Care Home Mortality Data from the UK and Actuarial Challenges

By Nathan Worrell

Long-Term Care News, February 2023

The following article references data from the UK Office of National Statistics under the Open Government License.

From the very first days of the pandemic, COVID-19 has had severe impacts on elder care facilities. Recent data from the UK may be worth exploring for insights on how to assess pandemic impacts from a statistical and demographic perspective versus an actuarial one.[1]

A quick note about what the data represent:

The term “care home residents” . . . refers to all deaths where either (a) the death occurred in a care home or (b) the death occurred elsewhere, but the place of residence of the deceased was recorded as a care home.

A recent release covered the experience in England and Wales. In both locations, there were fewer deaths in 2021 than 2020, and 2021 also had fewer deaths than the five-year pre-pandemic average:

- In England, 127,171 deaths of care home residents were registered in 2021 (wherever the death occurred); this is a decrease of 18.2% compared with 2020 (28,205 deaths) and a decrease of 3.2% compared with the pre-pandemic five-year average between 2015 and 2019 (4,213 deaths).

- In Wales, 6,612 deaths of care home residents were registered in 2021 (wherever the death occurred); this is a decrease of 19.7% compared with 2020 (1,624 deaths) and a decrease of 6.1% compared with the five-year average between 2015 and 2019 (429 deaths).

In 2021, dementia/Alzheimer’s disease outpaced COVID-19 as the leading cause of death.

- Dementia/Alzheimer’s disease was the leading cause of death in both male and female care home residents in England (accounting for 26.4% and 34.0% of deaths, respectively) and Wales (28.3% and 36.2%, respectively) in 2021. COVID-19 was the second highest leading cause of death in both male and female care home residents in England (11.5% and 10.8%, respectively) and Wales (12.9% and 11.1%, respectively).

The overview of the study calls out potential explanatory factors around the lower deaths results, stating, “Caution needs to be taken when interpreting these results. Several factors may have contributed to lower total deaths in 2021 compared with 2020, including changes in care home occupancy, availability of vaccinations and availability of personal protective equipment (PPE).”

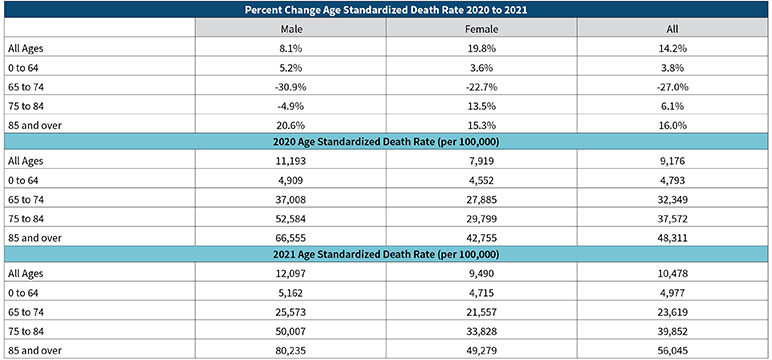

While demographers and statisticians may be interested in counts, actuaries are going to be concerned about rates. The UK Office of National Statistics describes its measurement approach for standardized mortality rates on its website.[2] Table 1 shows a comparison of care home death rates for England from 2020 to 2021, broken down into age cohorts.

Table 1

Comparison of Care Home Death Rates in England (2020–2021)

Source: Office for National Statistics (ONS). Deaths of Care Home Residents, England and Wales (dataset). ONS website, Nov. 22, 2021, https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/deaths/datasets/deathsinthecaresectorenglandandwales (accessed Jan. 20, 2023).

While there may have been fewer deaths in 2021, the standardized death rate increased overall, with different experience across age bands and some gender differences as well. In particular, the 65 to 74 cohort really jumps out as the lead contributor to the improved mortality result. Insight into this type of result would be worth noting.

Actuaries concerned with setting mortality assumptions for care home populations will appreciate the nuances of understanding that come from expanding granularity.

Pandemic data are creating consternation across the actuarial profession. COVID and long COVID impacts to mortality assumptions or mortality improvement are difficult things to quantify. Long-term care actuaries face additional challenges segregating active and disabled mortality assumptions.

Explaining potential counterintuitive results (fewer deaths, higher rates) is something that actuaries must be prepared to communicate. To help mitigate the risk of confusion, actuarial vigilance and discipline will be required in documenting data, data sources, basis for assumptions and rationale for actuarial judgment.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Nate Worrell, FSA, is a client support actuary with Moodys’ Analytics. He can be contacted at nathan.worrell@moodys.com.