Drake Risk and Insurance Workshop on Catastrophe Risk

By Yiqing Chen and Kevin Croft

Expanding Horizons, June 2021

We live in a rapidly changing environment marked by the occurrence of all kinds of catastrophes with rising frequency and increasing severity. Besides the devastating consequences of the ongoing COVID-19 pandemic, insurers face the wide-ranging impacts of climate change. All these catastrophes have created great challenges for academics, practitioners and regulators. The Drake Risk and Insurance Workshop on Catastrophe Risk, which took place virtually on February 19, 2021, served as a platform for academic researchers and industry practitioners to exchange research ideas and disseminate recent advances in catastrophe insurance and related fields. The workshop was hosted by the School of Actuarial Science & Risk Management in the College of Business and Public Administration at Drake University, Des Moines, Iowa.

It was a long journey to a successful event. The original plan was to hold the workshop onsite on May 1, 2020. At the time everything was ready to go (invited speakers, budget and logistics), the outbreak of the pandemic forced a postponement. The organizing committee had numerous meetings, speculated on all possibilities and communicated with the committed invited speakers multiple times. Committee members finally decided to run the workshop in a virtual mode and add a COVID-19 roundtable session. Due to the format change, participants were asked to register but were not charged a fee to attend.

Once the virtual mode was decided on and the date fixed, the workshop website was updated and a list of important dates for abstract submissions, notices of acceptance and online registration were released. Various approaches to advertise the workshop were used including the Society of Actuaries’ (SOA’s) public listservs (thanks to the SOA for providing this service); the Casualty Actuarial Society’s (CAS’s) website and calendar of events; and other social media including LinkedIn, Facebook, Twitter and Instagram.

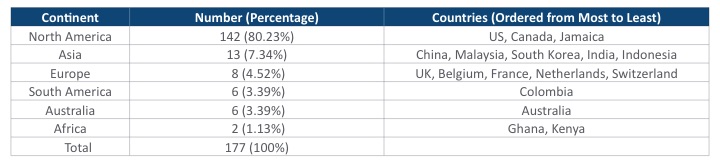

As shown in Table 1, the workshop attracted 177 academics and practitioners from 17 countries across six continents. Attendees included 91 academics from 46 universities and 86 industry practitioners from 50 companies and government departments. There were 18 research talks (divided into 10 invited and 8 contributed) and a roundtable session. All talks and speeches, delivered by either academics or industry practitioners, focused on the thematic topic of catastrophe risk.

Table 1

Breakdown of Workshop Attendance by Continent and Country

It was a busy but exciting day. The workshop started at 8:30 AM when Dean Alejandro Hernandez of Drake’s College of Business & Public Administration (home to Drake’s actuarial science program) delivered a welcome speech chaired by Dr. Toby White. The scientific program started at 8:50 AM with the first invited talk by Professor Edward (Jed) Frees from the University of Wisconsin-Madison and Australian National University. The program continued with the following sessions (in chronological order):

- Invited session titled “Modeling Insurance Risk” (Chair: Lisa Gardner, Eastern Kentucky University)

- Invited session titled “Flood Risk” (Chair: Fan Yang, University of Waterloo)

- Roundtable session titled “COVID-19 Is Changing the Insurance Industry,” with panelists Brad Buchanan, Mandy Jia, Meyer T. Lehman, Brent Mardis, Tom Mulrooney (Chair: Kevin Croft, Drake University)

- Contributed parallel session titled “Valuation and Managing Insurance Risk” (Chair: Jianxi Su, Purdue University)

- Contributed parallel session titled “Catastrophe Risk in a Changing World” (Chair: Tianxiang Shi, Temple University)

- Invited session titled “Emerging Risks” (Chair: Yi Lu, Simon Fraser University)

After multiple invited talks, the roundtable session was held at noon with five panelists who are industry practitioners or government advisors, chaired by Kevin Croft, Director of the Kelley Center for Insurance Innovation. The roundtable panelists shared their organizations’ experiences during the pandemic. Positively, each organization had a smooth transition to remote working. IMT Insurance and Sammons Financial Group both commented that their firms had unfortunately built new office space that coincided closely with the pandemic. EMC Insurance noted that as work from home increased, the definition of a workers compensation claim became blurred. The financial impact to each organization was mixed. UnityPoint felt the greatest impact as a health care provider. Expenses were elevated due to an increased need for personal protective equipment, while high profit margin elective procedures declined. The State of Iowa’s revenue was impacted in offsetting ways. Federal farm subsidies and Paycheck Protection Program (PPP) loans to small businesses supported revenues, while sales and use taxes declined in urban areas. Insureds have benefited from extended unemployment benefits and direct government payments and have not needed to utilize withdrawals from annuity policies as is often experienced during economic downturns.

After two parallel contributed sessions and another invited session, the workshop’s last invited talk was given by Professor Qihe Tang from the University of New South Wales. It ended at 5:30 PM with a closing speech delivered by Susan Watson, Director of the School of Actuarial Science & Risk Management. In the closing moment, the organizers started to cheer each other for the great success of the workshop.

That success was determined by the high quality of the contributing speakers and panelists comprising both academics and practitioners. The 10 invited speakers (in alphabetical order) were:

- Tatyana Bolton, R Street

- Mathieu Boudreault, Université du Québec à Montréal (UQAM)

- Vytaras Brazauskas, University of Wisconsin-Milwaukee

- Runhuan Feng, University of Illinois at Urbana-Champaign

- Edward W. (Jed) Frees, University of Wisconsin-Madison and Australian National University

- Steve Kolk, Kolkulations LLC

- Scott Stransky, AIR Worldwide, Verisk Cyber Solutions

- Qihe Tang, University of New South Wales

- Gabriele Villarini, University of Iowa

- Maochao Xu, Illinois State University

The prestigious peer-reviewed journal Risks has launched a special issue titled “Catastrophe Risk and Insurance” in conjunction with this workshop in recognition of the importance of the topic and the scientific value of the talks. Dr. Yiqing Chen, Chair of the Organizing Committee, is co-editing this special issue together with Dr. Tim Boonen from the Universiteit van Amsterdam.

The success of the workshop represents one of the greatest events in the actuarial science community worldwide during the current pandemic. “Drake University’s location in Des Moines, a city which is home to more than 80 insurance companies, puts us in a unique position to host a day of conversations on the impact of catastrophes on the industry,” said Alejandro Hernandez. “The large number of attendees made it clear to us that the topic of how to respond to the increasing frequency and severity of catastrophes resonated across business schools, and government and business communities.”

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Yiqing Chen, PhD, is Associate Professor of Actuarial Science and Robert W. Stein Professor of Enterprise Risk Management at Drake University. She can be reached at yiqing.chen@drake.edu.

Kevin Croft, ASA, CFA, is EMC Associate Professor of Practice and Director of the Kelley Center for Insurance Innovation, Drake University. He can be reached at kevin.croft@drake.edu.