How COVID-19 Affected Insurance Innovation: One Year On

By Ewa Clibborn-Dyer

International News, May 2021

EDITOR’S NOTE: This article original appeared, with minor differences, on ninety.com and it summarizes a whitepaper published by Ninety Consulting Ltd. [1]

About a year ago we published our whitepaper “Insurance Innovation Opportunities Beyond COVID-19.” In the paper we made some predictions on what innovation opportunities the pandemic would bring to the insurance space.

It is hard to believe, but we’ve already had a year of living with the pandemic. In recognition of how much time has passed, we want to look back at a few of our customer realities from last spring set against the innovations that have been delivered in the market since. In this article we will also share some of our reflections on COVID-19’s impact on insurance innovation. Our article is drawn from the resource-rich Idea Pulse 2021 Report and the Idea Pulse dataset.

What Were Our Predictions for COVID-Related Innovation Opportunities?

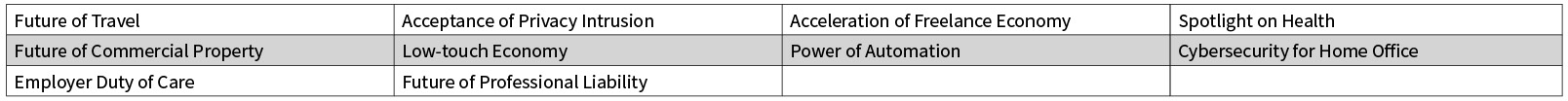

Figure 1

New Customer Realities Outlined in “Insurance Innovation Opportunities Beyond COVID-19.”

New Customer Reality: Future of Travel

In this customer reality, we have looked at travel insurance opportunities. We now know that the travel industry has suffered a much larger loss and for far longer than anticipated at the beginning. In this instance, insurance has played a key role in bringing some reassurance to customers to help them make the decision to travel as and when it has been declared safe to do so.

Example:

Emirates will offer free coverage for COVID-19-related expenditure for passengers, including medical and quarantine expenses, in what the airline is touting as a “world-first.” The Middle East carrier will offer cover for medical expenses of approximately $245,000 and quarantine costs of approximately $160 per day for 14 days for any passenger diagnosed with COVID-19 during their trip, while they are away from home.[2]

Even though COVID-19 risks are still far from over, and many countries are enduring a third wave as we write this piece, as more of the world’s population receive their vaccine and the conversations continue about having vaccination passports, we are curious to see what travel insurance covers will look like going forward. From some recent news it looks like that perhaps COVID-19 cover has become the standard and is here to stay.

Example:

Tesco Bank—whose insurance portfolio spans pet, home and motor—has brought travel coverage back to the mix, after previously withdrawing the product in 2018.

Core features of the new Tesco Bank Travel Insurance include cover for medical expenses, trip cancellation or delays, and lost or stolen baggage or money. Policyholders can choose from three tiers of cover, all with coronavirus protection as standard, with a range of add-ons also available.[3]

New Customer Reality: Spotlight on Health

Last year we were confident that telemedicine would become a standard in patient treatment—and it has been a hugely helpful tool in fighting the pandemic and in providing other basic medical support. We have seen it become a pretty much standard feature in all available health insurance, both private and public. Many insurers have also tried to go above and beyond to support their members with extended mental health services.

Example:

Aetna International is partnering with Wysa, a confidential and anonymous mental wellbeing app and service, as part of the company's ongoing efforts to address the “second curve” of the COVID-19 pandemic. The app’s AI-driven chat function allows members to “chat” about their mental wellbeing via text and will direct them towards self-help content and coaching packs that can be used to develop tailored management plans. In response to members’ increasing mental wellbeing needs, Aetna International recently enhanced member access to a range of resources, including its virtual health offering, vHealth, and its employee assistance programme, which provides support from professional clinical counsellors over the phone or face-to-face.[4]

Health insurance providers continue to support their members in new and innovative ways. The majority of health insurance support during the pandemic has come in the form of value-added services.

Example:

John Hancock, the US division of Toronto-based Manulife, announced that life insurance customers participating in the John Hancock Vitality Program will be awarded 400 Vitality Points for having the COVID-19 vaccination.

Beginning this spring, Vitality Program members will have the opportunity to earn 400 program reward points when they share proof of their COVID-19 vaccination. Vitality Points accumulate and drive a range of discounts and benefits, including premium savings, travel and retail discounts, and savings on healthy food and wearable fitness devices. Points are earned for a broad spectrum of everyday activities, including physical activity, eating well and getting good sleep.[5]

New Customer Reality: Cybersecurity for Home Office

In our predictions we looked at the cybersecurity of home offices. This issue is definitely becoming more relevant as the pandemic has brought with it an unimaginable shift in people’s work/life balance and most likely has forever changed the ways of working for many businesses. Remote working has become the norm with many companies; for example, Spotify and Twitter announcing that their employees can stay with remote working forever if they want to. Statista shares data on the frequency of remote work in the USA before and after the pandemic: working 5+ days a week from home has increased from 17% to 44%. This increase has brought a significant change to the business insurance needs that we see some insurers responding to.

Example:

Chubb has launched Work from Home (WFH) Insurance for the Asia-Pacific region, helping employers to offer protection to employees working from home amid the ongoing COVID-19 pandemic. The new policy, which is considered to be a market-first in the Asia-Pacific region, is designed to allow employers to care for the wellbeing of their employees as they work remotely.

Chubb’s WFH insurance covers mental health benefits for the psychological counselling of employees diagnosed with stress disorders due to working remotely. Other features of the policy include ergonomic injury and prevention benefits for postural injuries/strains resulting from inadequate workstation setups as well as coverage for employees who take their work outside or are on the move and sustain an injury. It also offers cover for accidental death and permanent disability payments for slips and falls within the home from hazards such as stairs and unkept toys.[6]

Insurance Innovation Through the Pandemic—Our Analysis

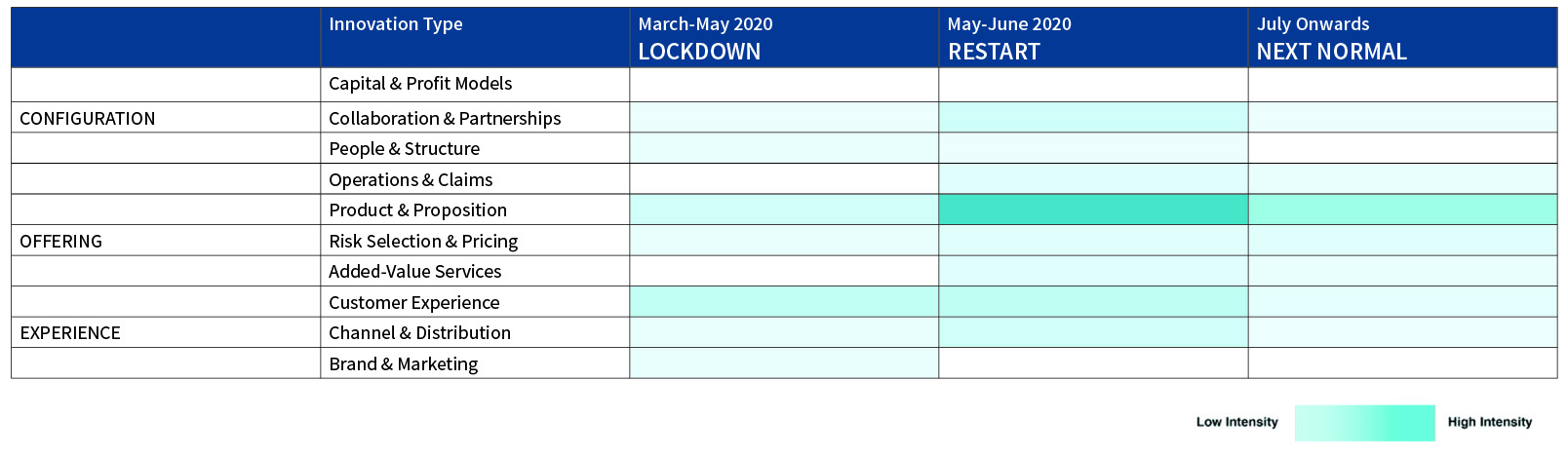

At the end of 2020 we looked at the question of how the pandemic has impacted insurance innovation. We investigated this in our Insurance Idea Pulse 2021 where we have analysed 154 examples of COVID-19-related innovations in the insurance space. We tracked them across the different Ten Types in three overlapping phases from March to July 2020 and onwards. As innovation effort was concentrated on specific needs created by the pandemic, the most impacted areas and lines had the highest concentration of innovation activity.

The following is an abridged version of some of the relevant analysis from the Insurance Idea Pulse 2021 report:

The heat map below shows how innovation shifted from high and mid-intensity innovation types over 16–24 weeks.

Figure 2

Three Phases of Innovating in COVID-19

Source: Insurance Idea Pulse 2021

The First Phase (March–May 2020): Lockdown

This phase we describe as “lockdown,” when the majority of the global population and economies were operating remotely under government-mandated lockdown or shelter at home orders. All lines of business were affected in this first phase; health in particular, which was at the front line of the crisis response. Innovation efforts in this phase were focused on these Ten Types of Insurance Innovation: People and Structure, Added-Value Services, and Product and Proposition. The first phase concentrated on business continuity and customer response—activating/testing existing models for quick response rather than new ideas. This stage leveraged prevailing digital innovations for People and Structure to the fullest—accelerating or expanding existing initiatives or with new digital partners. Examples include work from home and remote operations for employees; virtual customer service models; AI and chatbots to deal with a surge in claims and enquiries; activating access to digital healthcare, virtual mental health, and wellness solutions; and providing COVID-19 assistance/information via digital apps to address customer concerns.

The Second Phase (May and June): Restart

As global lockdowns eased to help get economies restarted, insurance innovation moved towards building new products for COVID-19 cover, risks in the new normal and extending digital customer-facing operations to contactless distribution and assessments. Innovation efforts in this Restart phase were focused on these Ten Types: Product and Proposition, Channel and Distribution, and Added-Value Services. Travel in Personal P&C, Health, Specialty and Life were the most active in this second phase.

Product and Proposition dominated this phase, which marked the launch of COVID-19 insurance or product structures specifically designed to cover risks such as lockdowns and isolation. Medical expense products included features such as coverage aligned to requirements of COVID-19 care—tests, quarantine, hospitalisation, the inclusion of co-morbidities and fixed pay-outs. Employer health plans with COVID-19 inclusion also came to the market. Some of the product innovation activity has been at the prodding of regulators; nevertheless, customers have benefited with a reasonable choice of affordable, short-term plans. In a distribution twist, travel operators and retail businesses are offering COVID-19 cover as a marketing incentive. Travel insurers, in particular, in collaboration with the travel industry, had maximum innovation activity in this phase. Insurers had previously stopped covering COVID-19 and claims for trip cancellations, brought on by international air travel restrictions, and ceased writing new policies after March. In a bid to re-engage with customers, insurers have introduced multiple forms of customer engagement and product innovations. Travel insurance products covering COVID-19 medical expenses and trip cancellation, extension or repatriation outlay from COVID-19 disruptions are steadily increasing in number.

The Third Phase (July 2020 onwards): Next Normal

Some of the reactive changes in organizational structures, business models and customer behaviours necessitated by the pandemic have started evolving into permanent forms brought on by the continuing crisis. Virtual working or working from home is one such area. Much innovation shifted towards Specialty products for the new normal in this third phase. Product and Proposition and Risk Selection and Pricing were the Ten Types with the highest innovation activity, with Commercial and Specialty and Personal P&C lines driving the majority of these efforts. Specialty products for the new normal include virtual event insurance, work from home protection insurance, standalone liability products for eCommerce delivery, and bike insurance for work commutes. Liability risks remain a grey area affecting many businesses and workers. There is much more work for insurers to do to create distinctions between liabilities of working at home, cyber risks and coverage of office equipment when used at home. Bike insurance is another example, where bikes are covered under home contents or for recreational purposes but may be excluded for damage or accidents on work commutes.

What Next?

We believe, after the unpredictable past year, that few of us are bold enough to make any firm statements about what will happen in the future in the insurance space. Indeed, our analysis from last year refers to a “Next Normal” from July 2020—a fantastically over-optimistic statement from the time!

Nevertheless, it is not an exaggeration that insurance, as an industry, has become more agile and used to adapting to change. As a result, we hope to see in the upcoming years, more bold and exciting insurance innovations entering the market. We will leave you with a thought from one of the Innovation Leaders at Lloyd’s Market:

“COVID-19 had a short-term impact where the priority was business-critical activity. This distracted us from innovation as it was not deemed an immediate priority. But, very quickly it has become a positive as the barriers to innovation have been removed by the circumstances. A range of new ideas and new thinking has suddenly become completely normal in the space of a few months and we are riding that wave.”

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the global EY organization or its member firms.

Ewa Clibborn-Dyer is an innovation & product manager at Ninety where she looks after Ninety's internal innovation, marketing, and research. She can be reached at ewa.clibborn-dyer@ninety.com.