Research Spotlight

By Claire Liu, Shelby Samantha Green and Karen Jiang

Predictive Analytics and Futurism Section Newsletter, August 2021

In the research paper, “InsurTech: A Guide for the Actuarial Community,” Carrie Kelley, FSA, MAAA, and Kiki Wang, ACAS (2021), examine the recent trends and development in InsurTech space and explore the opportunities for actuarial practitioners.

InsurTech History and Current Development

InsurTech is the use of emerging hardware, software and user interfaces to address inefficiencies or opportunities in the insurance value chain. It often involves technology, data and analytics. It targets the evolution/disruption of (a) the interaction between insurers and their customers, (b) the automation of processes, and (c) the modification of old/creation of new insurance products.[1]

According to Kelley and Wang, InsurTech broadly encompasses the startups to the InsurTech-focused incubators and accelerators established by the incumbent insurance companies. The global funding of the InsurTech has increased dramatically since 2012 from $348 million to $7.1 billion in 2020, with some of the largest deals of 2020 listed below:

Table 1

Sample InsurTech Deals in 2020

The authors believe that despite the insurance industry’s early adoption of computer usage and data management processes, the inherent conservatism significantly impedes the industry’s ability to innovate.

- Customer: Customer experiences are often sacrificed when the industry focuses on the risk management of distribution, profitability and regulatory compliance.

- Distribution: Dominance of the traditional agent/broker model limits the direct-to-consumer online distribution.

- Regulation: Complex and burdensome regulatory requirements in paperwork, underwriting, pricing and products discourage the innovation.

- Technology: Legacy systems are inefficient and expensive to replace.

InsurTechs are looking to improve these four limiting insurance factors through:

- Customer: Prioritizing personalized, digital offerings that give customers multiple ways to interact. Today’s customers want innovation-based insurance companies that offer a high quality, low price ecosystem of interconnected services (i.e., Auto Insurance that includes purchase, sale, safe driving monitoring, discounts, and emergency support).

- Distribution: Reducing distribution costs by eliminating traditional agents and brokers given that customers seek direct distribution channels.

- Regulation: Regulators are willing to establish the prudent and simplified regulatory framework to foster innovation in the digital era.

- Technology: Many InsurTech companies have created an application programming interface (API) that can be used to bridge the gap for insurance companies’ legacy systems and create ease of use for technology-savvy consumers.

InsurTech Across the Insurance Value Chain

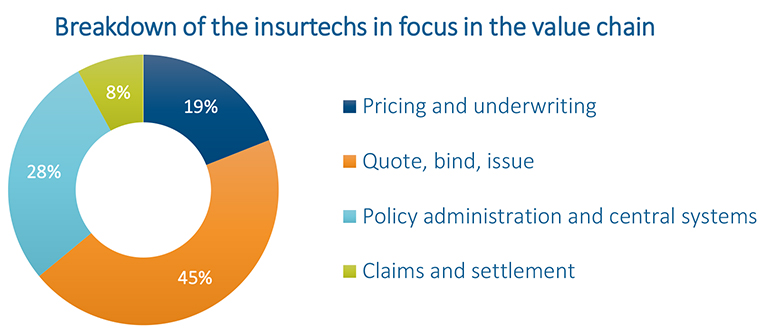

Kelley and Wang further discuss that InsurTech can play a role in many different areas along the insurance value chain, from pricing and underwriting, policy issuance and administration, to claim adjudication and settlement. Many InsurTech investments were intended to modernize the existing processes using new technologies.

Table 2

InsurTech Applications

Figure 1

Breakdown of the InsurTechs in the Value Chain

Technologies in InsurTech

While big data and AI are widely known among the insurance companies, Kelley and Wang (2021) argue that it is important to recognize how the emerging technologies play their roles in the InsurTech space. In the research paper, they list four broad categories of technology that give InsurTech advantages in revolutionizing the insurance industry.

- Data, Analytics and AI: Machine learning, natural language processing, computer vision and data analytics allow InsurTech to capitalize on the large data that insurance companies have accumulated, but largely underutilized, over the years.

- Connected Device, IOT (Internet of Things): Smart devices, wearable trackers and monitoring systems could help predict the insurable events to a whole new level.

- Digital and Virtual Customer Engagement: The internet-powered video conferencing, chatbot and virtual agents provide better customer experience and more streamlined services.

- Enterprise, Cyber and Security: Robotic process automation, big data and mobile solutions help optimize the operational efficiency.

Opportunities for Actuarial Practitioners

InsurTech is not just a future possibility, but an accelerating industry trend that has secured its place in the insurance industry. Actuaries should embrace the new technology and position themselves as leaders and experts in the InsurTech space.

In the article, Kelley and Wang (2021) summarize a few sound pieces of advice from their interviews with the InsurTech practitioners. First, they point out the core strengths of actuaries as:

- Broad understanding of the business from actuarial training and work experience provides value to both technical and non-technical roles.

- Self-learning ability through years of exam studying and continuing education requirements in the credential process helps actuaries to learn and apply new concepts in a rapidly changing environment.

- The emphasis on ethics and actuarial professionalism is also valued in the InsurTech space.

Next, they observe some common challenges faced by traditional actuaries:

- Effective communication is important, not just to InsurTech roles, but also traditional actuarial roles—however, there is a greater need in the InsurTech space due to the greater variety of stakeholders involved.

- Actuaries are associated with the inherently conservative and risk-adverse culture and this creates a barrier since the InsurTech culture can be almost seen as the complete opposite.

- Additional technical and business skills outside of the traditional actuarial wheelhouse can be another challenge for actuaries to expand or pivot their job description.

Finally, they further discuss the emerging InsurTech trends that actuaries should be cognizant of when assessing opportunities.

- Technologies in life and health sectors, such as wearable and biometric devices, health records and genetic data.

- Digital customer experience that may span from selling insurance online, premium payment to claims filing.

- Challenges in implementing data analytics, such as data quality, IT infrastructure, data privacy and modeling capabilities.

- Automation of many manual processes, such as underwriting, claims and compliance.

Conclusion

Kelley and Wang (2021) provide a comprehensive overview of the current landscape of InsurTech from the actuarial perspective. Borne of technology and built to innovate, the InsurTech industry seeks creative, communicative minds. Traditional actuaries interested in InsurTech can research what their company is already doing to innovate, whether that be through financial investment in a start-up or the roll-out of a digital system. As the InsurTech industry continues to grow, actuaries will find themselves in the pivotal role of translator. Actuaries already have the technical skills to succeed in an analytics-based environment. More importantly, actuaries can provide an understanding between InsurTech software developers and incumbent insurers.

This article provides a summary of the research paper. For more details, see “InsurTech: A Guide for the Actuarial Community.”

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Claire Liu is a senior at the University of Wisconsin—Madison majoring in Actuarial Science, Risk Management & Insurance, and Statistics. She will be the university’s Actuarial Club president for this upcoming school year. She can be contacted at cyliu2@wisc.edu. LinkedIn: http://linkedin.com/in/claire-y-liu

Shelby Samantha Green is a senior at Temple University double majoring in Actuarial Science and Risk Management & Insurance. She can be contacted at shelby.green@temple.edu. LinkedIn: https://www.linkedin.com/in/shelby-s-green/

Karen Jiang, FSA, CERA, MAAA, is a life insurance actuary for MetLife. She can be contacted at kjiang@metlife.com.