Fully Reinsured Business: Are the Financial Implications Neutralized, Or Not?

By Tianchi (Paul) Zhang and Ryan Kiefer

The Financial Reporter, November 2024

Reinsurance is utilized by companies for a variety of strategic purposes. Among the key uses of reinsurance in the industry is risk profile management. A company looking to reduce risk related to a specific product, for example, may fully cede the associated risk through a reinsurance deal. While this effectively mitigates the risk associated with the business, it may not fully immunize the earnings impact from the reinsured block of business. Even when business is fully ceded, earnings discrepancies may still appear on financial statements between direct and ceded businesses under both long-duration targeted improvements (LDTI) and International Financial Reporting Standards (IFRS) accounting frameworks, resulting in non-zero net earnings.

This article will focus on two primary factors contributing to earnings discrepancies between the direct and ceded side of fully ceded business: The ceding commission structure and the implementation of a reinsurance treaty after the issuance of the direct business. The impact of the ceding commission structure will be demonstrated with an example, assuming the block is ceded at the time of issue. The earnings discrepancy arising from post-issuance reinsurance treaties is influenced by multiple drivers, including the ceding commission, which will be examined in the next section.

Additional factors beyond these two cases will be qualitatively discussed at the end of the article.

Ceding Commission Structure

A ceding commission is a fee paid by a reinsurer to cover various expenses, including acquisition, maintenance and administrative costs, and may also reflect the reinsurance premium that the direct company pays for risk transfer. This commission emerges from negotiations between the two parties.

While ceding commissions are generally paid at the onset of the reinsurance agreement, IFRS 17 and LDTI stipulate that the impact on earnings should be distributed over subsequent periods as further discussed below.

LDTI

LDTI requires that no immediate earnings or losses be recognized at the start of a reinsurance treaty (ASC 044-40-25-33). Any ceding commission excess or shortfall relative to the expenses paid by the direct writer is recorded and amortized through the “cost of reinsurance.” This balance is amortized over the life of the contract, with the amortized amount reflected in the earnings statement (ASC 944-605-35-14).

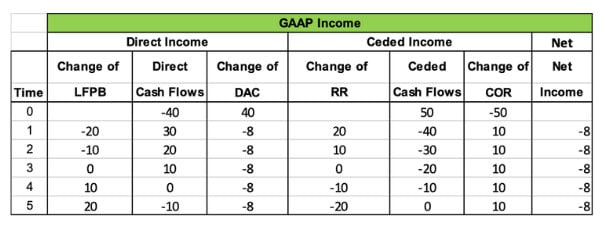

For example, consider a uniform block of five-year term business that is fully reinsured at issuance, with the displayed expense, benefit and premium cash flow pattern, as shown in Table 1.[1] The direct writer incurs $40 in acquisition costs at the policy issue date and a $10 maintenance expense recurring every year. As a reimbursement, the direct writer receives a $50 ceding commission from the reinsurer,which reimburse the ceding maintenance expenses but exclude the expenses incurred for sales. [2] We also assume a straight-line pattern for DAC amortization.

Since the business is fully reinsured, premium and benefits are identical between direct and ceded.[3] The differences arise from the expenses including acquisition costs and maintenance expenses on the direct business and the ceding commission on the ceded business.

Table 1

Cash Flows for LDTI Example

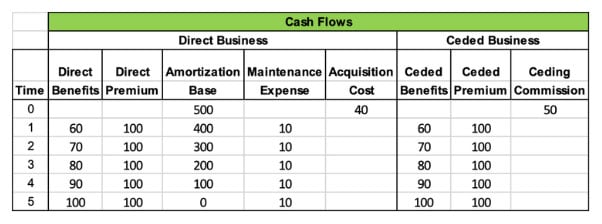

Although the ceding commission is paid at the treaty's inception, such a payment is not immediately reflected in the income statement. Instead, a cost of reinsurance balance is established as mentioned above. Consequently, despite identical premium and benefits between direct and ceded, the direct writer’s income is not neutralized. In the illustrative example in Table 1, the negotiated ceded commission is $50, which is not sufficient to cover the acquisition costs and maintenance expenses, which total $90. That $40 difference is recognized as an $8 loss each year over five years, as shown in Tables 2 and 3.[4]

Table 2

Balance for LDTI Example

IFRS 17

Paragraph 38 of IFRS 17 stipulates that no gains should be recognized at the start date of a reporting unit. Consequently, the initial contractual service margin (CSM) is calculated as the negative sum of the best estimated liability (BEL) and the risk adjustment (RA). Differences in the CSM arise due to variations between expenses (both acquisition and maintenance) on the direct side and the ceding commissions on the ceded side. These variations in CSM balances lead to different amortization amounts in future periods, resulting in discrepancies in earnings.

Table 4

Cash Flows for IFRS 17 Example

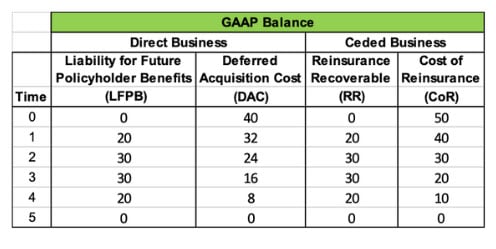

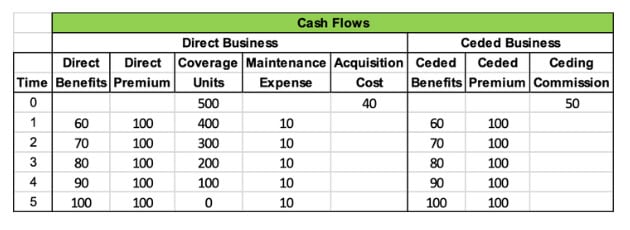

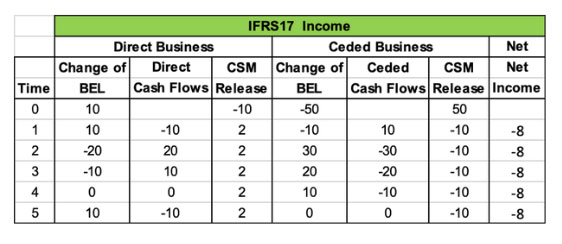

For the business scenario previously discussed for LDTI (with the same simplifications applying), as shown in Table 4, at the initial measurement, CSM differs between direct and ceded due to the differences between direct expenses and ceding commissions. At subsequent measurements, by assuming no actual-to-expected difference, change of BEL offsets with current period cash flow for both direct and ceded business. However, CSM is calculated by rolling forward from the previous period. Since the starting CSM balances for direct and ceded contracts are different by $40, the amortized amounts differ, resulting in an $8 loss in earnings in later periods, as shown in Tables 5 and 6.[5]

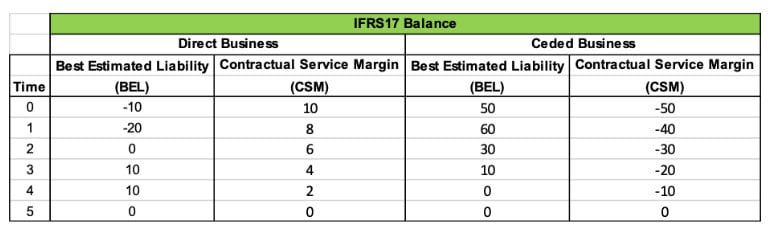

Table 5

Balance for IFRS 17 Example

Table 6

Income for IFRS 17 Example

Block Treaty

A Block Treaty is a reinsurance agreement that covers in-force business. Direct writers may experience non-zero go forward earnings on a net basis after reinsuring their existing business via a block treaty. This financial result is influenced by several factors, which vary depending on the applicable accounting standards, as outlined below.

LDTI

Block treaties commonly include a ceding commission paid by the reinsurer and assets transferred from the cedant to the reinsurer. The above example demonstrates the need for a cost of reinsurance balance to account for mismatches between the assets transferred, the expenses incurred by the cedant, and the ceding commission to ensure there is no day 1 gain or loss as required by GAAP. For a block treaty, the day 1 premium may differ (not proportional to the direct premium) from the actual ceded benefit, which creates a balance that must be deferred and amortized as a cost of reinsurance.

A block treaty adds an additional layer of complexity related to the calculation and subsequent release of the liability future policyholder benefits (LFPB) balance. The net premium method used in the calculation of the direct LFPB requires a net premium ratio (NPR) calculated at the direct issue date (or transition) for direct business or at the time the reinsurance treaty is entered into for the ceded LFPB. Additionally, the discount rate used for direct calculations is required to be the upper medium rate (or locked-in transition rate) at the time of issue for the direct business, or for the reinsurance recoverable calculation, the upper medium rate at the time of the reinsurance treaty. The locked-in upper medium rate for the ceded LFPB is the same as the “current rate” used to generate the direct LFPB balance that includes the OCI impact. There is no OCI impact on day 1 for the ceded balances.

Take an example of a block of direct business, issued with a locked-in rate of 4%. A year later, rates have risen to 5%. The direct LFPB and reinsurance recoverable, despite using the same assumptions in cash flow projections, as required by the accounting guidance, will have a 1% difference in discounting. Plus, the different inception date contributes the varying cash flows between direct and ceded business. These differences will be unwound through net income over time and will result in differences in income recognition between the direct and ceded business[6].

IFRS 17

IFRS 17 mandates that the BEL and RA be calculated prospectively, considering only future cash flows post-valuation date. Assuming identical cash flow projections for both direct and ceded contracts, it is expected that BEL and RA will largely offset each other between direct and ceded business, with perhaps maintenance expense mismatch causing some, often immaterial, differences between the direct and ceded calculations for these balances.

In contrast, the calculation of the CSM differs, necessitating that companies carry forward the balance from the previous period, considering accrued interest and amortization. For a block treaty, the reinsurance premium paid (i.e., the ceding commission less the assets transferred by the direct writer) is a key driver that determines the initial ceded CSM. This balance can be materially different from the direct CSM. Additionally, similar to LDTI, IFRS 17 mandates the use of a locked-in rate for CSM interest accretion. The different inception dates lead to different starting balances and CSM interest accretion rates between the direct and ceded business. This results in different patterns of release into income, which can result in earnings differences between direct and ceded business.

Other Factors Driven by Applicable Accounting Standards

In addition to the common factors mentioned above, there are specific factors unique to each standard that may also contribute to mismatches between the direct and ceded business:

- Cohorts & Groupings (IFRS 17 & LDTI): Both standards offer companies a degree of flexibility in determining the cohorts and groupings for reinsurance contracts. Depending on the company's policy decisions, the ceded cohorts may or may not align with the direct cohorts, particularly when a reinsurance arrangement covers only a portion of the direct cohort, potentially leading to earnings discrepancies at the granular level.

- Non-Performance Risk (IFRS 17): IFRS 17 requires companies to create a liability balance specifically for the risk of non-fulfillment of treaty obligations by a reinsurance company. This particular balance applies solely to ceded business and is not present in direct business. Fluctuations in this liability balance can affect the earnings of ceded reporting units, leading to discrepancies in earnings.

- Contract Boundary Considerations (IFRS 17): For a contemporaneous reinsurance deal, cession cash flows associated with future new business and subject to the reinsurance will be included in the contract boundary determination on the ceded side. However, such cash flows will not be included on the direct side.

- VFA Measurement Approach (IFRS 17): IFRS 17 offers two measurement approaches for long-duration contracts: The general measurement model (GMM) and the variable fee approach (VFA). It specifies that ceded business cannot be accounted for using the VFA approach. Consequently, a company may use VFA for direct business and GMM for ceded business. This discrepancy in measurement approaches can lead to earnings discrepancies due to accounting model differences. For instance, impacts from financial risk updates are absorbed by CSM for the direct business under the VFA approach whereas they would be reported as Profit & Loss (P&L) in the ceded business where the GMM approach is adopted. This variation in treatment leads to P&L being reported only for the ceded group, resulting in earnings discrepancies. While IFRS 17 allows companies to reclassify CSM to P&L through reinsurance risk mitigation to reduce these differences, some residual discrepancies may still persist, causing inconsistencies in earnings. Similarly, reinsurance agreements that are short duration in nature may result in the direct side valuation using GMM while the ceded calculation may be eligible for the premium allocation approach (PAA).

- Credit Spread for Market Risk Benefit (LDTI): LDTI requires companies to include credit spreads in the discount rates used for calculating market risk benefits. However, credit spreads differ between direct and ceded cases—the direct spread quantifies the bankruptcy risk of the company itself, while the ceded spread quantifies the bankruptcy risk of the reinsurance company. This difference in credit spreads leads to varying discount rates between direct and ceded cases, which in turn can result in non-zero earnings.

Conclusion

In conclusion, the phenomenon of non-zero net earnings in fully reinsured businesses is influenced by a complex interplay of factors under both IFRS 17 and LDTI standards. Despite the initial expectation of neutral earnings post-reinsurance, various elements introduce discrepancies that affect financial outcomes. These factors ensure that even when risks are transferred, the financial statements reflect non-zero earnings due to the structured handling of commissions, the timing of treaty inception, and the application of different accounting rules for direct and ceded business.

While the accounting impact may not be of primary concern when evaluating a reinsurance transaction, understanding these nuances is crucial for accurately interpreting the financial health and risk management strategies of insurance entities. This insight not only aids in regulatory compliance but also enhances strategic decision-making by highlighting the underlying causes of earnings variations in fully reinsured business scenarios.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of Deloitte Consulting LLP or any of the global Deloitte network of member firms and are not necessarily those of the Society of Actuaries, or the newsletter editors.

Tianchi (Paul) Zhang, FSA, MAAA, is a manager at Deloitte. He can be reached at tianczhang@deloitte.com.

Ryan Kiefer,ASA, MAAA, is a senior manager at Deloitte. He can be reached at rkiefer@deloitte.com.

Endnotes

[1] For the purposes of clarity, the example assumes that all benefits, premiums and maintenance expense are paid at the end of each year. Additionally, the time value of money is not considered in this scenario.

[2] For the ceding commission, the portion that represent recovery of acquisition costs shall reduce applicate unamortized acquisition cost balance while the rest will flow into Cost of Reinsurance. For clarify purpose, the ceding commission reimburse the maintenance expense only and exclude recovery of acquisition in this example.

[3] Typically, the reinsurer does not provide ongoing reimbursement for maintenance expenses. Instead, these expenses are paid upfront as part of the ceding commission at the beginning of the treaty and are factored into the initial setup of the Cost of Reinsurance balance.

[4] The example has been simplified by assuming no investment income, matching actual cash flows with expected ones, and no assumption unlocking.

[5] To simplify the illustration, risk adjustment is not included in this example. In practice, risk adjustment is expected to even out between direct and ceded, assuming the reinsurer’s non-performance risk is insignificant.

[6] This article is focusing on the day one impact of a block treaty and associated impacts to income. This article does not explore the ongoing updates for future discount rate updates and the misalignment associated with the impact to OCI for block treaties.