Biosimilars, Part 4: The Financial Impact

By Gregory Warren and Tony Pistilli

Health Watch, November 2023

This article has been edited and updated since its original publication on the Axene Health Partners website.

As we discussed in Part 3 of this article, the extent of the financial impact of the coming wave of biosimilars is not yet fully known, but there are trends we can follow that help predict what this change will look like. We know biosimilar uptake is key to driving savings, but it can take a while to ramp up and become material. Biosimilars increase competition, and there will be a lot of opportunity through the “big event” (launches of biosimilars for Humira) to drive competition to an extent that we really haven’t seen with previous biosimilars. So, let’s dive into what drives the financial impact of these pharmaceuticals.

Accelerating Savings from Biosimilars

Savings from biosimilars have accelerated significantly in the past few years. There have been a number of relatively recent biosimilar launches that can help to shape our expectations of the financial impact that could result from this year’s big event.

Although it can take a while for savings to ramp up in markets with biosimilars, in 2020 and 2021 the quarterly savings due to biosimilars have grown to where they now exceed $2 billion according to Amgen’s analysis of market data in their Biosimilar Report (see page 15).

Biosimilar Uptake Pace is Critical

The pace of the biosimilar uptake curve is a critical driver of savings resulting from biosimilars (see Amgen Biosimilar Report, page 14). The oldest biosimilar (Filgrastim), launched in 2015, had a longer and more gradual pace, giving its uptake curve a flatter shape. It has ultimately achieved 78 percent uptake, which is very substantial, but it took many years to get there.

The next biosimilar on the market (Infliximab) has also had a flatter uptake curve; as of 2021, it had still only reached 26 percent uptake since its launch in 2017. The next two biosimilars—Pegfilgrastim and ESA, both launched in 2018—have had modestly steeper uptake curves than Infliximab but had still reached uptake rates of only 37 percent and 30 percent, respectively, by 2021.

The more recent biosimilar launches (Bevacizumab, Rituximab and Trastuzumab) have shown steeper, more promising uptake curves that give strengthening hope to the financial impact we might expect from the coming wave of biosimilars. We can also observe that oncology products sometimes have quicker uptake than non-oncology products.

Biosimilar Competition Drives Price Declines

As biosimilar uptake accelerates, prices for both the reference product and its biosimilars drop sharply due to the intensifying competition. The “Average Sales Prices” (ASPs) of biosimilars, which are net of rebates for those products that pay rebates, are decreasing at a compound annual growth rate (CAGR) of 9–24 percent while the ASPs of most reference products are decreasing at a CAGR of 4–21 percent.

When there are more biosimilars for a reference product, there is more opportunity for competition to accelerate the drop in average sales price. Where there are fewer biosimilars, it can be more difficult for those that exist to gain uptake traction. With 2023’s big event of the Humira biosimilar launch, there will be a huge opportunity for biosimilar uptake with so many biosimilars entering the market. Thus, the opportunity for even faster, steeper price declines is greater than what we’ve seen from biosimilars in the past.

Biosimilar Cost Savings Sensitivities

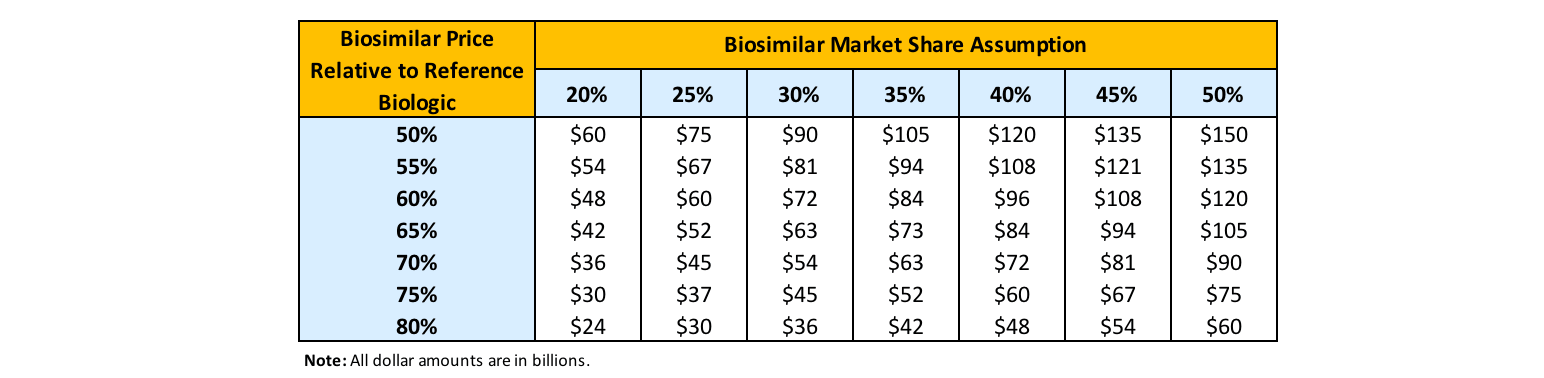

Biosimilar uptake (or market share assumption) and biosimilar (and therefore reference product) price declines due to competition are the two most important factors driving biosimilar cost savings. Total 10-year biosimilar cost savings estimates ranged from as low as $24 billion up to $150 billion in a RAND study (Figure 1).[1]

Figure 1

Sensitivity Analysis Results: 10-Year Biosimilar Cost Savings

Source: Andrew W. Mulcahy, Jakub P. Hlavaka and Spencer R. Case, “Biosimilar Cost Savings in the United States,” RAND Health Quarterly 7, no. 4 (2018): 3, https://www.rand.org/pubs/periodicals/health-quarterly/issues/v7/n4/03.html.

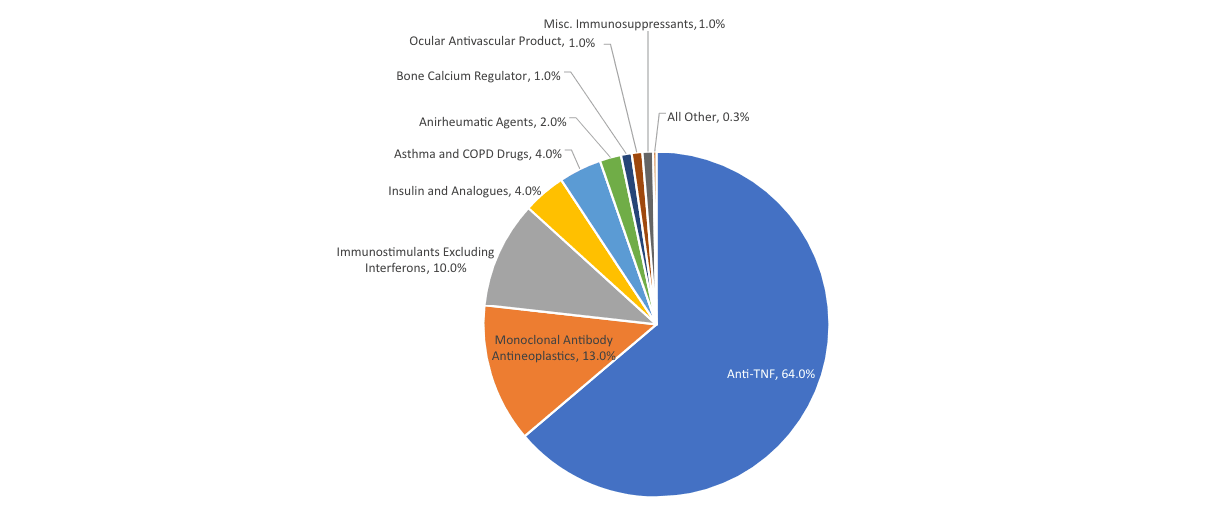

The same study estimated the portion of savings coming from each of several different biologic classes (Figure 2).

Figure 2

Estimated Cost Savings by Biologic Class

Source: Andrew W. Mulcahy, Jakub P. Hlavaka and Spencer R. Case, “Biosimilar Cost Savings in the United States,” RAND Health Quarterly 7, no. 4 (2018): 3, https://www.rand.org/pubs/periodicals/health-quarterly/issues/v7/n4/03.html.

The Anti-TNF (anti–tumor necrosis factor) products are the various reference products and biosimilars competing with Humira. So the launch of Humira biosimilars, and the related biosimilar uptake and price competition that will result over the next few years, are expected to comprise about 64 percent of the total biosimilar savings.

Summary

It will take a couple years for us to see what the full financial impact of the Humira biosimilar launches will be. But we will get leading indicators as we track the biosimilar uptake curve and related average sales price declines of Humira and each of its biosimilars and compare them to the same curves for other biosimilar launches in the recent past. Ultimately the financial impact of this big event could comprise half or more of the total financial impact of the coming wave of biosimilars over the next 10 years. It won’t be long until we have a good idea what the total financial impact could be.

In Parts 5 and 6 of this article (coming in the January 2024 issue), we will review how maximizing adoption of biosimilars by pharmacies and payers will be key to cost savings and how payers’ decisions in particular will be made.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Gregory Warren, FSA, MAAA, FCA, is a partner and consulting actuary at Axene Health Partners. Greg can be reached at greg.warren@axenehp.com.

Tony Pistilli, FSA, MAAA, FCA, CERA, CPC is a consulting actuary at Axene Health Partners. Tony can be reached at tony.pistilli@axenehp.com.