Free Continuing Education Resources for Modeling Section Members!

By Mary Pat Campbell

The Modeling Platform, September 2021

One of the concrete benefits one gets as a member of the Modeling Section is free access to some of the section-sponsored webcast recordings. Currently, it’s webcasts older than a year that you have access to. This policy may change, and I anticipate the change will be for a shorter lag between the event and free access for section members. Watch for it!

This article will touch on two items:

- The current recordings available for free to Modeling Section members, as of August 2021, and

- how to access these recordings.

Recordings Currently Available to Modeling Section Members (for Free!)

Table 1 shows all the webcasts available, in reverse chronological order.

Table 1

All Available Webcast Recordings Free to Section Members

| Title | Description |

| LDTI Implementation Series: Modeling Considerations for MRB Webcast 6.23.20 Recording | This webcast will discuss key modeling considerations and issues for market risk benefits (MRBs) in the implementation of LDTI. |

| Super Models Webcast 8.2.19 Recording | "Super models" are developed based on rigorous data analytics techniques, and they provide a range of potential outcomes and financial metrics that can be used to evaluate when material changes are necessary. This webcast will emphasize data visualization and communication of highly technical concepts to colleagues and non-actuarial stakeholders. |

| LDTI implementation series: Modeling & Reporting Webcast 7.25.2019 Recording | This webcast will be a deep dive into the required modeling and reporting changes that firms should anticipate to meet the requirements of LDTI—including, modeling functionality, architecture, and output reporting. |

| LDTI implementation series: Data and Systems Challenges Webcast 7.18. 2019 Recording | This webcast will delve into specific data—including, assumptions and systems challenges, that have been identified from impact assessments performed to date. We will also talk about the different architecture options and the various challenges that companies are encountering as a part of their adoption journey. |

| LDTI implementation series: Introduction Webcast 7.11.19 Recording | This webcast is an introductory session outlining key areas of significant operational changes and potential implementation challenges. |

| Economic Scenario Generator – Risk Neutral Webcast 5.28.19 Recording | This economic scenario generation (ESG) webcast will focus on risk neutral application and its uses and techniques. |

| Economic Scenario Generator – Real World Webcast 5.14.19 Recording | This ESG webcast focuses on real world economic scenarios. |

| Economic Scenario Generator – Fundamentals Webcast 5.7.19 Recording | This ESG webcast is an introductory course that will educate the audience regarding uses and techniques for ESG. |

As you can see, there are two big series and one standalone webcast in the above table. Let’s look at these in groups.

Super Models (1.8 CPD Credit)

Moderator: John Dizer, FSA, MAAA

Presenter: Timothy Paris, FSA, MAAA

In this webinar, Timothy Paris looks at the process of modeling, in how one must balance predictive power and goodness of fit in one’s models. The goal, as he says, is to “Improve risk management through a statistically justified model with quantified fit and predictive power.” While modeling involves the “science” of statistical techniques, there is an “art” to modeling to find that balance, in order to get a “Super Model.” Timothy Paris uses his experience in developing policyholder behavior experience studies to consider the trade-offs in model choices as well as cost-benefit analysis in getting more data to fit models.

Related article: “Super Models,” Timothy Paris, The Modeling Platform, April 2019

ESG Series

Moderator: Jim McClure, FSA, MAAA

Presenters: Alasdair Johnston; Daniel Schobel, ASA; Hal Pedersen, ASA; Ricky Power, FSA

Each of these webcasts is 90 minutes long, at 1.8 CPD credits for SOA CPD credits.

This three-part series covers core concepts surrounding ESGs, from looking at fundamental concepts in this modeling, to two major ESG model classes: risk-neutral models vs. real world models.

Part 1: Fundamentals (1.8 CPD Credits)

This session introduces the concept of stochastic ESGs, talking about key concepts to introduce those new to the area: reasons for using ESGs, risk-neutral versus real-world models, model calibration, practical issues in working with ESGs, classes of models used in ESGs, and the types of behavior one may capture with these models.

Part 2: Real World (1.8 CPD Credits)

This session focuses on the major class of ESG models that are based on “real world” (RW) probabilities of economic variables. With this focus on RW ESGs, the presenters look at applications of RW models, methodologies for generating and using scenarios, specific RW models such as the AAA ESG, statistical techniques used in calibrating the models, and how one validates RW models.

Part 3: Risk Neutral (1.8 CPD Credits)

Rounding out this series, this session focuses on the other major class of ESG models, the risk-neutral (RN) models, which are intended to capture market prices used in pricing various embedded options in various assets and insurance liabilities. The session starts with a review of regulatory aspects in both U.S. statutory and U.S. GAAP valuation, as well as recent changes. Then techniques for using RN models in a practical sense, how to build and calibrate a RN model, how RN models behave, and how to test RN models to make sure they are truly RN, as opposed to bleeding into being RW models.

LDTI Implementation Series

This four-part series covers the Long Duration Targeted Improvements (LDTI) project by GASB, which has changed valuation approaches for life insurance and annuities under U.S. GAAP. The implementation of these changes presents many challenges to valuation actuaries.

Moderators: Anna Felbinger, FSA, MAAA; Karthik Yadatore, FSA, MAAA; Katie Cantor, FSA, MAAA; Aden Jiang, ASA

Presenters: Dylan Strother, FSA, MAAA; Housseine Essaheb, FSA, MAAA, CERA; Brody Lipperman, FSA, MAAA, CERA; Vikas Advani, FSA; John Brady; Christian Poeschl; Judy Hanna, FSA, MAAA; Jon Staron, FSA, MAAA; Jason Neufeld, FSA; Greg Johnson FSA, MAAA; W. Joel Smith FSA, MAAA

Part 1: Introduction (1.5 CPD credit)

In the first webinar of the series, the presenters cover an overview of the LDTI changes from the prior U.S. GAAP approaches for life insurance/annuity valuation; an implementation timeline (which may have changed since the pandemic hit); and challenges and opportunities in this change. There is a great deal of focus on the many dimensions of challenges involved in implementing LDTI, such as: input, systems, reporting, and transitioning the valuation (especially as MRB involves retrospective transitioning.) This introductory session sets up the landscape for the next three, where each zeroes in on specific areas of LDTI.

Part 2: Data and Systems Challenges (1.5 CPD credit)

After the foundation has been set in the first webinar, presenters dig into the details. The first part of this webinar looks at the impacts of LDTI on actuarial data processes, looking at the level of detail needed in the data and where financial reporting may be simplified (DAC) and where it may be complicated (MRBs) in the new standard. Next, key design principles and considerations are noted, in how different aspects of the standard (and yes, there are many acronyms) need different levels of treatment. It is noted that different insurers may land in different areas of a spectrum from minimal compliance with LDTI up to maximum benefits from new data architecture for insurer systems. Finally, end-to-end architecture to support LDTI is looked at, zooming out from the individual portions and how one may lead to decision-making in choosing vendors and platforms in implementation.

Part 3: Modeling & Reporting (1.5 CPD credits)

As with the prior webinar, this one comes in three parts: model architecture, model build road map for term life, and LDTI outputs in reporting. In model architecture, the different major approaches are considered: traditional liabilities, DAC, and MRB—looking at the modeling impacts of each of these changes, with the level of aggregation at which item is calculated, changes in valuation approach itself beyond granularity, and how flexible models need to be. With these major changes, there is an opportunity to modernize the actuarial modeling function in order to meet these needs. In the model build road map section, the process for applying the new approaches, and what changes will be needed to the current actuarial processes, are considered, with a practical target of a term life block. This gives us an idea of what is involved for even a relatively simple product. Finally, in considering LDTI outputs, the new standard requires detailed disclosures that had not been done before: roll-forwards for various elements requiring multiple model runs; providing a practical map of such multiple runs; and the mapping of model outputs into new financial reporting templates. Coordination with multiple functional areas will be necessary: accountants, actuaries, data specialists, and management.

Part 4: Modeling Considerations for MRB (1.5 CPD credit)

In the final video of the series, the presenters take a deep dive in determining MRBs. They follow MRB, from the purpose and scope of this new line item in U.S. GAAP for life insurance and annuities, through assumptions and inputs to the fair value models that calculate this item, to the reserving methodology for MRB, and how one transitions to this new method in reporting (which includes retrospective calculations), rollforward analysis, and disclosure considerations.

How to Access the Recordings as a Section Member

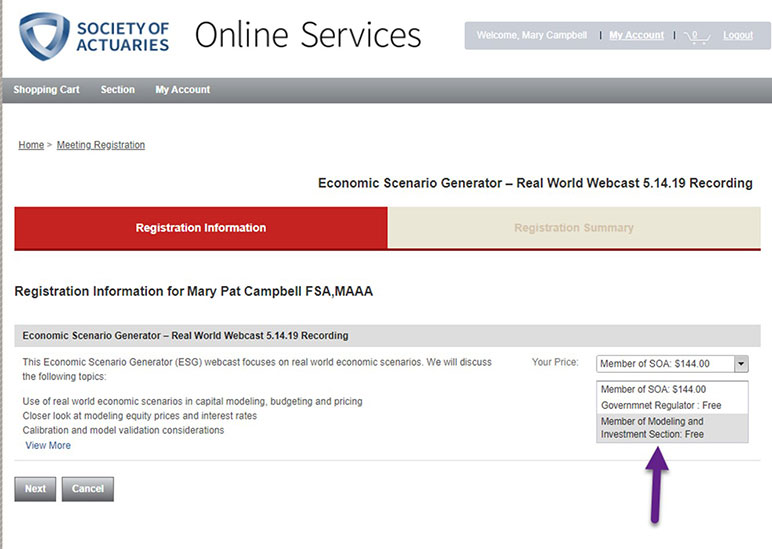

The easiest way to access the webcasts above, is to click on the link for the specific recording you want. This will take you to the SOA Store. You will likely see a non-zero price as the default option for purchasing access, but there will be a drop-down menu, one of which should be a zero price if you’re a member of the section. See Figure 1

Once you have been through that process, the recording will be added to your e-Learning account, which you can access at https://learning.soa.org/.

However, if you don’t have these handy links available, or, if later you want to check as new webcasts become available, you will want to visit the Modeling Section community on SOA Engage.

If you don’t have that link, we have a link from the Modeling Section webpage at the SOA, at the top of our list of resources.

Once logged into the site (using your SOA login), you will see not only a table of the free recordings, but also a list of your fellow section members. Then you can click on the recording links, which will send you to the store as before.

Bonus Free Continuing Education—for Anybody!

I was emphasizing the webcasts freely available above, most of which have a “list price” currently of $144 per recording. What a deal for section members!

But let me not leave out the rest of the people potentially reading this article. Yes, there’s plenty of free continuing education content for you as well.

Many are unaware, but reading publications can be counted for continuing professional education credits, depending on which organizational requirements you need to fulfill. You’re looking at a free resource right now—the Modeling Platform itself.

Also, on the Modeling Section Resources page, we have links to section-sponsored research, as well as podcasts. The podcasts are more informal than the webcasts, and some may not qualify for continuing education, but some should. Check them out! They range in length from 16 minutes to about 40 minutes in length, covering a variety of topics.

Get cracking on your continuing education!

Statements of fact and opinions expressed herein are those of the individual author and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective author’s employer.

Mary Pat Campbell, FSA, MAAA, is vice president, Insurance Research, for Conning in Hartford, Conn. She can be contacted at marypat.campbell@gmail.com.