Coinsurance as a Capital Optimization Tool in Korea: Attracting Increased External Capital Through Alignment with Global Practices

By Dean Kerr, Seong-Weon Park, Katie van Ryn, and Yiru Sun

International News, July 2021

Increasing the range of permitted coinsurance structures in the Korean marketplace would benefit the Korean life insurance industry by attracting more external capital and align more closely with global coinsurance norms.

Background

In 2020, the Korean insurance regulator, Financial Services Commission (FSC), introduced a coinsurance structure allowing for full risk transfer—including investment risk, interest rate risk, insurance risk, and policyholder lapse risk—as a permitted practice. Expanding use of coinsurance in the Korean insurance market brings a suite of potential benefits to Korean insurance companies including increased financial flexibility, options to improve policyholder protection and shareholder value through optimization of business strategies. As such, FSC’s initiative and intention to introduce coinsurance opportunities to the market is commendable.

Realization of the above benefits is dependent on whether coinsurance structures meet key objectives of both ceding companies and reinsurers and entice external capital providers to offer risk transfer solutions to Korean insurers. More detailed guidelines, clarification of regulations pertaining to permissible coinsurance transactions among participants and alignment with global norms will encourage execution of coinsurance transactions.

After reviewing Korea’s permitted coinsurance structure with reinsurance premium deferral (RPD)[1], we note that two important aspects of the current regulation require further clarification to ensure consistency with global coinsurance practices: 1) ceding companies’ ability to achieve full risk transfer, especially investment and interest rate risks, to third parties and 2) reinsurers’ available business actions to restructure their overall investment and ALM strategies.

The above considerations are not unique to the Korean market, but constitute common issues faced by coinsurance transactions across a range of jurisdictions, leading to the evolution of different types of coinsurance structures in the U.S. and other insurance markets.

In this article, we review economic risk transfer under the Korean RPD structure with an illustrative case study and propose potential amendments to the RPD structure based on typical U.S. coinsurance funds withheld structures.

Economic Risk Transfer Under Current Korean Coinsurance Structures

Current Korean regulation permits two coinsurance structures, designed with the intention of providing full risk transfer solutions to ceding companies, as described below:

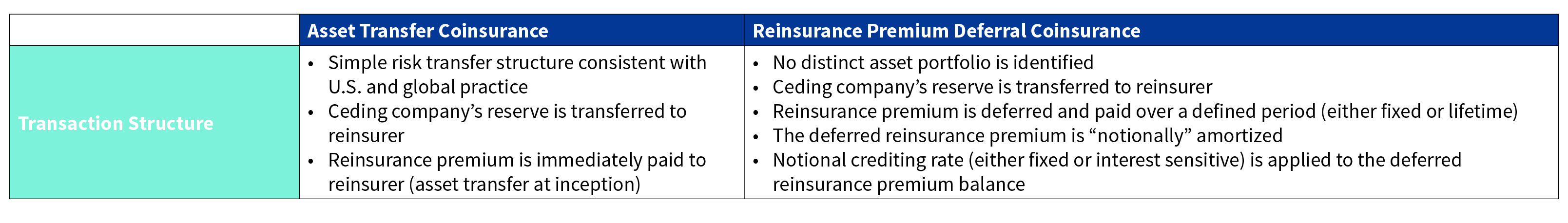

Table 1

Current Coinsurance Structures Permitted by Korean Regulation

Under current Korean regulation, for most Korean life insurance products, both structures satisfy “insurance risk transfer” because the insurance benefit ratio would be higher than 10 percent[2]. However, our economic risk analysis indicates the risk positions of the asset transfer structure and the RPD structure to be quite different, which impacts both the ceding company’s long-term economic position and level of capital released from a coinsurance transaction.

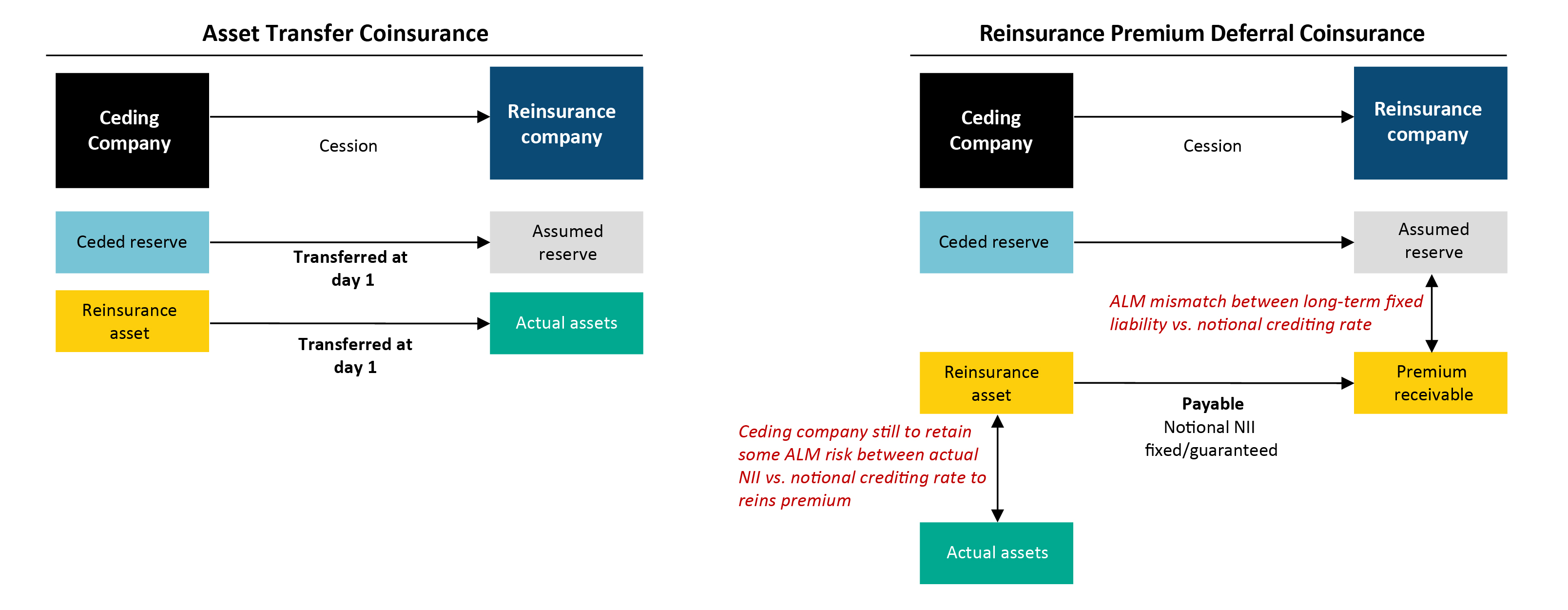

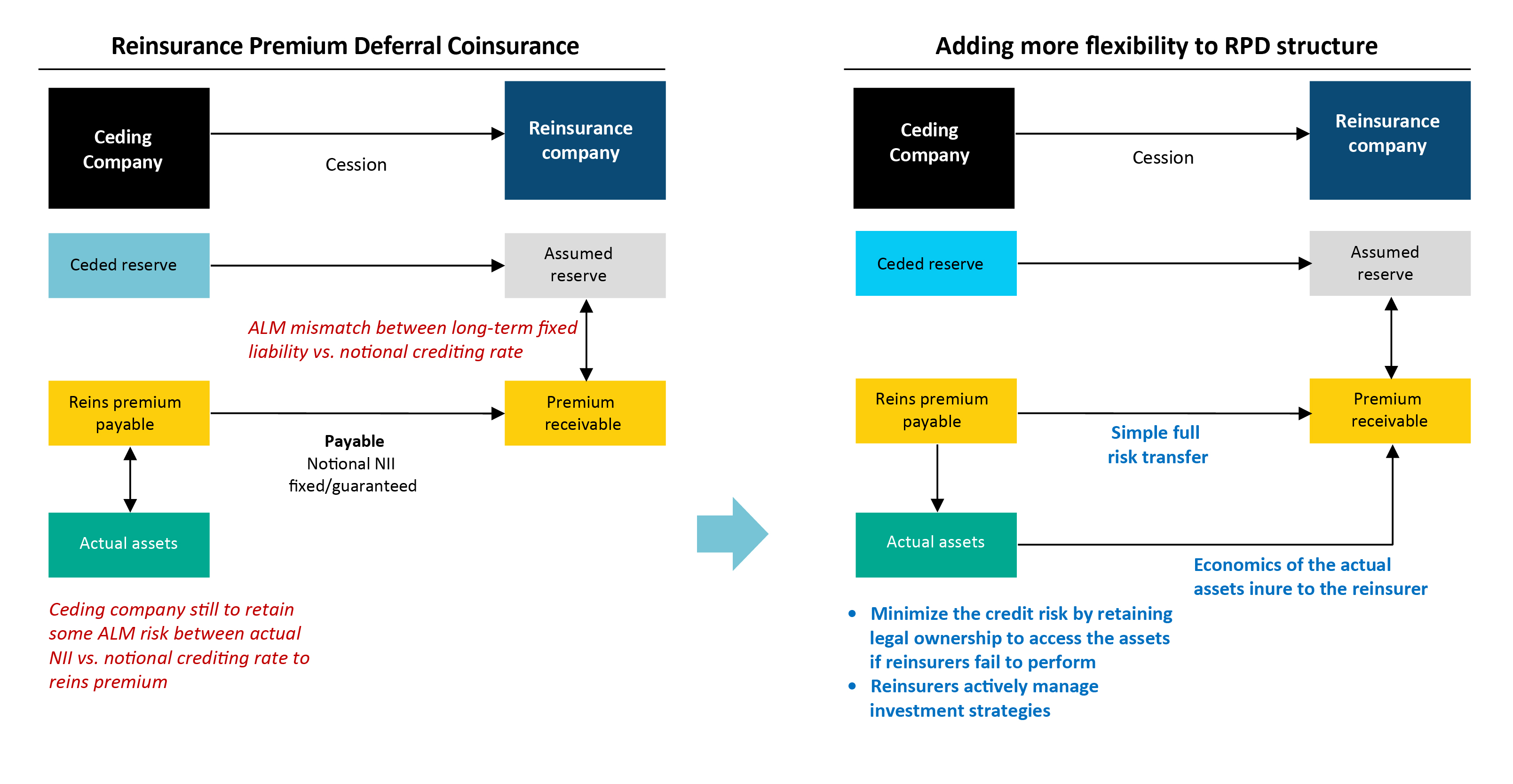

Under the asset transfer structure, the reinsurer owns the ultimate economic return and risk from its investment and ALM activities after it receives the up-front reinsurance premium (i.e., the reinsurance asset is transferred to the reinsurer). However, under the RPD structure, the transfer of economic risk may not be fully completed as fixed income and equity risk are still fully retained by the ceding company while interest rate risk is partially transferred. The primary reason for the incomplete risk transfer is due to a structural issue whereby the actual performance of the underlying investment portfolio is not directly passed to the reinsurer, as illustrated in Figure 1 and summarized in Table 2.

Figure 1

Comparison of Asset Transfer Structure vs. RPD Structure

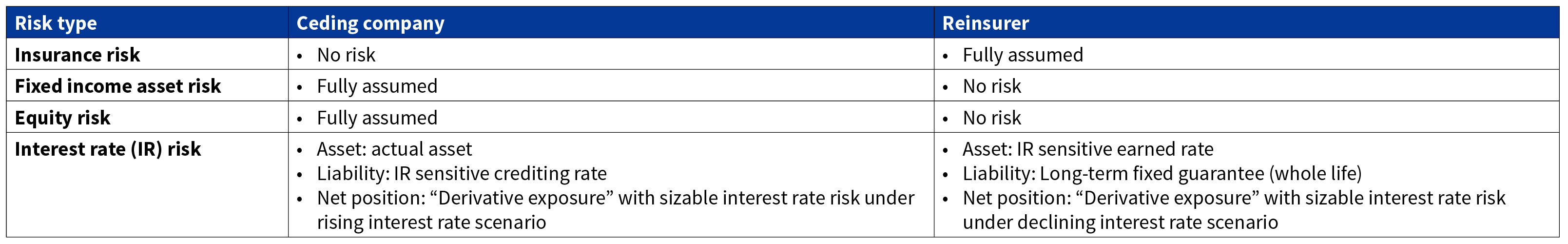

Table 2

Risk Exposure of Ceding Company and Reinsurer Under RPD Structure

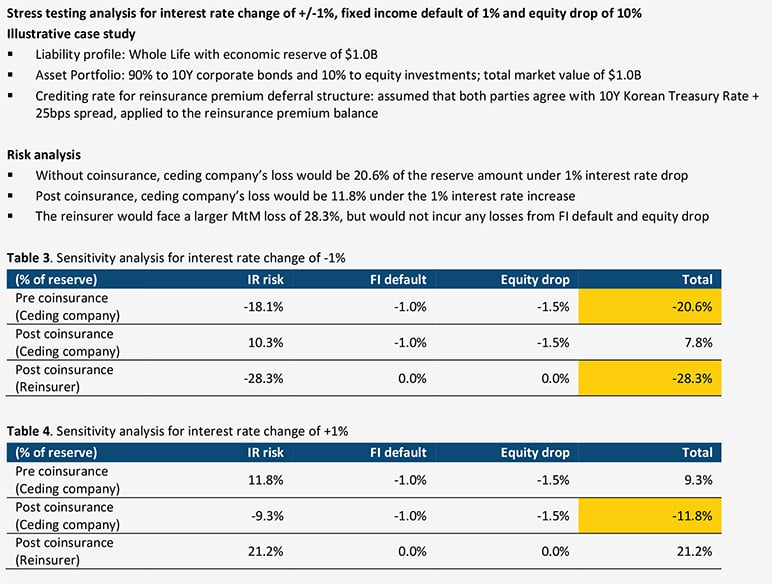

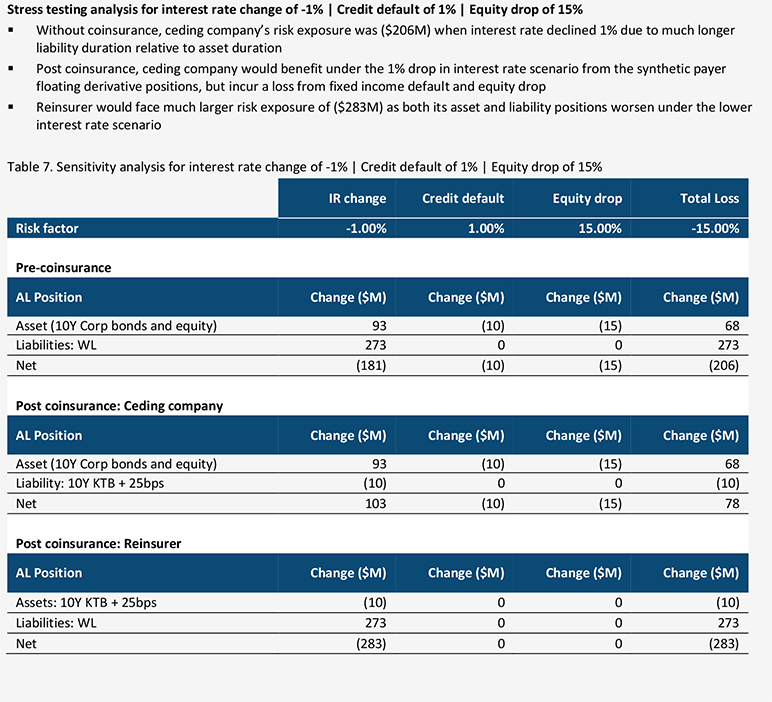

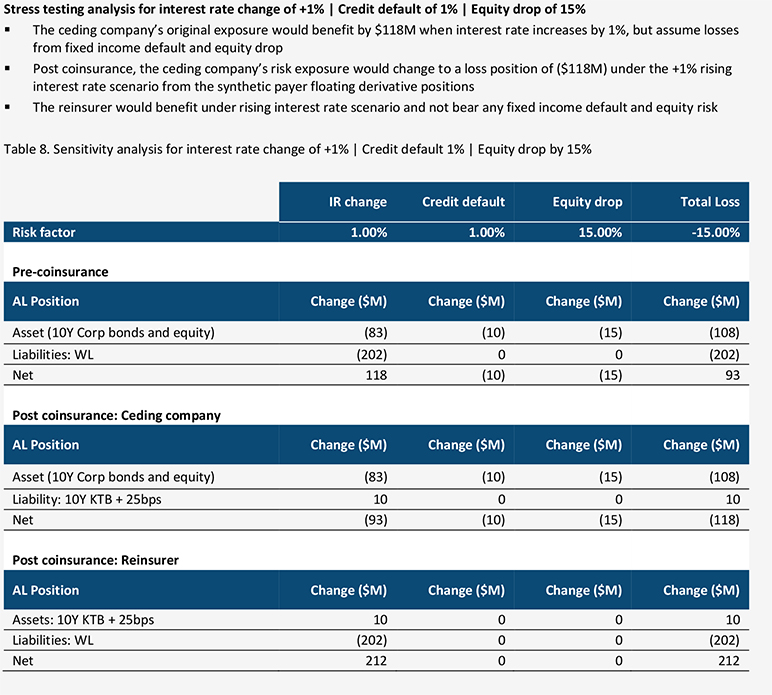

Risk analysis under the RPD structure can be illustrated via a simple case study[3]:

As illustrated above, post RPD coinsurance, the ceding company still retains investment and interest rate risk as its liability becomes the premium payable to the reinsurer at the notional crediting rate (fixed or interest sensitive), and it retains actual assets and corresponding net investment income (NII) or losses. The ceding company would thus incur financial losses from any underperformance of the investment portfolio relative to the notional crediting rate and under rising interest rate scenarios. Meanwhile, the reinsurer would also be exposed to ALM mismatch between the long-term fixed liability and the premium receivables at the notional crediting rate. Under decreasing interest rate scenarios, reinsurer risk exposure becomes more leveraged as both the asset and liability positions worsen. Under no scenario would the reinsurer incur a loss from fixed income default and equity drop.

Therefore, the current RPD structure in Korea prevents full transfer of interest rate and investment risk to the reinsurer and instead exposes both ceding company and reinsurer to significant interest rate and investment risk.

Without full risk transfer, the current RPD structure may have other unintended drawbacks, i.e., the ceding company may be unable to fully release required capital or receive full credit from regulators and rating agencies from a risk transfer viewpoint, due to the remaining interest rate and investment risk exposure. In addition, the reinsurer would demand a higher price from the ceding company to compensate for the reinsurer’s leveraged interest rate risk exposure and limited ability to undertake management actions on investments.

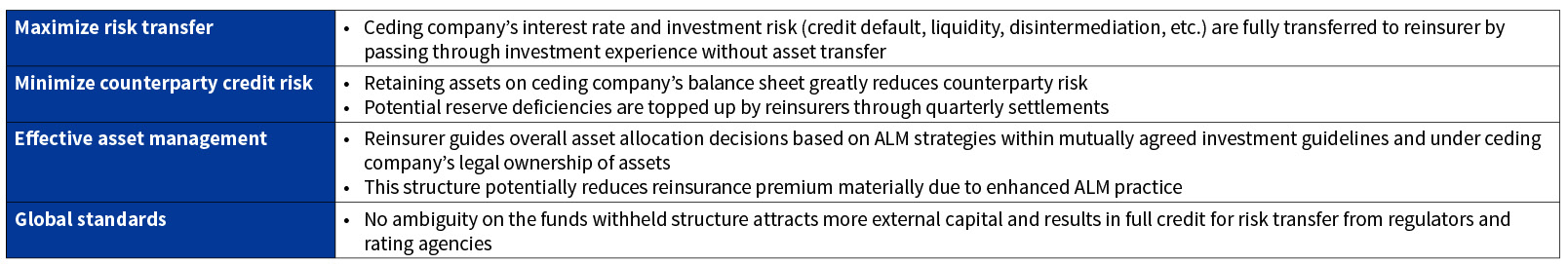

Full Risk Transfer Solutions Under Typical U.S. Coinsurance with Funds Withheld Asset Structures

The U.S. insurance industry has developed and heavily utilized various coinsurance structures such as coinsurance with Funds Withheld Asset (FWA) and Modified coinsurance (ModCo). The FWA coinsurance structure permitted in the U.S. follows a similar concept to Korea’s RPD structure as it seeks to minimize the ceding company’s counterparty credit risk; however, this structure is notably different from Korea’s RPD structure in that the ceding company needs to identify a distinct investment portfolio from its general account assets to back the liabilities reinsured under the coinsurance agreement. Benefits of this structure are summarized below:

Table 5

Benefits of Coinsurance with Funds Withheld Asset Structure

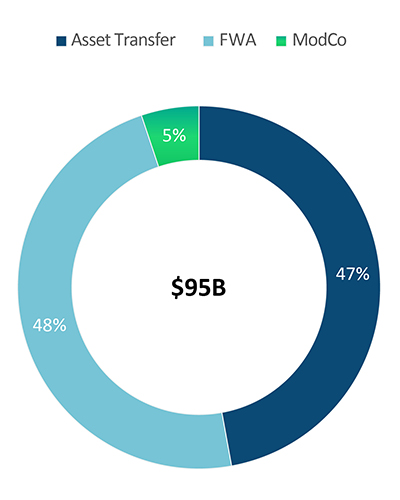

Due to the above benefits, more than 50 percent of coinsurance transactions among leading U.S. domiciled reinsurers involve a coinsurance structure where the ceding company retains the legal ownership of invested assets supporting the coinsurance transaction (i.e., either coinsurance with FWA or ModCo).

The volume of U.S. reserves coinsured under funds withheld arrangements suggests that the implementation of global coinsurance practices in the Korean life insurance industry would serve to expand domestic reinsurance capacity.

Figure 2

Types of Coinsurance in US Market

Source: S&P Global Market Intelligence

Summary of individual life and annuity coinsurance reserves from nine major reinsurers’ U.S. operations

Adding More Structural Flexibility to Korean Coinsurance Structures

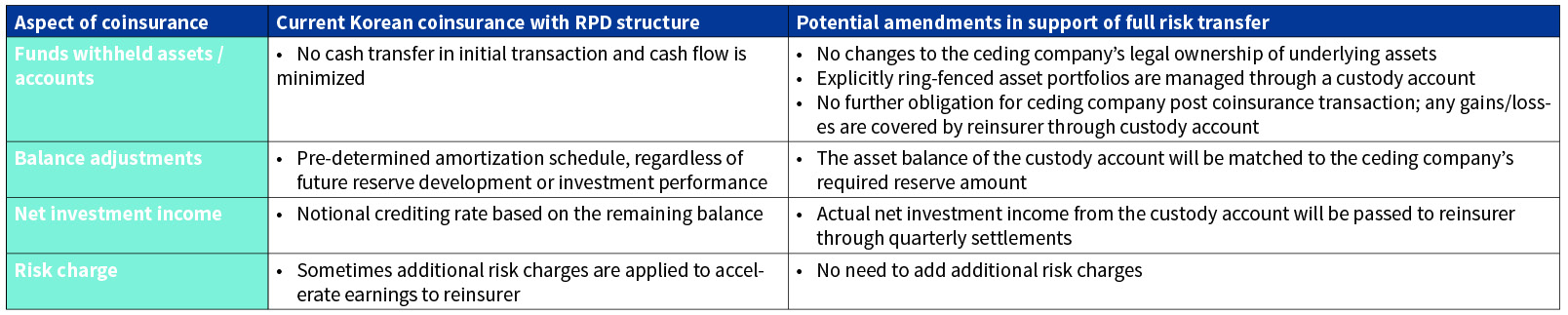

We believe the following amendments to the Korean RPD structure will support full risk transfer.

Figure 3

Potential Amendments to the Current Korean RPD Structure

Table 6

Potential Amendments to the Current RPD Structure

Conclusion

As Korea’s insurance market grows, coinsurance solutions will benefit the overall industry as an effective business and capital optimization tool to meet insurance companies’ various strategic needs and combat challenges in a sustained low interest rate environment.

In this article, we evaluated potential amendments to the Korean coinsurance structure via introduction of coinsurance with FWA structure, which is commonly used in the U.S. We believe these amendments would align the Korean coinsurance structure more closely with global practices and would attract more onshore and offshore capital, to the benefit of the overall Korean insurance industry.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Dean Kerr, FSA, MAAA, ACIA, is a partner at Oliver Wyman. He can be reached at dean.kerr@oliverwyman.com.

Seong-Weon Park, FSA, is a principal at Oliver Wyman. He can be reached at seongweon.park@oliverwyman.com.

Katie van Ryn, FSA, MAAA, is a consultant at Oliver Wyman. She can be reached at Katie.vanRyn@oliverwyman.com.

Yiru Sun, FSA, MAAA, is a consultant at Oliver Wyman. She can be reached at Eve.Sun@oliverwyman.com.

Appendix A: Risk Transfer Analysis Case Study for RPD Coinsurance

The following representative asset and liability positions are used to demonstrate the risk exposure of both ceding company and reinsurer, pre- and post-Korean reinsurance premium deferral coinsurance structure.

- Liability profile: Whole Life with economic reserve of $1.0B

- Asset Portfolio: 90 percent to 10Y corporate bonds and 10 percent to equity investments; total market value of $1.0B

- Crediting rate for reinsurance premium deferral structure: assumed that both parties agree to 10Y Korean Treasury Rate + 25bps spread, applied to the reinsurance premium balance