey series includes individuals from age 45–80, and offers insights about how people think about planning, what concerns they have, and how they manage during retirement. The surveys are important to retirement system stakeholders because they offer insightful perspectives into what the users of the system do and how they think vs. what advisors and plan sponsors think they should.

The 2024 survey results were summarized in two formal reports: Family Support and Retirement[1] and Technology and Retirement[2]. The surveys blend information from questions that have been repeated from previous iterations of the survey and selected areas of special topical relevance in each survey. Figure 1 shows the special topics of interest in the 2024 survey. The goals of this survey were to gain insights into recent societal developments, see how behaviors have changed since the last iteration, gather thoughts on developing trends including technology and AI, how family obligations and caregiving interact with managing retirement, and the link of recent inflation to retirement saving and planning.

Note on methodology: The survey data was weighted to reflect the U.S. population, which included 2,012 Americans, made up of 1,007 pre-retirees and 1,005 retirees. The survey sample included an overweighting for racial and ethnic groups. A minimum of 200 respondents were in each of three groups: Black/African American, Hispanic and Asian American. The oversight group advising completion of the survey represents multiple disciplines, thereby bringing well-rounded and diverse perspectives to the questions. The Deloitte research team brought together actuaries and other professionals, which also added further perspectives.

Figure 1

Areas of Focus in 2024 Retirement Risk Survey

In this article, we will discuss the key findings from the survey in each of the six focus areas as well as major trends. Overall, we observed many of the same trends as in prior reports. There are major differences in risk perspectives of survey respondents by the income level and pre-retirees are generally more concerned about risks than retirees.

To help interpret the results by income level, we categorize the findings into three primary income bands.

- Lowest income group—this group is likely managing paycheck to paycheck and may have unpaid debt. They are most concerned about risks and are unlikely to be able to save for retirement until they are stabilized. This group depends primarily on government benefits for retirement security. They may also own a house which provides a retirement resource. The SOA’s generations surveys[3] offer additional insight into how groups manage by generation and income.

- Middle income group—this group is at middle level concern about risk and should be proactively organizing a retirement savings program. When they are able to start saving, their focus should be on how to invest and on emergency funds. This group often gets a substantial part of their retirement security from the value of their house as well as government benefits. Other assets are often modest.

- Highest income group—they are the most likely to have significant retirement savings and a significant emergency fund. Key issues for them are how much they save, how they invest to build assets, and how they use the assets during retirement.

Note that the respondents in these three groups are in different financial positions in regard to retirement savings and their answers to the risk survey series reflect this. This is a finding throughout the series of surveys.

Results by Area of Focus

Family Members/Family Structure

This year’s survey explored the influence that family members have on retirement preparation—both financially and emotionally. The data for this survey included a range of family situations and demographics, leading to new insights. The survey explored issues such as:

- Respondents’ household living situations.

- The frequency and amount of financial support provided to family members for pre-retirees and retirees, segmented by income and family situation.

Prior consumer research from the SOA showed that family is a frequent source of help when adult children, parents and other family members need help, but that there is little planning for this increased support. This can be very difficult at the time when help is needed because it can be disruptive to work, personal responsibilities, and financially.

The research team found the responses to be generally consistent with their expectations, but with some exceptions:

- Counterintuitively, those with higher income responded that familial costs had a higher level of influence on retirement savings as compared to those with lower incomes. A possible explanation is that the higher income group are saving the most, so spending more has more impact on savings.

- When it comes to the impact on retirement savings, children and stepchildren under 18 and grandchildren over 18 have the highest reported influence on pre-retirees’ retirement savings. These situations are less common, so the impact for the family may be felt more.

- The majority of both pre-retirees and retirees expect minimal to no financial support from family. However, pre-retirees report slightly higher expected percentages of moderate to significant financial support.

Members of the group overseeing the survey for the SOA commented that this valuable research offered new insights as well as raised more questions. Additional research analyzing specific case-studies could provide more real-world examples of how certain types of families deal with some of the financial and non-financial situations explored. Some potential topics for further study include:

- How do those in the “sandwich generation”[4] deal with retirement planning when there are financial and familial pressures from both children and parents/in-laws?

- How do retirement planning patterns differ for those who started families younger versus those waiting later in life to have children?

- What is the significance of race/ethnicity/culture on the level of influence family can have when it comes to retirement planning, savings, and/or timing?

- What unique issues do blended families and families of choice face in retirement planning and preparedness? What unique issues do solo agers face in retirement planning?

These are subjects which may be better explored through personal essays, case studies, or in-depth interviews because individual situations can be vastly different. A report that highlights findings from the survey related to family was published in 2025.

Technology and Artificial Intelligence (AI)

AI is a new subject area for this type of SOA consumer research. Both technology and AI are changing rapidly, and important to monitor. The survey explored the roles that technology and AI play in personal financial and retirement planning, and related perceived risks associated with those technological platforms. The survey findings included the use of technology and AI by age group; how it is used for retirement planning and finances; and perceptions about risks of using technology.

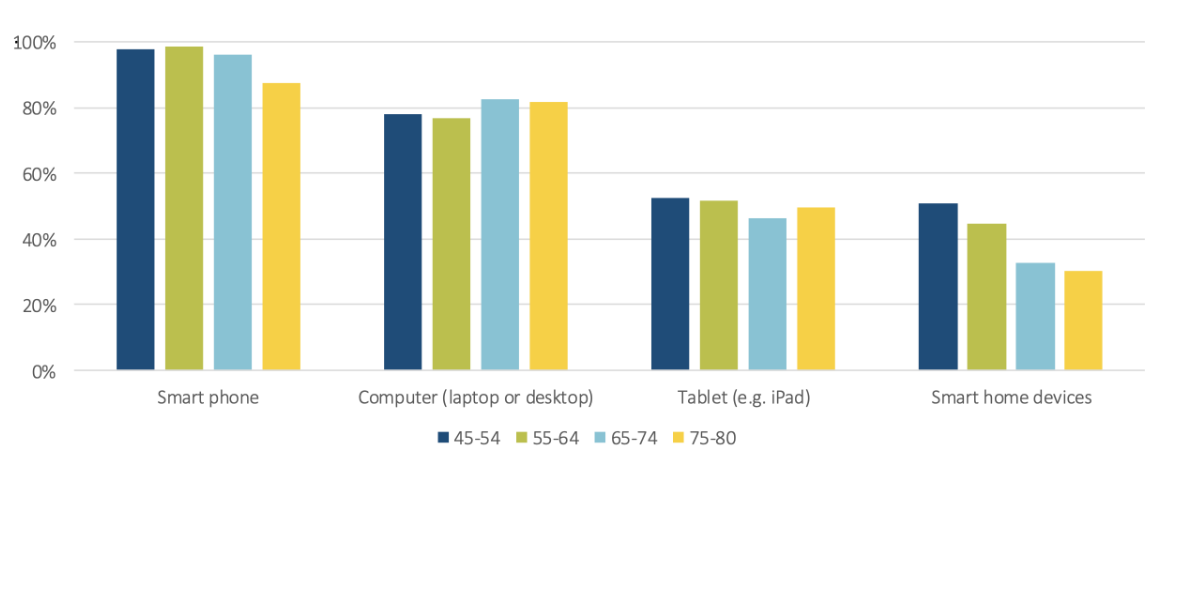

The survey results indicated smart phones are the most commonly used devices and there was minimal difference in use by age as reported by survey respondents. There was also minimal variation in computer and tablet usage by age, while smart home device use was notably more prominent at younger ages.

My own observation based on personal experience in a senior community is that use varies greatly by individual. In addition, knowing who uses devices does not provide insight into how many applications they might use and how up-to-date their skills and technology are. Some of the people I know are very skilled users of technology, whereas others are very limited in their use of technology.

The following figures provide some key data.

Figure 2

General Technology Use by Age Band From 2024 Retirement Risk Survey

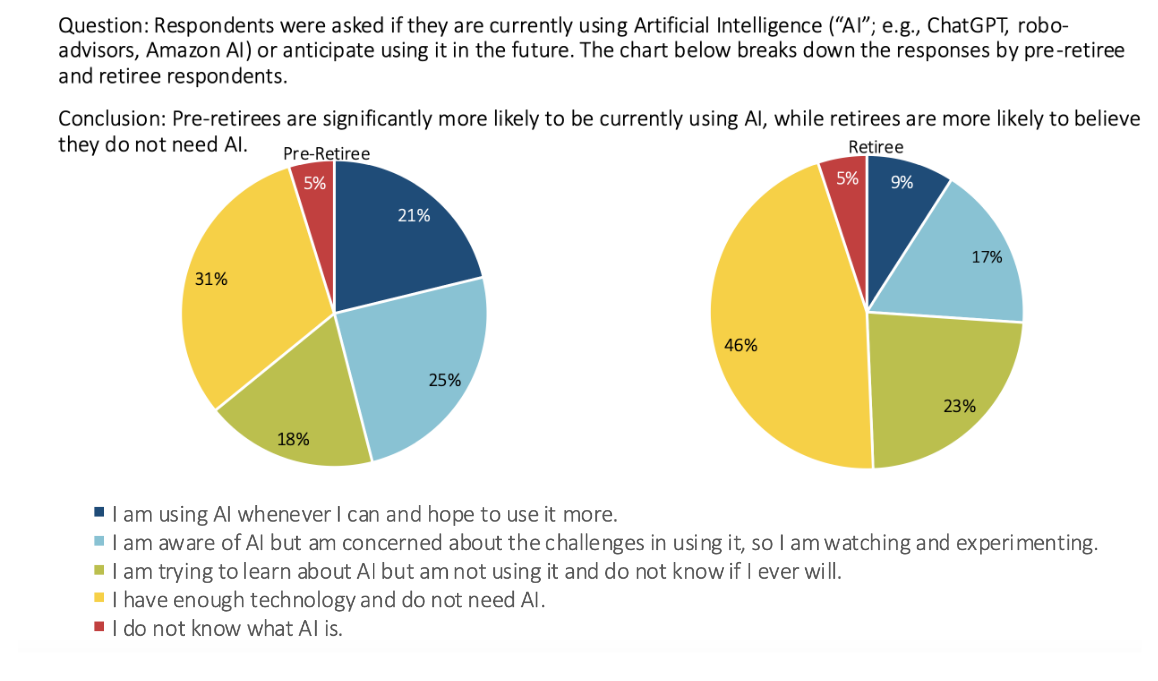

Figure 3

General Use of Artificial Intelligence by Pre-Retiree and Retiree

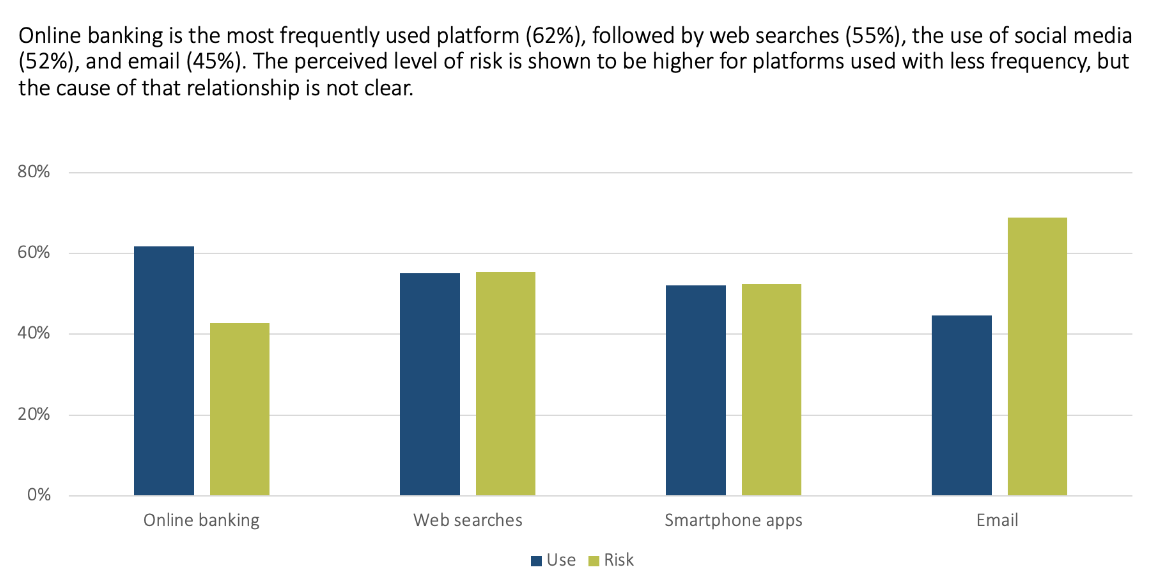

Figure 4

Financial / Retirement Planning – Technology Use vs. Perceived Risk (Pre-Retirees and Retirees combined)

This survey just begins to scratch the surface in our exploration of what people say about how technology plays a role in preparing for and living in retirement, but there are many opportunities for further research in this area, including:

- More research can be done regarding how manufacturers and service providers can support retirees as they deal with changes in cognition, dexterity, hearing, and other functional abilities where they may face difficulty in appropriately using technology. I am very concerned that these systems are challenging and frustrating to use and grow more difficult for people with limitations.

- With the increasing usage of AI, more research could be beneficial into understanding its prevalence of use by retirees and how they can safeguard themselves whether they realize they are using AI or not.

- This survey was only able to gather data on perceived risks, but it may be beneficial to study actual frequency and severity of negative outcomes to help individuals be more aware and prepared to handle the risks of using various forms of technology.

- Research can be done exploring ways to educate people on best practices for proactive fraud prevention and increasing accessibility to various forms of protection.

Inflation

The survey explored how inflation affected retirement savings and how people were living in retirement. It focused on life changes made to adjust for inflation now and what was expected, both for pre-retirees and retirees, and by income level. Inflation has been a major concern, one of the top three risks throughout the entire series of risk surveys. This survey explored in greater depth how inflation affected people.

In this iteration of the survey, the majority of pre-retirees and retirees are concerned about inflation’s impact on their retirement savings as in previous iterations of the survey, with the highest levels among lower-income retirees (over 60% of both pre-retirees and retirees). This is the group living with the lowest margin. Those at lower income levels are more likely to make changes with a more immediate impact to address concerns about current or future inflation, such as changes in housing or attempts to find new or additional work. This group is also most likely to be food or housing-insecure. Furthermore, this group is unlikely to have much money invested, so inflation affects primarily the spending side of the equation.

Those at higher income levels are more likely to make long-term changes regarding concerns about inflation, suggesting immediate financial needs are not as great of a concern. This group is more likely to have invested assets and not living where week-to-week budget balancing is a significant issue.

Most pre-retiree respondents say they are actively reviewing budgets and cutting discretionary expenses to stay prepared due to potential future inflation.

Retirement Income and Spending

This topic has been covered previously, with some questions repeated in all iterations of the survey. The questions explore how pre-retirees and retirees manage income sources and spending and how their experiences differ by income level. The results in these areas show continuity with prior survey iterations.

One of the major findings in the series, repeated here, is that people retire earlier than expected. The factors influencing early retirement decisions include changes in health status, job satisfaction, job loss, and achievement of retirement savings goals. The top reasons indicated in the survey for retiring earlier than expected were changes in health status (31%), job dissatisfaction (25%) and job loss (20%).

Shocks and Unexpected Events

This topic has been covered in the SOA’s consumer research several times (in focus groups and surveys). It provides insight into financial preparedness for potential expenses and how retirees and pre-retirees manage unexpected financial challenges. The results generally show that respondents plan for their regular spending, but often not for expected but irregular spending. For example, they know they pay for health insurance premiums, but they are unlikely to plan for out-of-pocket expenses. It looks at the overall financial preparedness and the impact of unexpected expenses (like health care, long-term care, dental/medical costs, and major home repairs). Both the 2024 and 2021 surveys explored preparation for emerging financial challenges, including inflation, market downturns, family emergencies, and disruptive events (such as pandemics or climate change) that may impact retirement security.

The 2024 survey results indicated some variation in financial preparedness from 2021 to 2024, but responses for being “Not Too Prepared” or “Not At All Prepared" were generally stable. Pre-retirees were much more likely to have experienced financial challenges in 2024 compared to 2021. Retirees reported being better equipped to manage reduced spending due to financial challenges than pre-retirees.

Caregiving

The 2024 iteration examined how many respondents had employers who had recognized the need to support caregivers, and how well prepared they were for caregiving. Flexible work arrangements are the top-ranked priority benefit among pre-retirees, followed by caregiver support groups. Lower income employees were more likely to have problems with caregiver benefits. The survey did not explore working conditions, but in general, lower income employees are more likely to have rigid work schedules or even work schedules where they do not find out their schedule until a few days before, and where shifts can be cancelled if there is not enough business.

The topics discussed in the survey can be expanded for further research into how caregiving needs affect retirement. Research areas may include:

- Better modeling of the lifetime loss of income from caregiving.

- The impact on segments of the population who have unmet caregiving needs from their employers.

- Increasing education and awareness of ways to prepare for future personal caregiving needs as the current working population approaches retirement.

- Challenges that are linked to caregiving and are likely to increase due to an aging population and an increasing shortage of caregivers.

Conclusion

The 2024 survey provides valuable information for many retirement system stakeholders. It enables individuals to see how their views stack up with those of the general public, and to gain insight into where there are gaps in their personal planning. Another benefit of the survey is that it can help financial service companies and employee benefit sponsors consider how they can better meet the needs of the people they serve. Stakeholders are encouraged to read the full report of the survey for a complete look at all of the findings.

References:

Prior years Retirement Risk Surveys: All reports are available on the same page as the 2024 survey, under “Previous Retirement Risk Surveys”

Analysis of prior work by topic

This article is provided for informational and educational purposes only. Neither the Society of Actuaries nor the respective authors’ employers make any endorsement, representation or guarantee with regard to any content, and disclaim any liability in connection with the use or misuse of any information provided herein. This article should not be construed as professional or financial advice. Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Anna Rappaport, FSA, MAAA, is president of Anna Rappaport Consulting. She can be reached at Anna.rappaport@gmail.com.

[1] https://www.soa.org/globalassets/assets/files/resources/research-report/2025/2025-retirement-risk-family-report-v2.pdf

[2] https://www.soa.org/globalassets/assets/files/resources/research-report/2025/2025-soa-retire-risk-tech-report.pdf

[3] https://www.soa.org/resources/research-reports/2021/generations-survey/

[4] Middle-aged adults in their 40s & 50s who care for both their growing children and their aging parents.